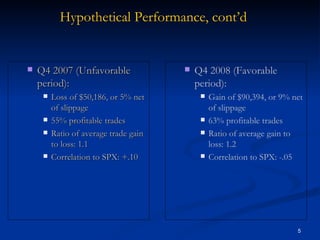

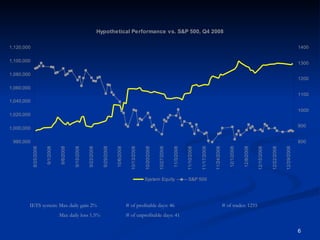

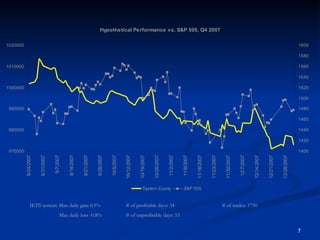

The document describes an intraday equities trend system that aims to identify liquid stocks exhibiting volatility and momentum for short-term trading. The system uses a proprietary technique to select stocks in a favorable "volatility and liquidity sweet spot" and takes long positions in strong stocks and short positions in weak stocks. Hypothetical backtested performance from 2007-2008 showed gains of 9% in high volatility periods and losses of 5% in low volatility periods, with the strategy aiming to return 15-20% annually while limiting drawdowns.