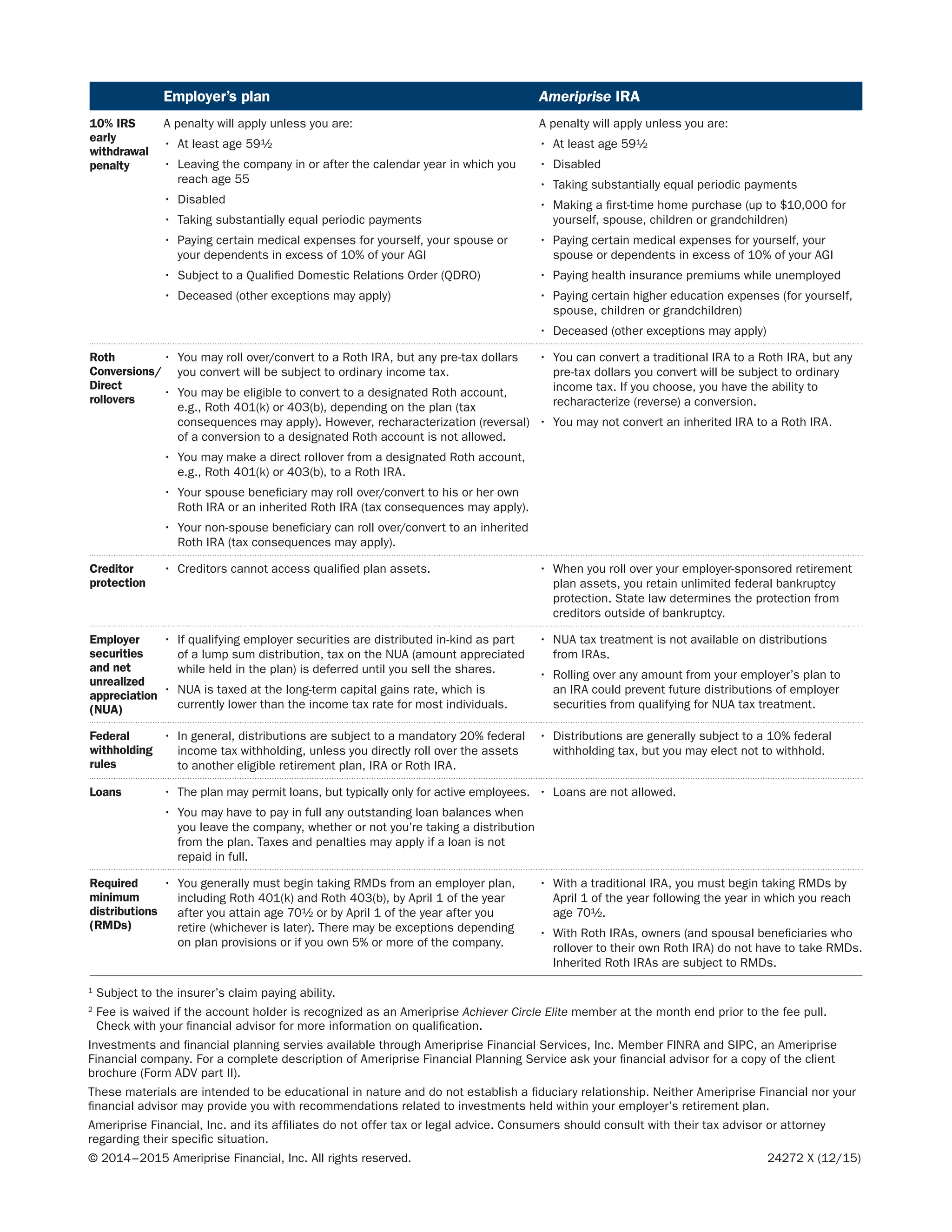

If you have savings in an employer-sponsored retirement plan like a 401(k), you have options when you leave your job such as leaving the assets in the employer's plan, rolling them over to an IRA or another employer's plan. There are various factors to consider in making this decision including who controls the assets, available investment options, fees, required minimum distributions, and beneficiary options. An Ameriprise financial advisor can help you evaluate these options and decide what is best for your individual situation based on your retirement goals.