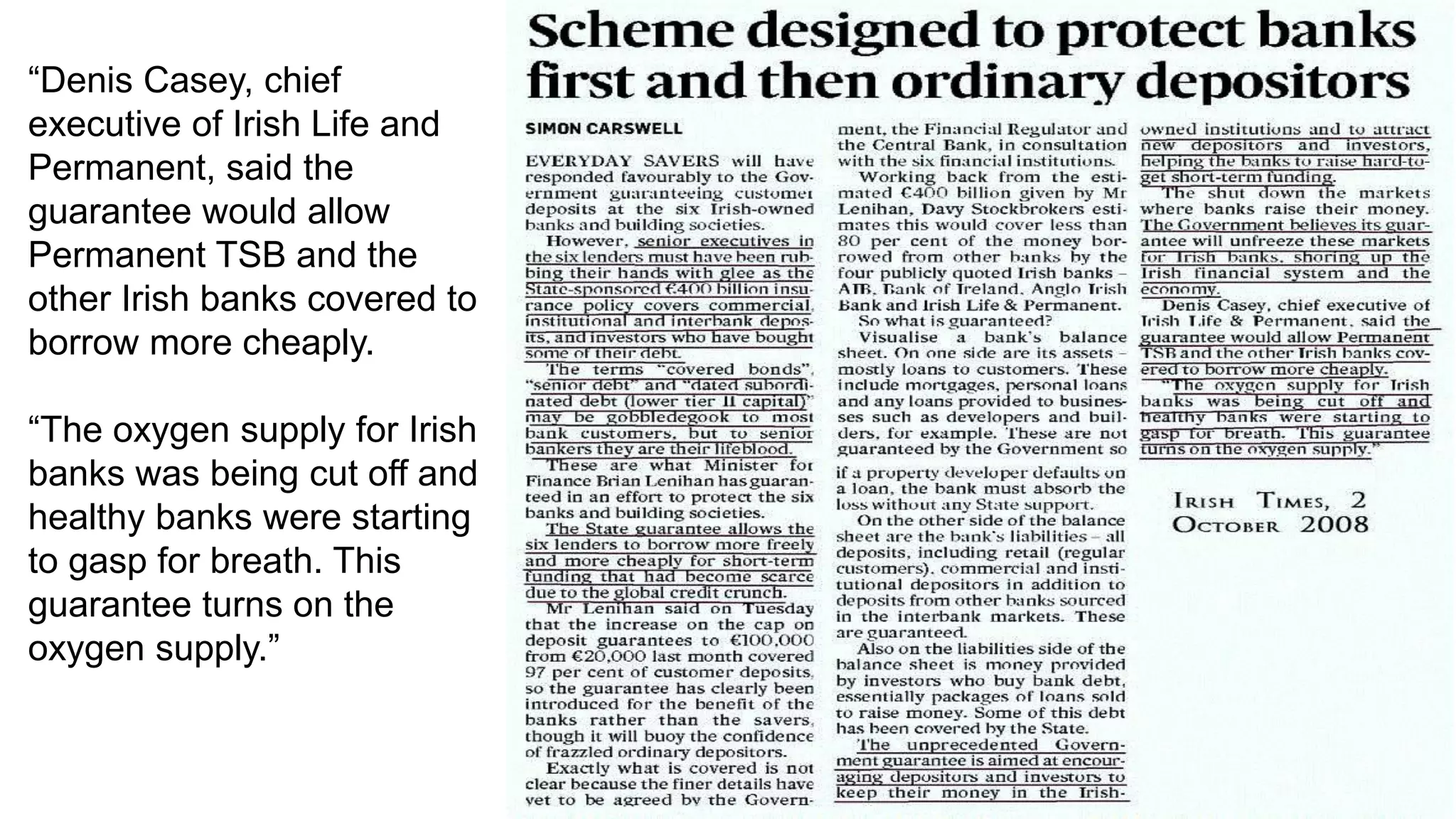

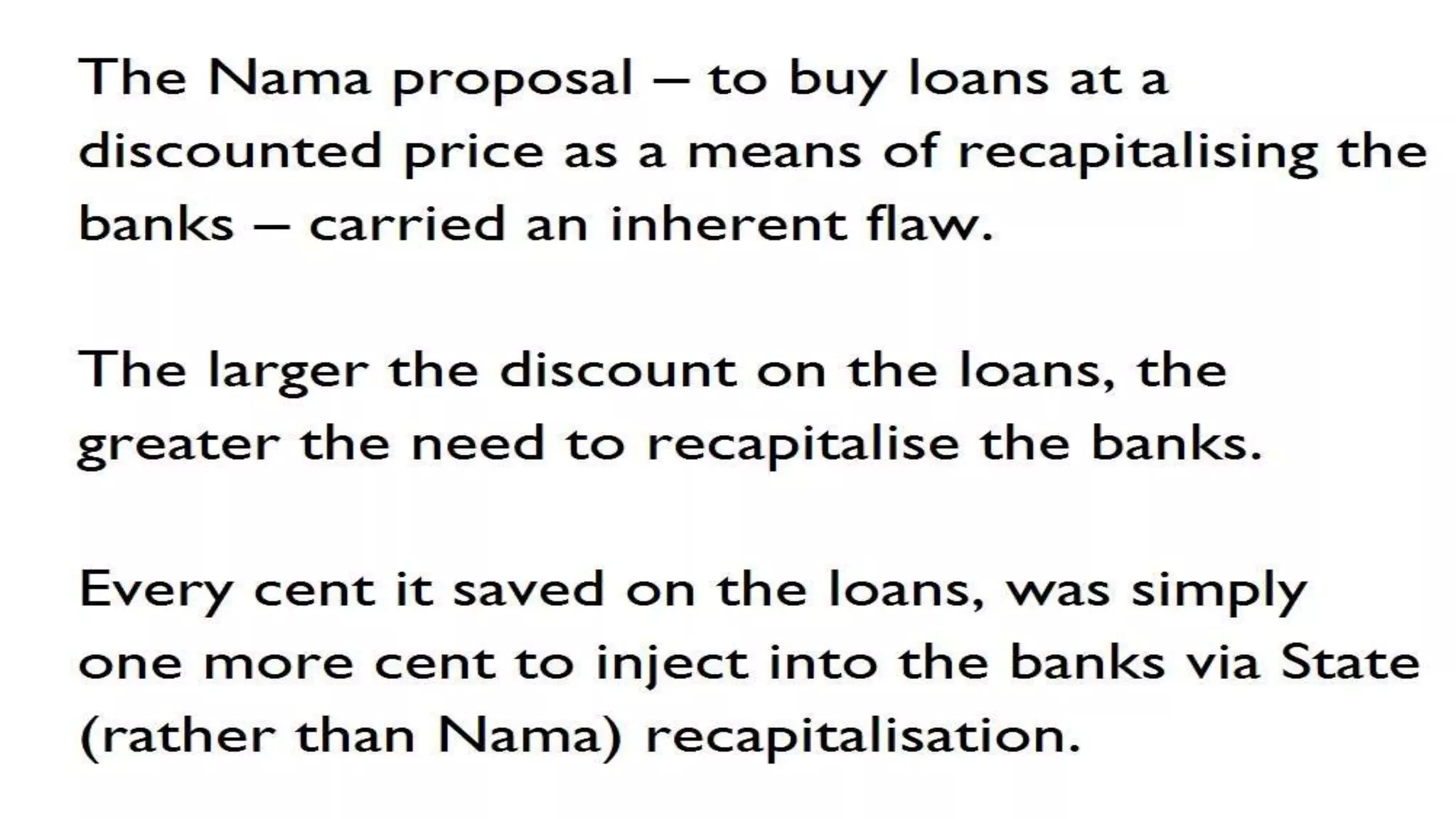

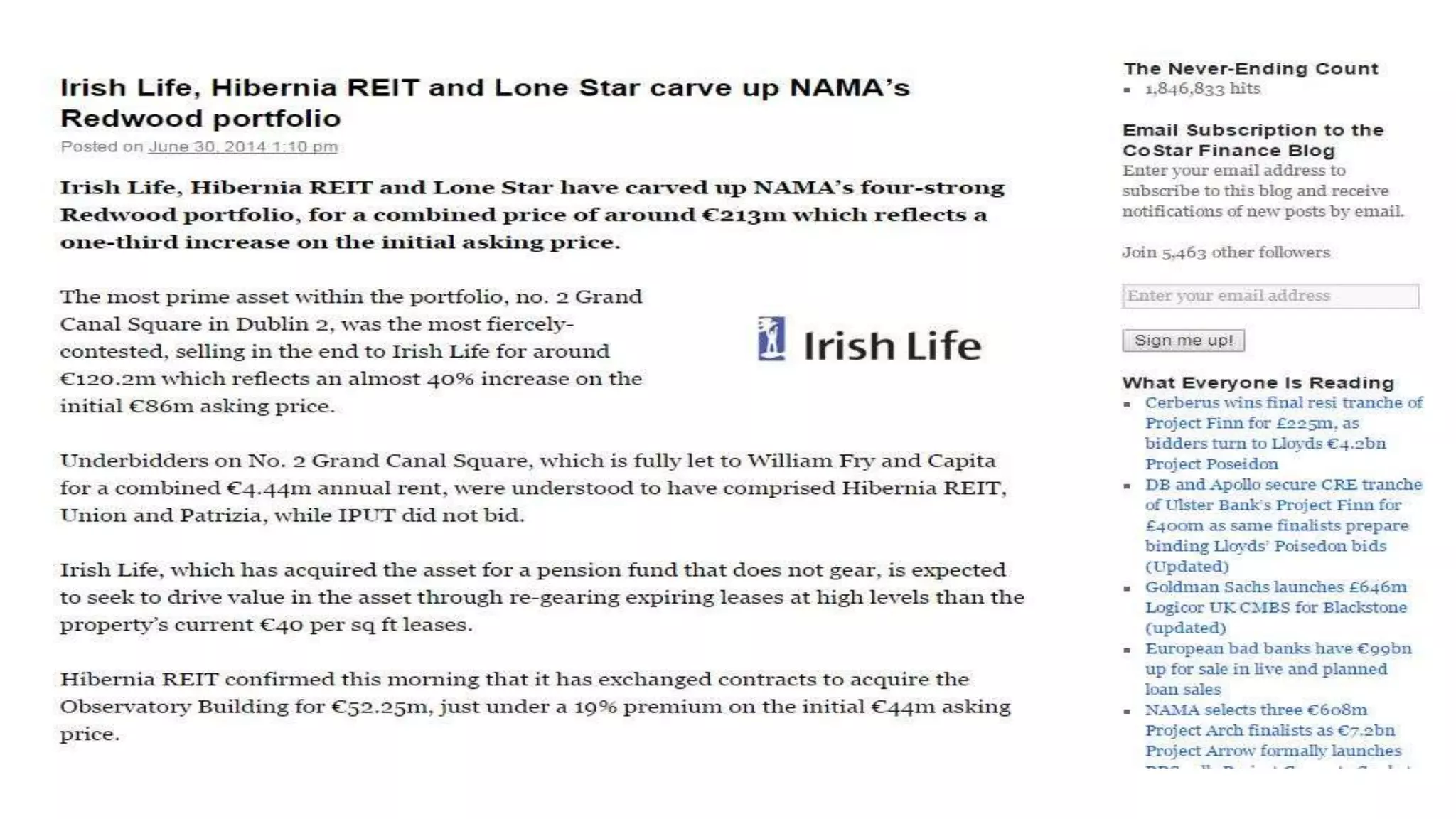

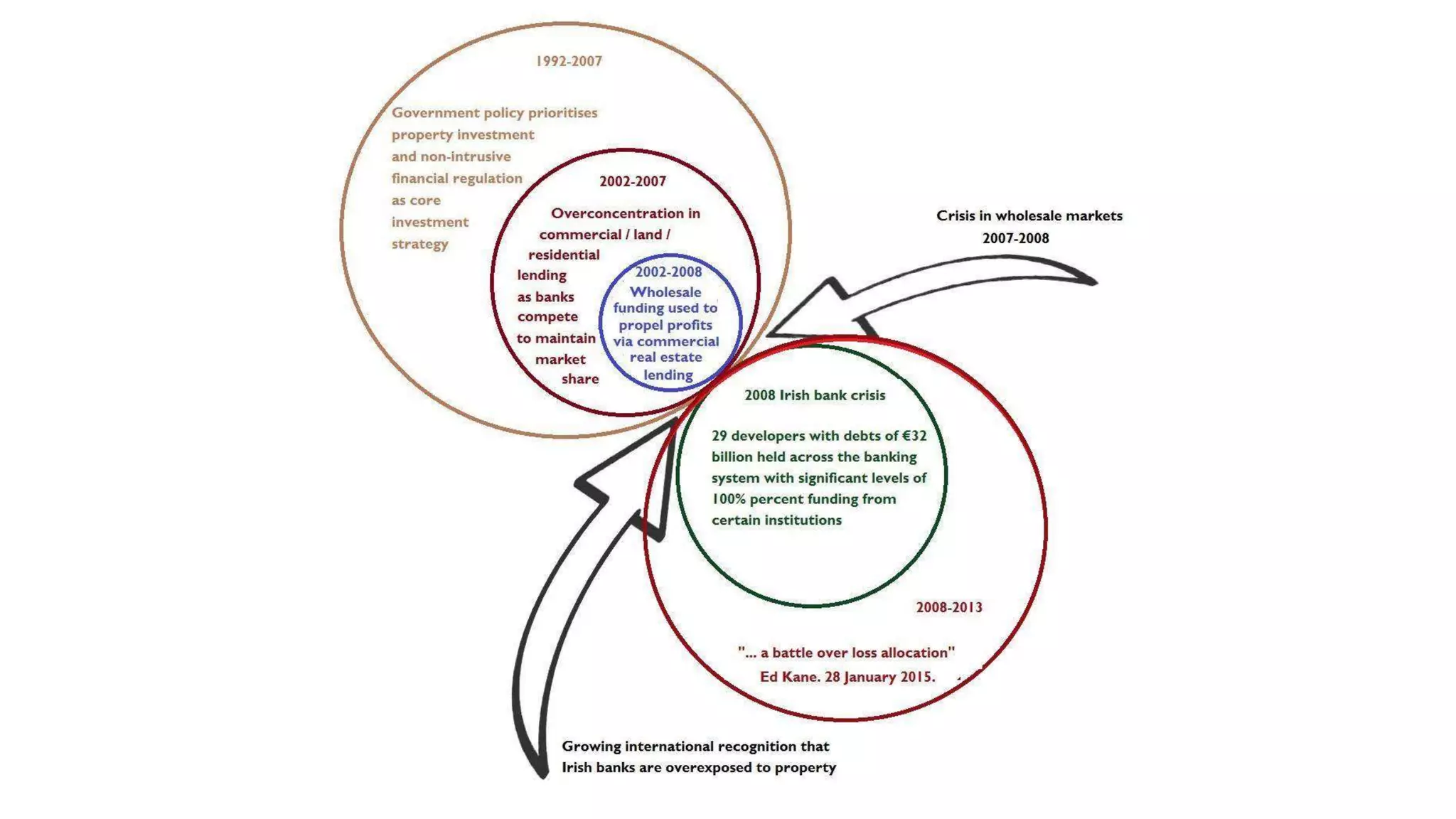

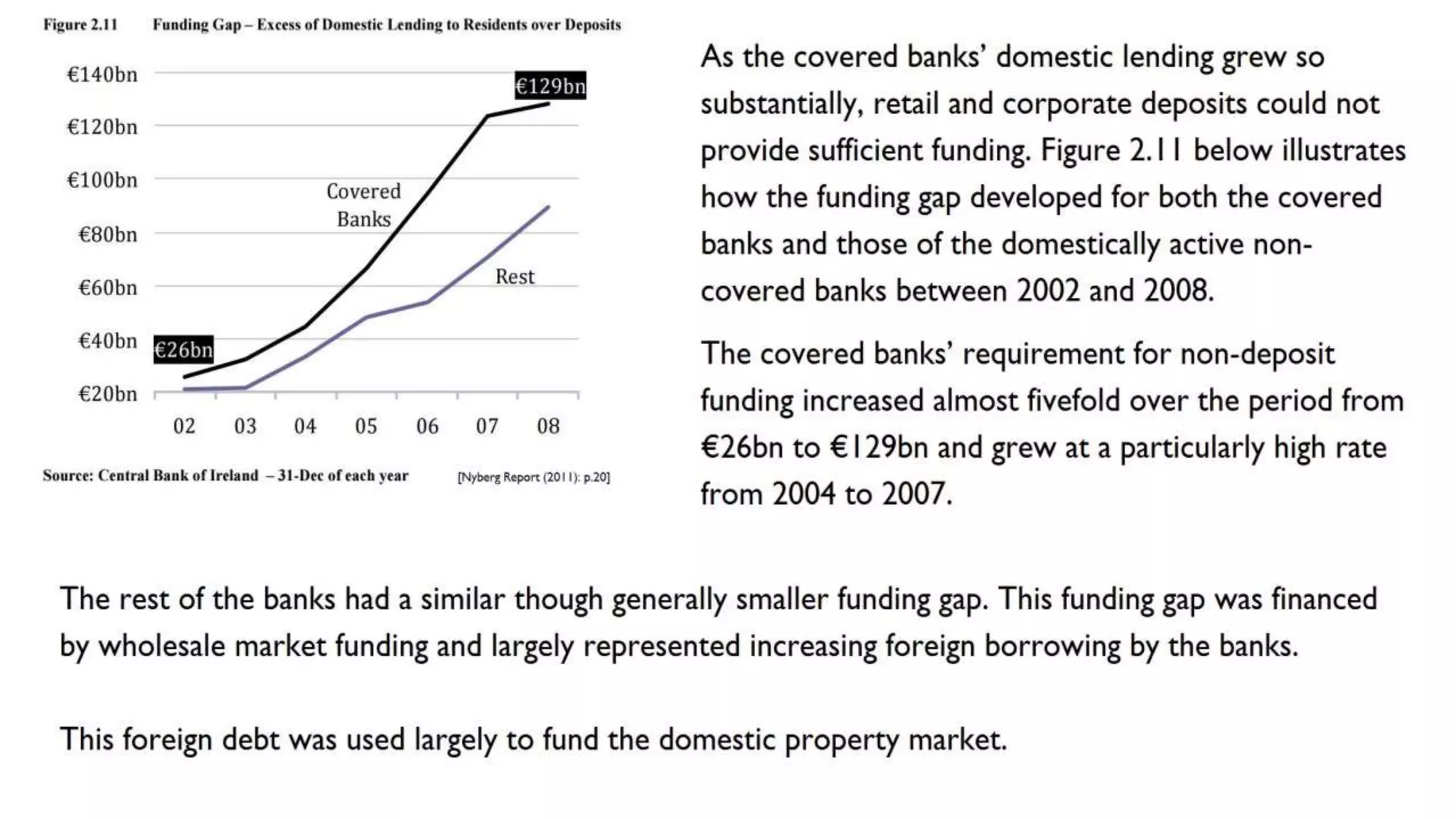

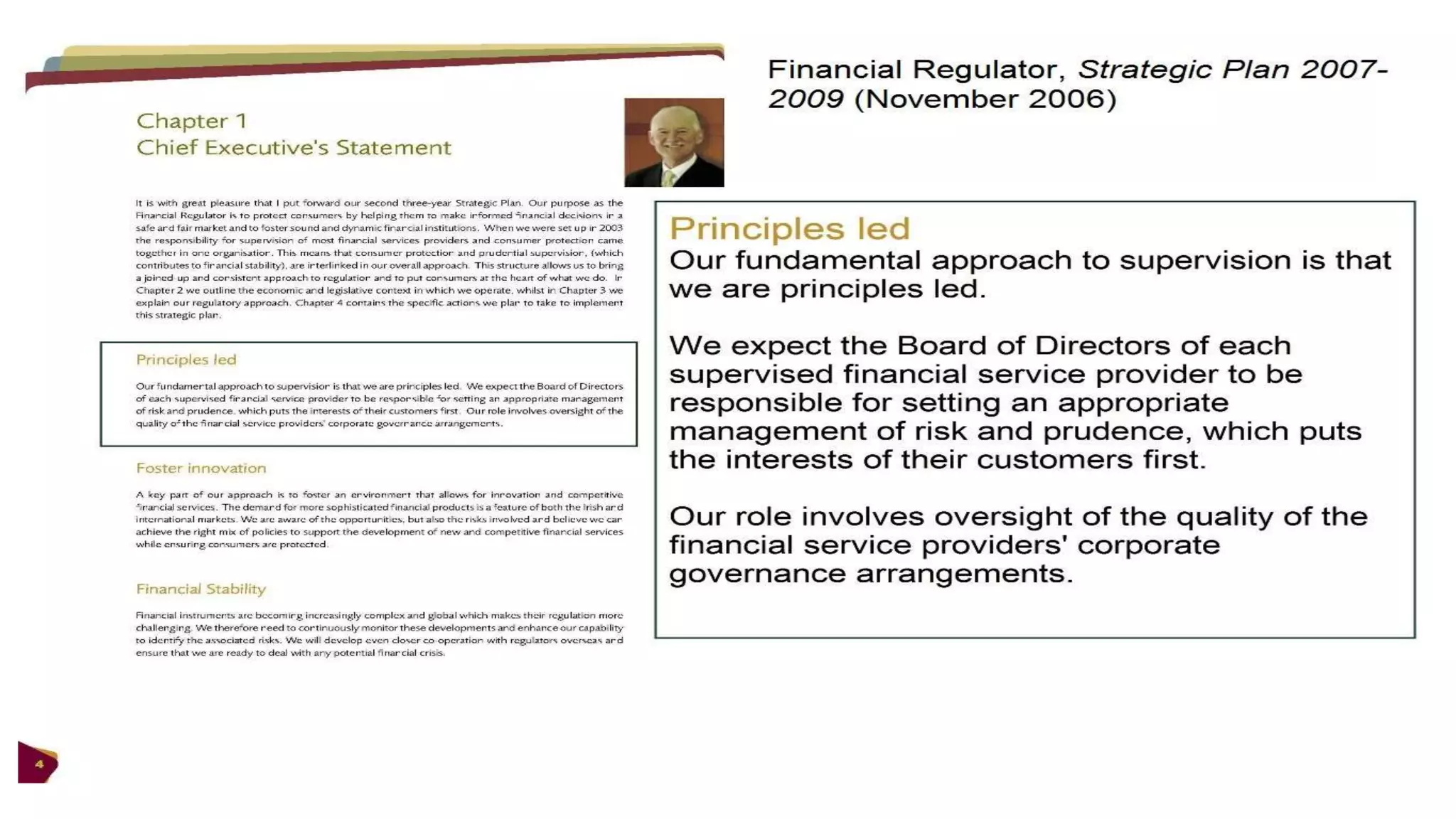

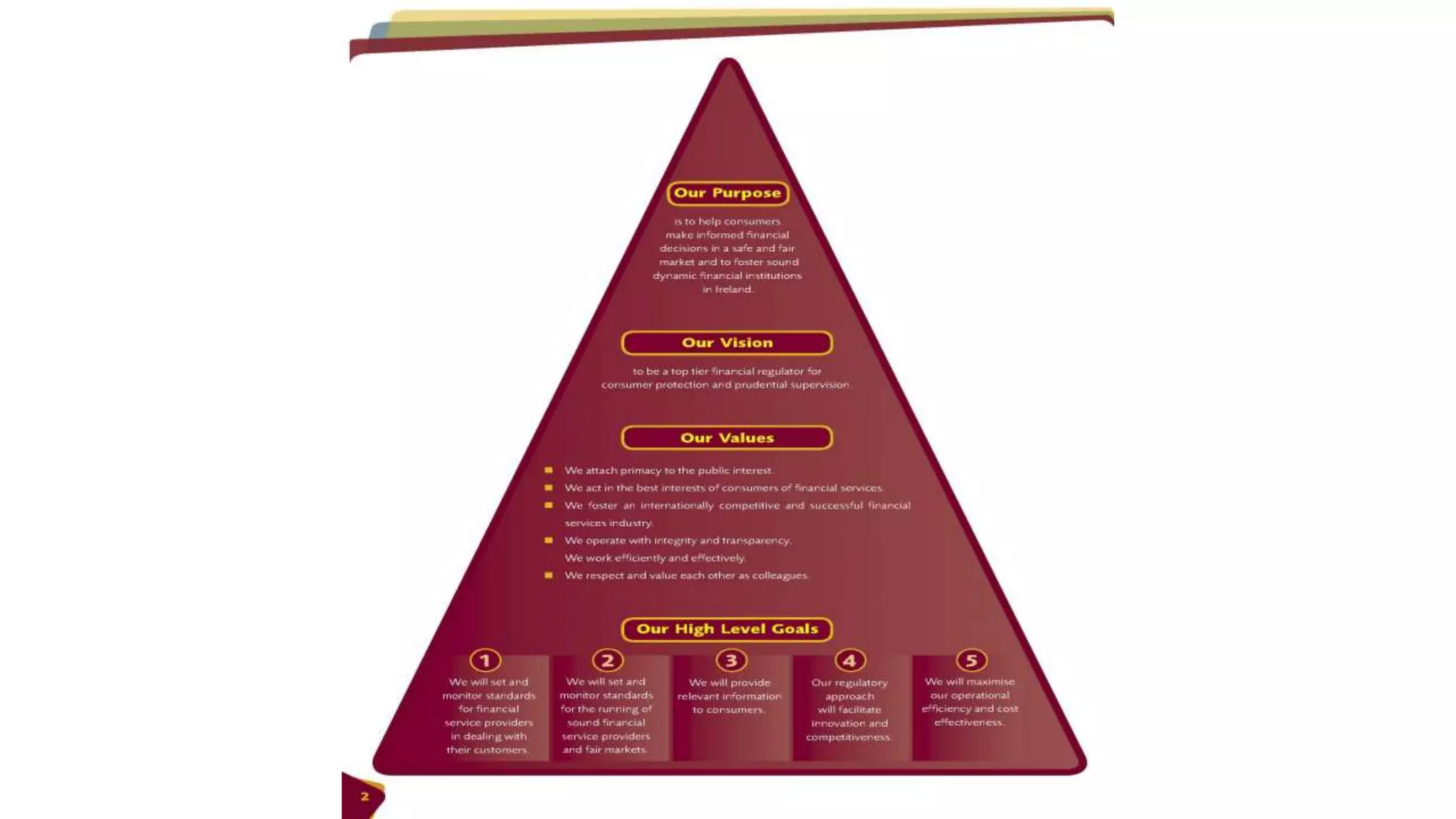

This document examines state-corporate crime in Ireland using a case study approach. It discusses concepts like mediated corruption and how corruption can indirectly benefit political actors. It also analyzes Ireland's relatively low levels of corruption in the early 1900s-1920s, when collective moral bonds and respect for the rule of law were strong. However, it suggests definitions of crime are politically shaped. It examines Ireland's 2008 banking crisis and the government guarantee that benefited banks over depositors. Finally, it discusses NAMA and the small number of debtors behind huge loans, reflecting an unsustainable bubble.

![Mediated Corruption

‘The individual who abuses public office for private gain does not

necessarily always directly benefit.

Instead [it] may indirectly benefit the public officials’ family, friends,

political associates, political party, constituency or other affiliation

associated with the public official.

The gain is political, often indirect, and valuable within its own

context.

Corruption therefore is the use of public office for private gain

without any direct link to a precise favour but in anticipation of future

benefits.

It may encompass undue influence in the formulation of policy and

legislation by vested interests at the expense of the public interest

but which benefit political actors through popular and political

support.’ (p.13)](https://image.slidesharecdn.com/nui-maynooth-3may2019-190503075144/75/Ireland-and-Corruption-5-2048.jpg)

![Ch.2 – Why So Little Corruption? 1900s-1920s

‘[An] unconditional respect for the rule of law, and the

pride in the 1922 Free State Constitution, generated a

collective moral bond….

…Although Ireland was not partitioned, this revolutionary

generation not only restored legislative independence lost

through the Act of Union, 1801, but secured wider

sovereignty for post-independence Ireland.

They achieved this because they sacrificed their self-

interest for the public good and assumed that the lessons

of Irish history were enough for this principle to endure

after them’ (p.33)](https://image.slidesharecdn.com/nui-maynooth-3may2019-190503075144/75/Ireland-and-Corruption-7-2048.jpg)

![Mediated Corruption

‘The individual who abuses public office for private gain does not

necessarily always directly benefit.

Instead [it] may indirectly benefit the public officials’ family, friends,

political associates, political party, constituency or other affiliation

associated with the public official.

The gain is political, often indirect, and valuable within its own

context.

Corruption therefore is the use of public office for private gain

without any direct link to a precise favour but in anticipation of future

benefits.

It may encompass undue influence in the formulation of policy and

legislation by vested interests at the expense of the public interest

but which benefit political actors through popular and political

support.’ (p.13)](https://image.slidesharecdn.com/nui-maynooth-3may2019-190503075144/75/Ireland-and-Corruption-11-2048.jpg)

![‘In general, white-collar crime is considered to be crime

committed by the natural persons, those capable of wearing

white-collars, while corporate crime is committed by artificial

legal persons, corporate entities….

… The core contribution of [Edwin] Sutherland’s work… was to

show that white-collar wrongdoing was a serious form of crime

which was not defined as such by the legal system…

… Though corporate and white-collar crime is a broad area of

inquiry, this monograph is restricted to an analysis of the

enforcement of criminal offences in the Companies Act and

matters which have had an impact on their enforcement.’ (pp.6-7)](https://image.slidesharecdn.com/nui-maynooth-3may2019-190503075144/75/Ireland-and-Corruption-21-2048.jpg)

![“As understood by the Financial Regulator, ‘principles-based’

regulation relied very heavily on making sure that appropriate

governance structures and systems were in place in banks and

building societies.

To this extent, the underlying philosophy was oriented towards

trusting a properly governed firm; it was potentially only a short

step from that trust to the emergence of a somewhat diffident

attitude on the part of the regulators so far as challenging the

decisions of firms was concerned.

[Also], legislation set as a statutory objective of the [central

bank and financial regulator] the promotion of the financial

services industry in Ireland, the situation was ripe for the

emergence of a rather accommodating stance vis-à-vis credit

institutions.”

Honohan Report on the Irish banking crisis, May 2010, p.44.](https://image.slidesharecdn.com/nui-maynooth-3may2019-190503075144/75/Ireland-and-Corruption-73-2048.jpg)