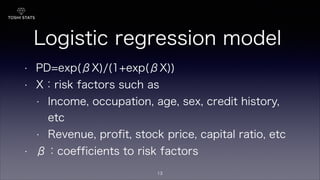

The document provides an overview of credit risk management, defining credit risk and its significance through historical examples, such as Japan's economic bubble and the 2008 financial crisis. It outlines the framework for managing credit risk, emphasizing the importance of assessing individual loans and managing loan portfolios through diversification. Additionally, it explains how to measure creditworthiness using probability of default and credit ratings, while highlighting the necessity for ongoing updates to risk assessments.