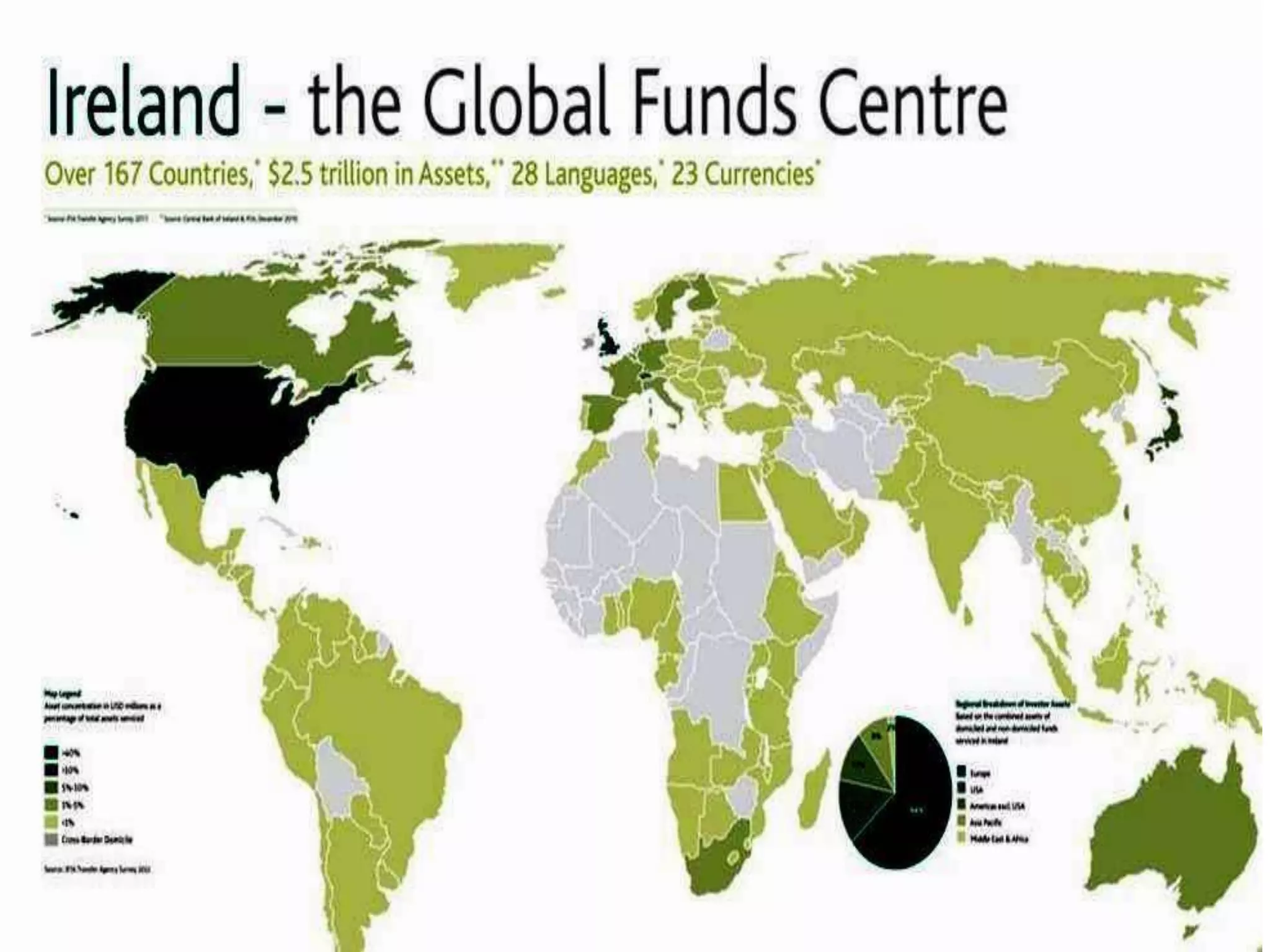

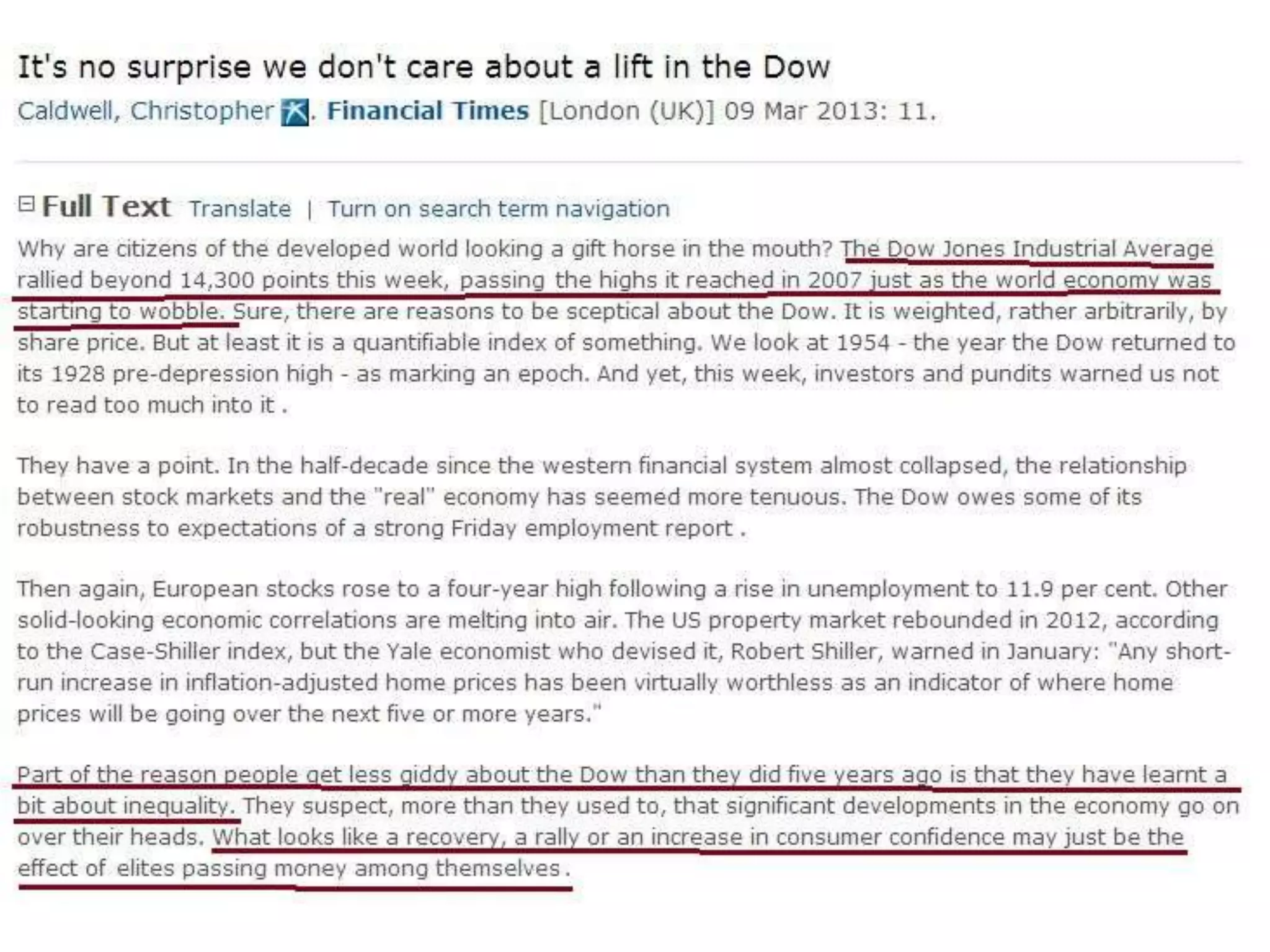

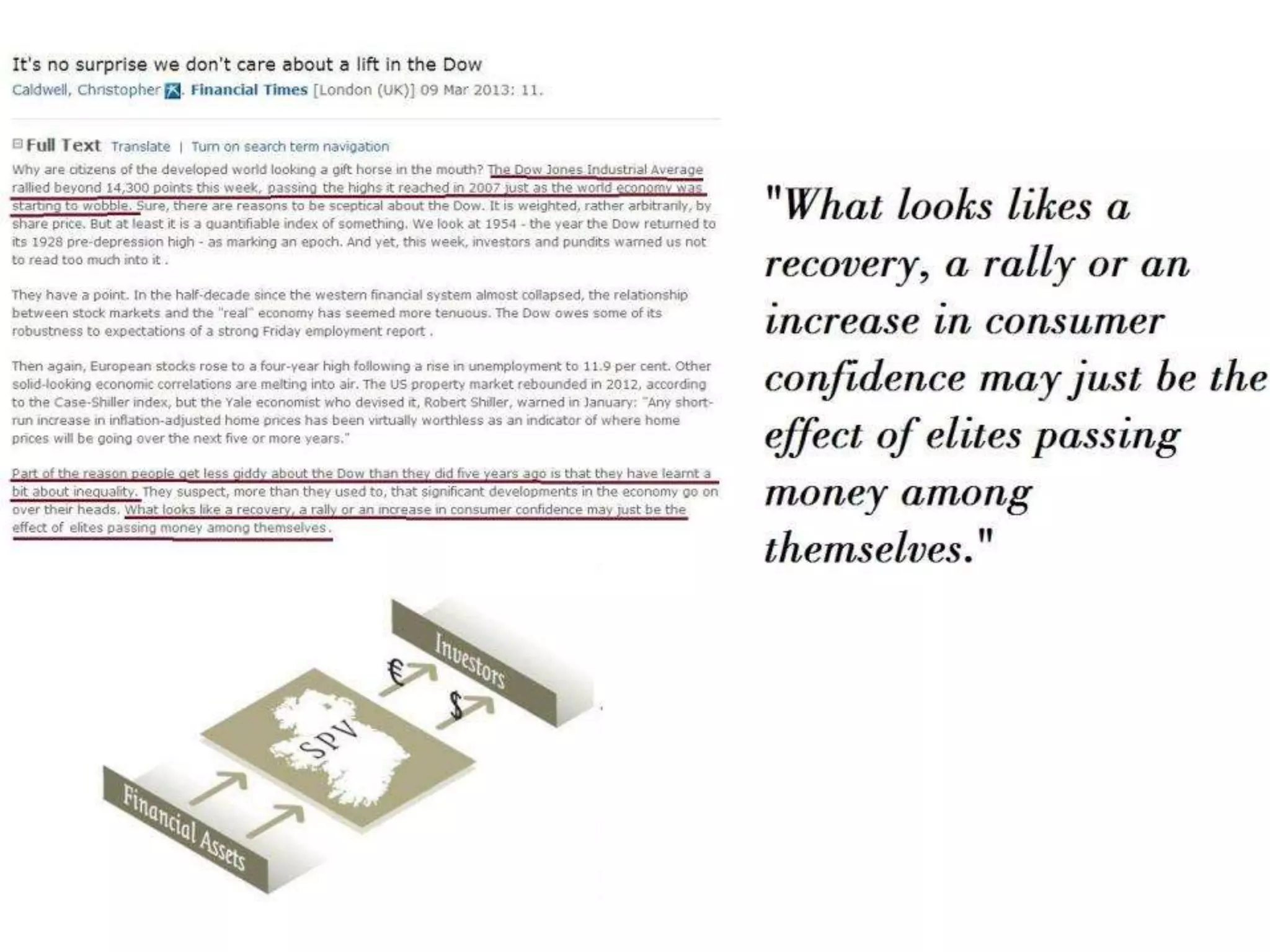

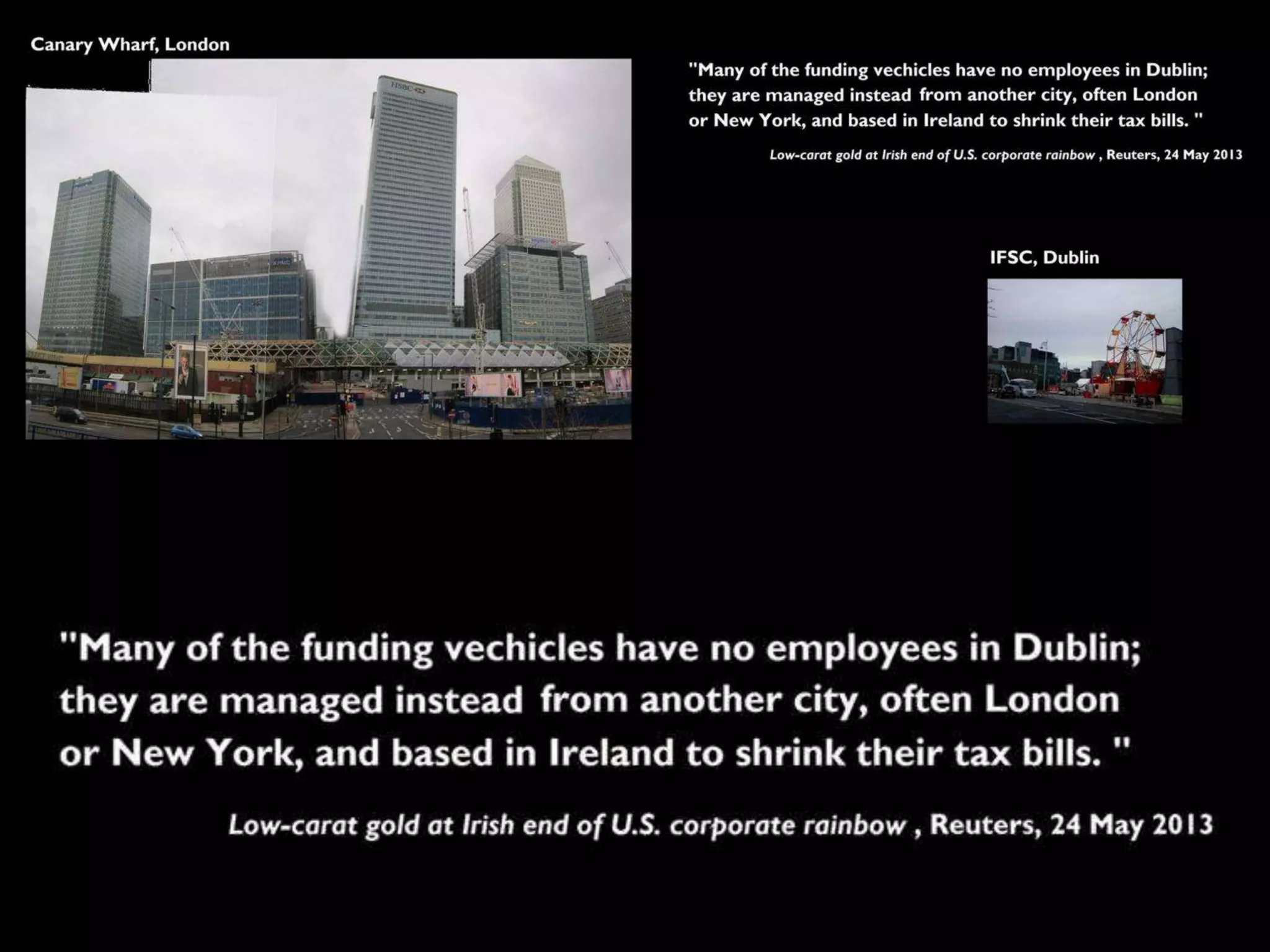

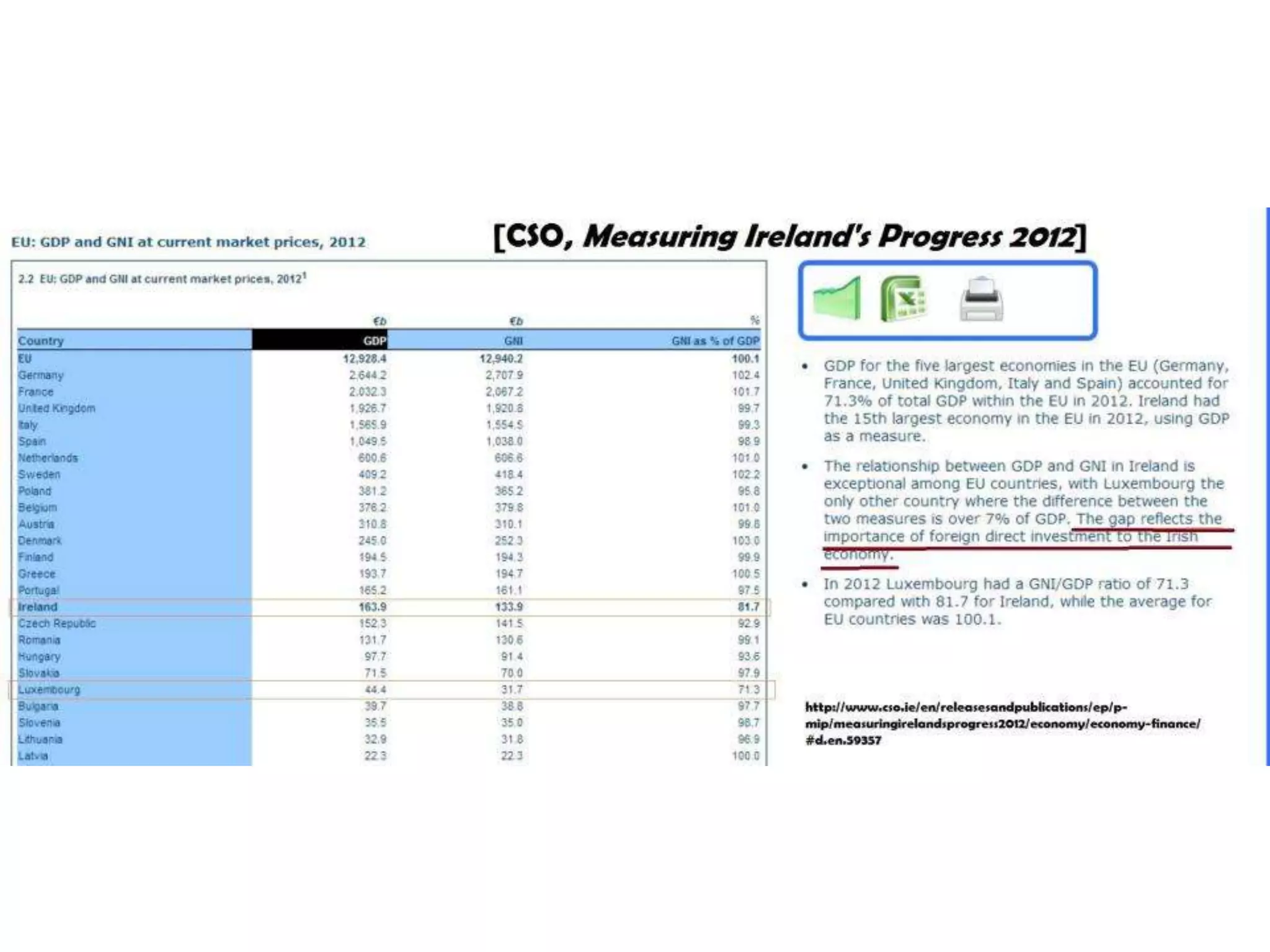

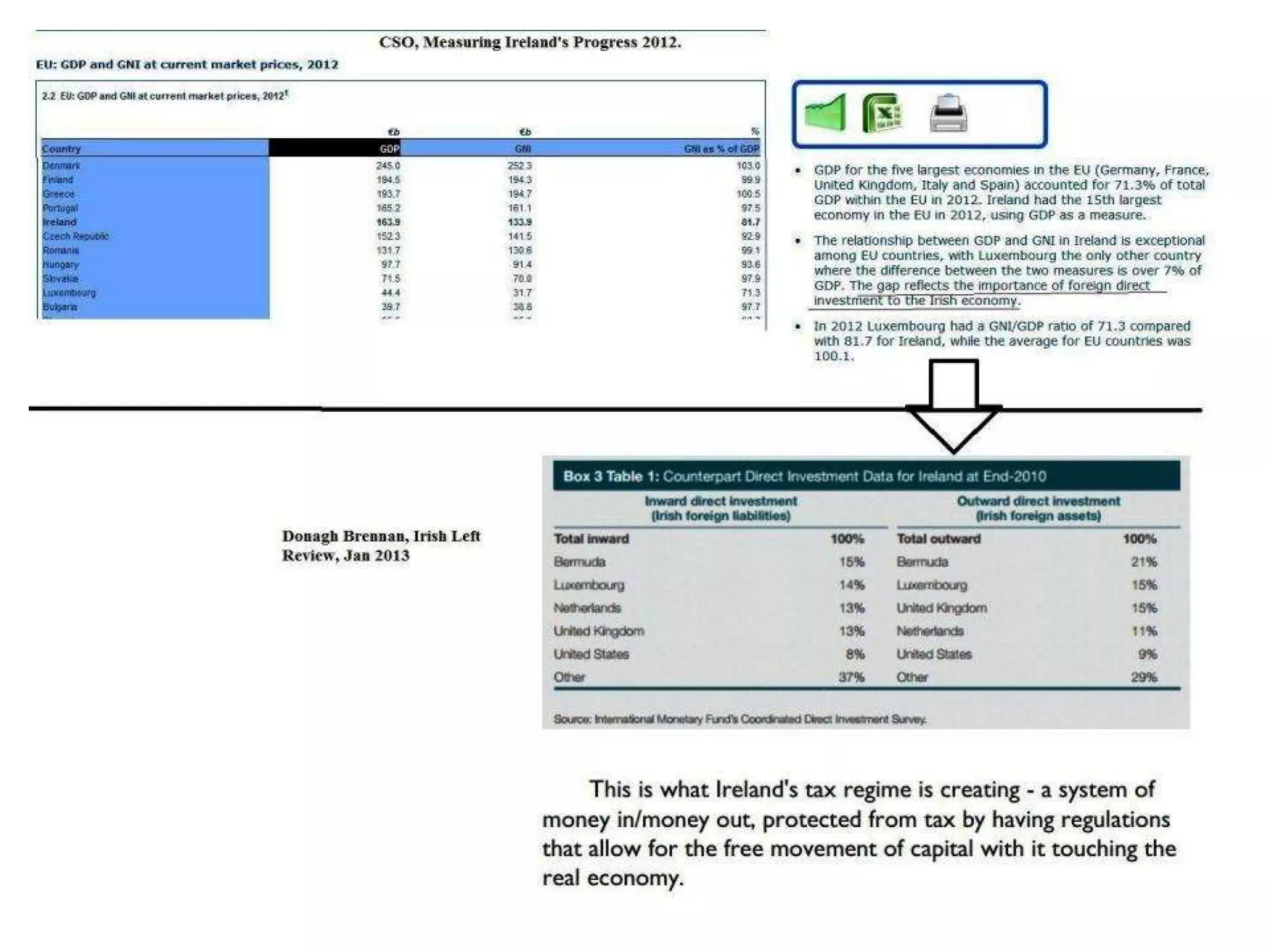

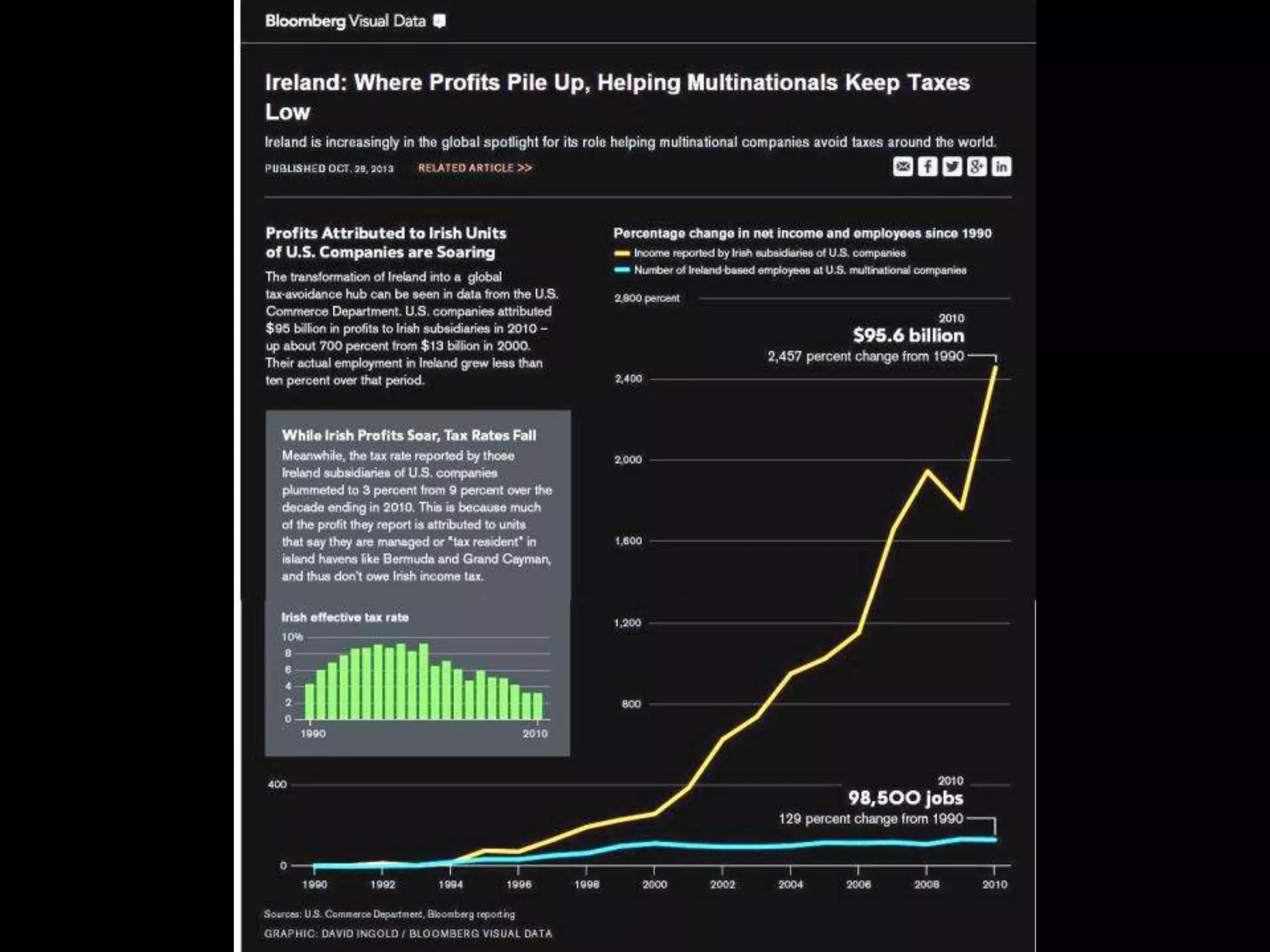

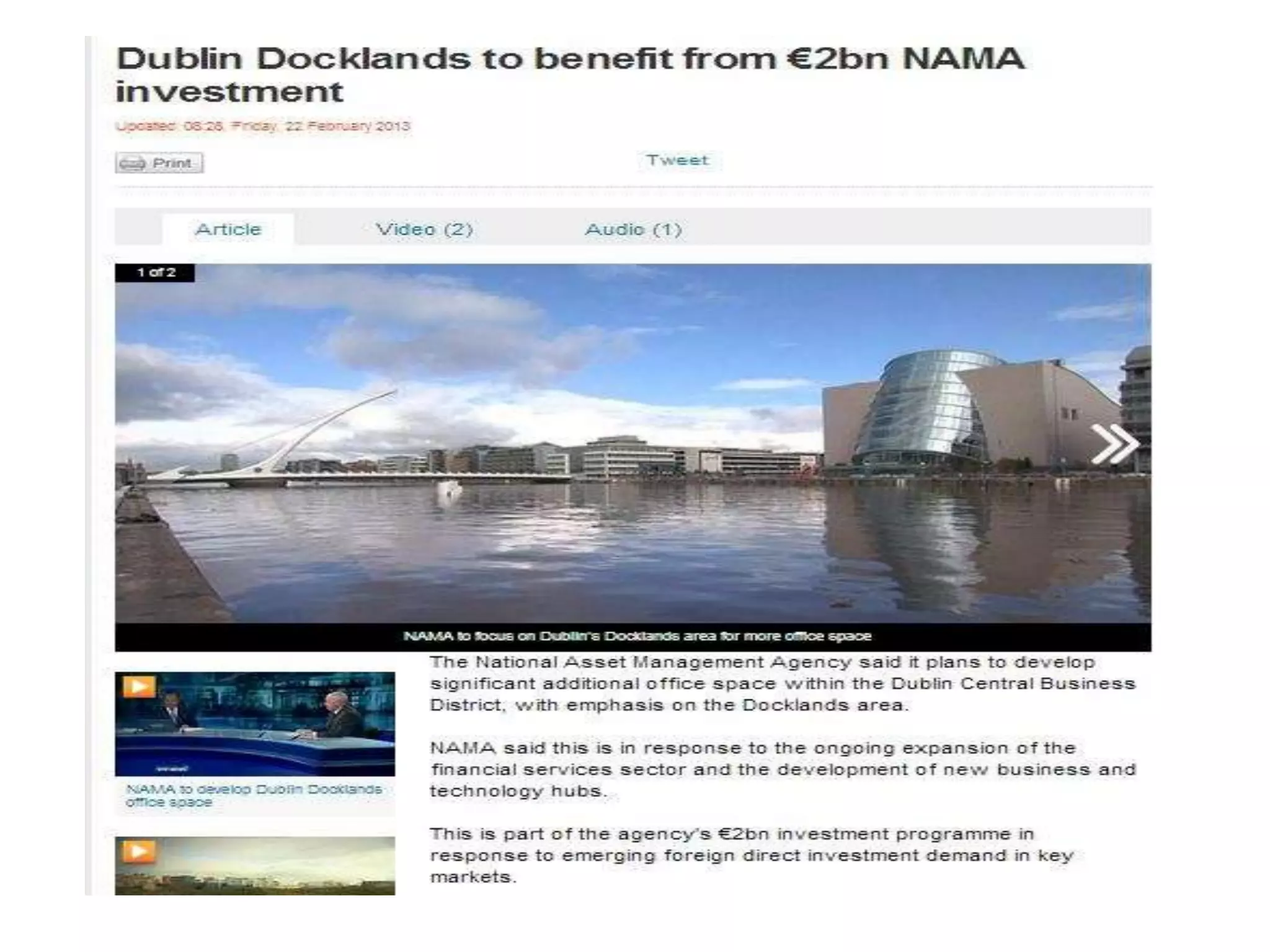

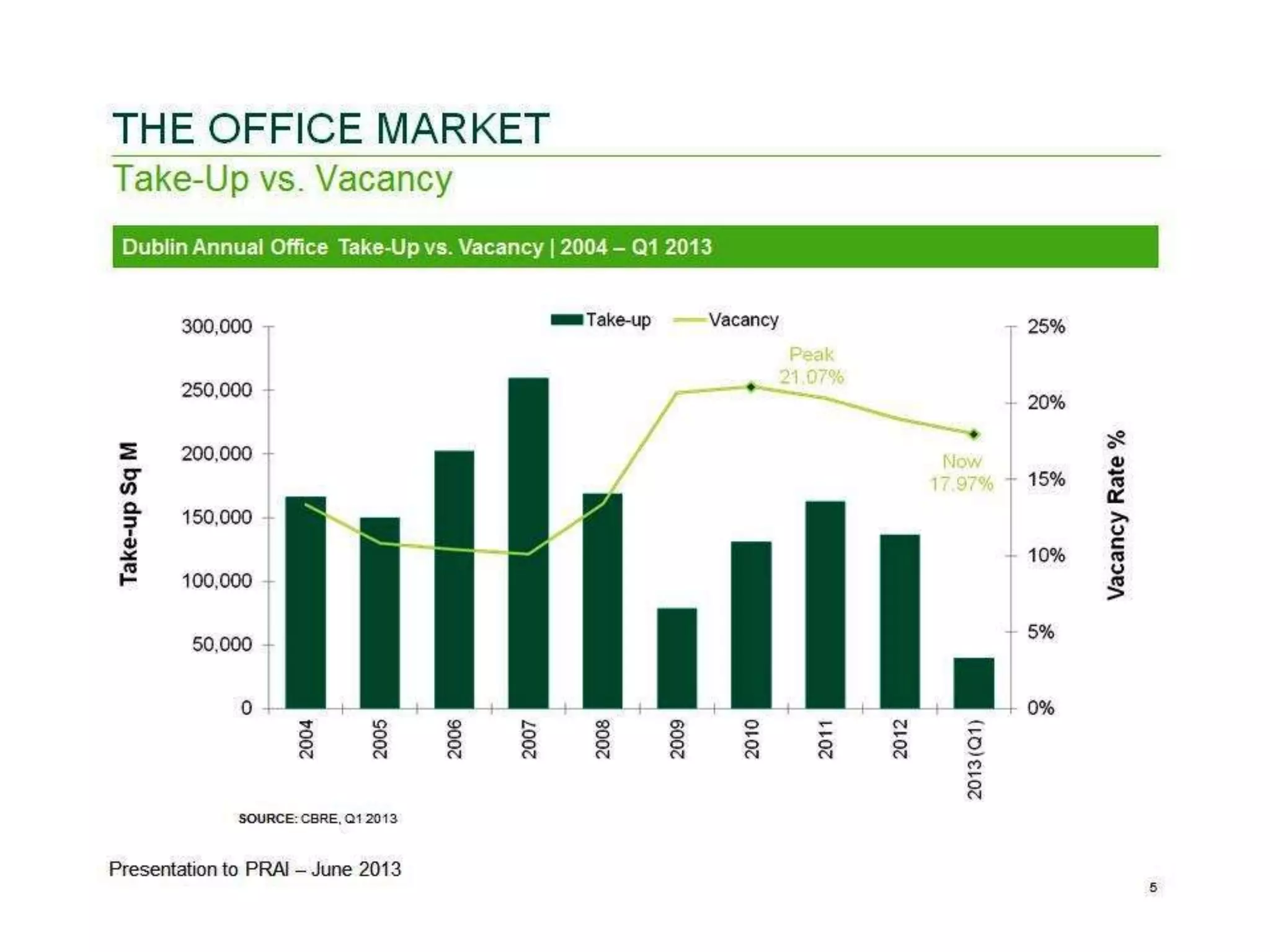

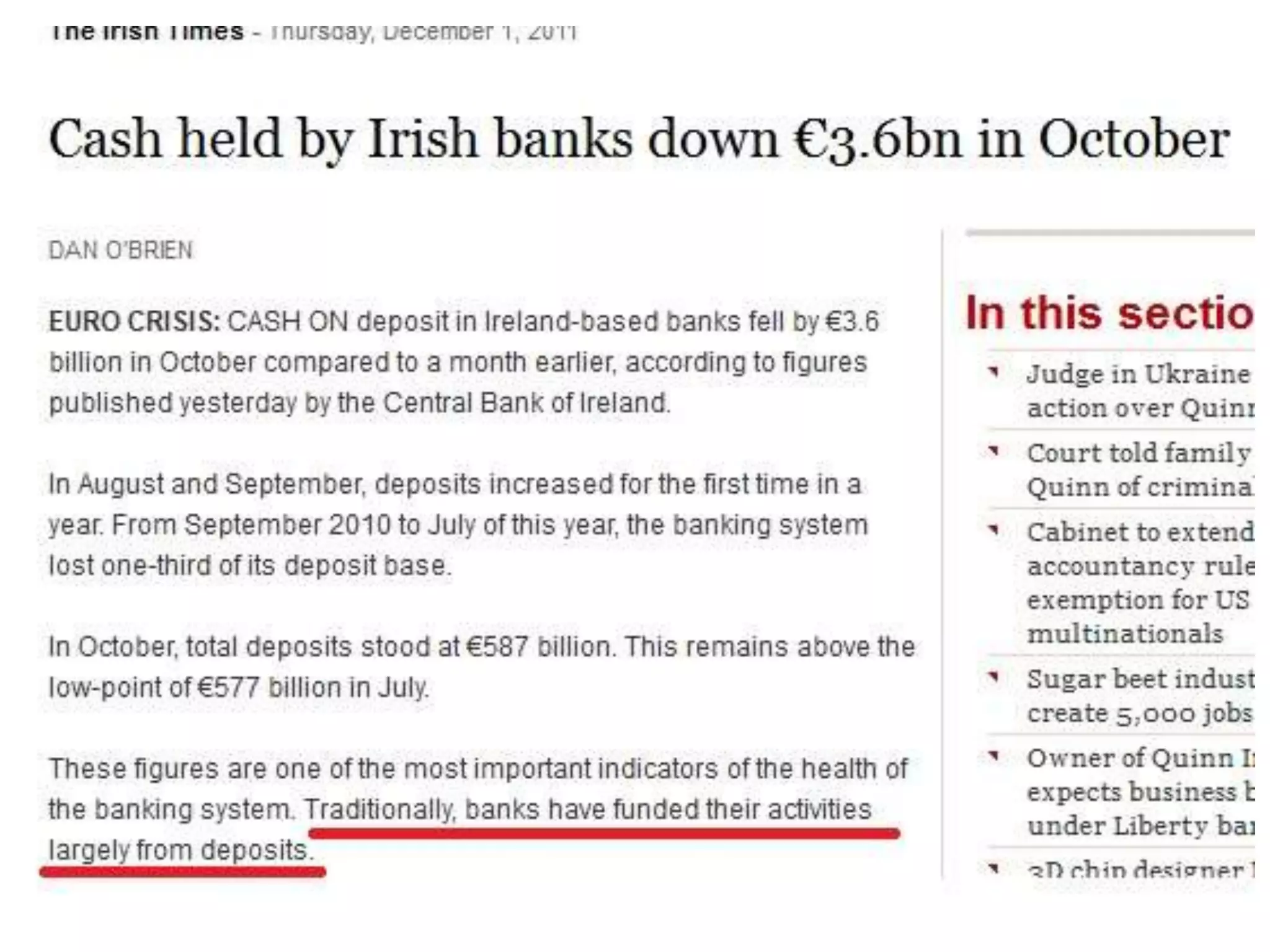

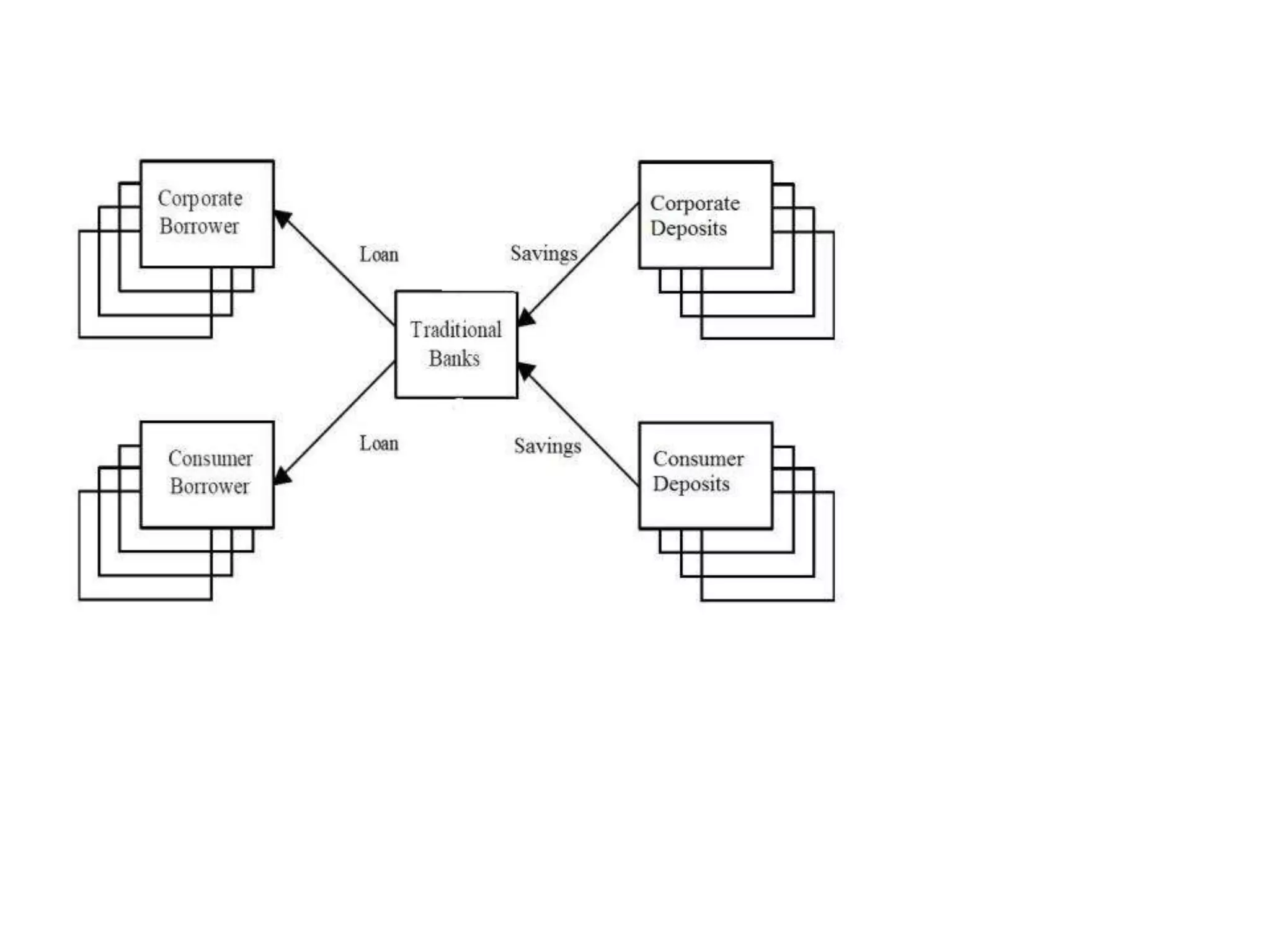

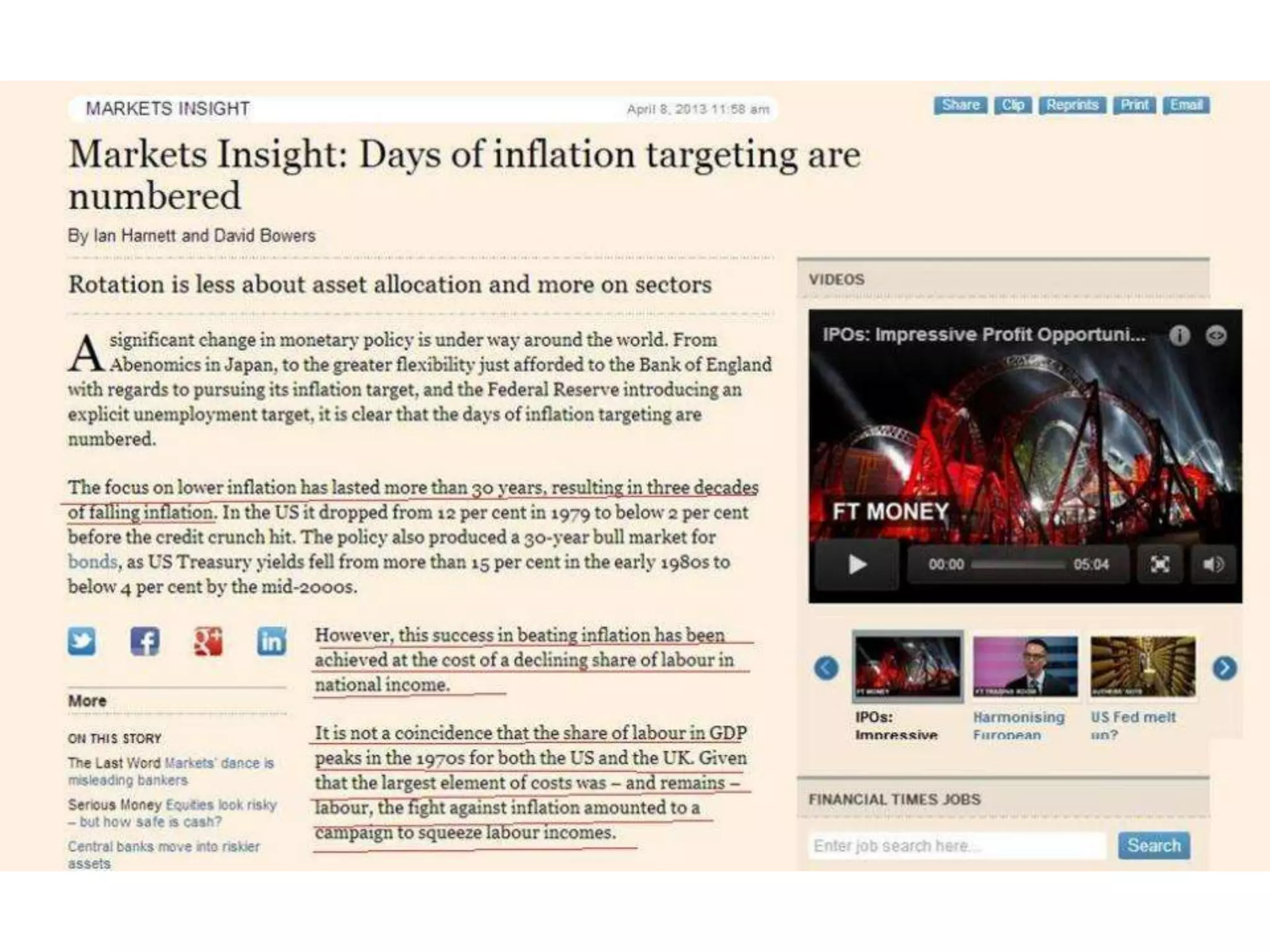

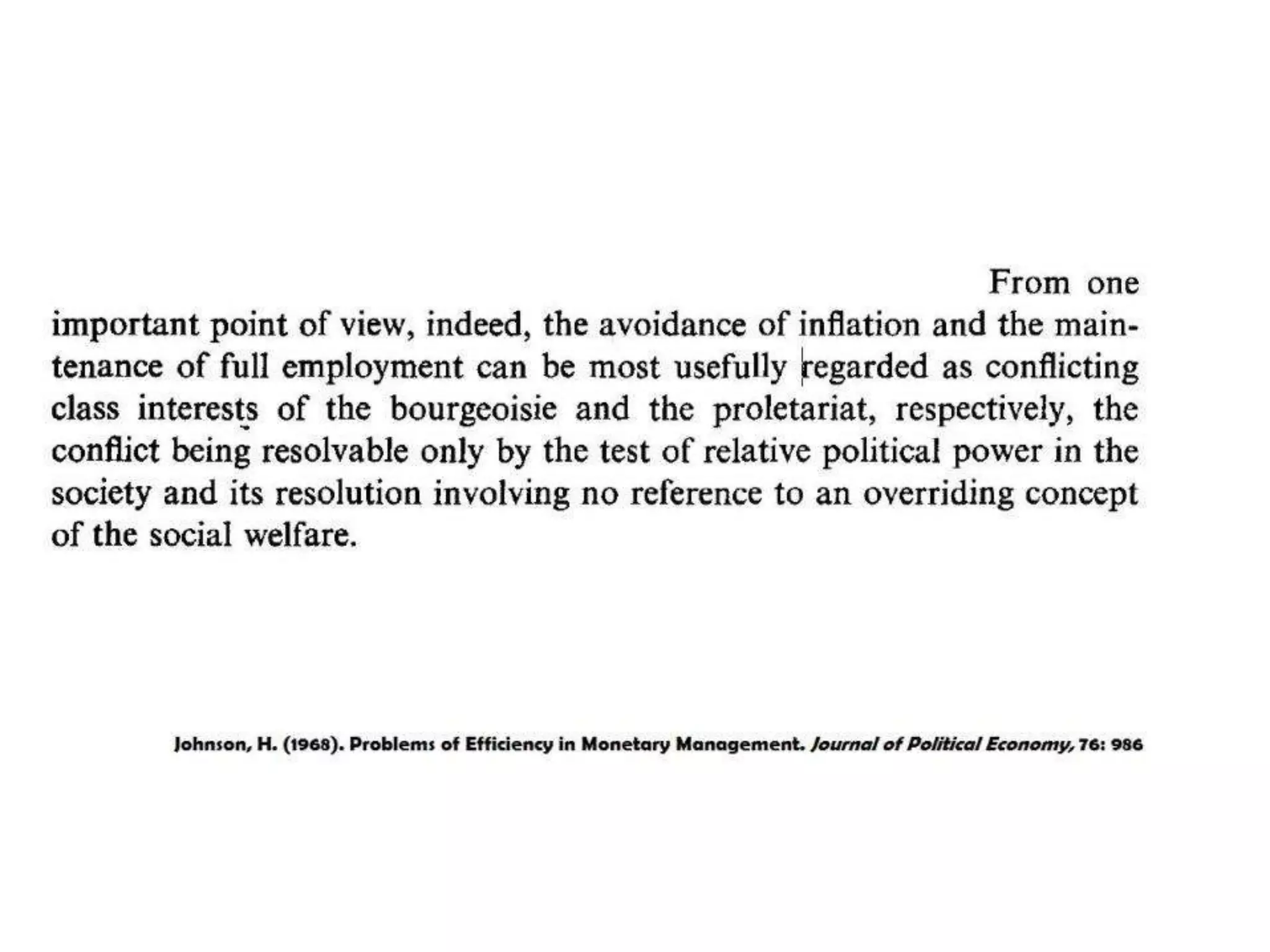

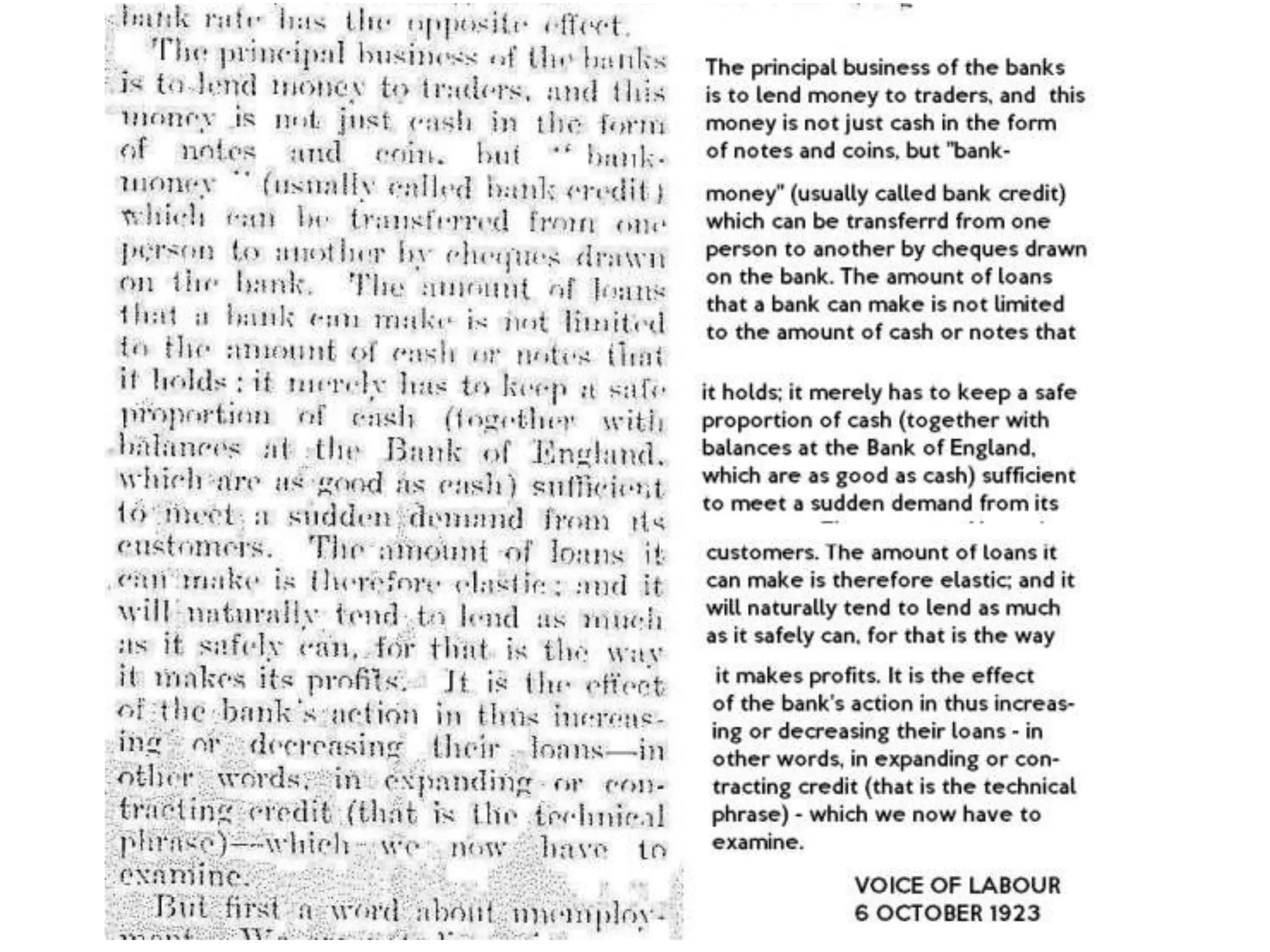

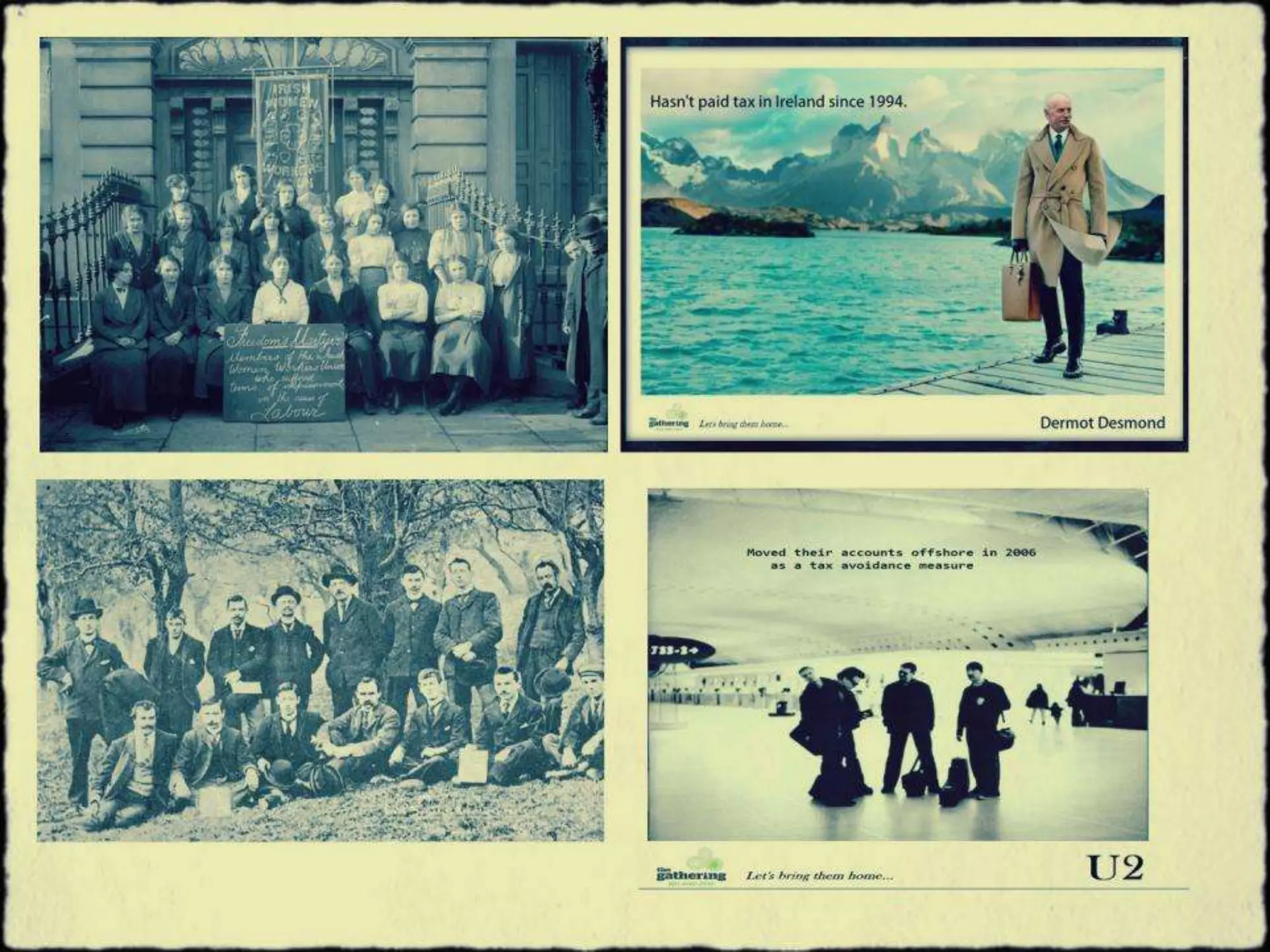

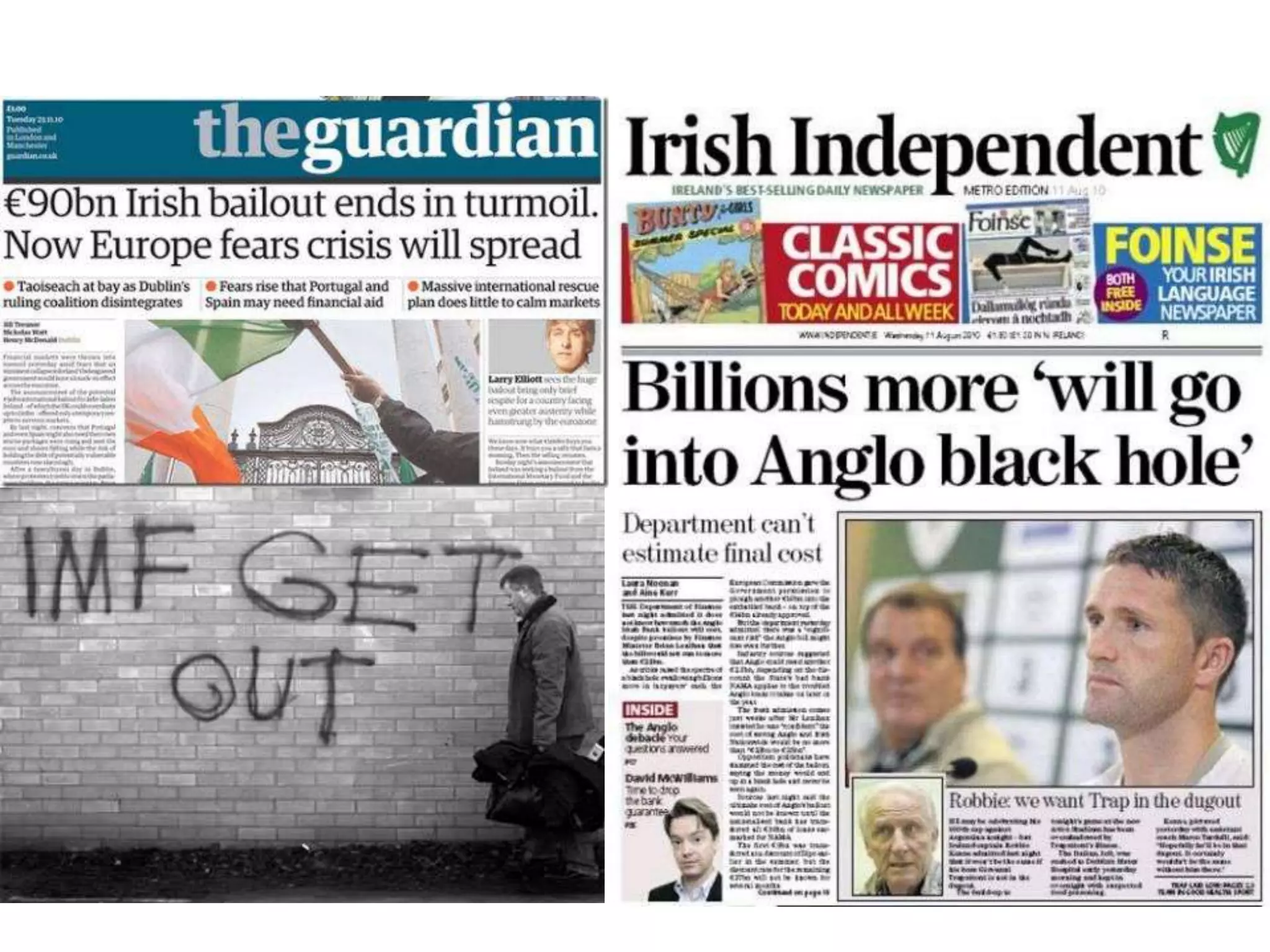

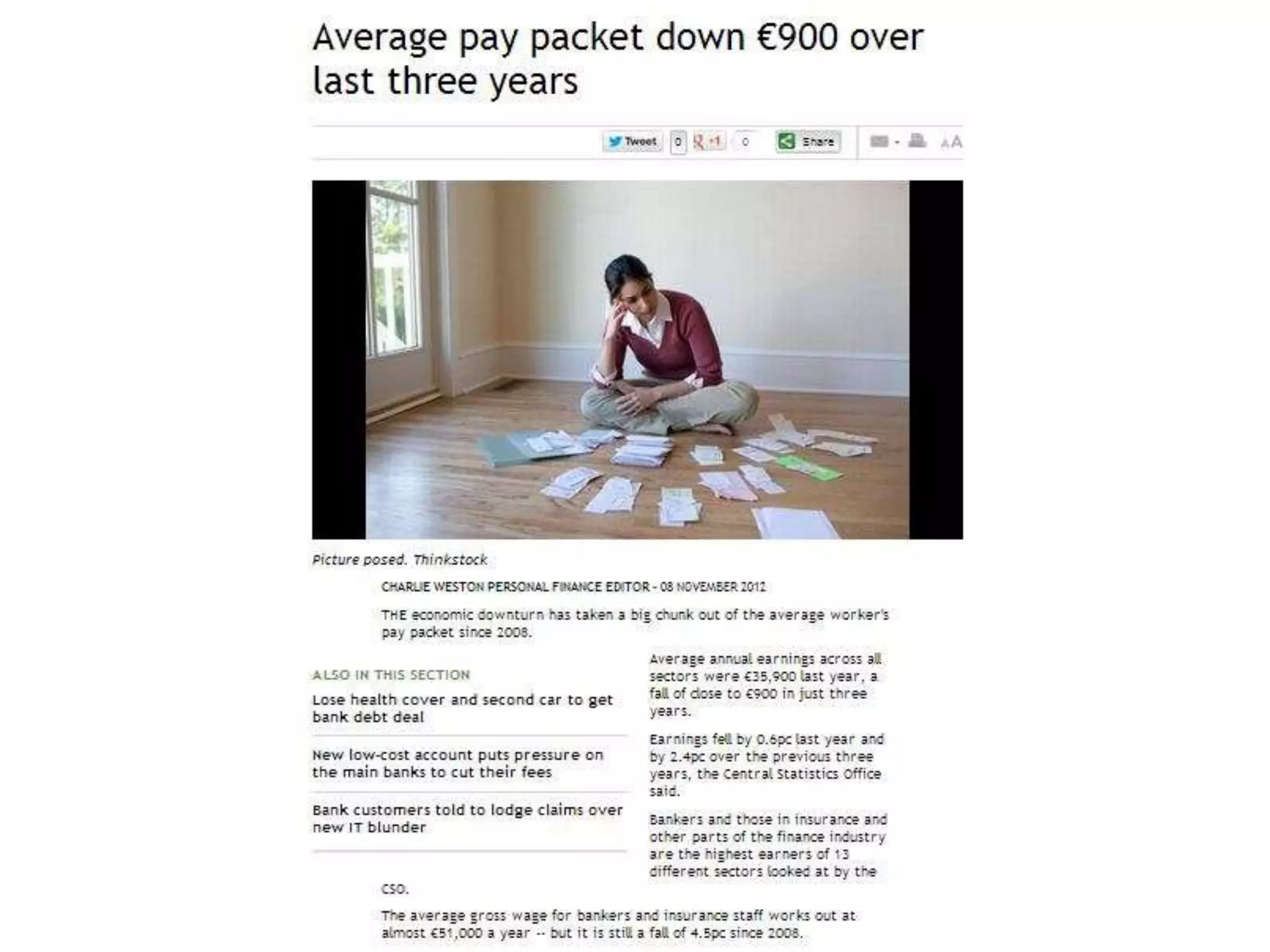

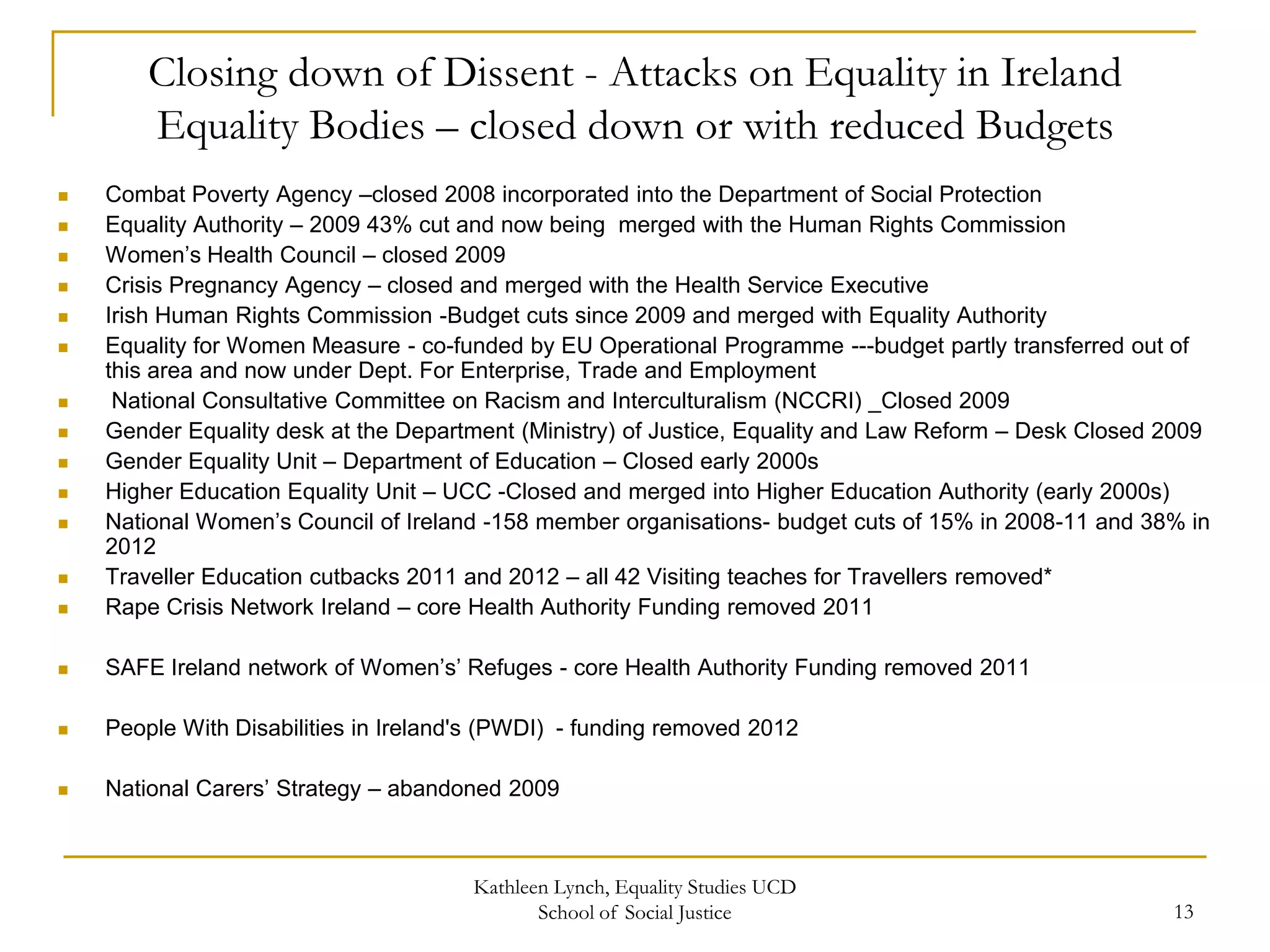

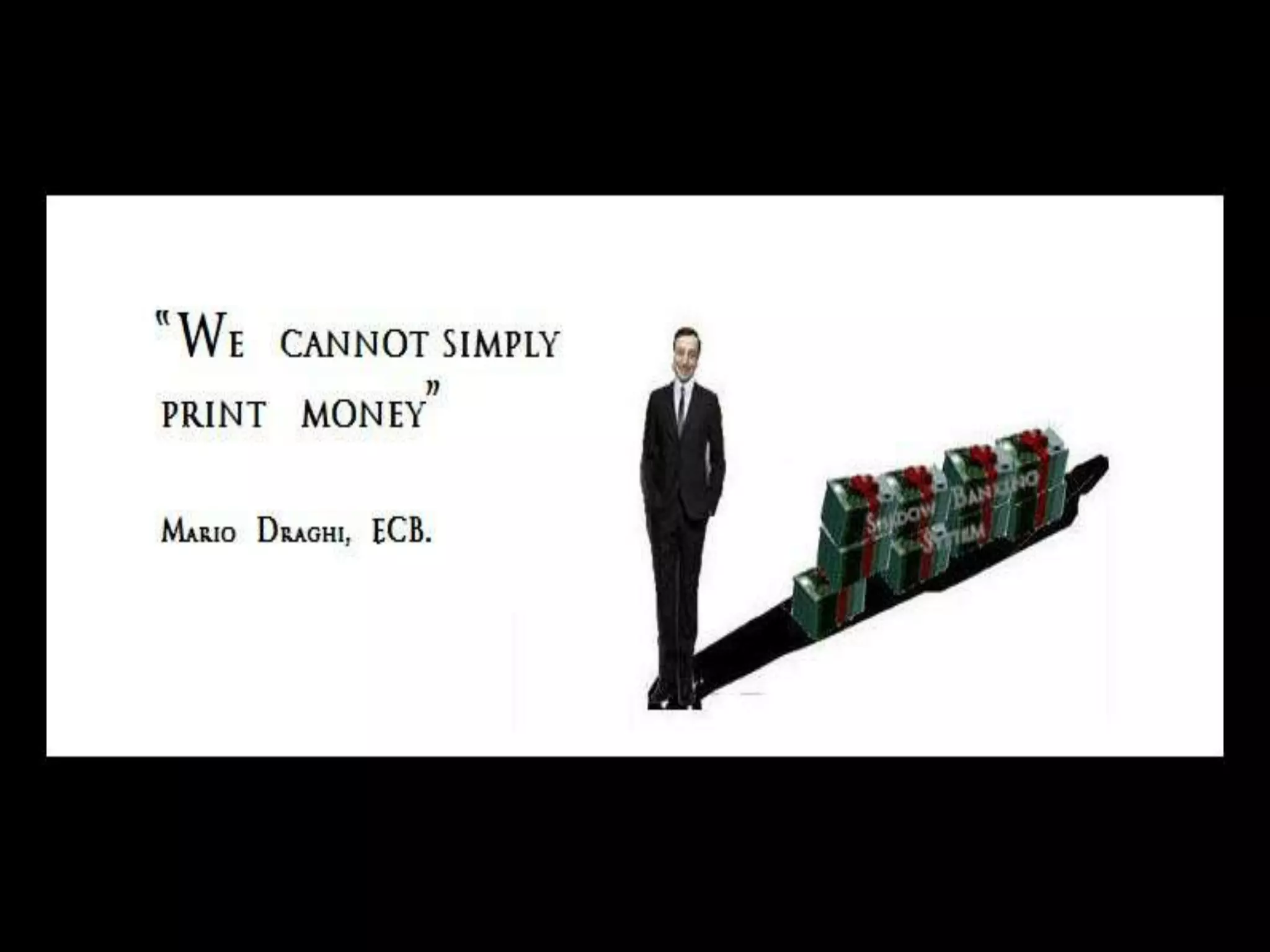

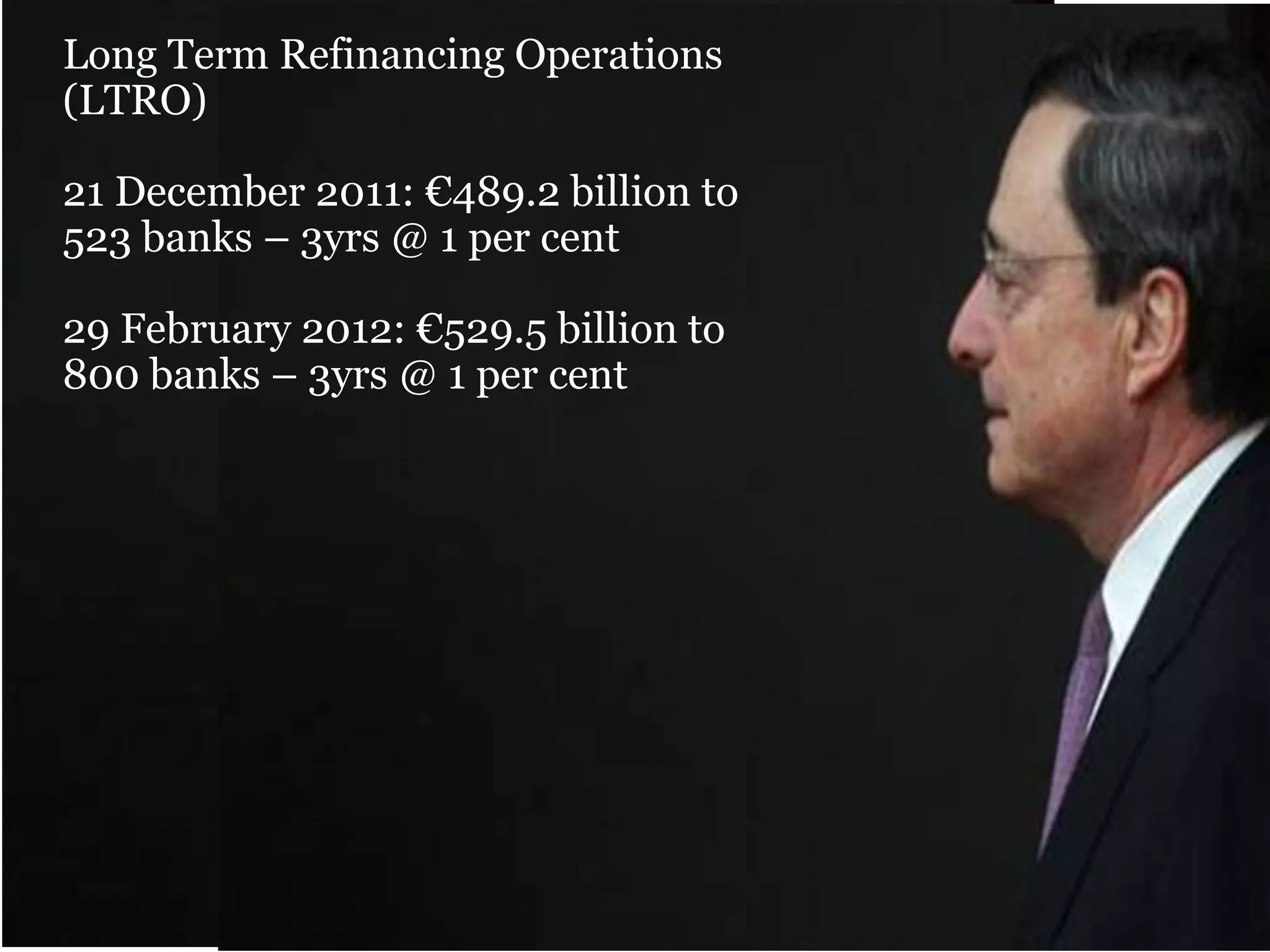

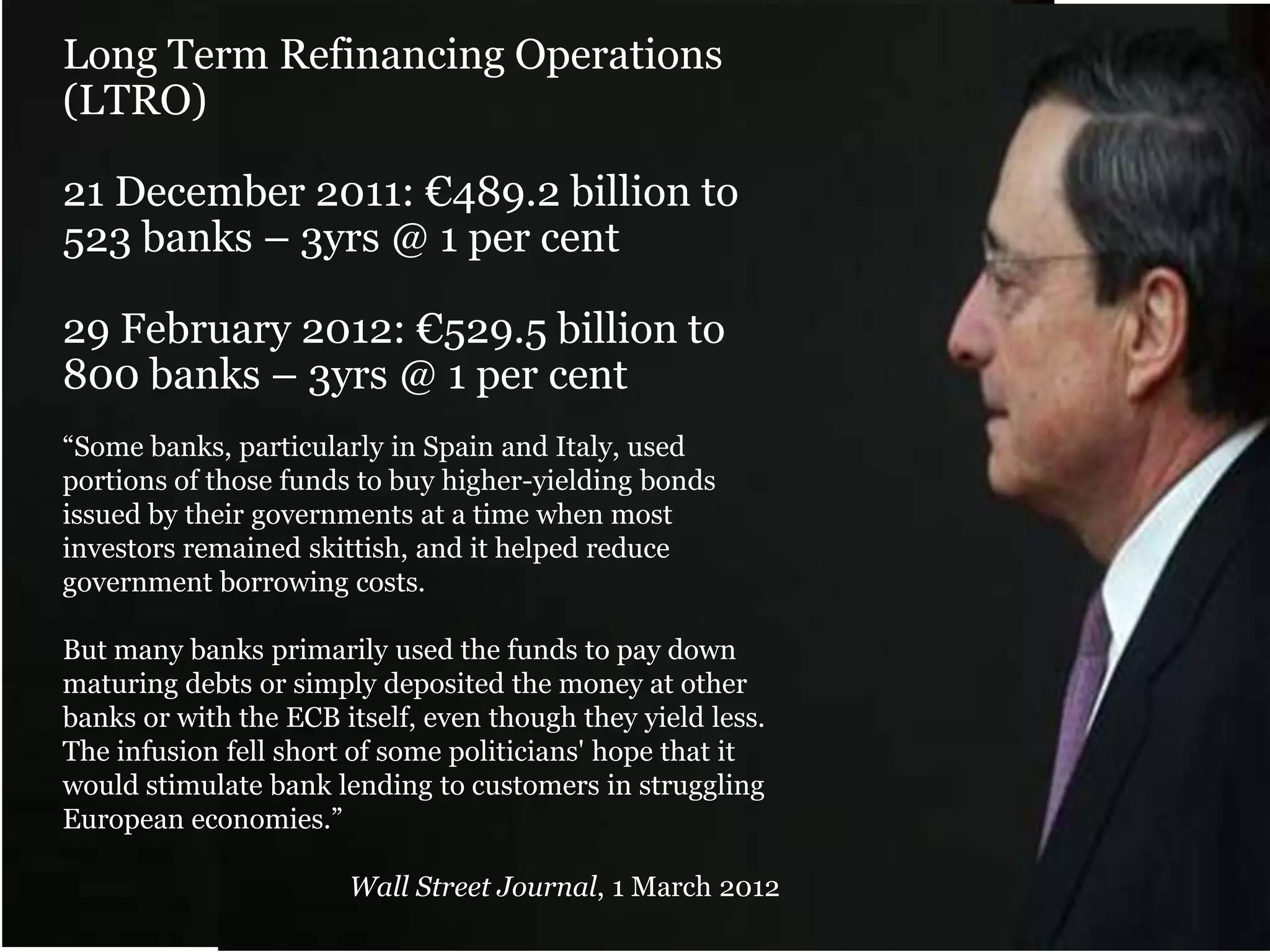

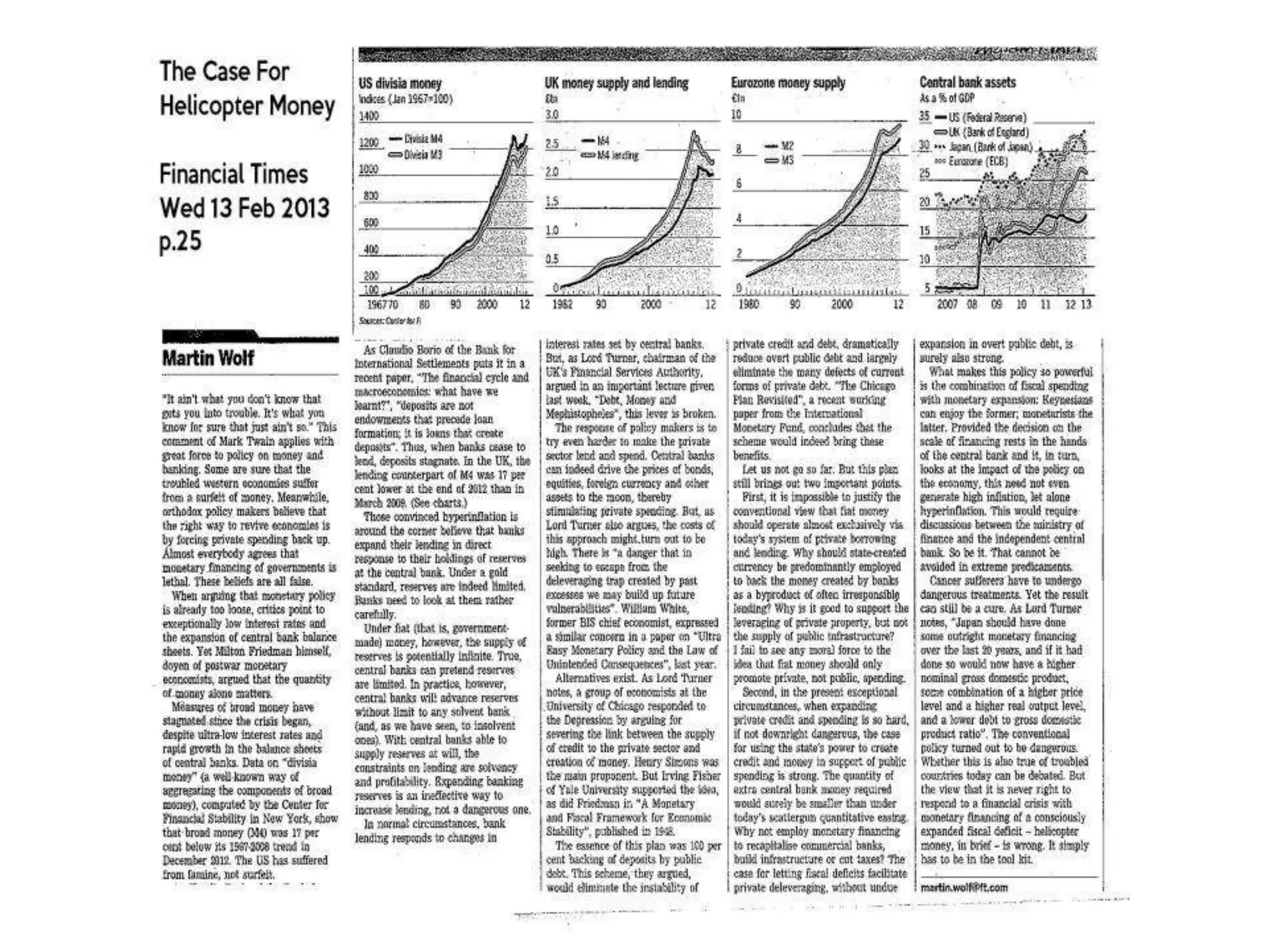

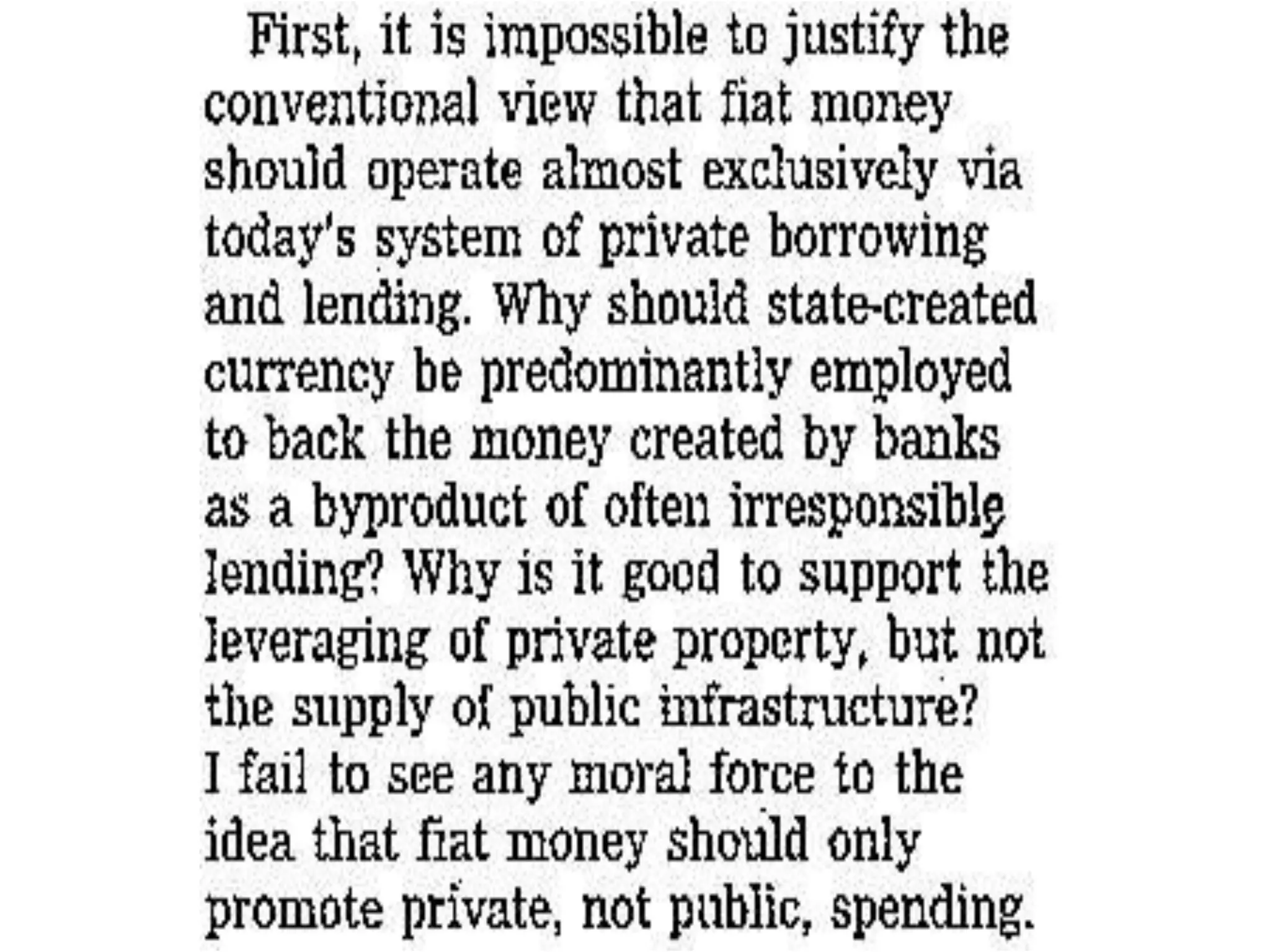

This document summarizes a presentation given on February 18, 2014 on finance and equality in Ireland. It discusses the closing or reduction of budgets for several Irish equality bodies between 2008 and 2012. It then provides details on Long Term Refinancing Operations by the ECB that provided over 1 trillion euros to banks at low interest rates in 2011-2012. The remainder discusses the implications of greater financialization and mobility of capital for inequality and economic growth.

![[Lehman collapse, 15 September 2008 - headlines 16 Sep 2008]](https://image.slidesharecdn.com/mandate-austerity-feb-2014-140218031405-phpapp02/75/Mandate-Training-Feb-2014-Ireland-and-the-World-of-Finance-2-2048.jpg)

![Rather than being a modest

helper to the capital

accumulation process,

[finance] gradually turned

into a driving force.

Speculative finance became

a kind of secondary engine

for growth given the

weakness in the primary

engine, productive

investment.](https://image.slidesharecdn.com/mandate-austerity-feb-2014-140218031405-phpapp02/75/Mandate-Training-Feb-2014-Ireland-and-the-World-of-Finance-21-2048.jpg)