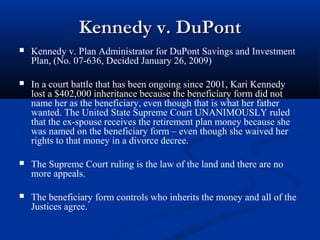

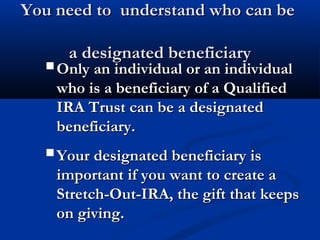

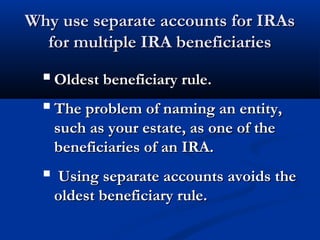

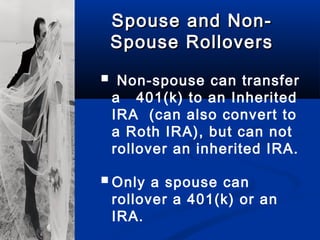

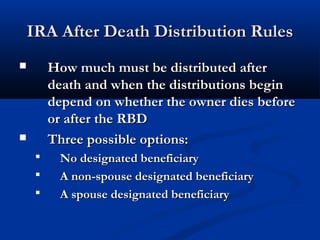

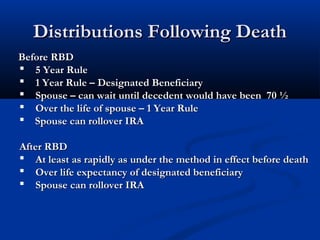

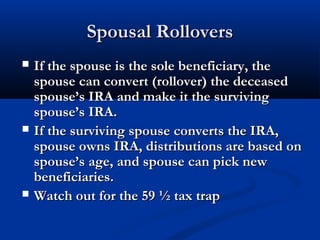

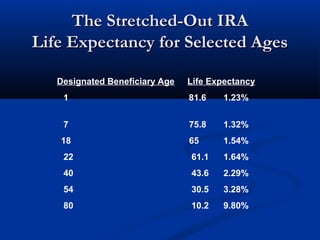

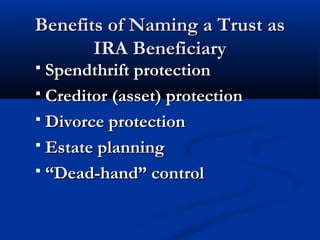

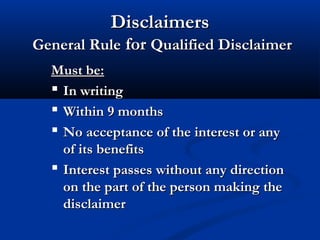

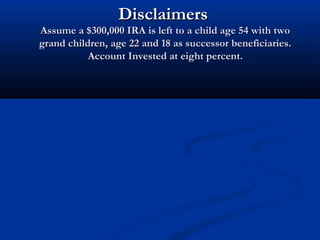

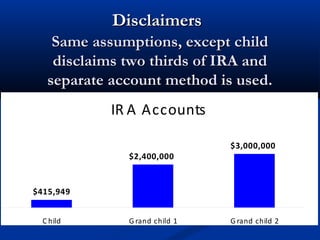

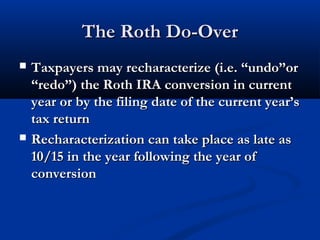

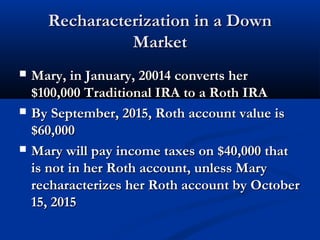

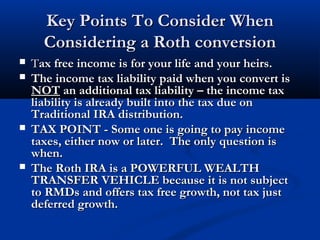

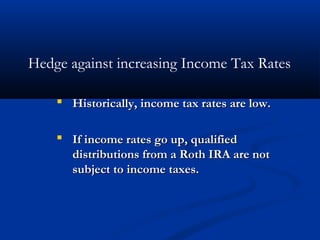

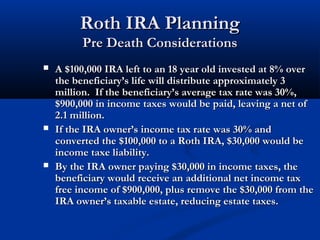

This document provides an overview of hot IRA topics and planning opportunities presented by Robert Wolff. It discusses problems that can arise from rollovers to IRAs, required minimum distributions from multiple plans, prenuptial agreements, keeping beneficiary designations up to date, and the Kennedy v. DuPont court case. It also covers spouse and non-spouse rollovers, IRA distribution rules after death, using trusts as beneficiaries, disclaimers, taking the income tax deduction, net unrealized appreciation, charitable remainder trusts, Roth conversions and recharacterization. The overall document aims to help people avoid estate catastrophes and take advantage of IRA planning opportunities.