The document discusses various wealth management and retirement planning strategies, including:

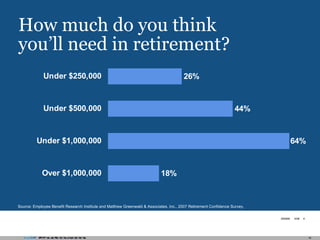

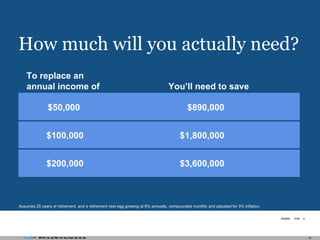

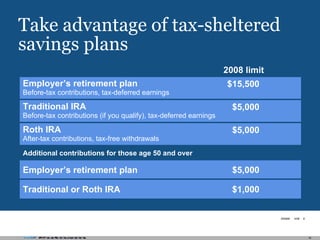

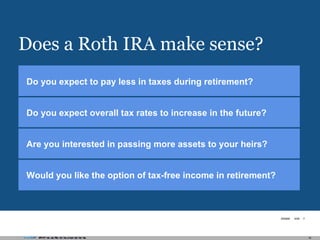

- Saving enough for retirement by maximizing tax-advantaged retirement plans and IRAs

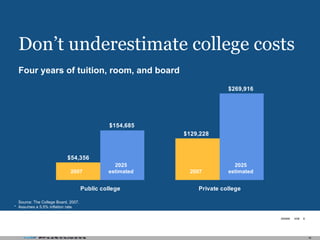

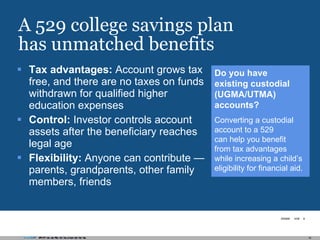

- Using a 529 plan to save for education costs tax-free

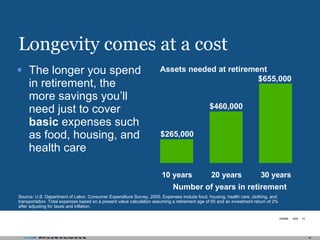

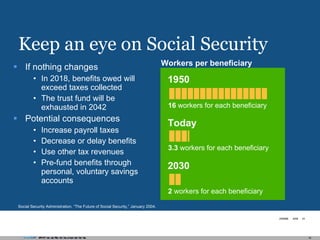

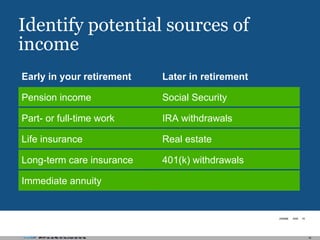

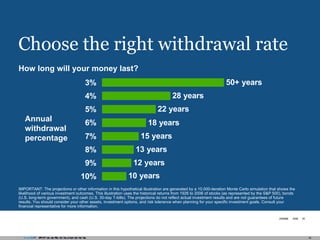

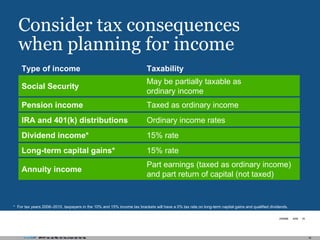

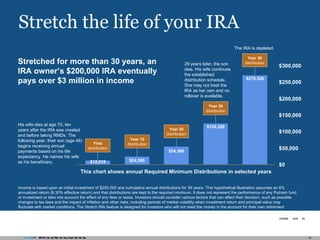

- Managing assets and withdrawals during retirement to ensure savings last through longevity

- Transferring wealth to heirs by using trusts, lifetime gifts, and beneficiary designations

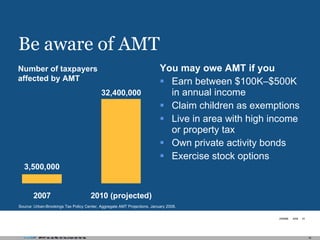

- Minimizing taxes through rollovers, the marital deduction, and stretching IRAs over generations