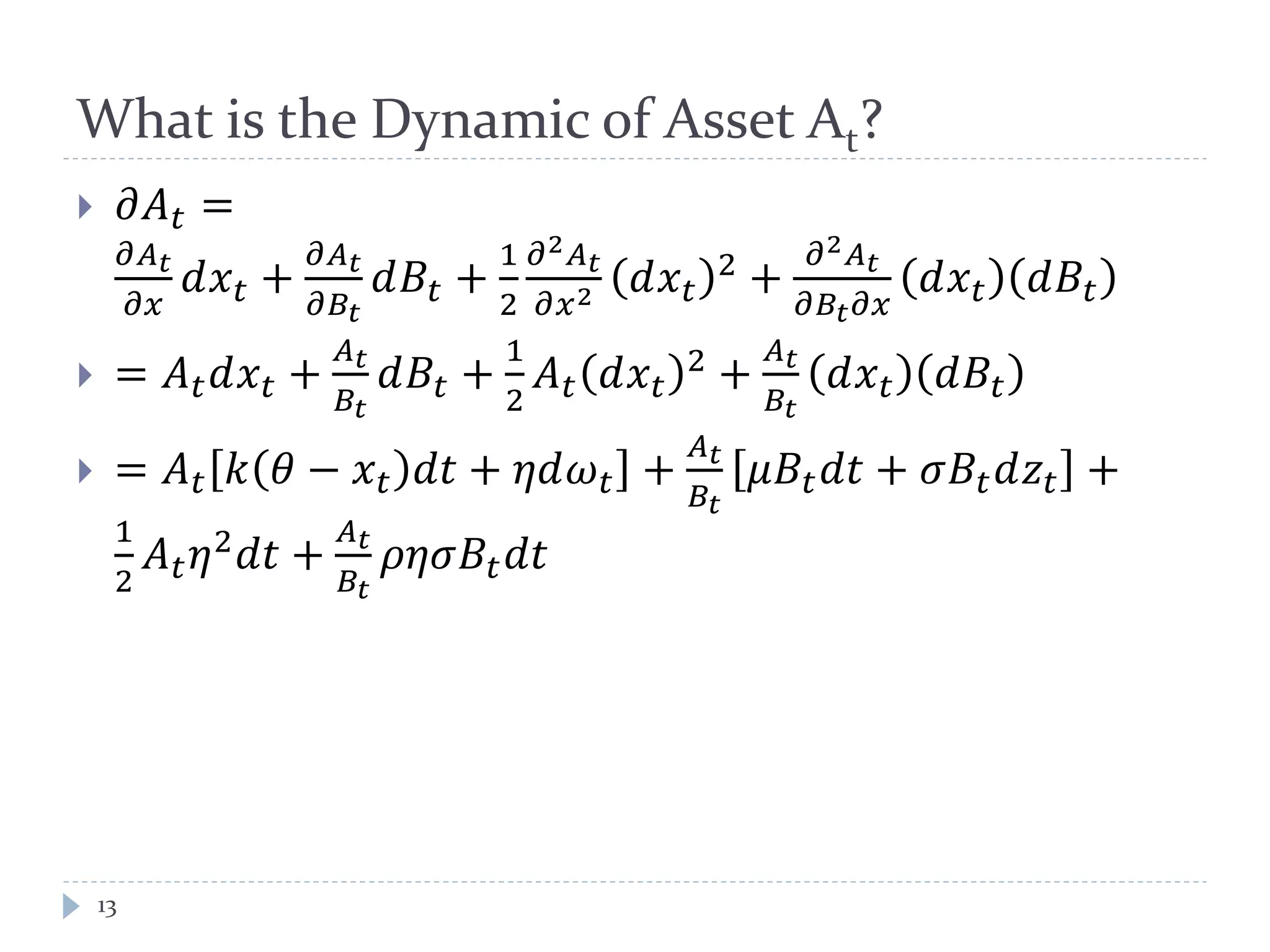

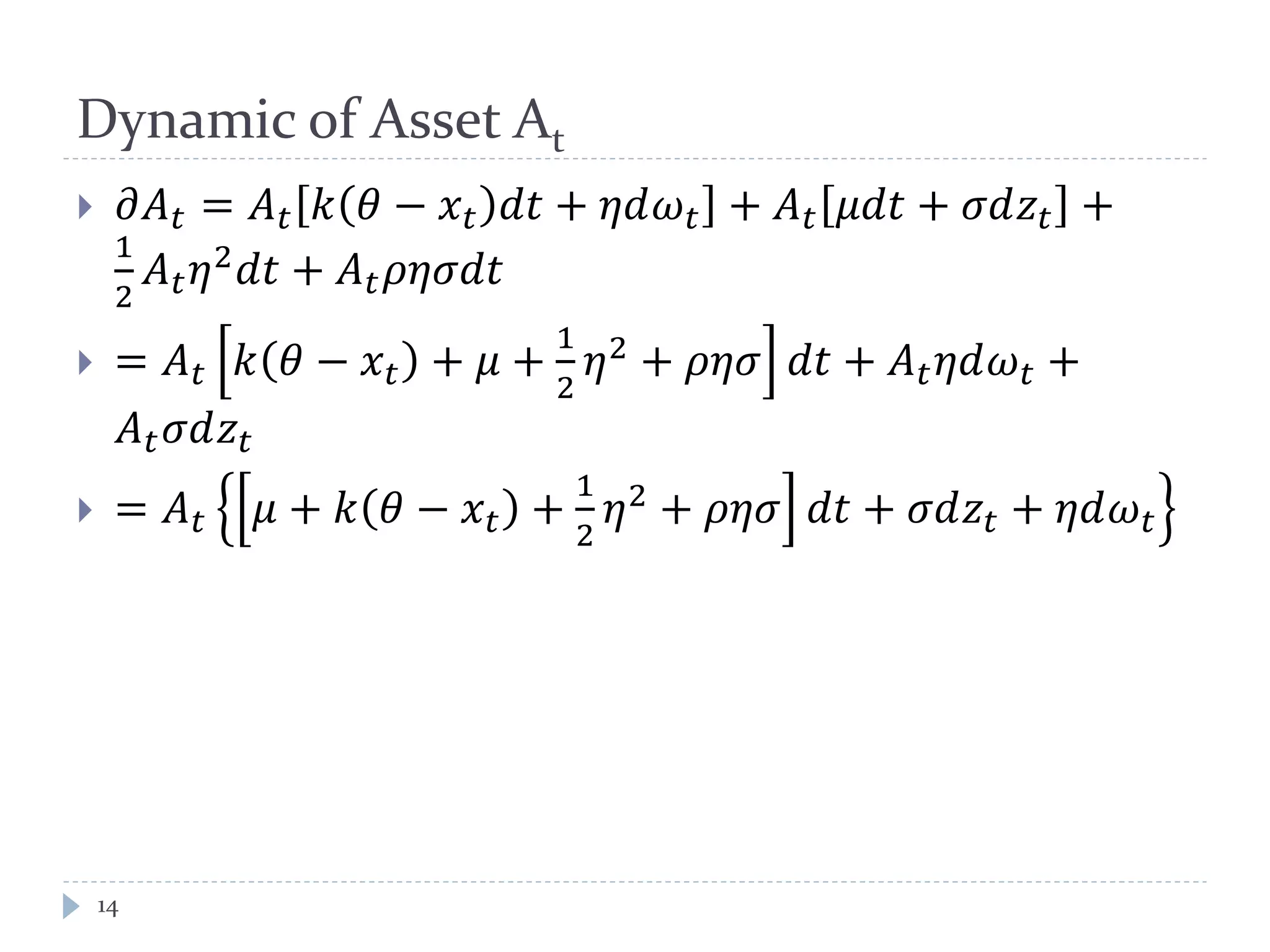

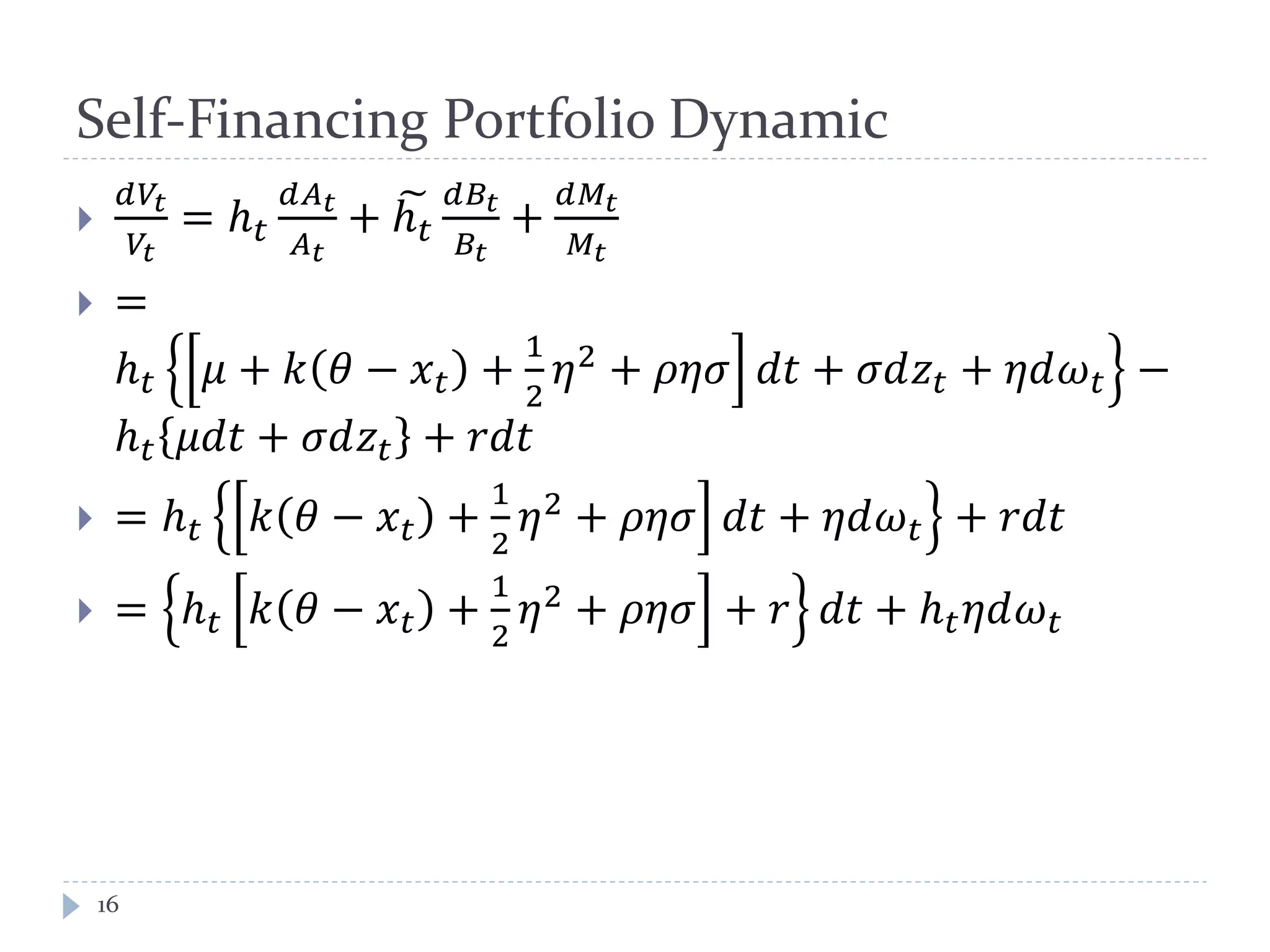

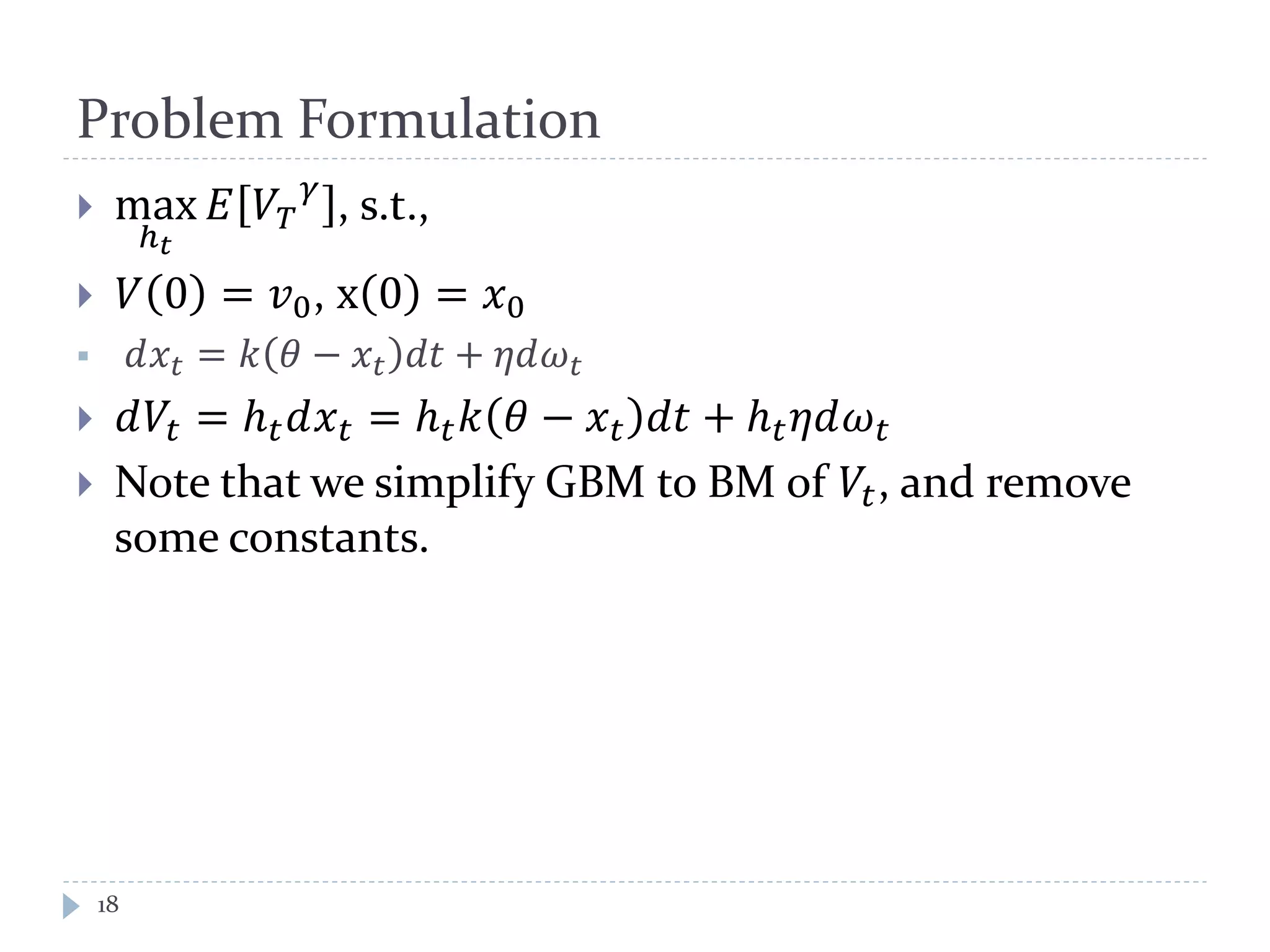

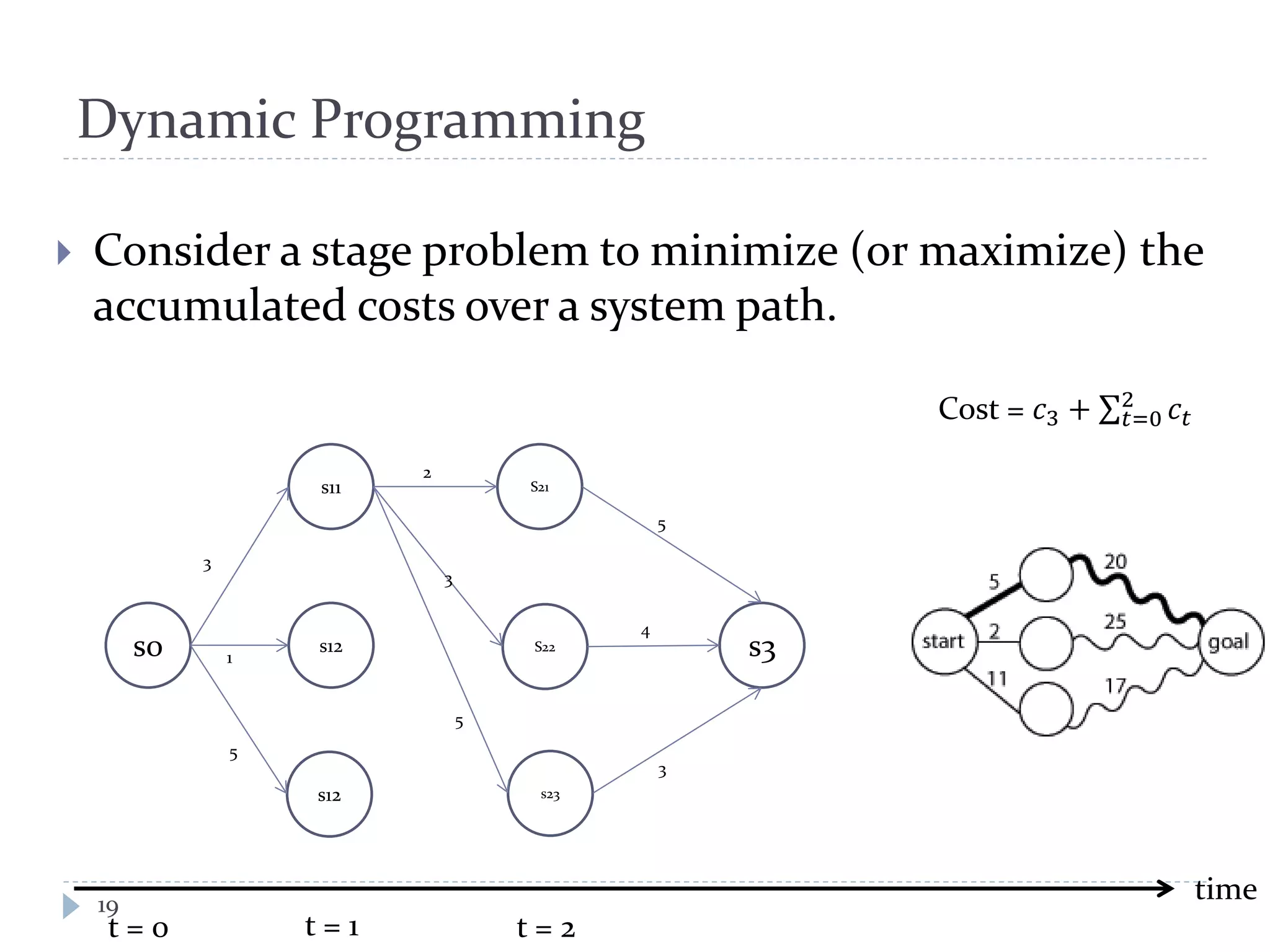

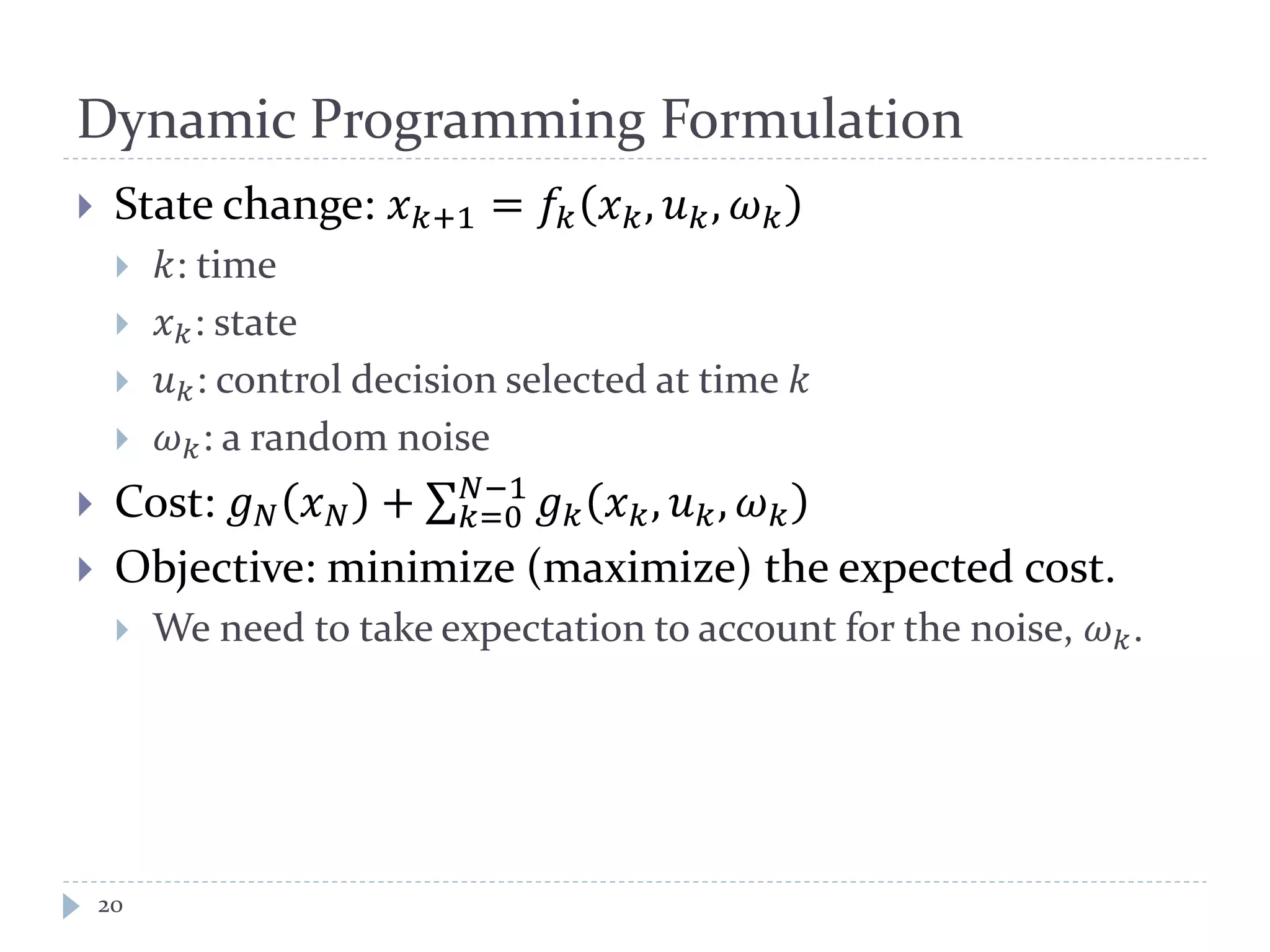

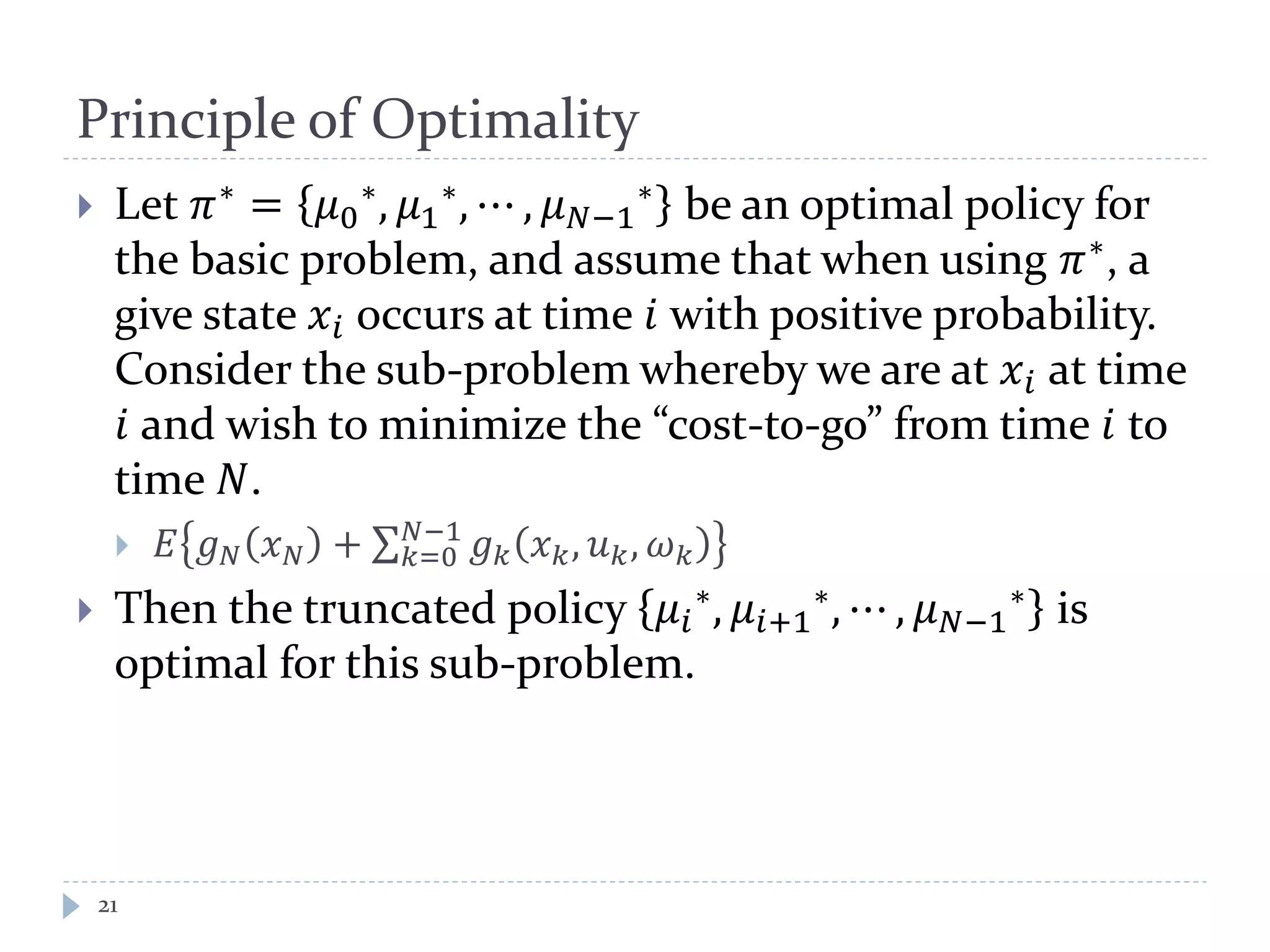

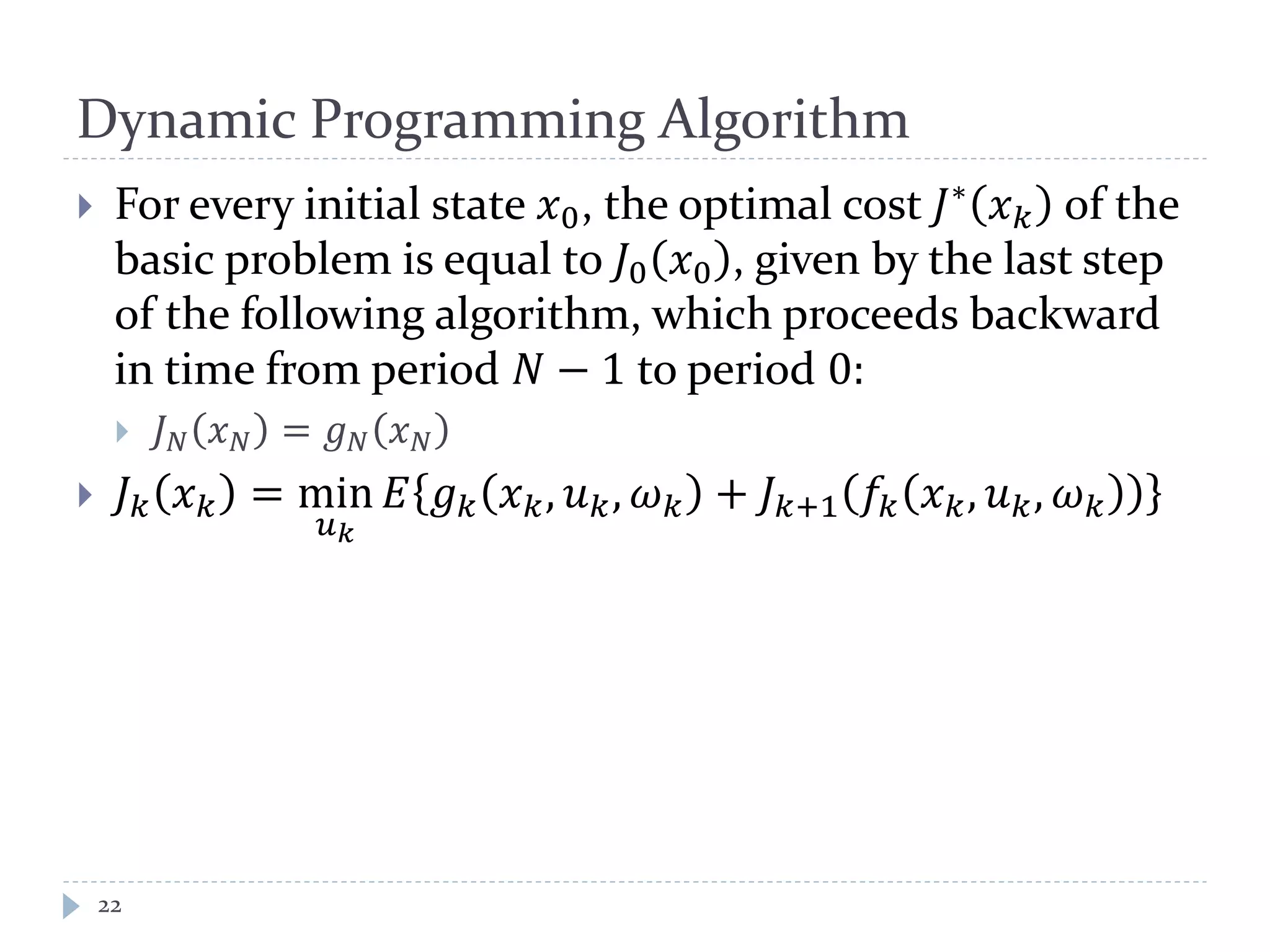

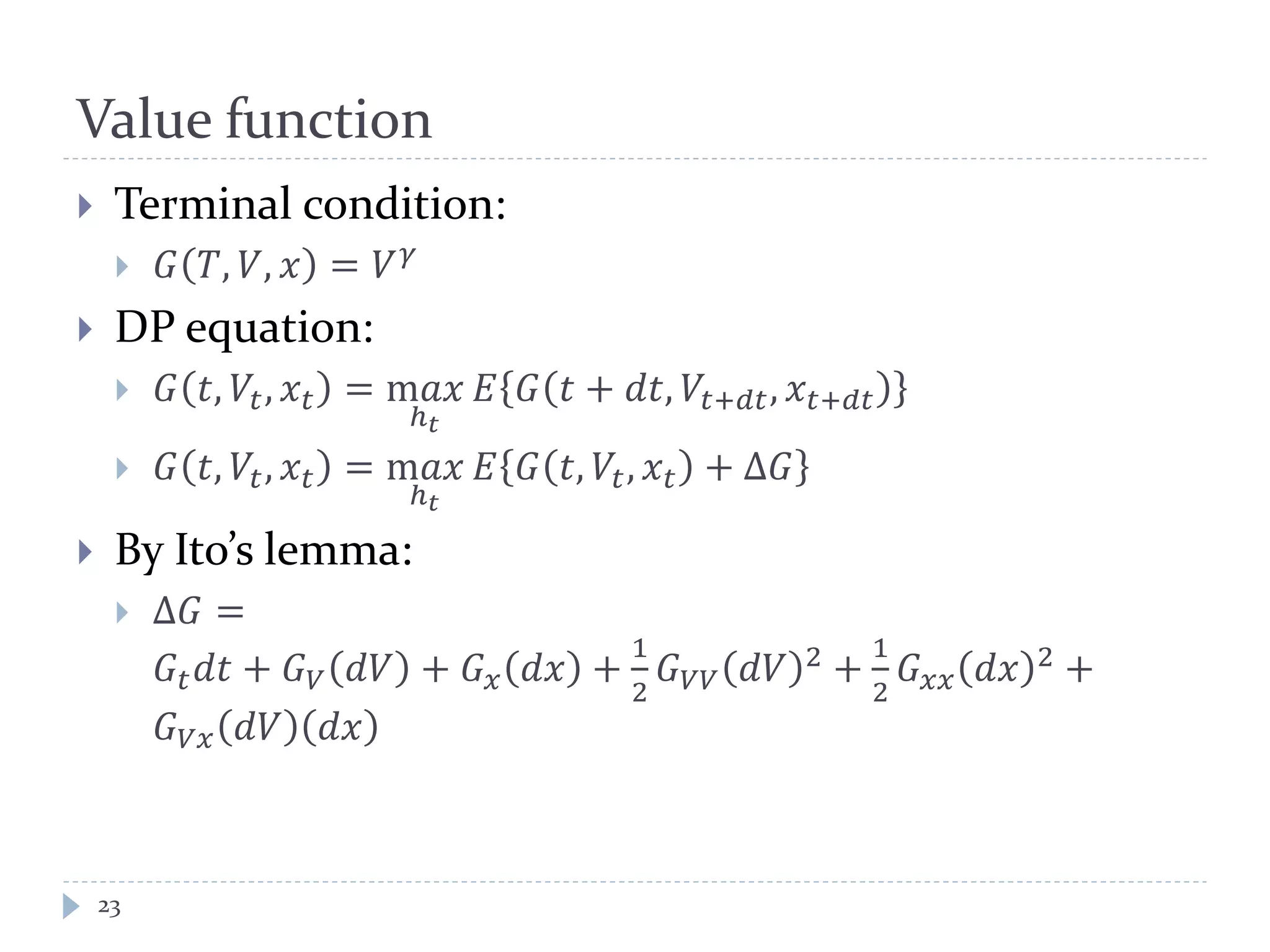

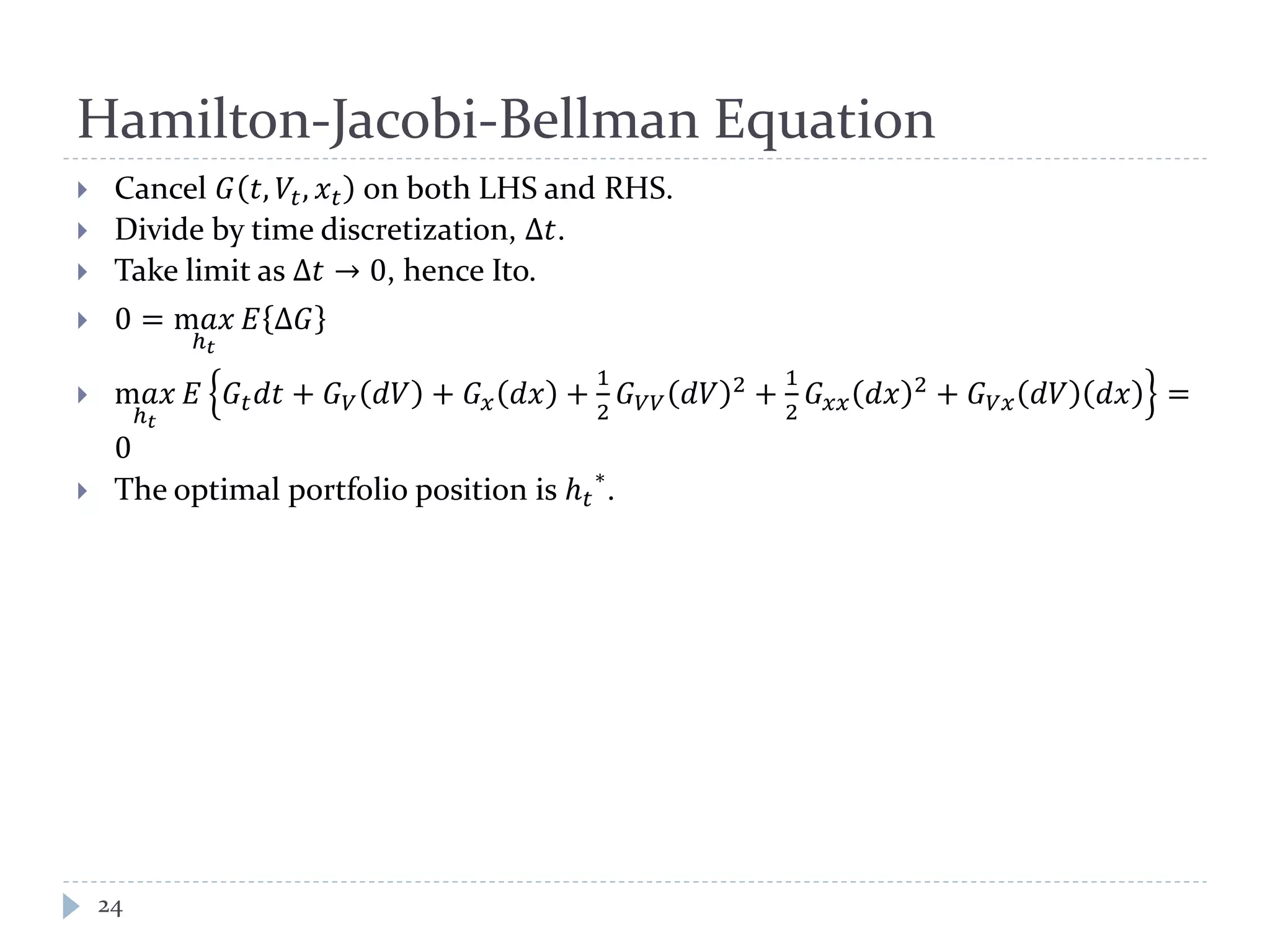

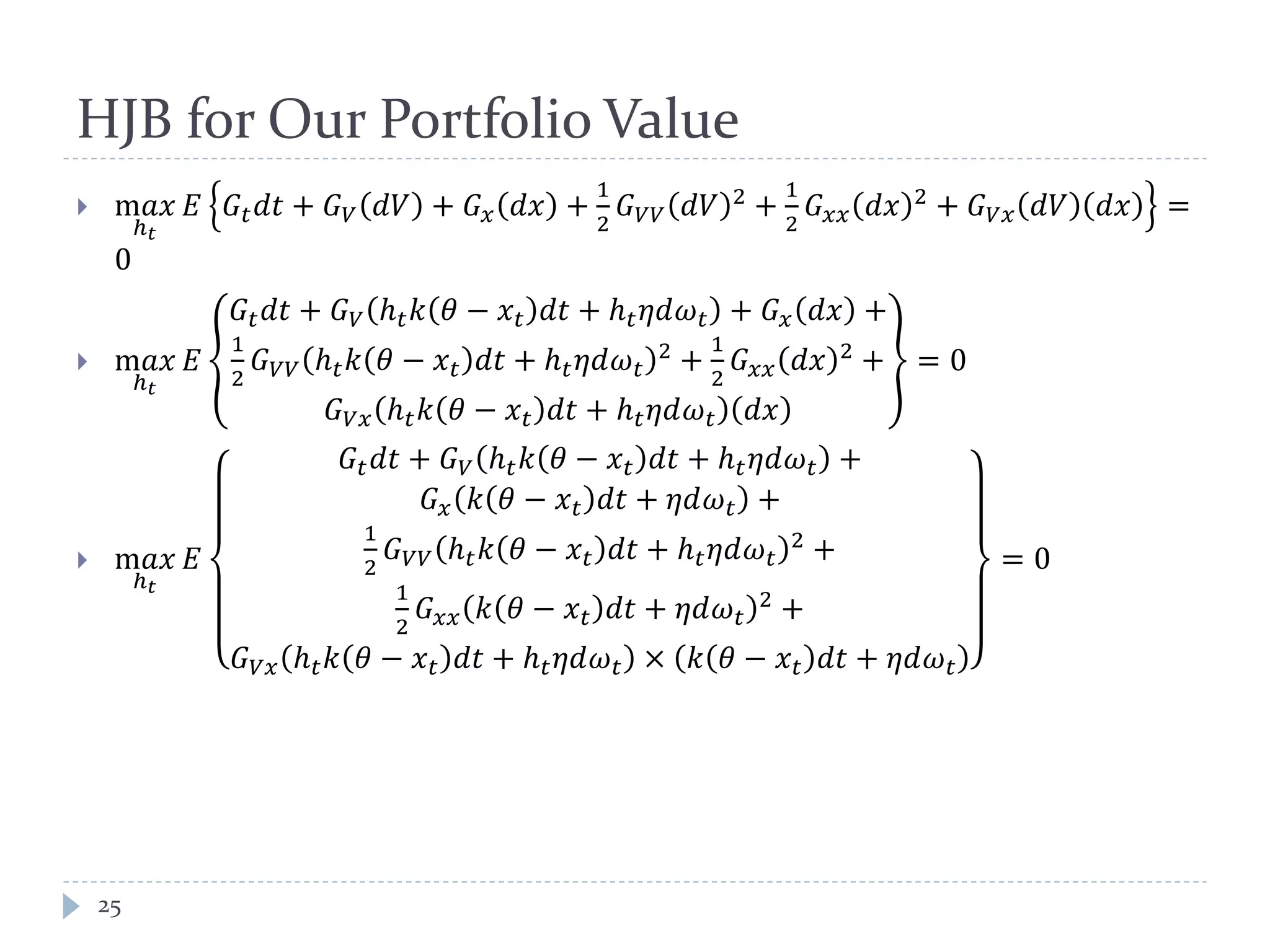

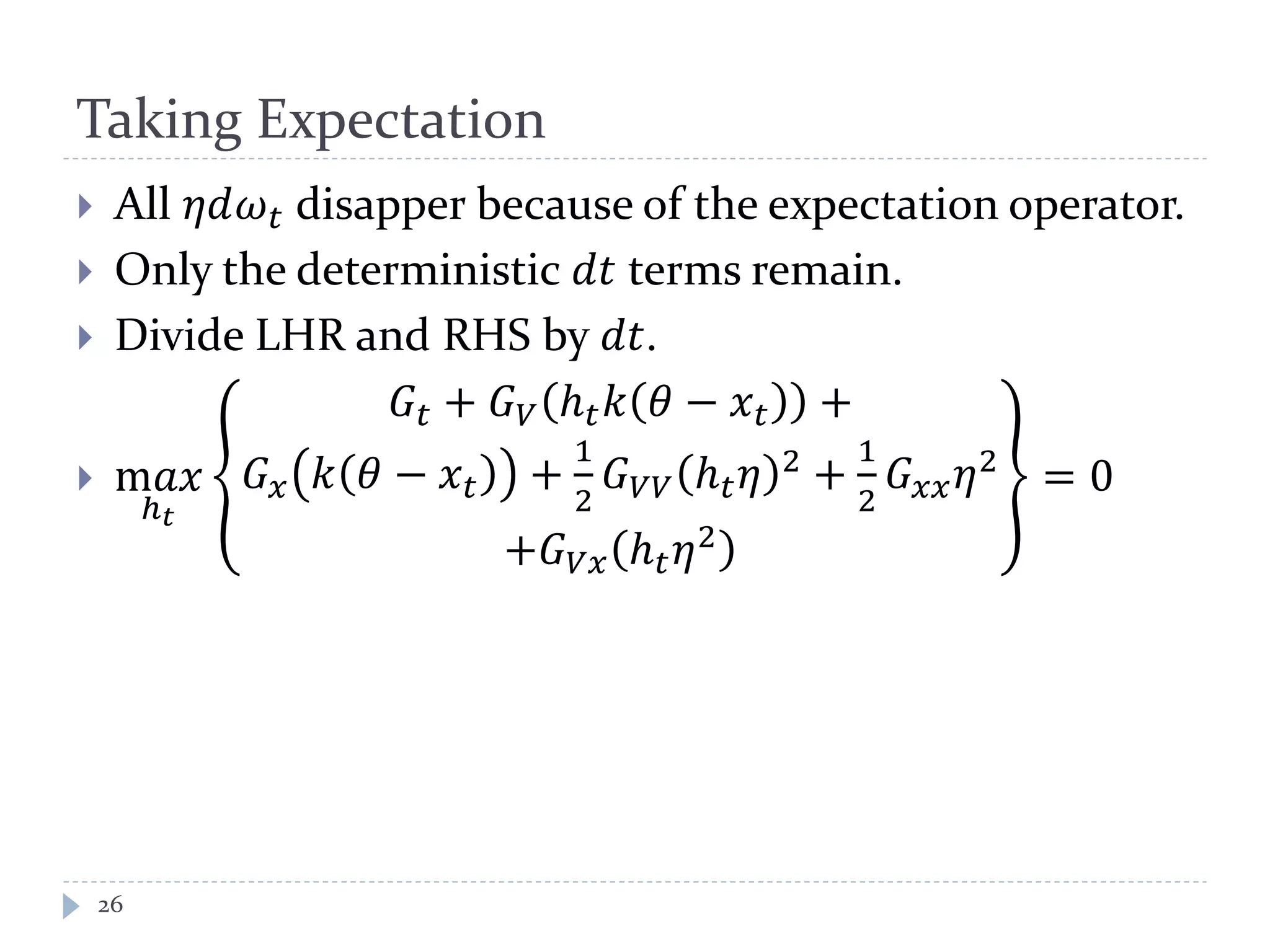

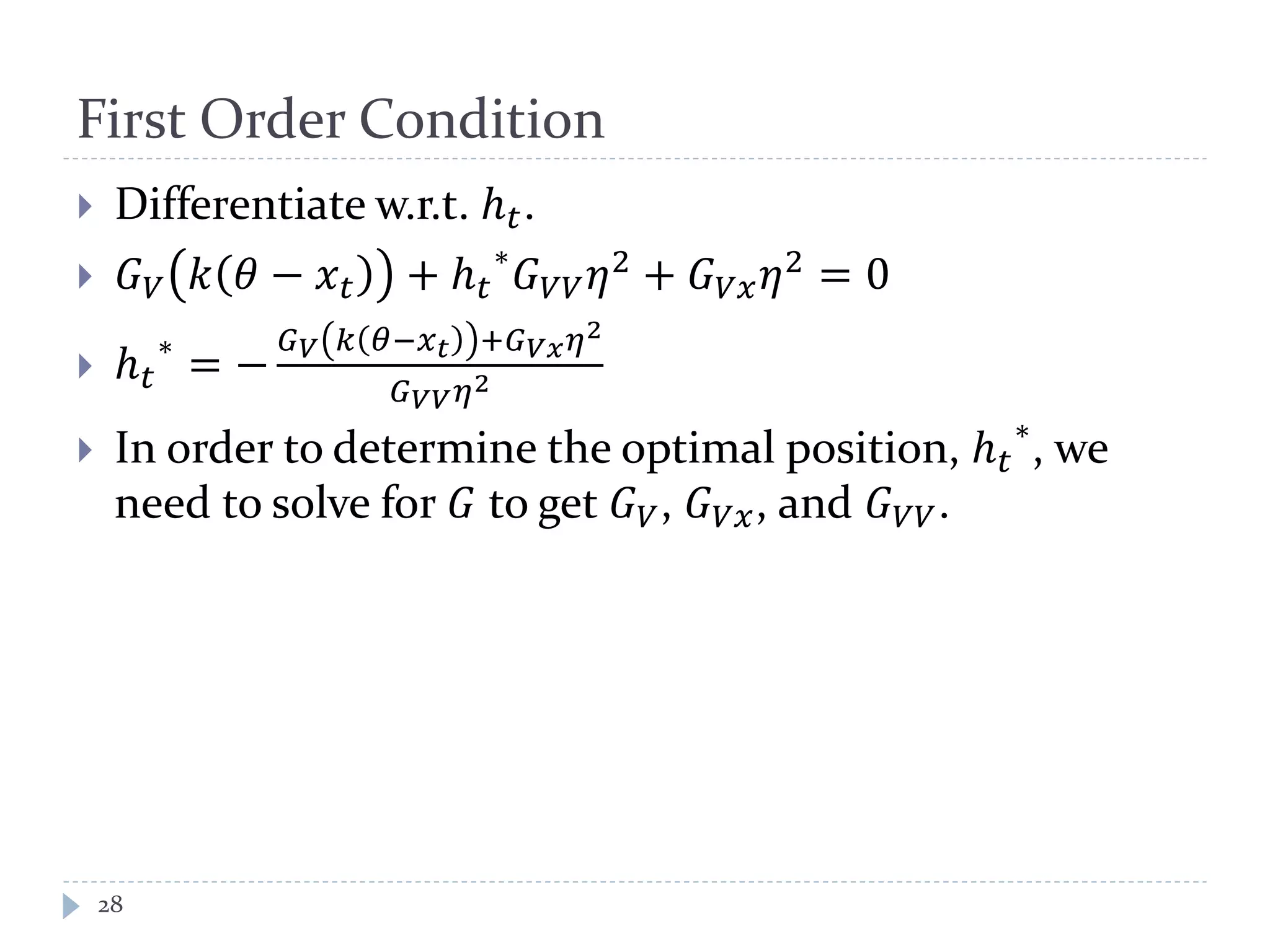

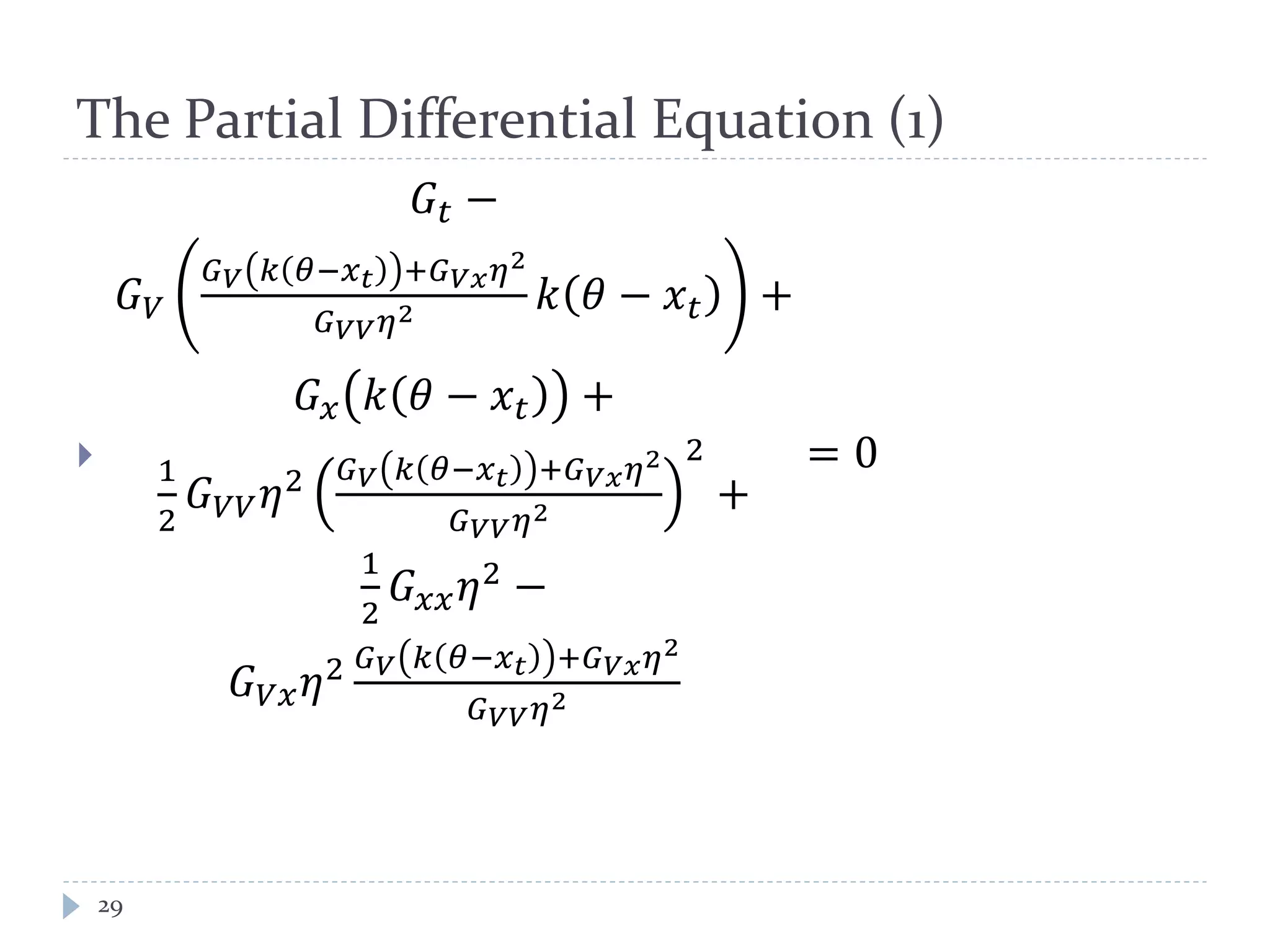

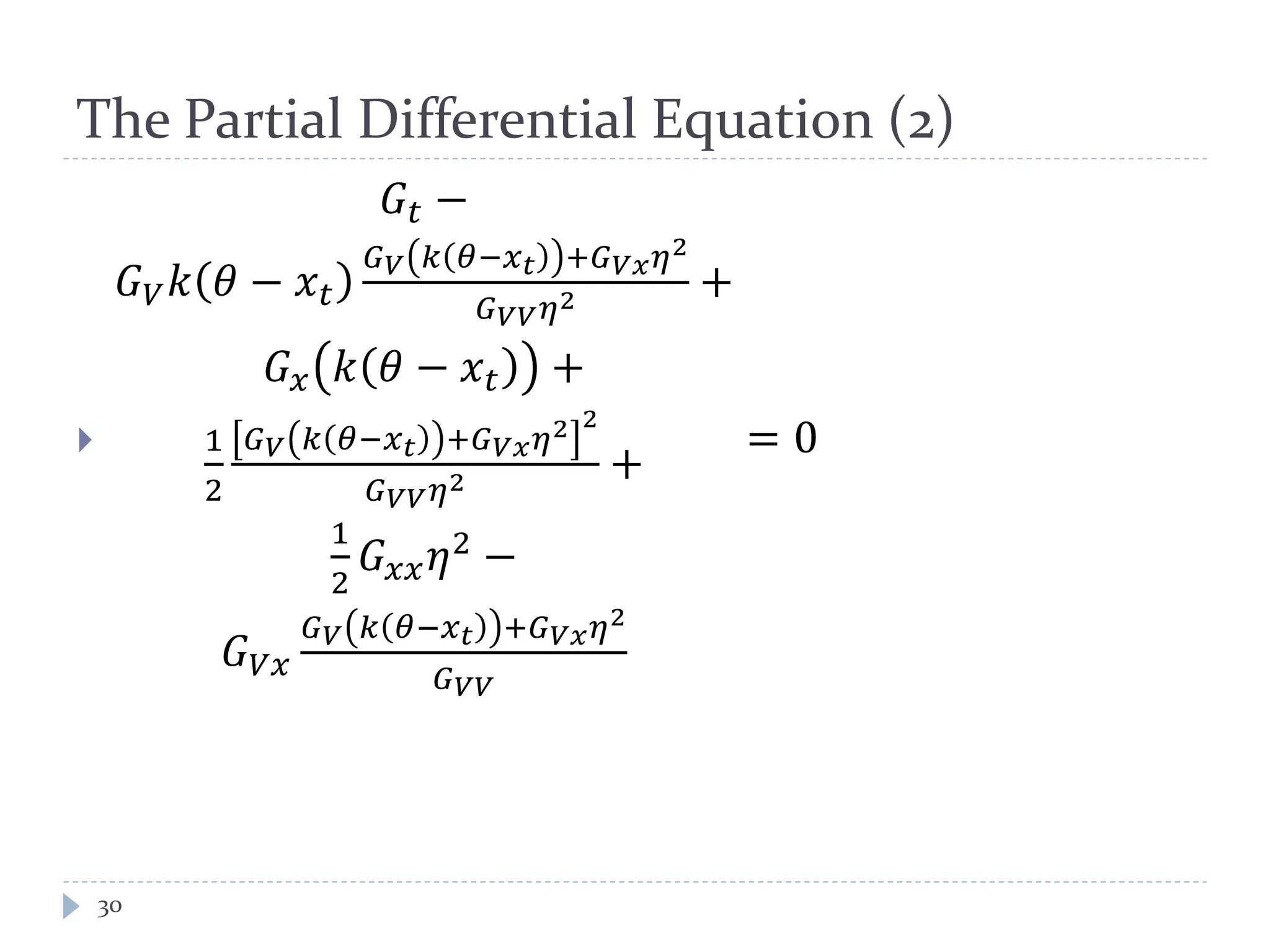

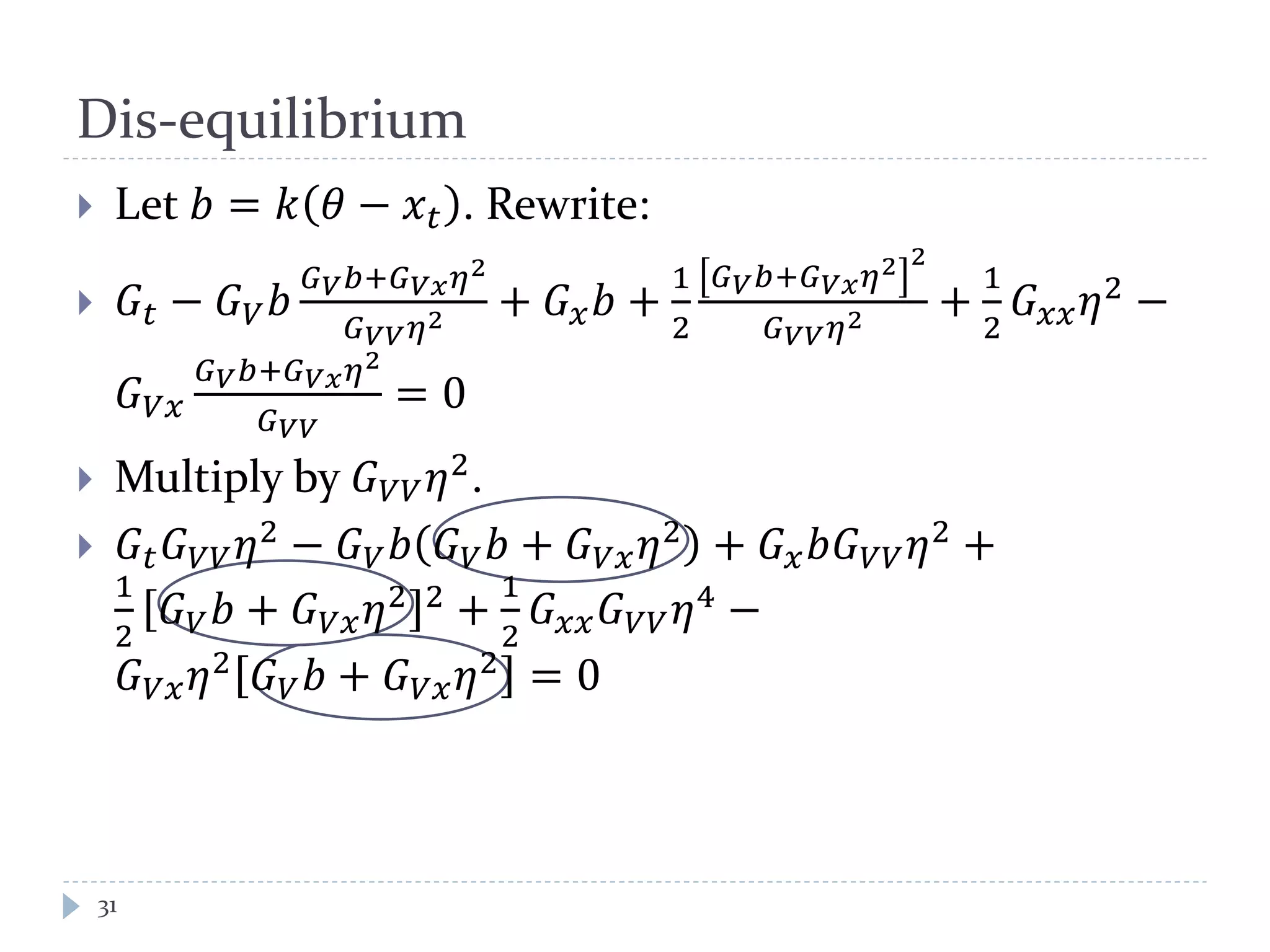

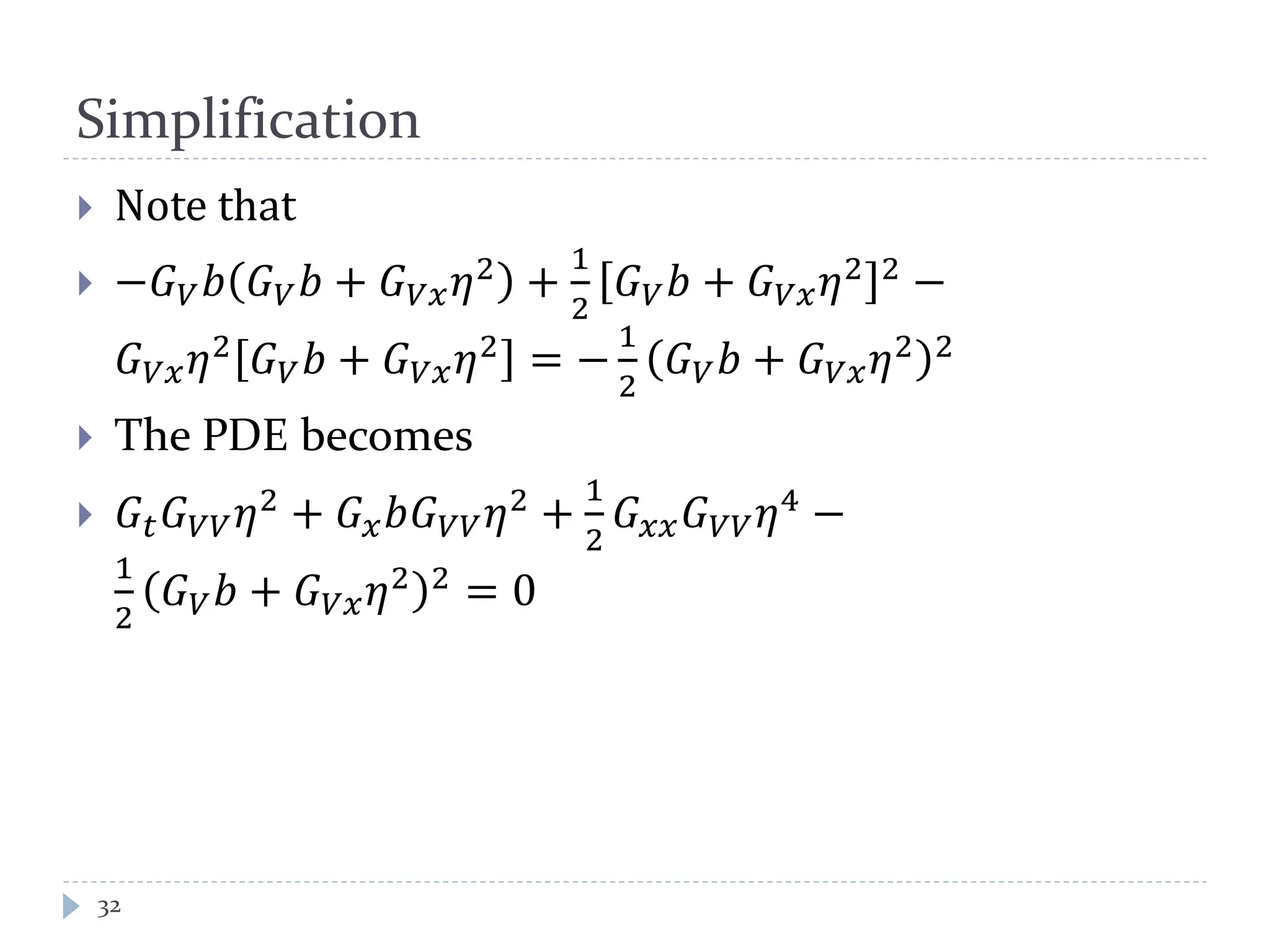

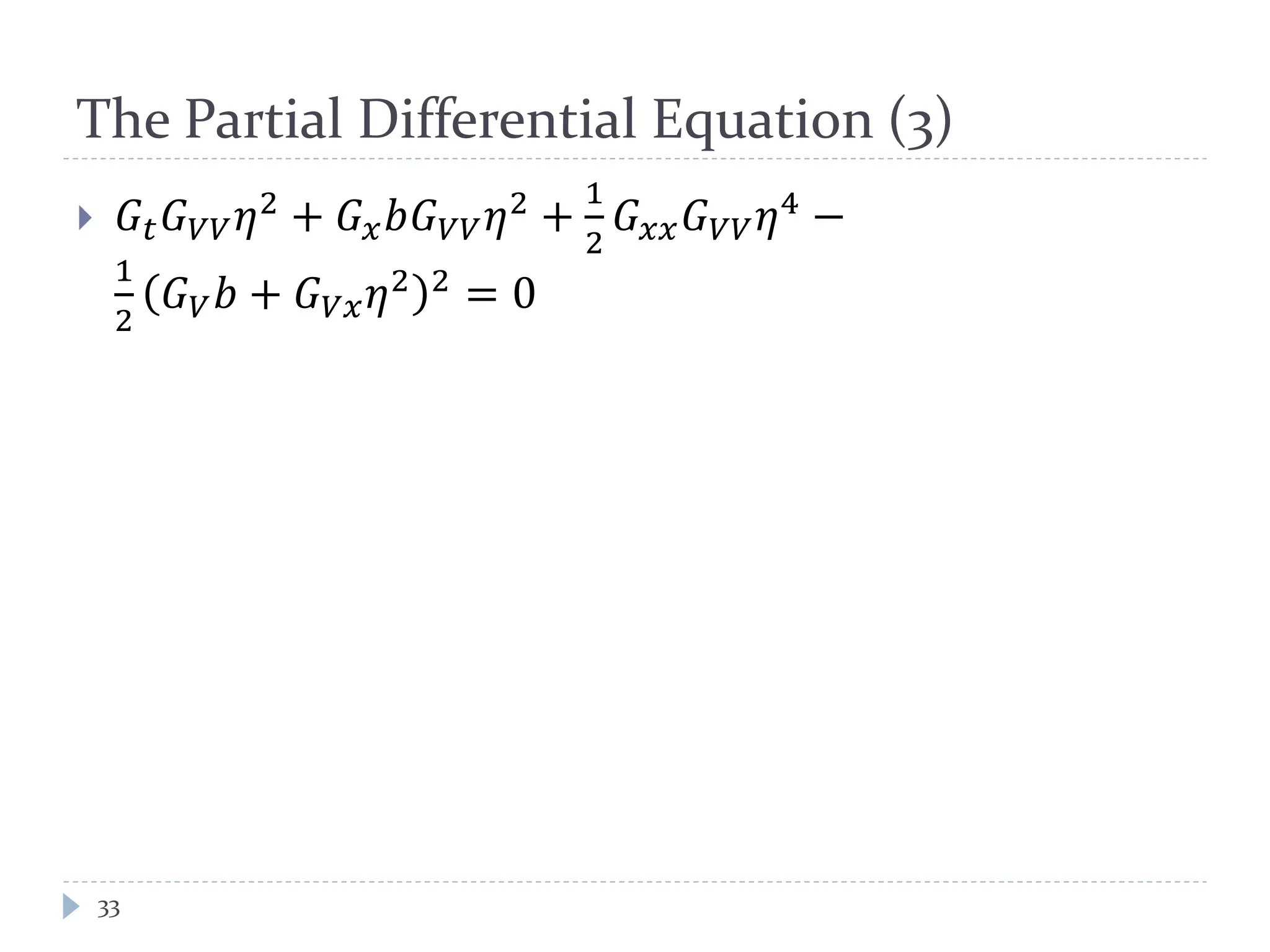

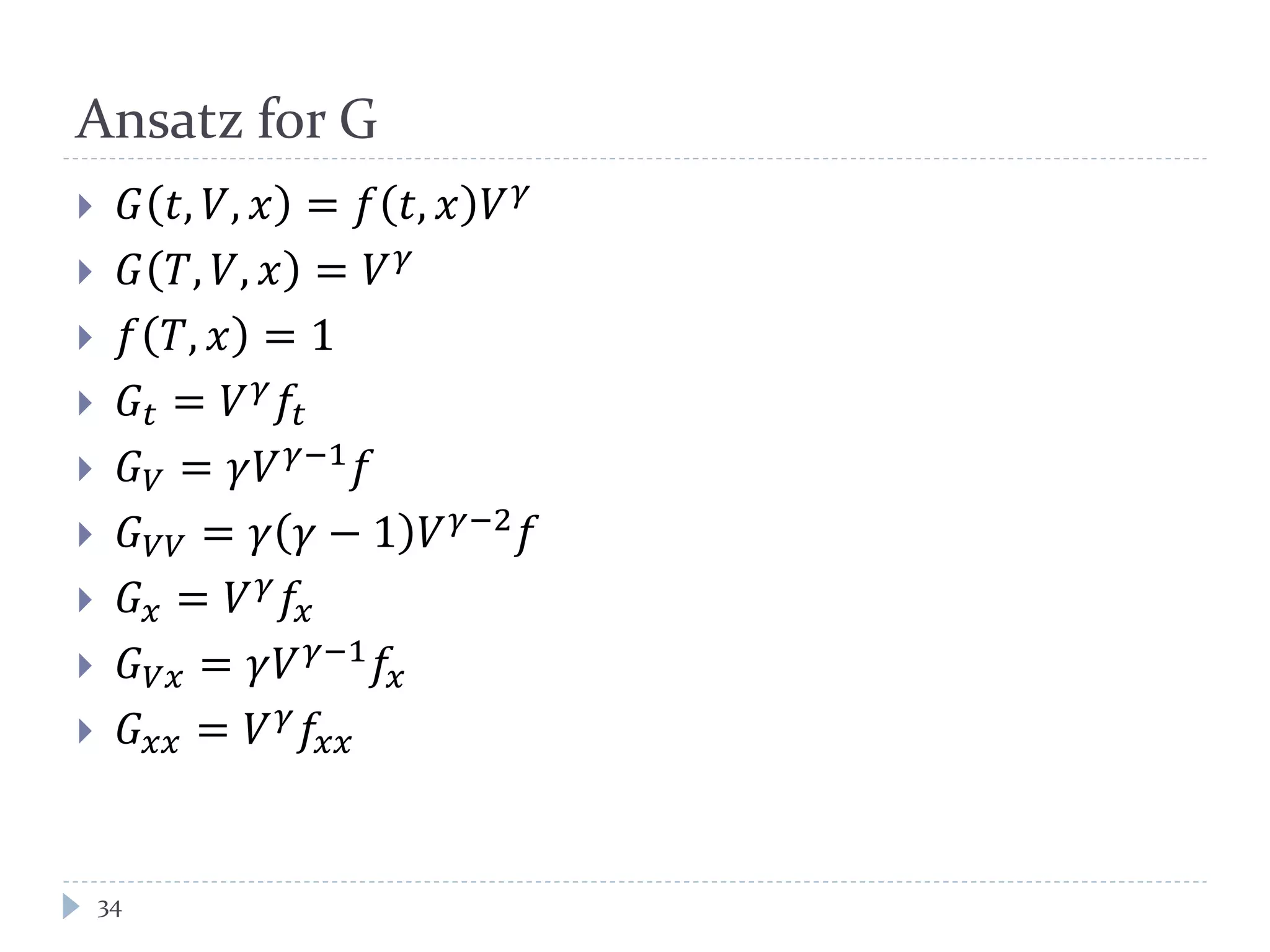

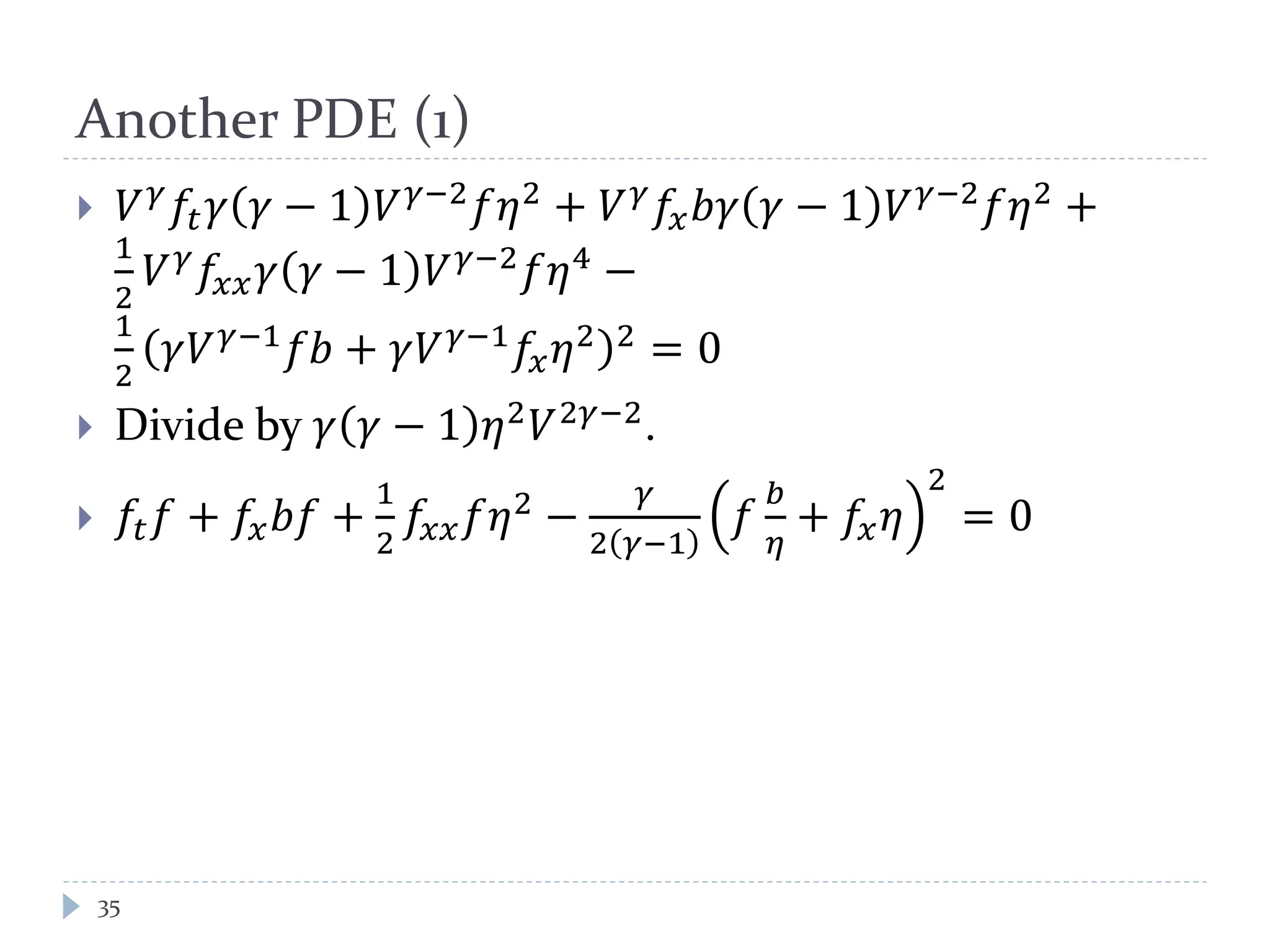

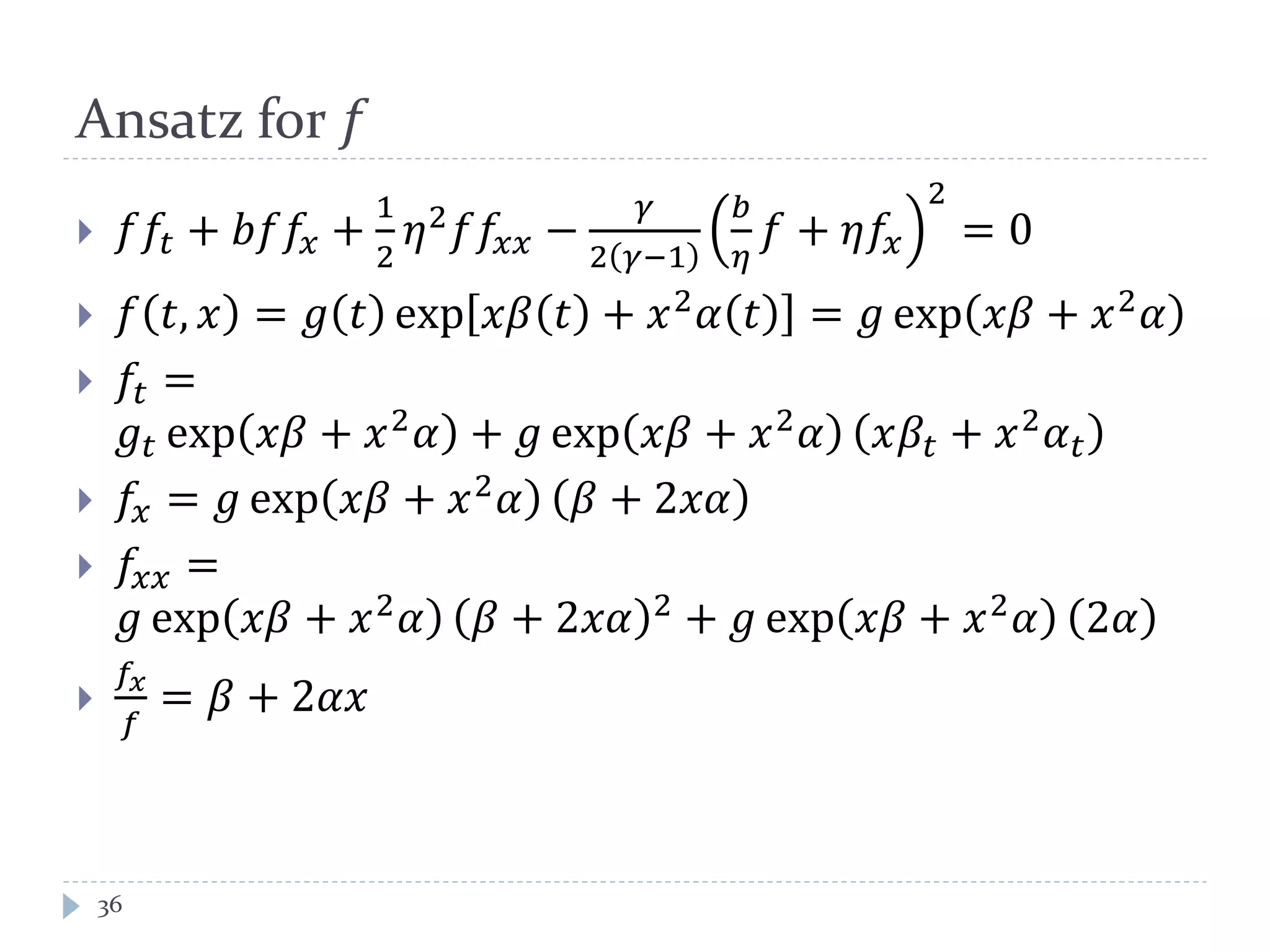

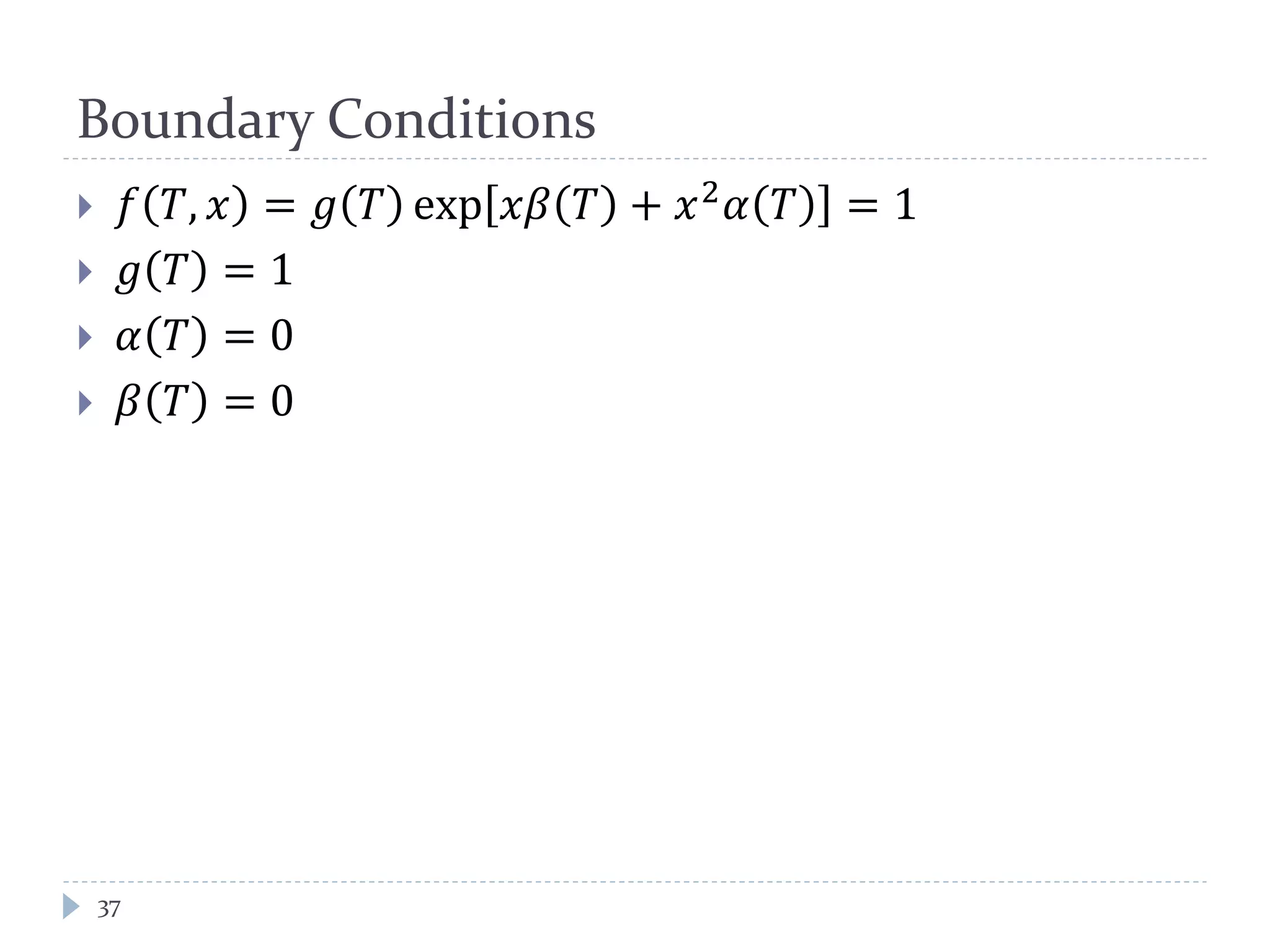

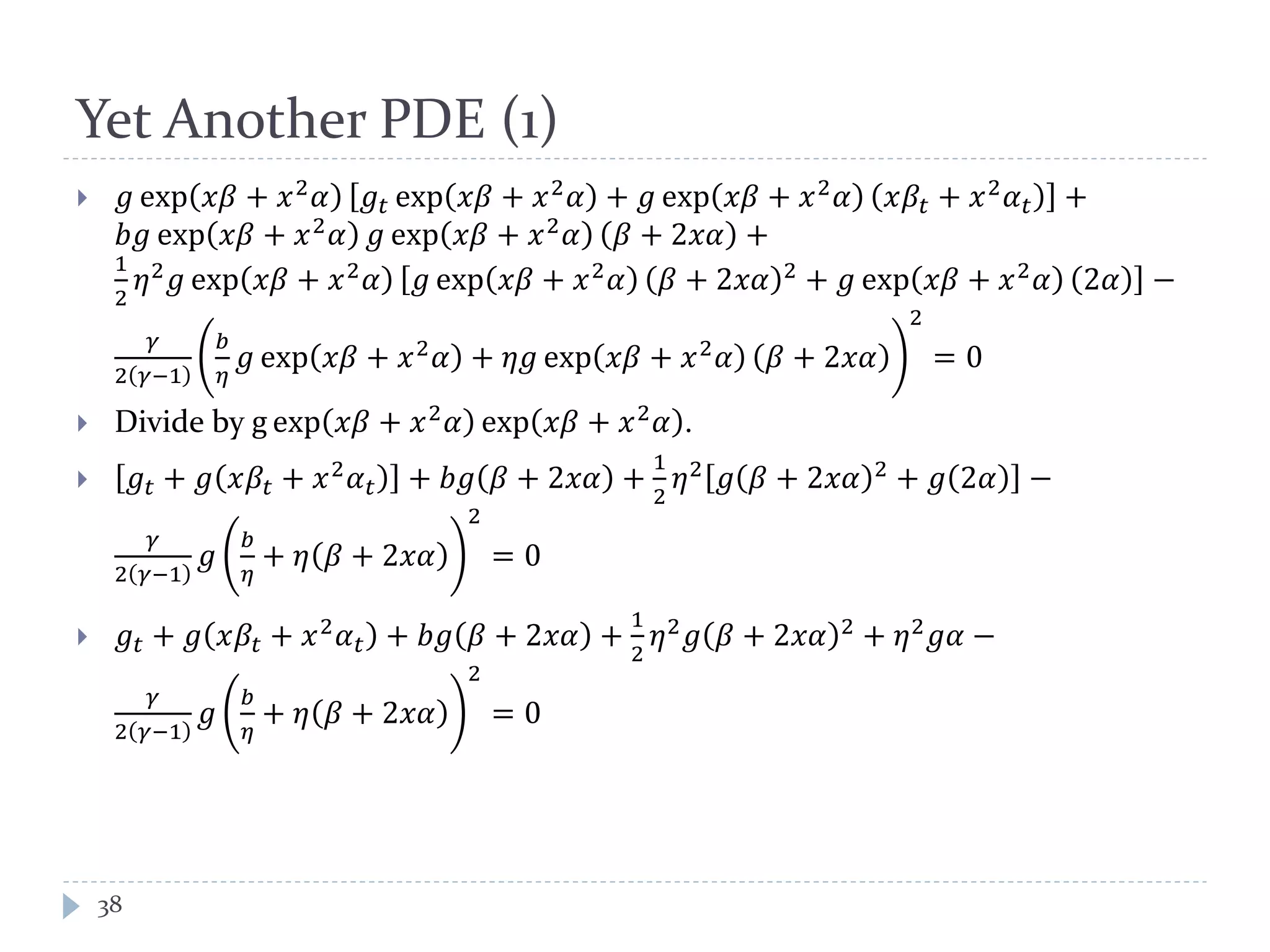

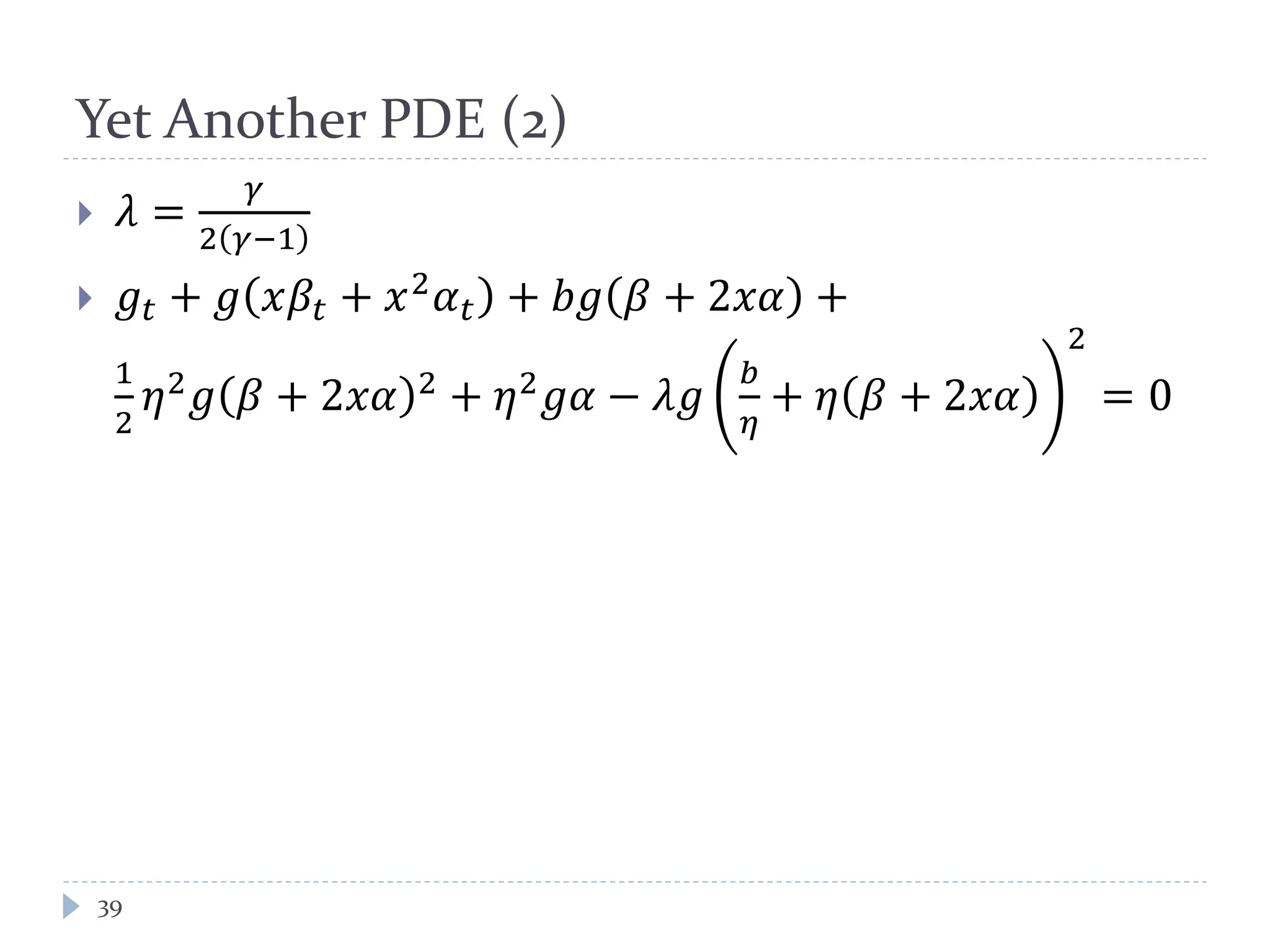

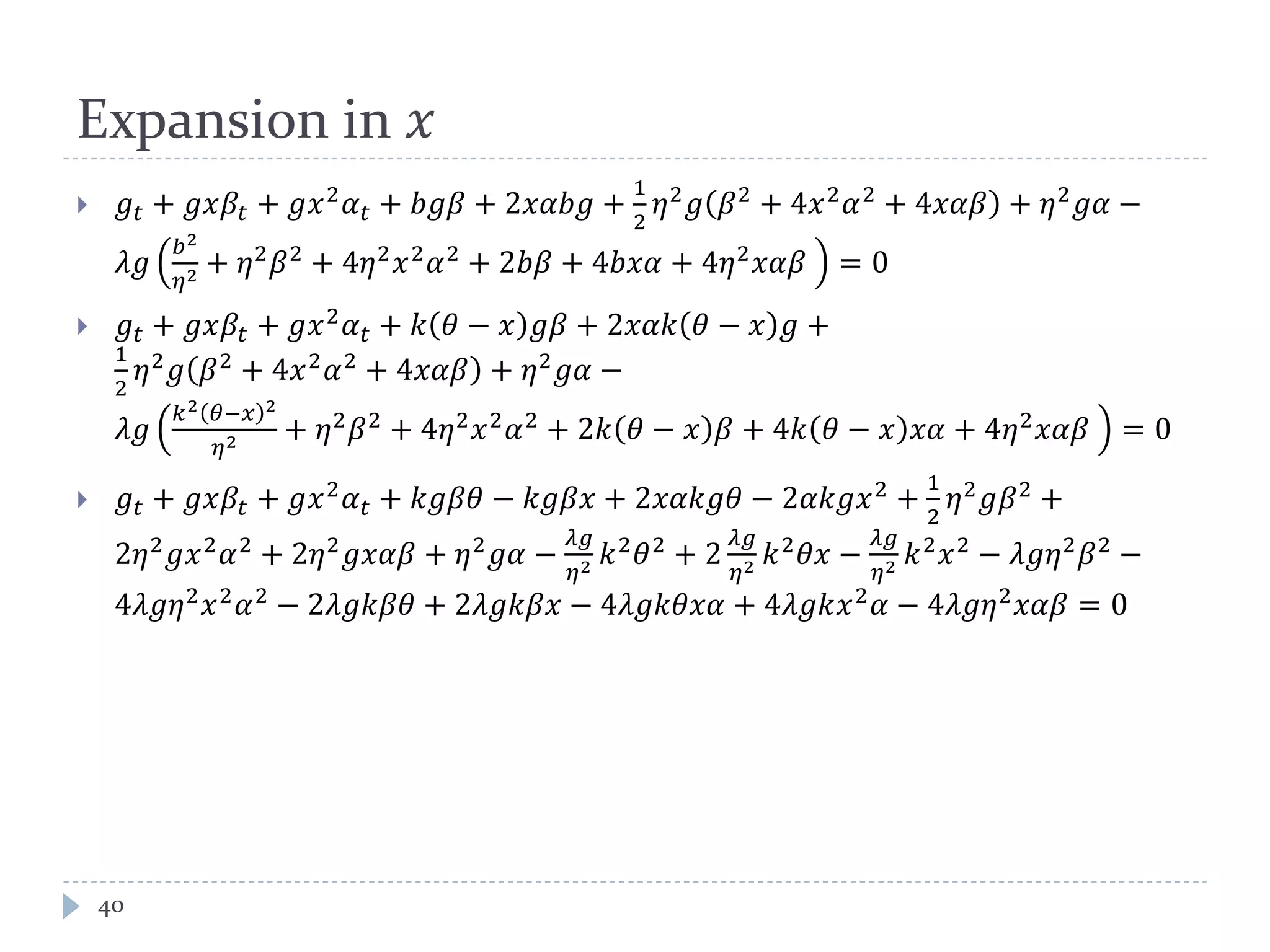

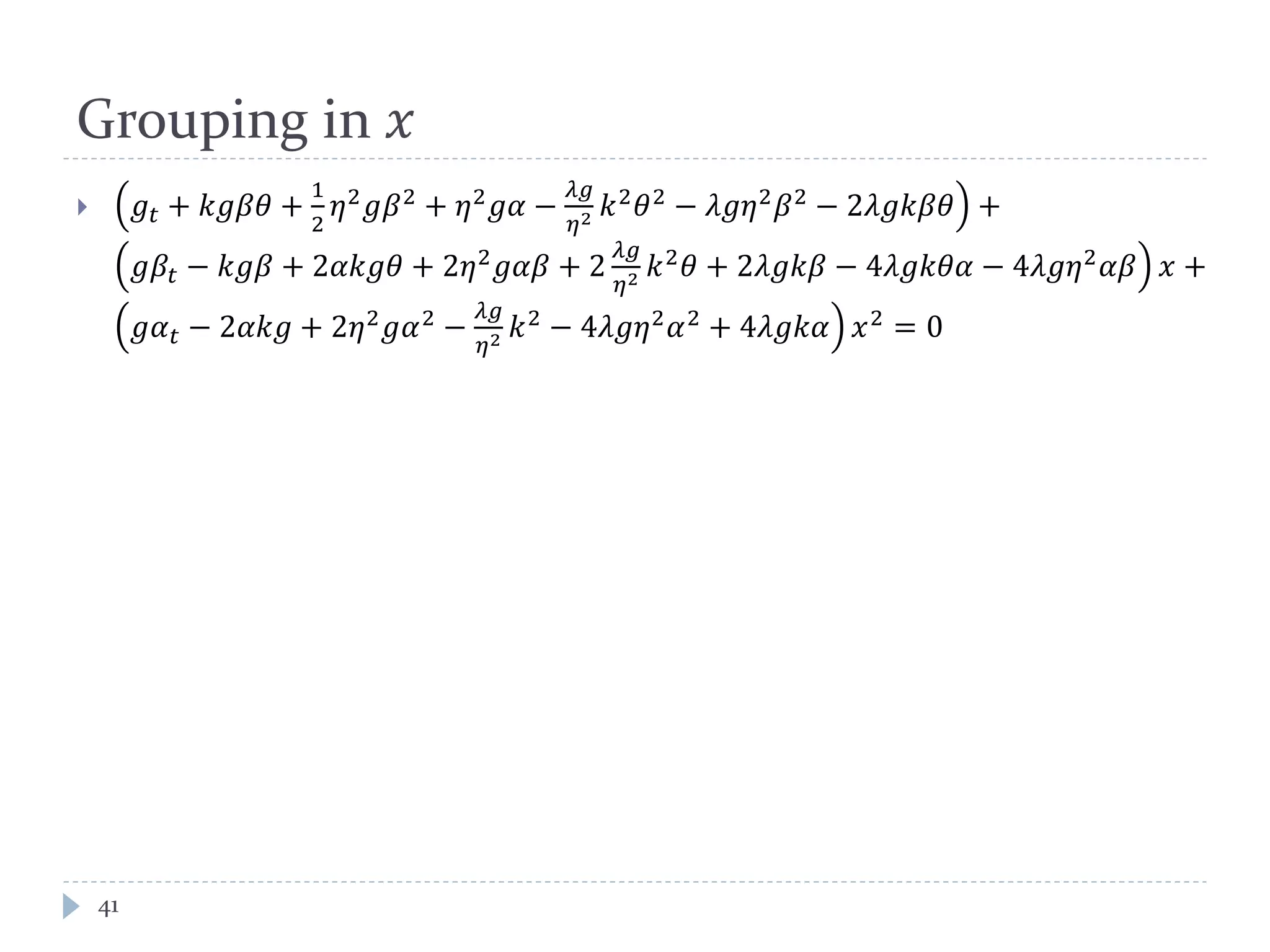

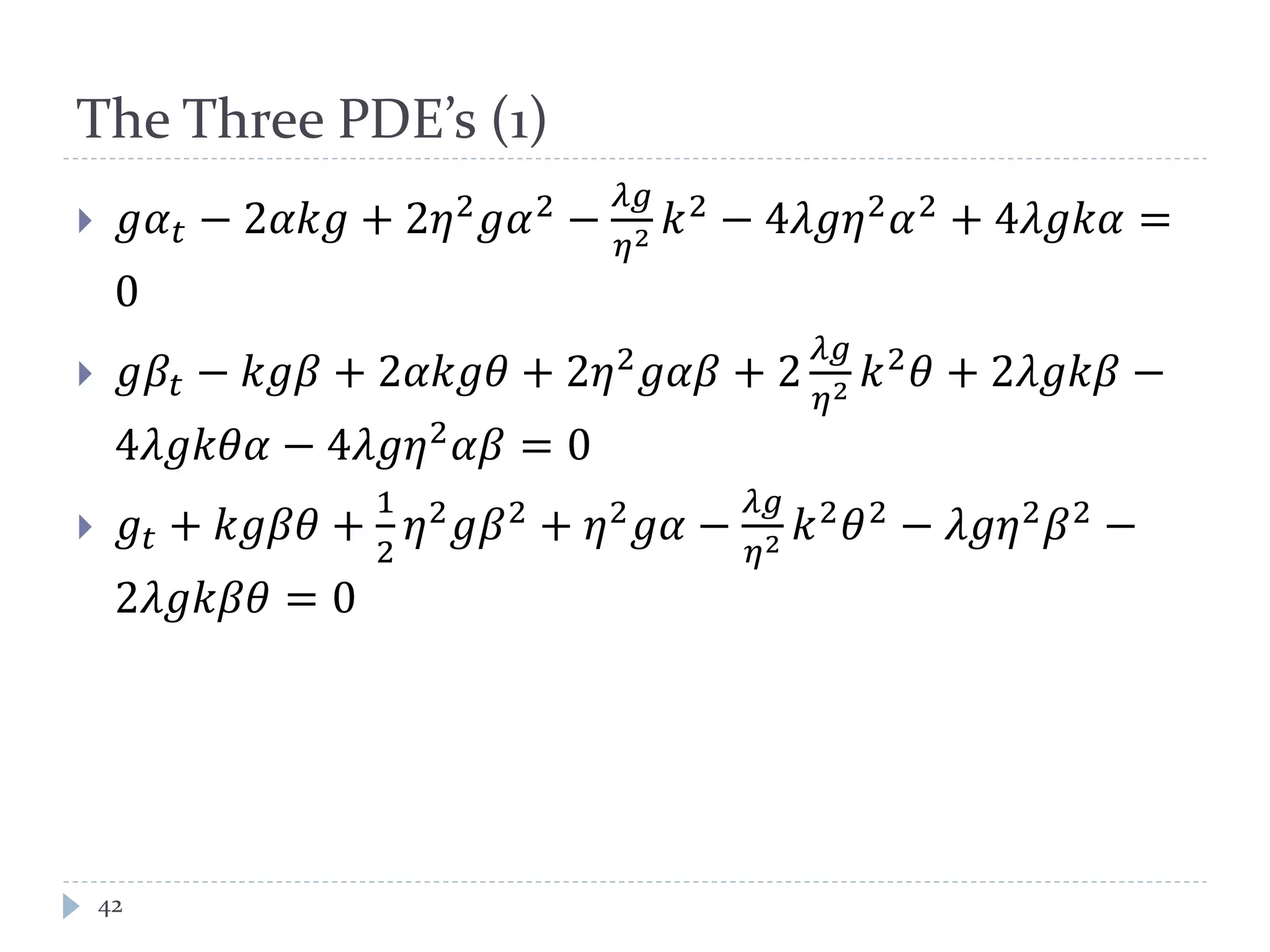

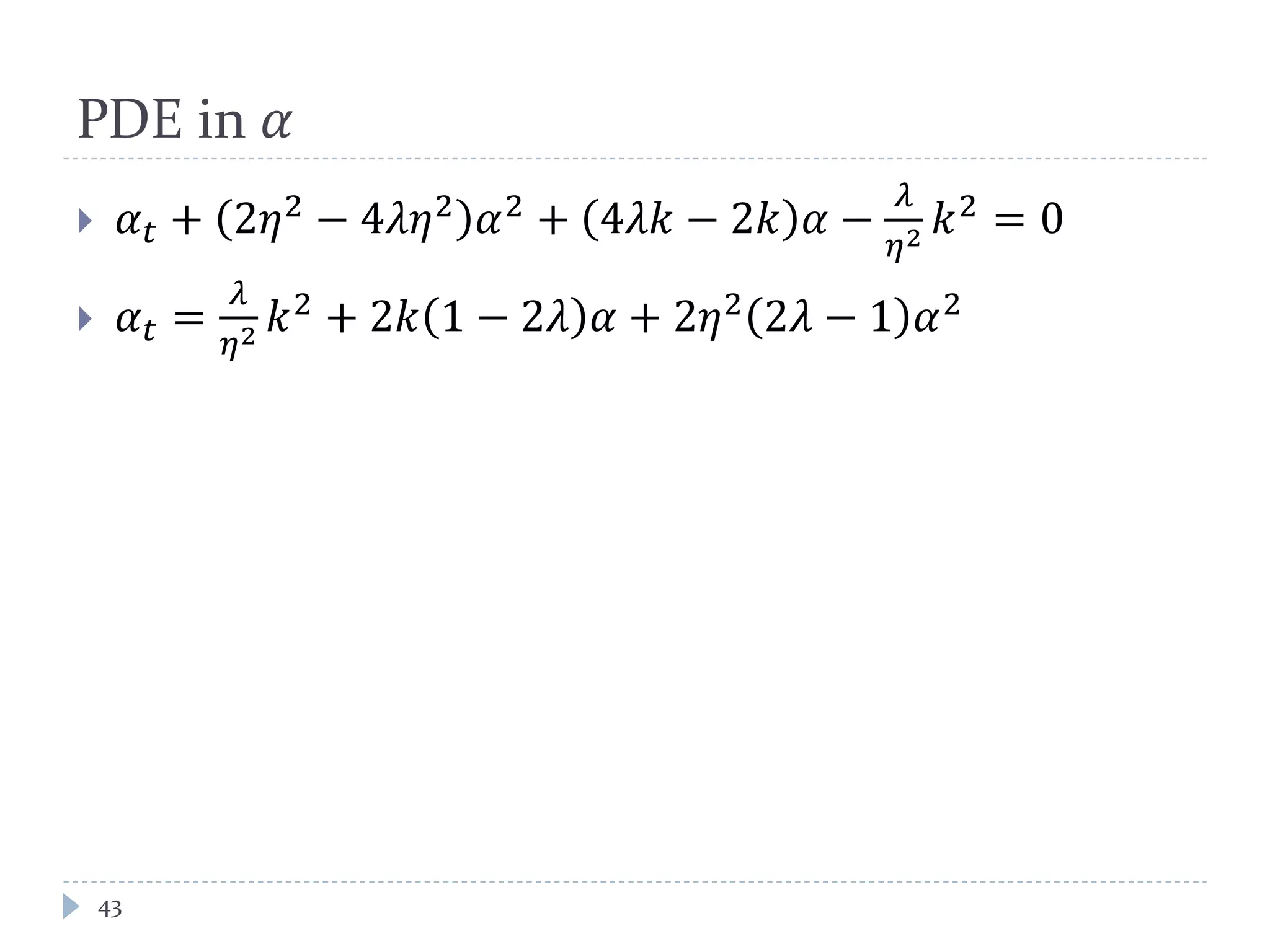

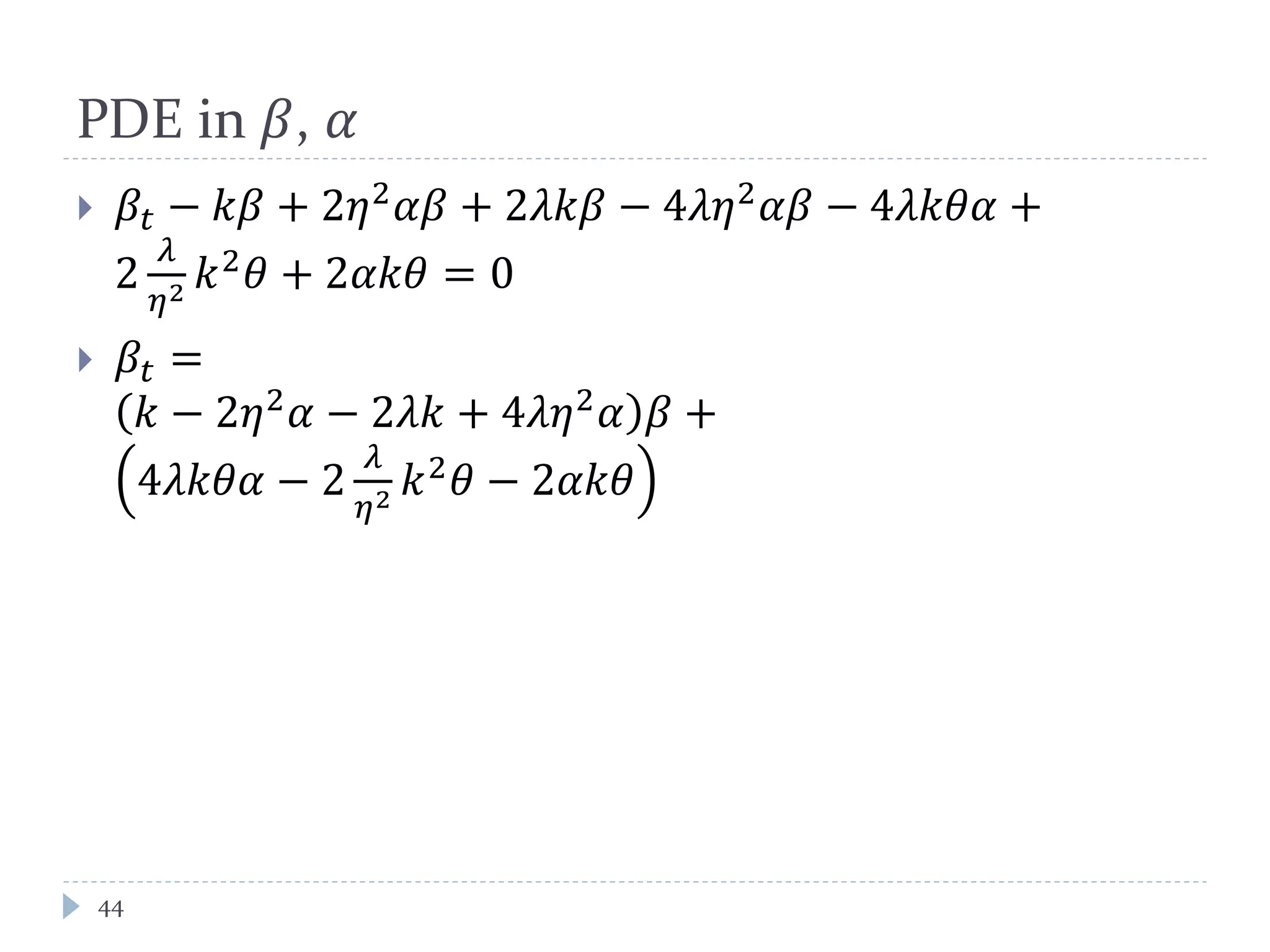

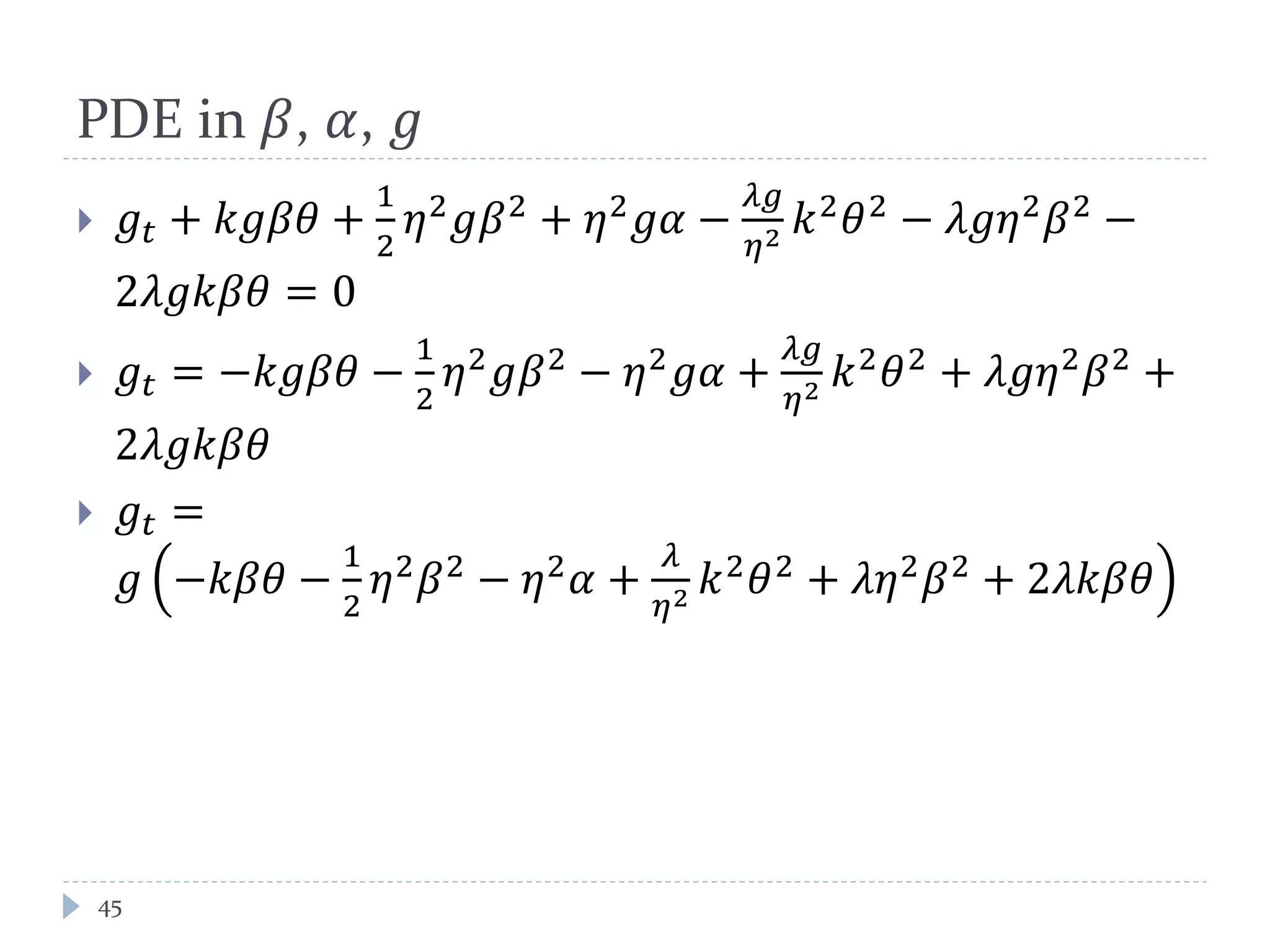

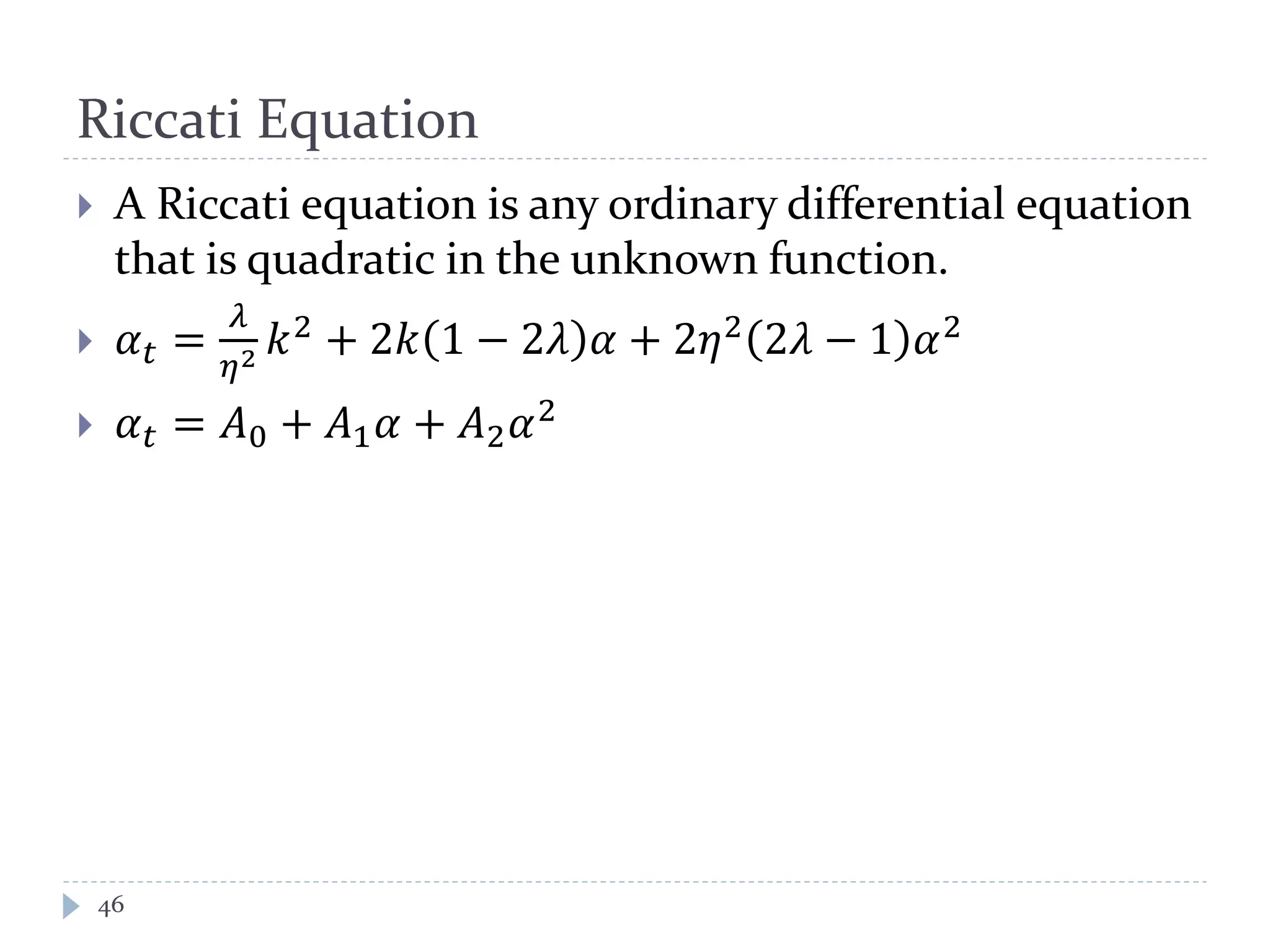

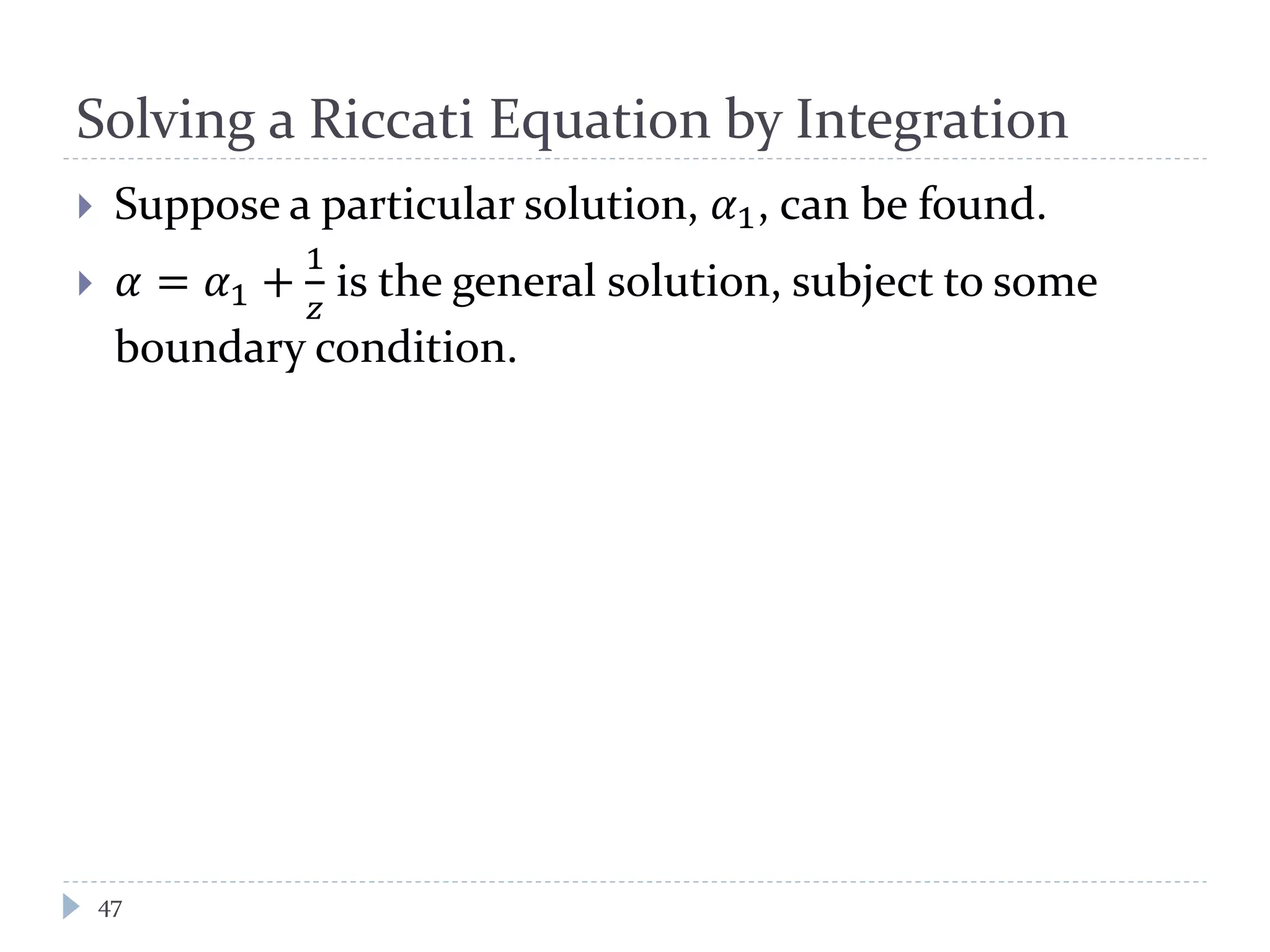

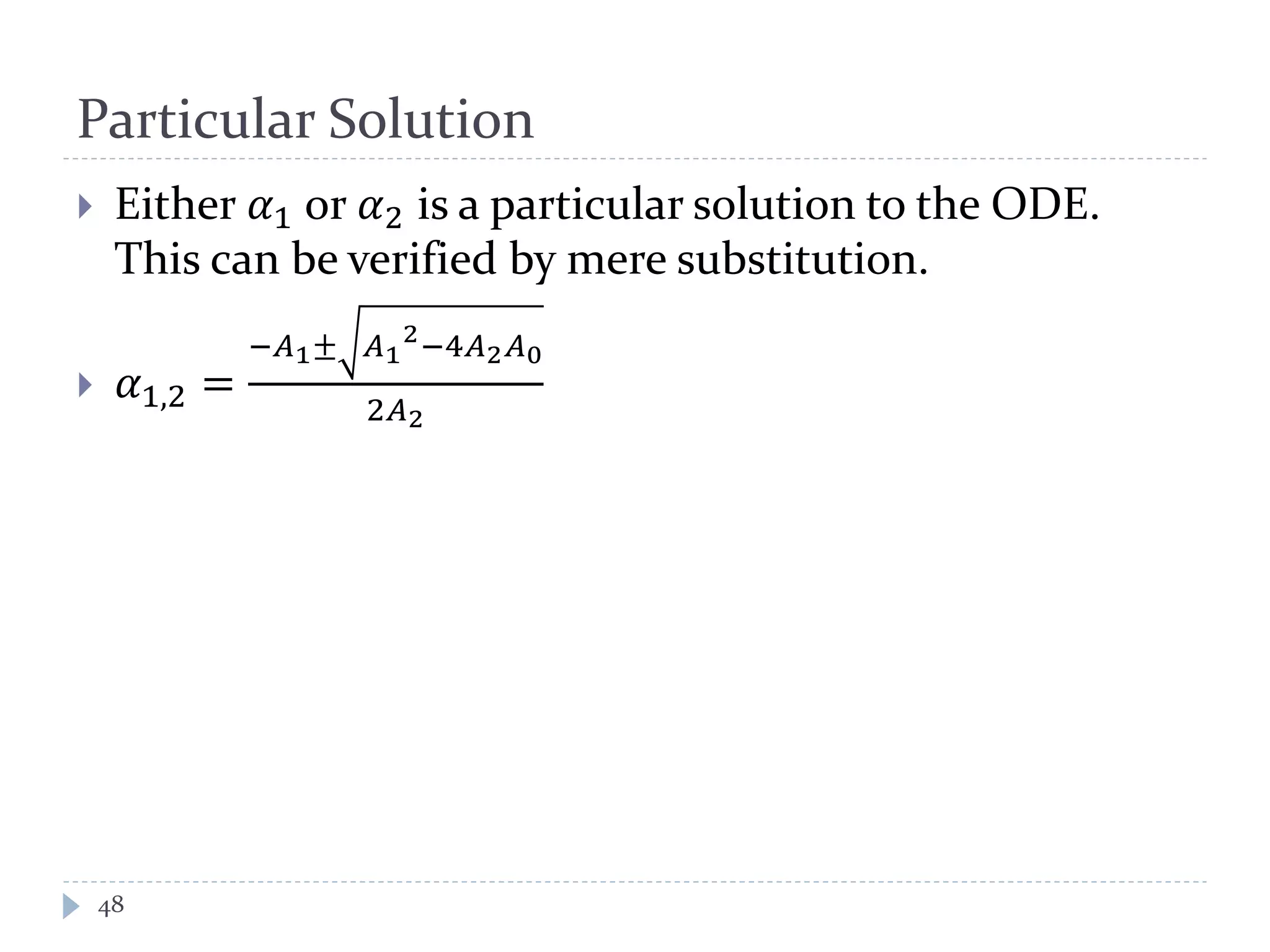

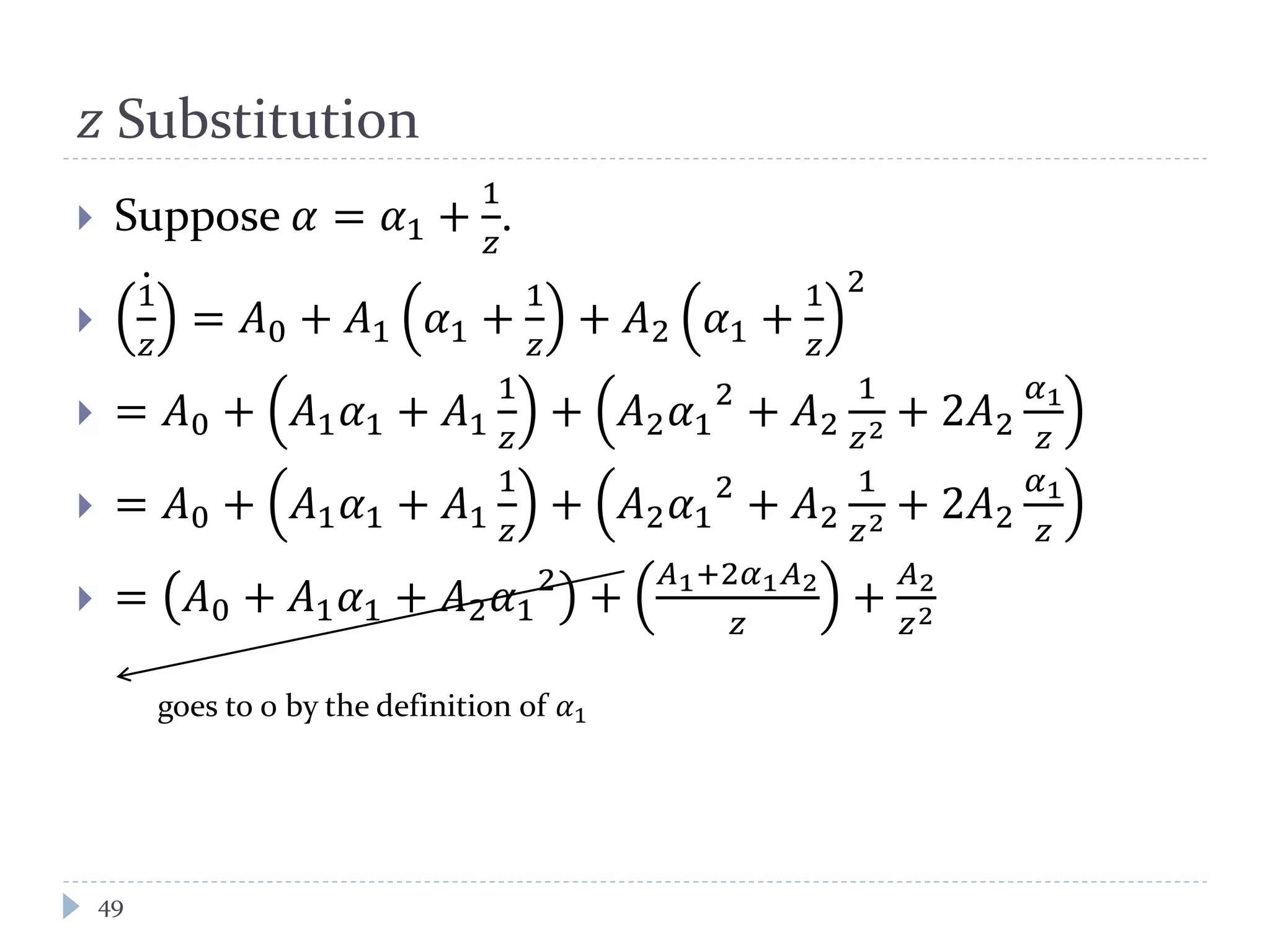

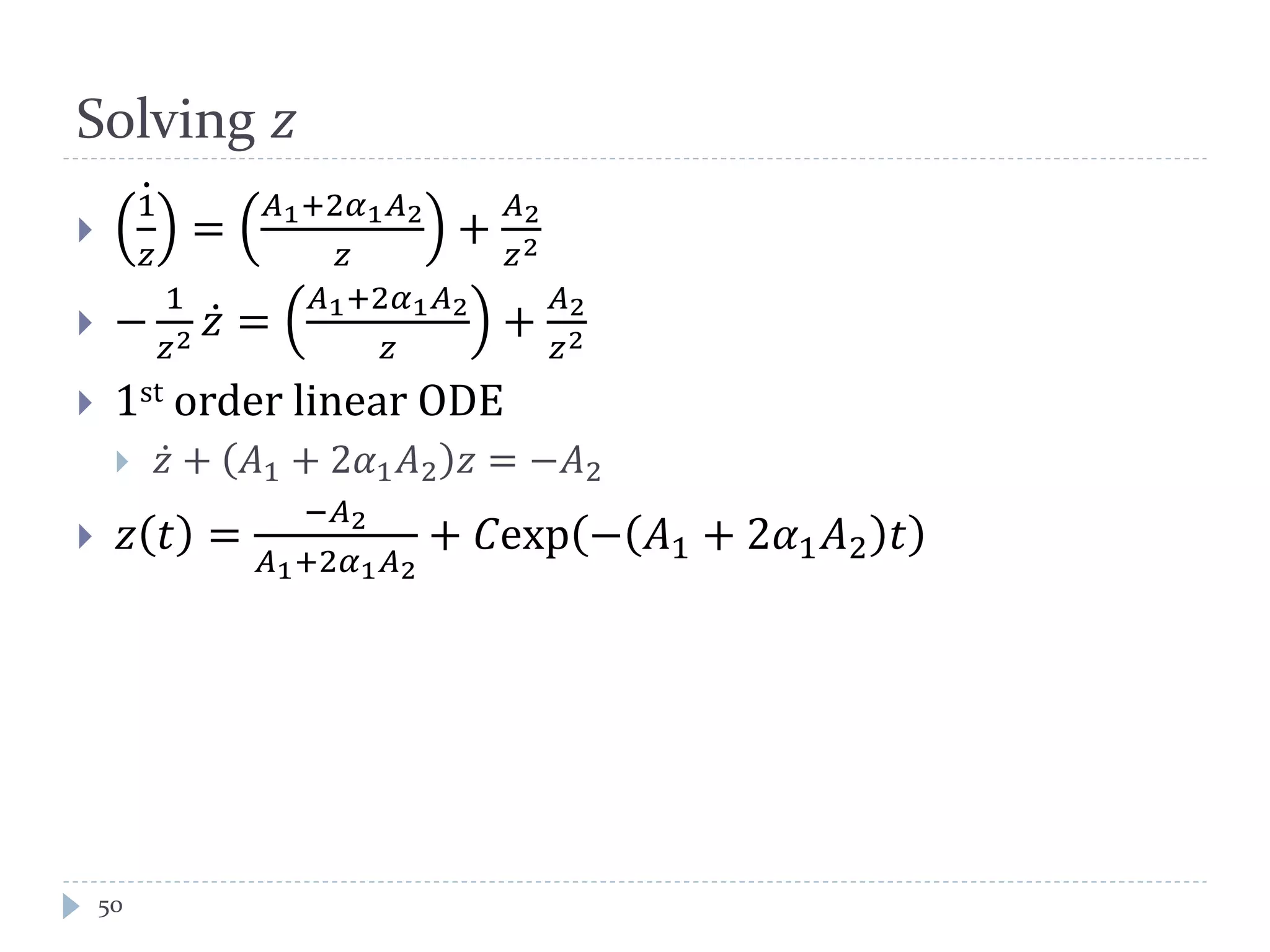

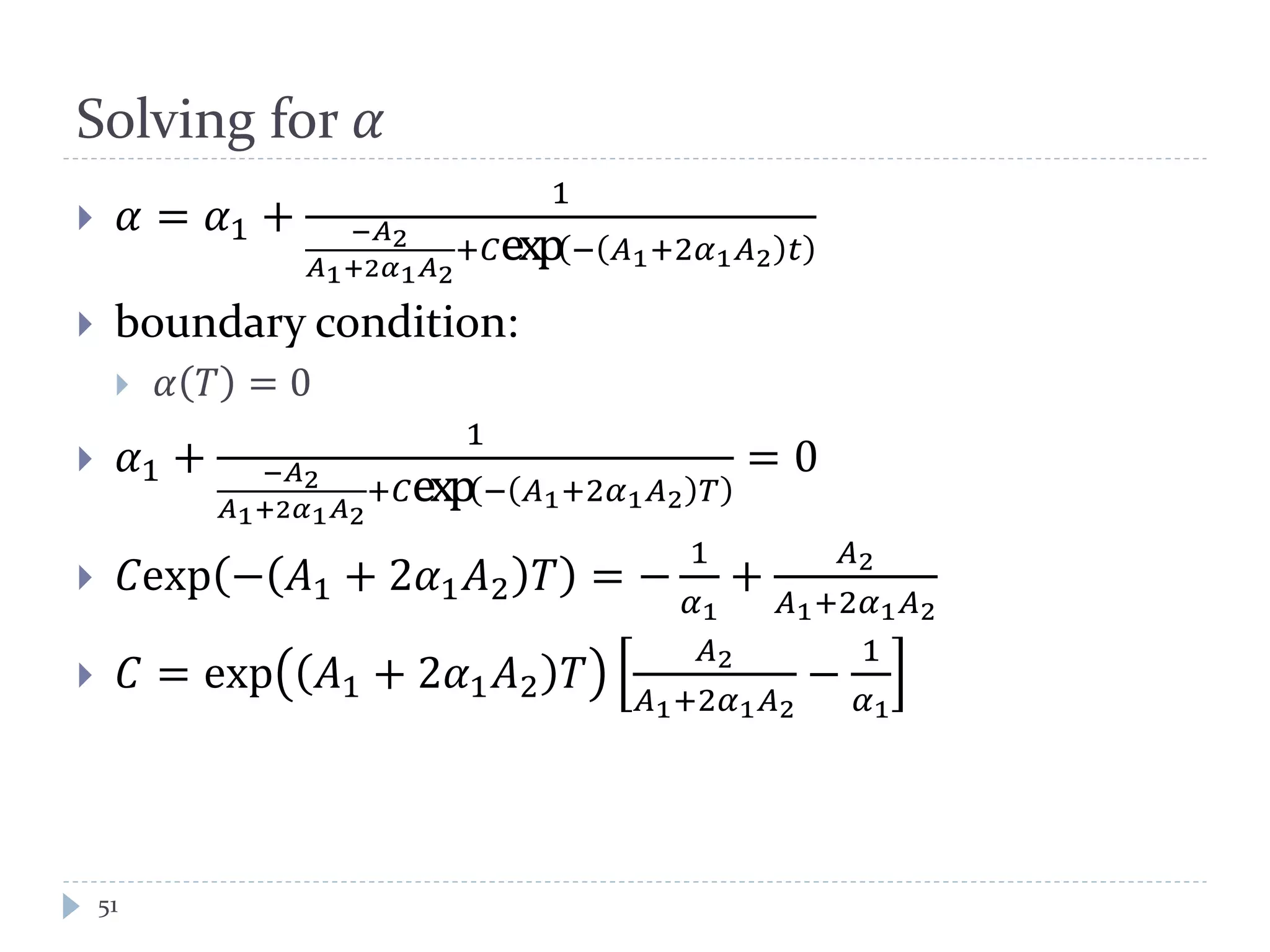

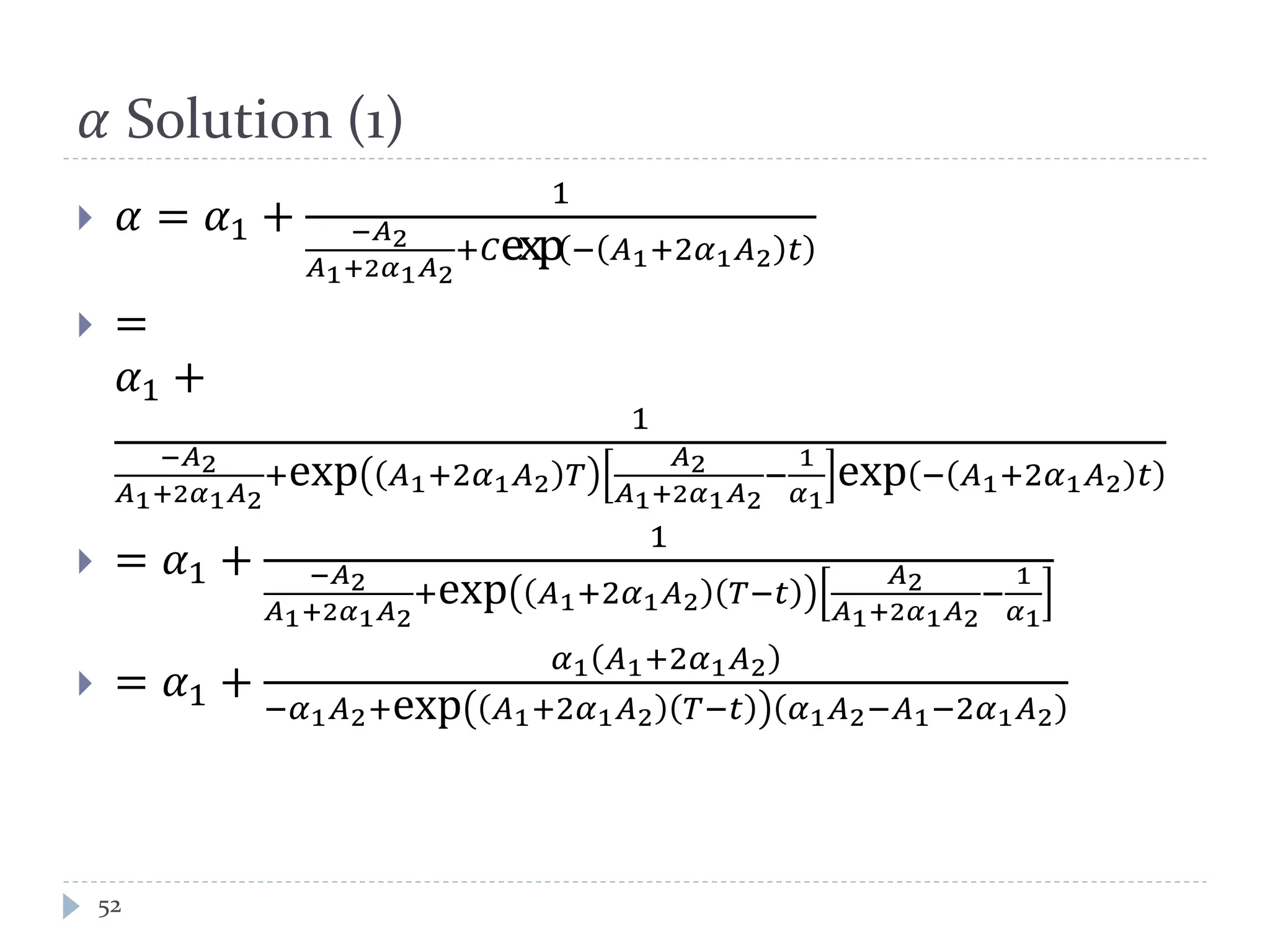

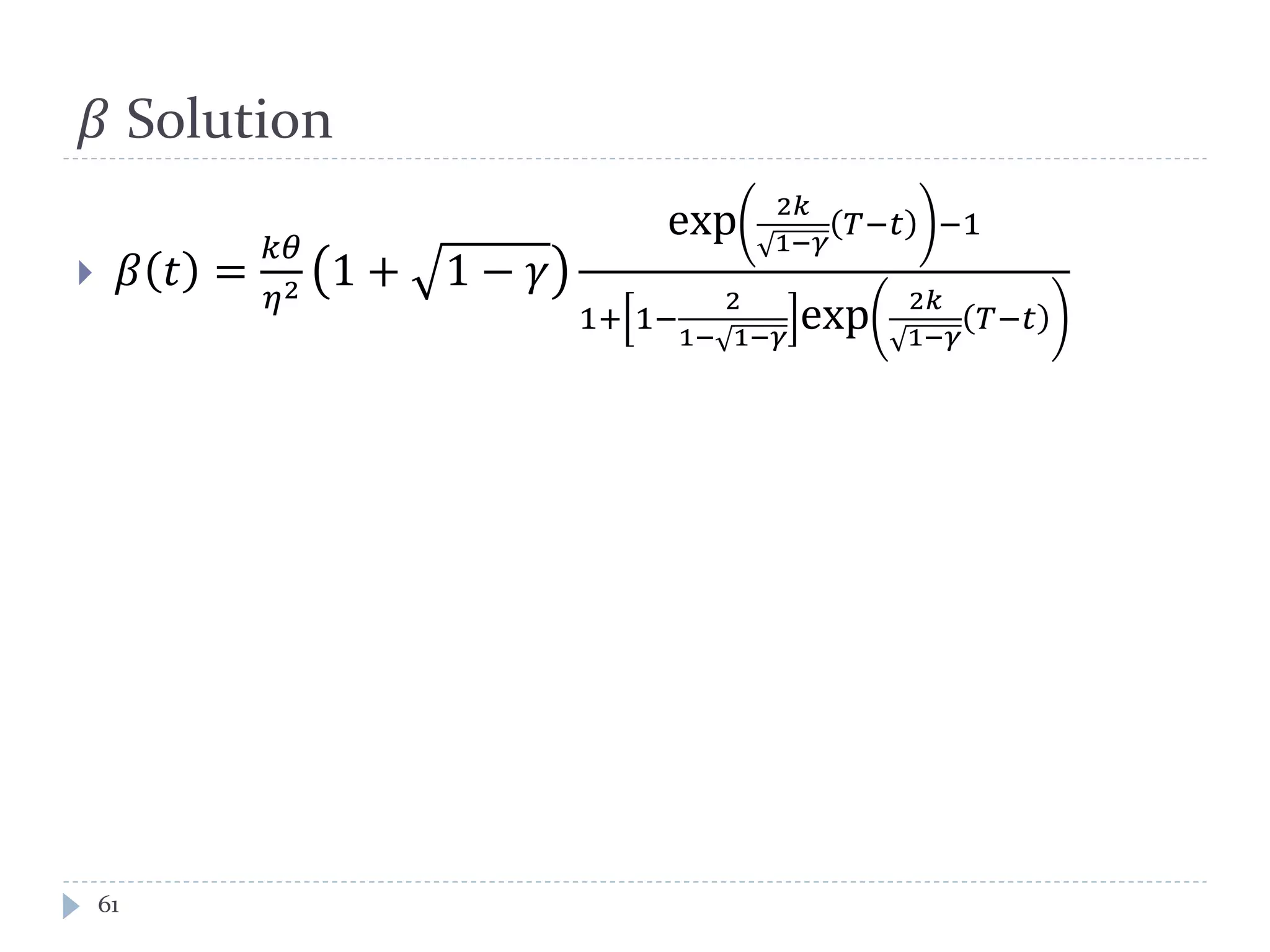

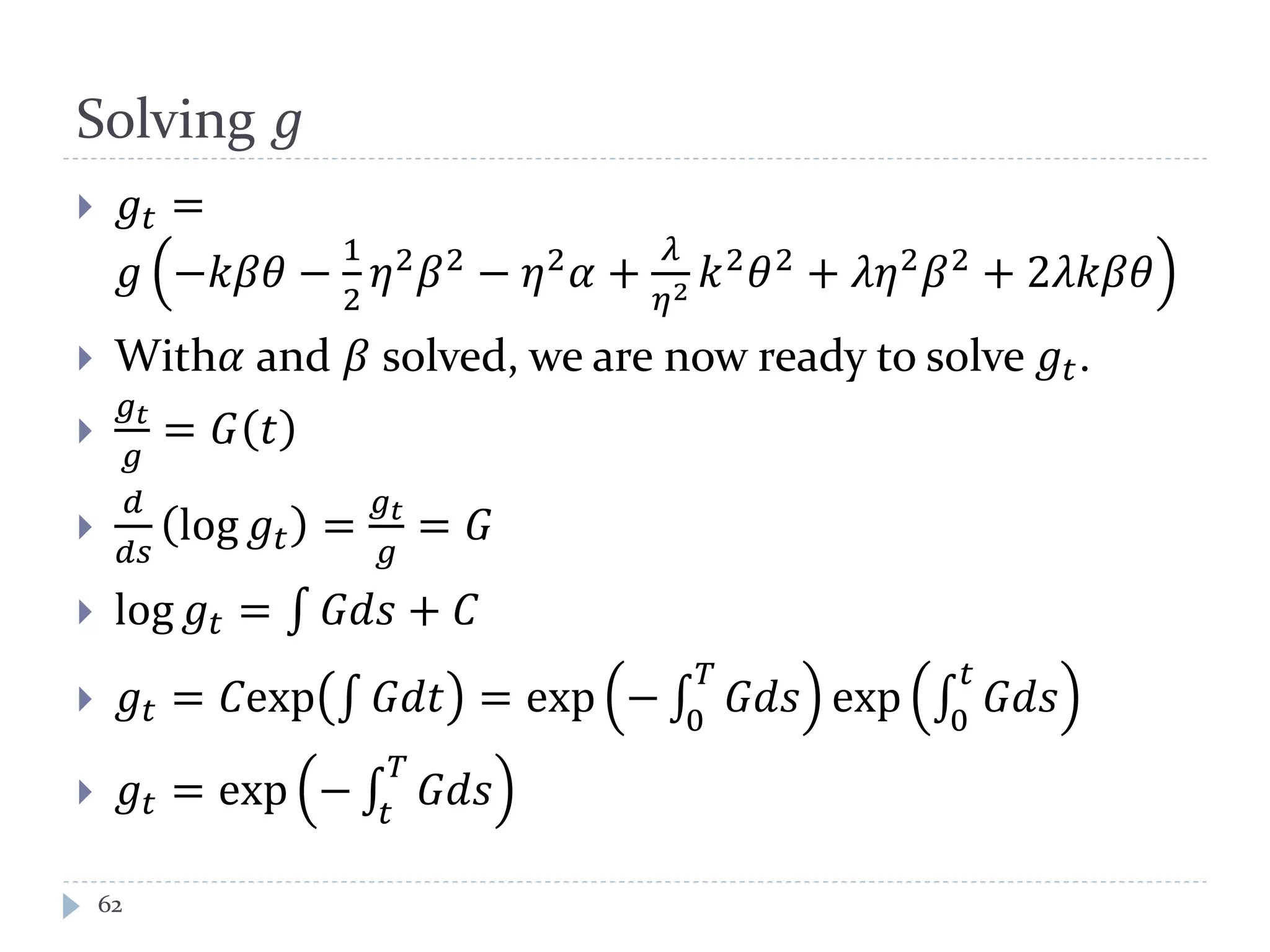

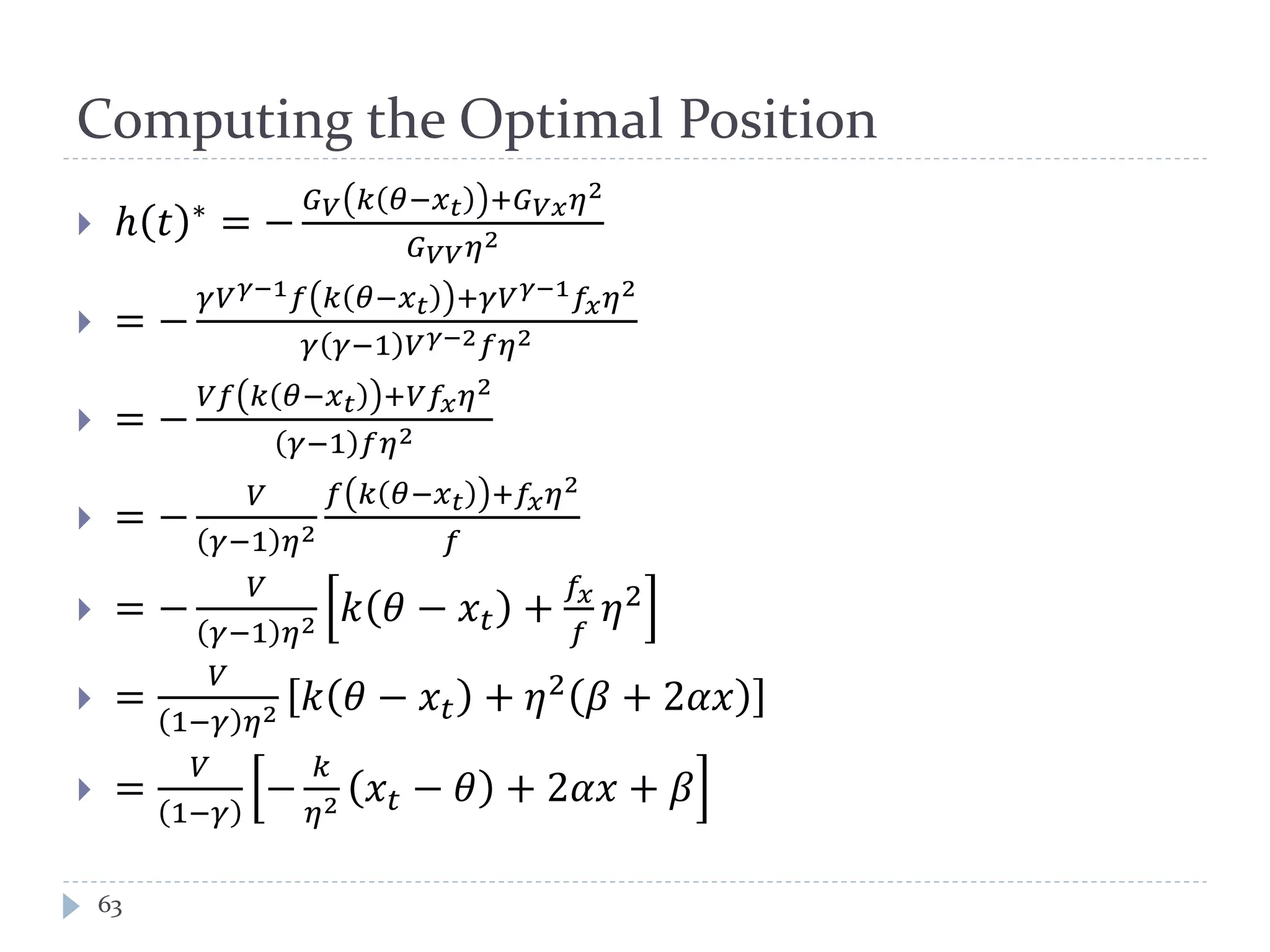

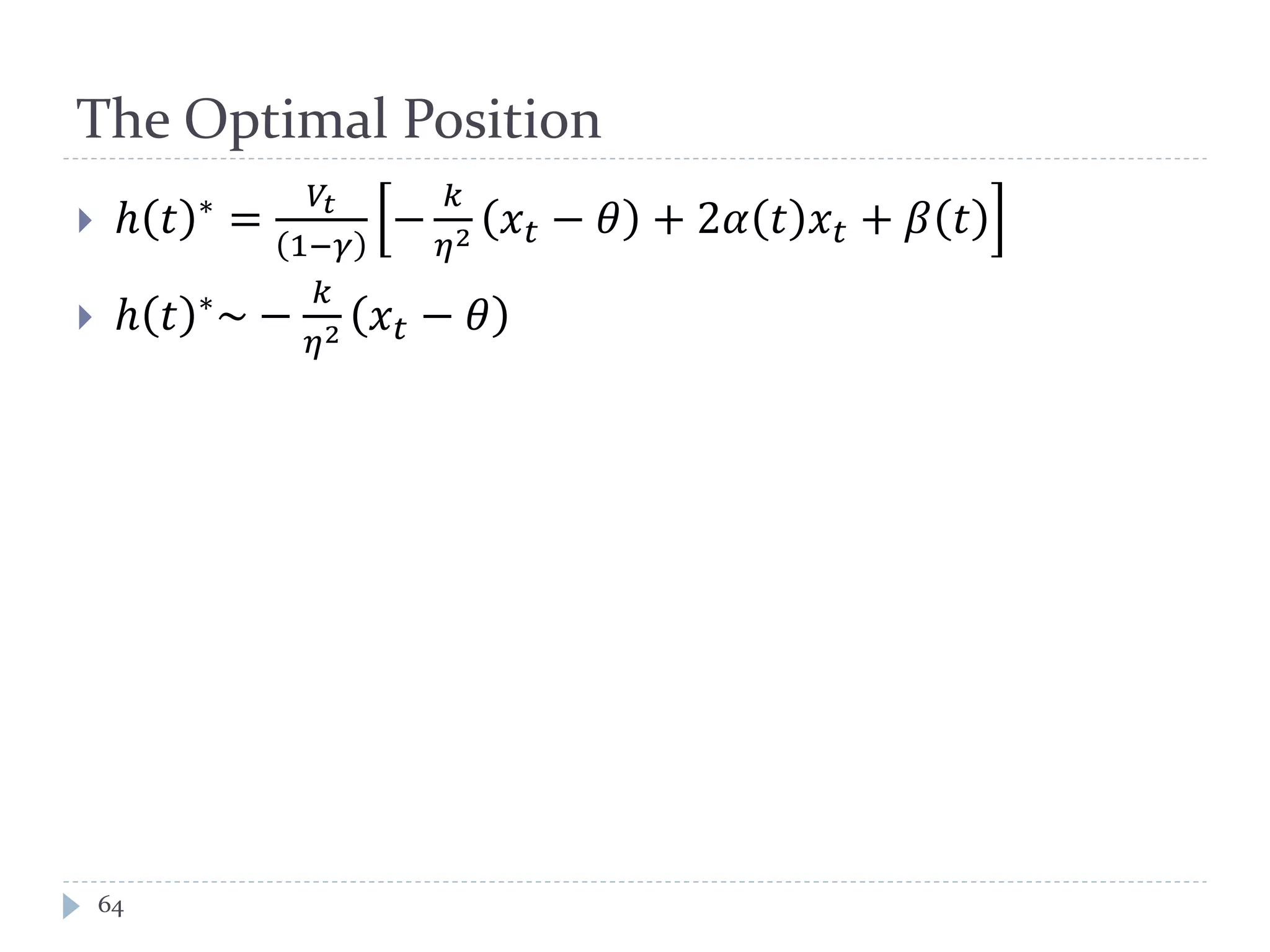

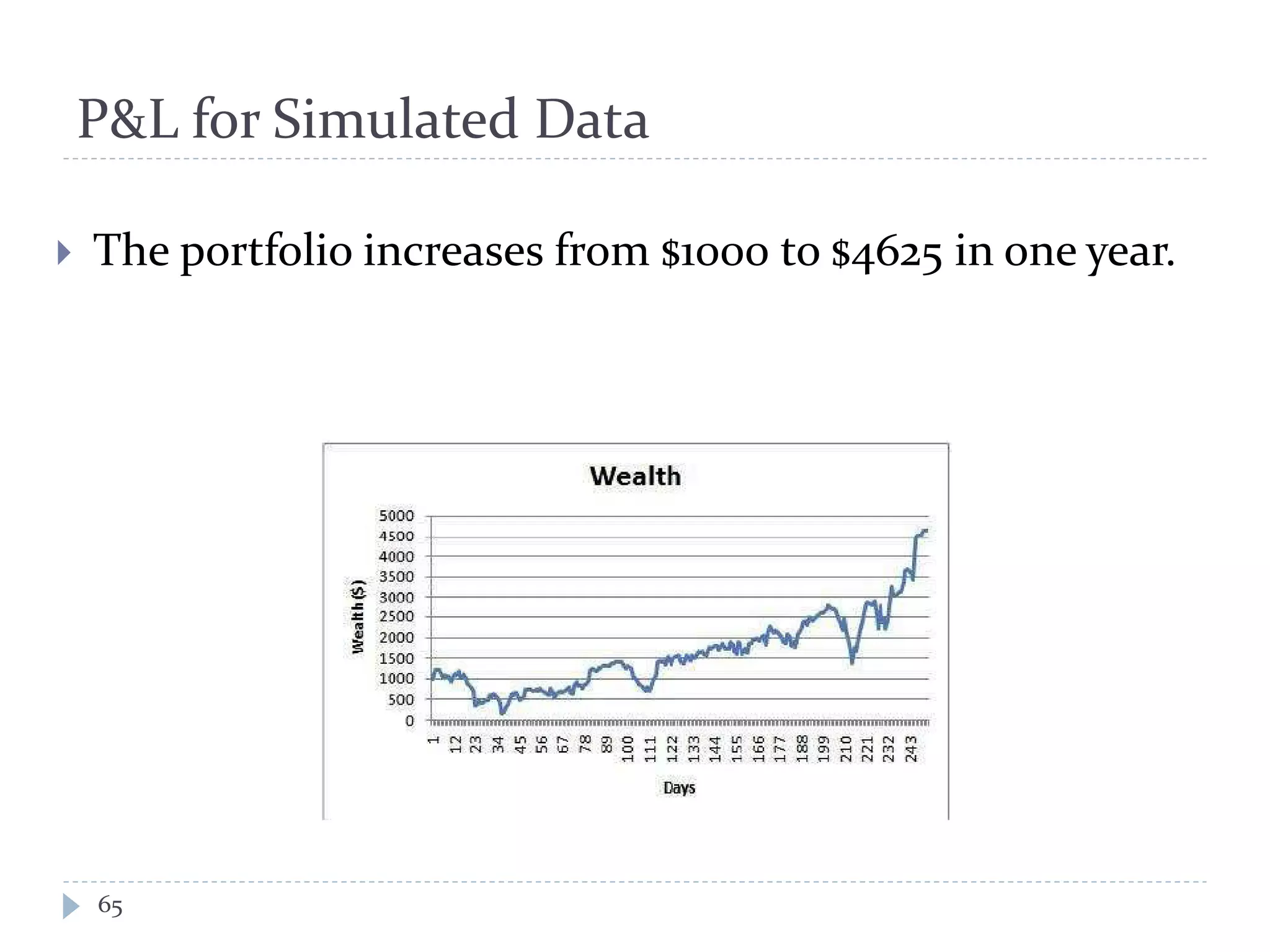

The document provides an introduction to optimal pairs trading using stochastic control. It discusses modeling the spread between two assets as an Ornstein-Uhlenbeck process and computing the optimal position as a function of the deviation from equilibrium. This is done by solving the Hamilton-Jacobi-Bellman equation using dynamic programming. The objective is to maximize expected utility of the trading portfolio value over time.