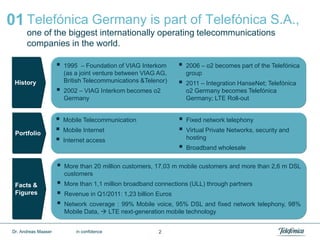

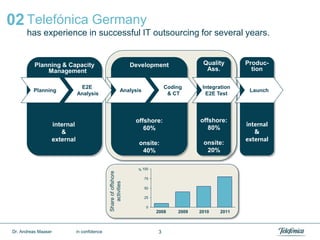

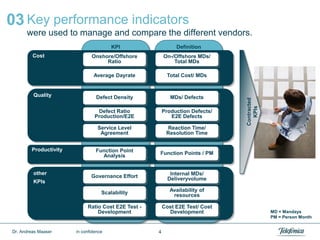

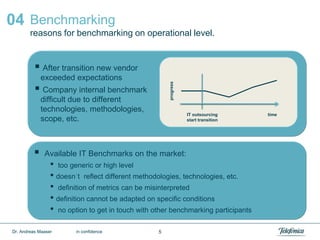

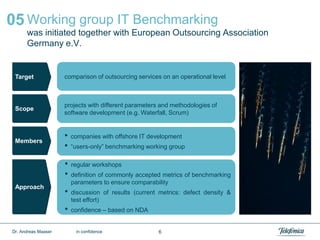

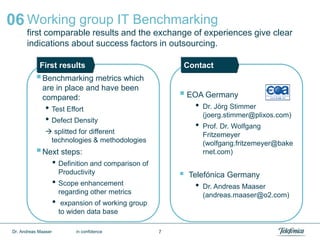

Telefónica Germany is a major telecommunications company with over 20 million customers and significant revenue from various services. The company has extensive experience in IT outsourcing and has established key performance indicators for evaluating vendor performance, identifying benchmarks and methodologies. A working group was created to develop comparable metrics for success in outsourcing, focusing on test effort and defect density while planning to expand its benchmarking data.