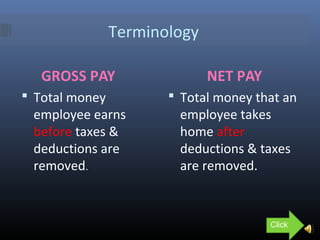

This document discusses how and when employees get paid. It explains key terms like gross pay, net pay, and different pay schedules such as weekly, bi-weekly, and semi-monthly. Employees may be paid an annual salary that is then divided over the number of pay periods. Taxes and other deductions are taken out of gross pay to determine net pay. Record keeping of pay stubs is important to verify accurate tax reporting. The overall message is for employees to understand their pay schedule and track their earnings.