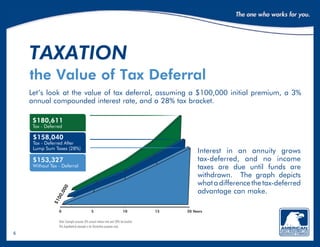

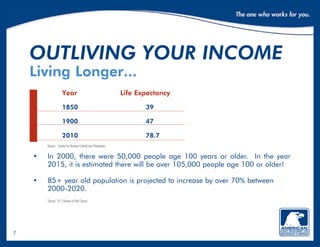

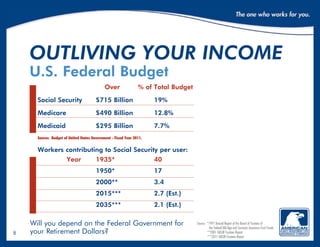

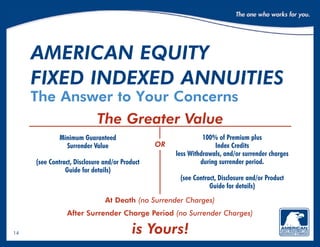

This document discusses concerns related to retirement planning and how fixed indexed annuities can help address those concerns. It outlines 6 common retirement concerns: safety of funds, accessibility of funds, taxation, outliving income, locking in interest credits, and probate costs. It then explains how fixed indexed annuities can help provide safety of principal, guaranteed access to funds, tax-deferred growth, guaranteed lifetime income, locking in annual interest gains, and bypassing probate. The document promotes American Equity Investment Life Insurance Company's fixed indexed annuity products as solutions that address these retirement planning challenges.