This document is a thesis that examines stochastic differential equations (SDEs). It begins with an introduction that provides background on SDEs and outlines the aims, objectives, and structure of the thesis. The body of the thesis first reviews key concepts in probability, Brownian motion, and stochastic integration. It then defines SDEs and explores numerical methods for solving SDEs such as the Euler-Maruyama and Milstein methods. Applications of SDEs in finance are also discussed, including the Black-Scholes option pricing model. The thesis concludes by summarizing the findings and proposing avenues for further research.

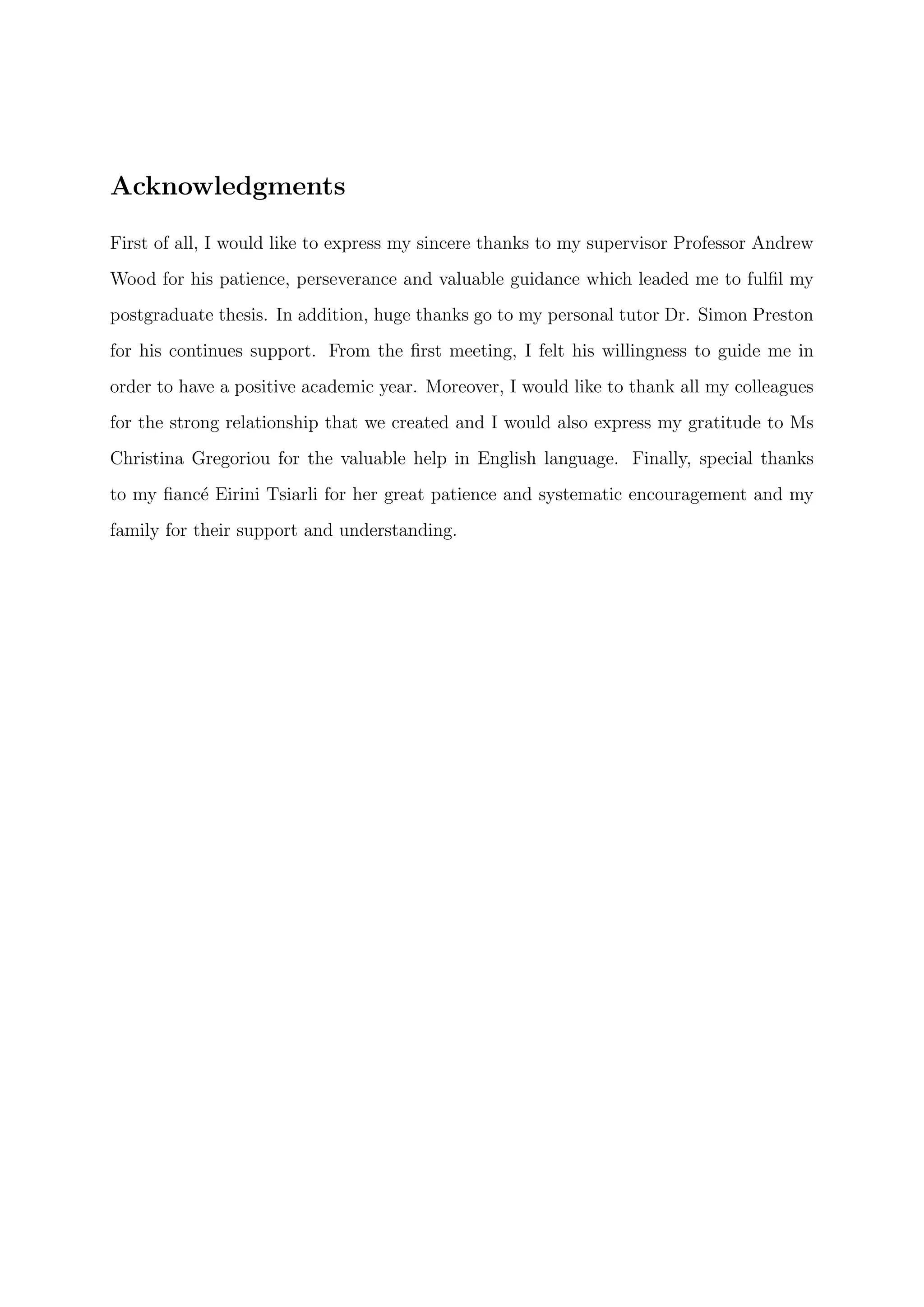

![2.2 Brownian Motion (or Wiener process)

This subsection provides the concept of Brownian Motion (or similarly Wiener Process)

and its properties as well as the proofs of them. Nowadays, it is known that Brownian

Motion is one of the most significant stochastic processes in Mathematics. Its name is

derived by the botanist Robert Brown, who observed by using a microscope the continuous

and irregular movement of particles in the water (at the age of 1827). The Brownian

process plays an important role in the theory of stochastic differential equations and

constitutes one of the cornerstones in mathematical finance and beyond.

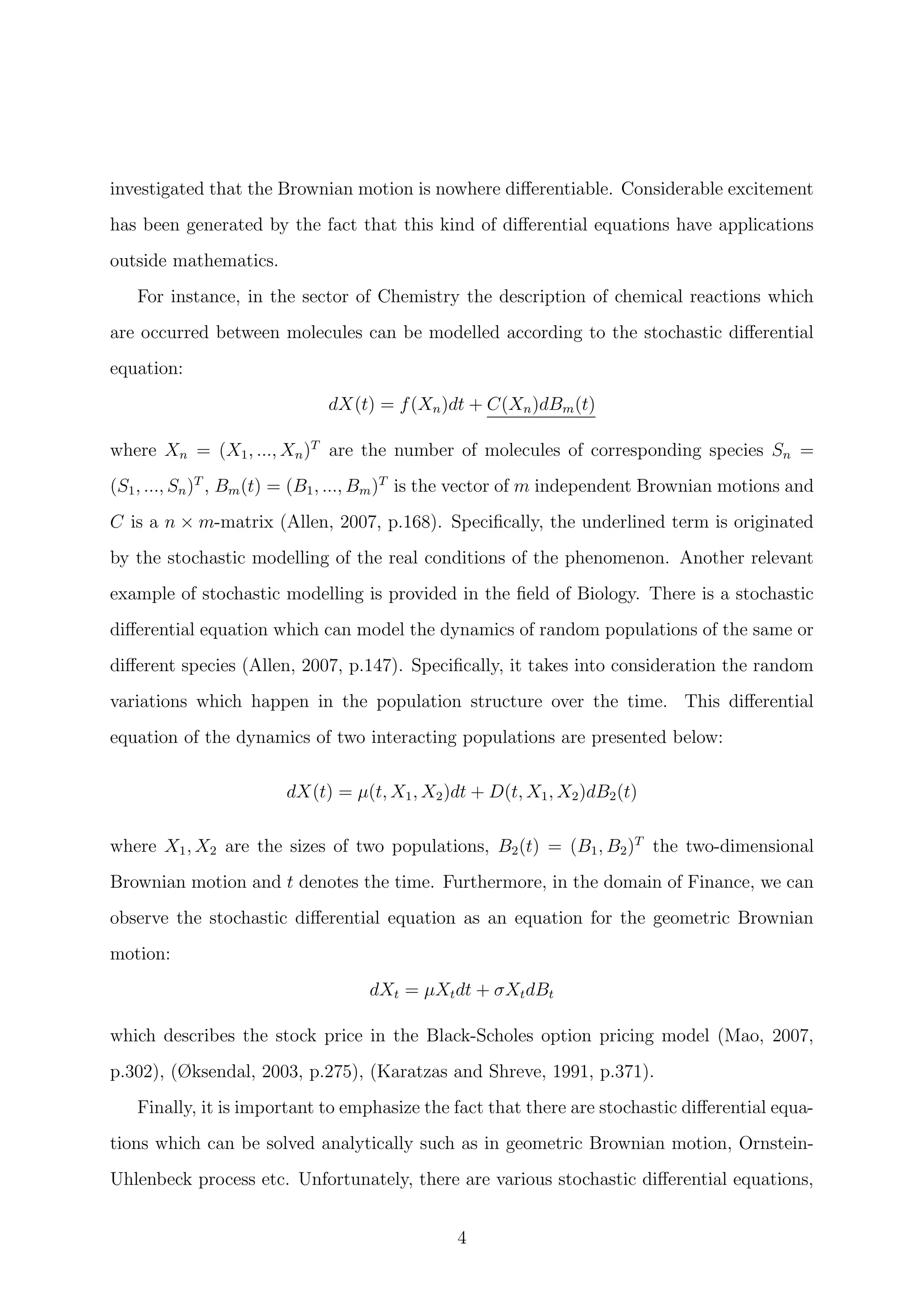

Figure 1: Two sample paths of standard Brownian motion on the time interval [0, 1] [see

code B.1.1].

Definition 2.2.1. Brownian Motion (or Wiener Process) (Friedman, 1975, p.36),

(Mikosch, 1998, p.33). Assume a stochastic process B = (Bt, t ∈ [0, ∞)). It is called

Brownian motion (or a Wiener process) if it satisfies the following conditions:

(i) B0 = x - this means that the process starts from the point x.

(ii) it has independent increments. For instance, for every sequence with 0 t1 < t2 <

. . . < tn, the increments:

Btn − Btn−1 , . . . , Bt2 − Bt1

are independent random variables.

11](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-14-2048.jpg)

![(iii) the increments Bt+h −Bt are normally distributed with expectation zero and variance

h.i.e.

Bt+h − Bt ∼ N(0, h)

(iv) Its sample paths are continuous.

Remark 2.2.2. (i) From Embrechts and Maejima(2000 p.6) and Mikosch(1998, p.33)

it can be seen that Brownian motion is closely linked to normal distribution.

(ii) Through the review of literature it is remarkable the fact that many definitions for

the Brownian motion assume that the process has 0 as a starting point. Specifically,

the condition (i) of the definition 2.2.1 is changed to B0 = 0, i.e. x = 0 and this

case is defined as a standard Brownian motion. Hence, the figure 1 (p. 7) shows

sample paths of standard Brownian motion. In this study it is determined any point

x to be a possible starting point of Brownian motion. (Mikosch, 1998, p.33), (Mao,

2007, p.15 ), (Friedman, 1975, p.36).

(iii) The condition (iv) of definition 2.2.1 can be found in many sources either as part of

the definition of Brownian motion, or as a property which follows from conditions

(i) − (iii). For instance on Mikosch(1998, p.33) it is written as a condition of the

definition. However, it is noticeable in the lecture presentation slides (Chapter 5,

p. 8/35) of Professor Philip O’Neill for the module of Stochastic Models that this

condition presents as a property of the Brownian motion. Furthermore, in Karatzas

and Shreve(1991, p.53-55) by using at first the Kolmogorov-Centsov Theorem and

then by considering the conditions (i)−(iii) of definition 2.2.1 to be the prerequisites

of the continuity, the desideratum is proved.

Corollary 2.2.3. Properties of Brownian Motion:

(i) 1. E[Bt | B0 = x] = x

2. V ar[Bt | B0 = x] = t

(ii) Sample paths of the Brownian motion are NOT differentiable.

12](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-15-2048.jpg)

![Proof. (i) From the condition (iii) we know that the probability density function is

f(x) = 1√

2πt

e

−x2

2t and the expectation of a general random variable g(Bt), where g

is a given function, is:

E[g(Bt)] =

1

√

2πt

∞

−∞

g(x)e

−x2

2t dx.

Using the above formula, it follows that:

E[Bt | B0 = x] = E[x + Bt] =

1

√

2πt

∞

−∞

(x + y)e

−y2

2t dy

. Therefore:

E[(x + Bt)] =

1

√

2πt

∞

−∞

(x + y)e

−y2

2t dy

=

1

√

2πt

∞

−∞

(xe

−y2

2t + ye

−y2

2t )dy

=

1

√

2πt

∞

−∞

(xe

−y2

2t )dy +

1

√

2πt

∞

−∞

(ye

−y2

2t )dy

=

x

√

2πt

∞

−∞

(e

−y2

2t )dy +

1

√

2πt

−te

−y2

2t

∞

−∞

=

x

√

2πt

∞

−∞

(e

−y2

2t )dy +

1

√

2πt

lim

y→∞

(−te

−y2

2t )

0

− lim

y→−∞

(−te

−y2

2t )

0

Set z =

y

√

2t

and dy = dz

√

2t.

=

x

√

2t

√

2πt

∞

−∞

e−z2

dz

√

π

=

x

√

2t

√

π

√

2πt

= x, as required.

13](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-16-2048.jpg)

![Whilst for the variance we have:

V ar[(x + Bt)] =

1

√

2πt

∞

−∞

(x + y)2

e

−y2

2t dy

=

x2

√

2πt

∞

−∞

e

−y2

2t dy +

2x

√

2πt

∞

−∞

(ye

−y2

2t )dy +

1

√

2πt

∞

−∞

y2

e

−y2

2t dy

=

1

√

2πt

y(−2te

−y2

2t )

∞

−∞

+

1

√

2πt

y(−te

−y2

2t )

∞

−∞

+

1

√

2πt

∞

−∞

y(−te

−y2

2t ) dy

= 0 + 0 −

1

√

2πt

∞

−∞

−te

−y2

2t dy

Set z =

y

√

2t

and dy = dz

√

2t.

=

t

√

2t

√

2πt

∞

−∞

e−z2

dz

√

π

= t, as required.

(ii) The basic consideration for this property is to show that Brownian motion is H-

self similar process defined in definition 2.2.5 below. That is the most important

point of the whole proof because we will subsequently show that any H-self similar

process is nowhere differentiable with probability 1. This particular syllogism can

lead us to our initial purpose. Namely, to show that Brownian motion is nowhere

differentiable. First of all, it is necessary to refer some helpful definitions.

Definition 2.2.4. (Mikosch, 1998, p.30). Let a stochastic process X = (Xt, t ∈ T)

and T be a subset of R. The process X has stationary increments if:

Xt − Xs

d

= Xt+h − Xs+h ∀t, s ∈ T and t + h, s + h ∈ T.

Definition 2.2.5. [Embrechts and Maejima, 2000, p.3] Assuming a stochastic pro-

cess X = (Xt, t = 0, 1, 2, 3, . . .). It is called to be ”H-self-similar” if ∀a > 0, ∃H > 0

such that:

{Xat}

d

= {aH

Xt}

In plain words, the term of ”self-similarity” can be described as the ability of a

graph which if you choose any part of it, in any time length interval, you can earn

the similar image as the initial one. It is important to note that you can’t get the

14](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-17-2048.jpg)

![same image as the original.

The following proposition is stated without proof in Mikosch(1998, p.36). A proof

of this result is given below.

Proposition 2.2.6. (Mikosch, 1998, p.36). Let {Bt, t 0} be a standard Brownian

Motion. Then {Bt} is 1

2

-self-similar process.

Proof. According to the proof of Embrechts and Maejima [2000, p. 5] it is obvious

that the proof which is given has brief description. As a result, in this thesis it is

provided a detailed proof to show that {Bt} is 1

2

-self-similar process.

From definition 2.2.4, we consider the relation below:

{Bat}

d

= {a

1

2 Bt} ∀a > 0.

However, it would be simpler to be proven that:

{a−1

2 Bat}

d

= {Bt} ∀a > 0.

Hence, we have to examine if the above relation can satisfy the conditions of the

definition 2.2.1. The condition (i) (of definition 2.2.1) is shown as below:

For t = 0,

{a−1

2 B0}

B0=0

= 0.

Moreover, to proof the condition (ii) (of definition 2.2.1), it is enough to show

that for all 0 t1 t2 . . . tk the random variables:

a−1

2 Bat1 − a−1

2 Bat0 , a−1

2 Bat2 − a−1

2 Bat1 , . . . , a−1

2 Batk

− a−1

2 Batk−1

have correlation equals to zero. Hence, when ti < tj:

E[(a−1

2 Bati

− a−1

2 Bati−1

)(a−1

2 Batj

− a−1

2 Batj−1

)] =

= E[a−1

Bati

Batj

− a−1

Bati

Batj−1

− a−1

Bati−1

Batj

+ a−1

Bati−1

Batj−1

]

= a−1

[ati − ati − ati−1 + ati−1] = 0

15](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-18-2048.jpg)

![and we conclude to the deduction that a−1

2 Bt has independent increments. Regards

the condition (iii) (of definition 2.2.1) we proceed with the following methods:

E[a−1

2 Bat] = a−1

2 E[Bat] = 0

E[(a−1

2 Bat)2

] = a−1

at = t

Finally, the condition (iv) follows from the condition (i) to (iii). Consequently

{a−1

2 Bat}

d

= {Bt} as required.

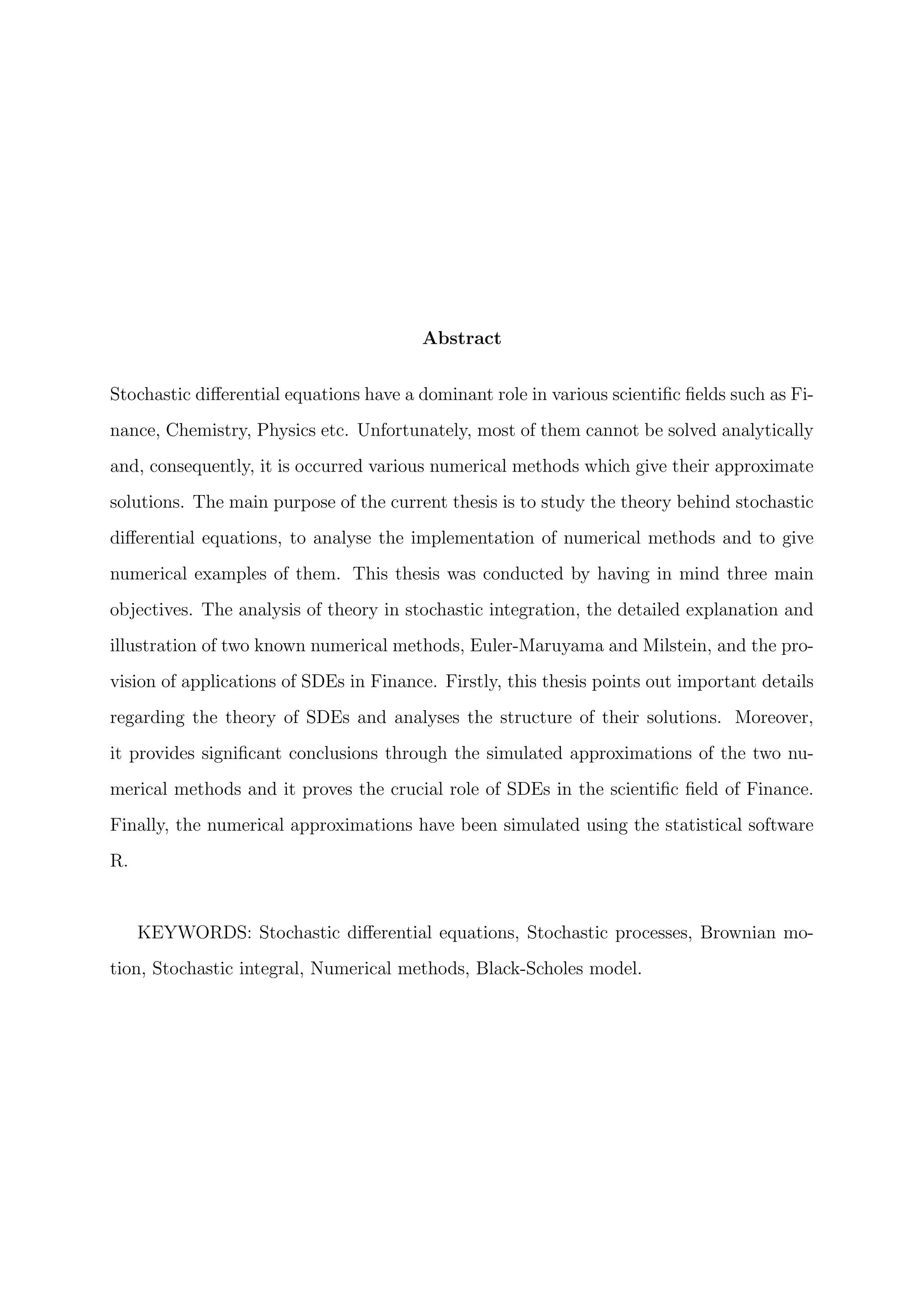

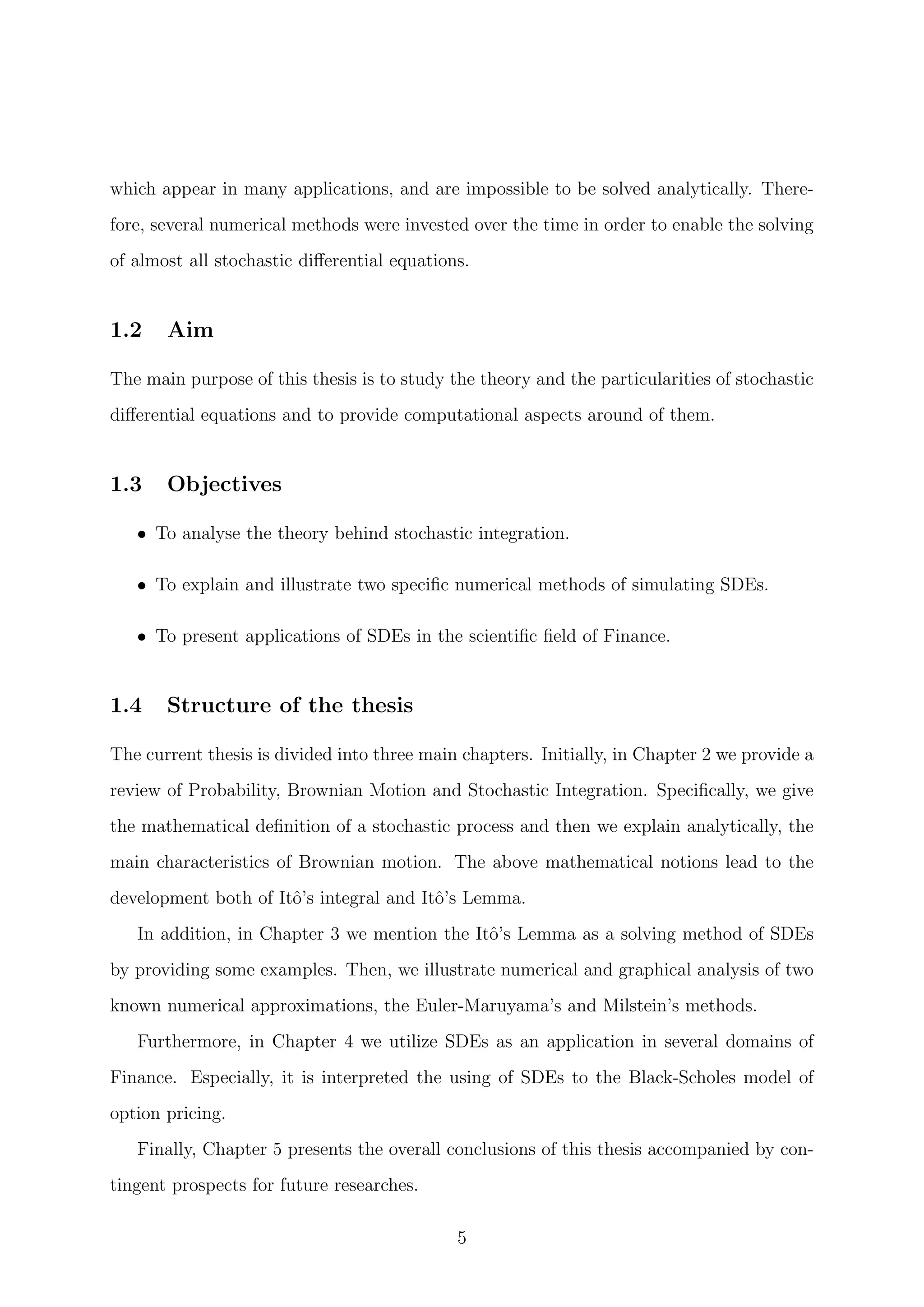

Figure 2: Self-similarity of Brownian motion (Mikosch, 1998, p.37).

16](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-19-2048.jpg)

![Thus, from the proportions 2.2.6 and 2.2.7 it follows that a Brownian sample path

is nowhere differentiable.

Therefore, we have just completed the proves of properties which were referred on

corollary 2.2.3.

Remark 2.2.8. As can be seen from Figure 1, which illustrates two random sample paths

of Brownian motion, it is noticeable that there is no regularity in the trend of the paths.

Therefore, the non-differentiability of Brownian motion is distinguishable by its graphical

representation.

Theorem 2.2.9. (Embrecht and Maejima, 2000, p.4). Let a stochastic process {Xt} be

H-self-similar and we assume E[X2

(1)] < ∞. Then

E[XtXs] =

1

2

{t2H

+ s2H

− |t − s|2H

}E[X2

1 ]

.

Proof.

E[X2

t ] = V ar[Xt] = V ar[tH

X1] = t2H

V ar[X1] = t2H

E[X2

1 ]

E[X2

s ] = V ar[Xs] = V ar[sH

X1] = s2H

V ar[X1] = s2H

E[X2

1 ]

E[(Xt − Xs)2

] = V ar[(Xt − Xs)] = V ar[X1(| t − s |)H

] =| t − s |2H

E[X2

1 ]

Therefore,

E[XtXs] =

1

2

{E[X2

t ] + E[X2

s ] − E[(Xt − Xs)2

]}

=

1

2

t2H

+ s2H

− |t − s|2H

E[X2

1 ]

Theorem 2.2.10. E[BtBs] = min {t, s}

18](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-21-2048.jpg)

![Proof. As we can see in Embrecht and Maejima(2000, p.5) the proof is based on the fact

that standard Brownian motion is 1

2

-self-similar process. Therefore, it can be used the

formula of the theorem 2.2.9. as below:

E[BtBs] =

1

2

t2H

+ s2H

− |t − s|2H

≡ min {t, s} .

Thus it helps us to acquire the desired result.

However, it can be provided in this thesis a second method in order to prove E[BtBs] =

min {t, s}.

Let assume 0 < t < s. Then,

Bs = Bs + Bt − Bt

BtBs = BtBs + B2

t − B2

t

BtBs = B2

t + Bt[Bs − Bt]

(linearity of expectation) E[BtBs] = E[B2

t ] + E[Bt[Bs − Bt]]

(by def.2.2.1, cond. (ii) and (iii)) E[BtBs] = t + 0 = t

Now, let assume 0 < s < t. Then,

Bt = Bt + Bs − Bs

BtBs = BtBs + B2

s − B2

s

BtBs = B2

s + Bs[Bt − Bs]

(linearity of expectation) E[BtBs] = E[B2

s ] + E[Bs[Bt − Bs]]

(by def.2.2.1, cond. (ii) and (iii)) E[BtBs] = s + 0 = s

Therefore, it is proved that E[BtBs] = min {t, s}.

Example 2.2.11. Find E[(Bt+w − Bt)2

] for t, w > 0.

E[(Bt+w − Bt)2

] = E[B2

t+w − 2BtBt+w + B2

t ]

(linearity of expectation) = E[B2

t+w] − 2E[BtBt+w] + E[B2

t ]

(by def.2.2.1, cond. (ii)(iii) and theorem 2.2.10) = t + w − 2t + t

= w.

19](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-22-2048.jpg)

![The above example shows that E[(dBt)2

] = dt where dBt = Bt+w −Bt. Specifically, the

expectation of (dBt)2

equals to the difference of t+dt and t. Obviously, V ar[Bt+w −Bt] =

E[(Bt+w − Bt)2

] since E[Bt+w − Bt] = 0.

2.3 Brief mention to Stieltjes integral

In this subsection we give a brief mention to the concept of Stieltjes integral and explain

why this concept is not valid for the definition of a stochastic integral. Initially, we start

by the definition of the Stieltjes integral for a step function.

Definition 2.3.1. (Dragomir, 2001, p.42). Consider a step function:

h = h010 +

n

i=1

h01(ti,ti+1]

where {ti} is a partition of the interval [0, t]. Let m be a random function on R+

. The

Stieltjes integral of h over m is defined as below:

t

0

hdm :=

n

i=1

hi[m(ti+1) − m(ti)]

A continues function h can be approached by a sequence hn of step functions with the

concept that hn → h. By this sequence we can create a new sequence consists by Stieltjes

integrals

t

0

hndm. Each one of these Stieltjes integrals is defined by the definition 2.3.1.

The limit, as n → ∞, exists and, actually, if hn and hn are two different sequences of

step functions which approach the same function h then the limits

t

0

hmdm and

t

0

hndm

coincide between each other. Consequently,

Definition 2.3.2. Consider h is a continues function and hn is a sequence of step func-

tions which approaches h. The Stieltjes integral of h over a function m is defined to

be:

t

0

h · dm := lim

n→∞

hn · dm

The function m is called integrator.

20](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-23-2048.jpg)

![The following theorem shows us the significance of the total variation of an integrator

in the Stieltjes integral. The proof is omitted since it is provided in many literatures e.g.

Dragomir(2001).

Theorem 2.3.3. Suppose m has a local bounded variation and h is continues function.

Then the Stieltjes integral

t

0

hdm exists and satisfies the condition:

|

t

0

hdm |

t

0

| h || dm | sup

0 s t

h(s)

t

0

| dm |

where

t

0

| dm |:= sup{

n

i=1

| m(ti+1) − m(ti) |}

and {ti} a possible partition of [0, t]. The supremum is obtained on all partitions.

The above theorem shows us that if an integrator does not have a finite variation then

the Stieltje’s integral has difficulties to be defined.

Consider now that the functions h and m are stochastic processes, i.e. h = h(t, w) and

m = m(t, w). Furthermore we define m(t, w) = Bt i.e. the integrator will be a Brownian

motion. The theorem (2.3.3) presents the main reason why a Stieltjes integral can not

exists with a Brownian motion as an integrator. A Brownian motion is a function with

an unbounded variation. Consequently, this specific characteristic puts forward the view

that the Steltjies integral can not be defined in terms of a Brownian motion, since the

integrator must be a bounded function. Therefore, the Steltjies integral can not define

stochastic integrals. The significant step to solve this problem is to set a limit as n → ∞

in L2

. This change in the determination of limit is the vital difference between the Itˆo’s

integral and Stieltjes integral.

2.4 Itˆo’s integral

As we have seen in a previous subsection the Brownian motion is a function which is

nowhere differentiable. However, the integration process can be applied to it. Hence,

through this subsection we will attend to the integration of a stochastic process with

21](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-24-2048.jpg)

![Brownian motion as an integrator. During the second world war, the Japanese math-

ematician Kyoshi Itˆo indicated the way to define this kind of integral and thus, it was

called the Itˆo’s stochastic integral. Today, this kind of integrations have applications in

many scientific fields, such as in Finance, Physics etc. Furthermore, on this subsection we

will see that the variation of Brownian motion is the main idea regarding the definition of

the Itˆo’s integral. Initially, we define the stochastic integral for stochastic step functions

and then, for ”suitable” stochastic processes.

Definition 2.4.1. A stochastic process f(t), t ∈ [a, b] is called a step function if there is

a finite sequence of numbers a = t0 < t1 < . . . < tn = b and a finite sequence of random

variables f0, f1, f2, . . . , fn−1 such that:

f(t) = fj if t ∈ (tj, tj+1], j = 1, 2, . . . , n − 1

Moreover, this kind of stochastic process f(t) can be written in form:

f(t) =

n−1

j=0

fj1(tj,tj+1](t) = f01[t0,t1](t) +

n−1

j=1

fj1(tj,tj+1](t) (2.3)

where,

1(tj,tj+1](t) =

0, if t ∈ (tj, tj+1]

1, if t ∈ (tj, tj+1].

From now on, we will denote the set of step functions on [a, b] as Mstep([a, b]).

From the above definition it is important to be mentioned the fact that the indicator

function is the reason of the appearance of steps in the graph of a step function.

2.4.1 The Itˆo’s integral for a step function

Then, it is defined the Itˆo’s stochastic integral for a step function.

Definition 2.4.2. The Itˆo’s integral for a step function Let a stochastic step func-

tion f of the form (2.3). The Itˆo’s integral of f in [a, b] with respect to the Brownian

22](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-25-2048.jpg)

![motion is defined as below:

I(f(t)) =

b

a

f(t)dBt =

n−1

j=0

fj(Btj+1

− Btj

).

Theorem 2.4.3. The Itˆo’s stochastic integral of a step function has the following prop-

erties:

(i) The Itˆo’s integral is linear, i.e. if f(t) and g(t) are two step functions then:

I(λ1f(t) + λ2g(t)) = λ1I(f(t)) + λ2I(g(t))

(ii)

E[I(f(t))] = E

b

a

f(t)dBt = 0

(iii) This property is called ”Itˆo’s isometry”:

E[I(f(t))]2

= E

b

a

f(t)dBt

2

=

b

a

E[f(t)]2

dt

Proof. (i) In Mao(2007, p.20), Allen(2007, p.70) and Mikosch(1998, p.107) the proof

leaves to the reader. However, the current thesis includes this proof as below:

I(λ1f(t) + λ2g(t)) =

b

a

(λ1f(t) + λ2g(t))dBt

by def. 2.4.2

=

n−1

j=0

(λ1fj + λ2gj)(Btj+1

− Btj

)

=

n−1

j=0

λ1fj(Btj+1

− Btj

) +

n−1

j=0

λ2gj(Btj+1

− Btj

)

= λ1

n−1

j=0

fj(Btj+1

− Btj

) + λ2

n−1

j=0

gj(Btj+1

− Btj

)

= λ1

b

a

f(t)dBt + λ2

b

a

g(t)dBt = λ1I(f(t)) + λ2I(g(t))

23](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-26-2048.jpg)

![(ii) By the definition 2.4.2:

E[I(f(t))] = E

b

a

f(t)dBt = E

n−1

i=0

fi(Bti+1

− Bti

)

=

n−1

i=0

E fi(Bti+1

− Bti

)

*

=

n−1

i=0

E[fi]E[Bti+1

− Bti

]

by def. 2.2.1

= 0.

explanetion of (*):

As we know, the variation Bti+1

− Bti

of Brownian motion is independent of Fti

.

Also, due to the fact that the random variable fi is Fti

− measurable, we conclude

that fi and Bti+1

− Bti

are independent.

(iii) According to some references, this proof is presented without detailed explanation.

Therefore this thesis provides a detailed step by step proof in order to have better

understanding and supervision of the methods that are used. Let assume a step

function f(t) of the form (2.3). Therefore, by the definition 2.4.2, this function has

the following stochastic integral:

I(f(t)) =

n−1

j=0

fj(Btj+1

− Btj

)

Then, it is able to be calculated the expectation of the square of the above quantity.

Indeed, by separating the diagonal and non-diagonal terms of the sum we get:

| I(f(t)) |2

=

n−1

j=0

f2

j (Btj+1

− Btj

)2

+ 2

k<j

fj(Btj+1

− Btj

)fk(Btk+1

− Btk

)

The variation of the Brownian motion (Btj+1

− Btj

) is independent of anything that

happened before of the time tj. Since the random variable fj is Ftj

measurable, the

random variables (Btj+1

− Btj

) and fj are independent. In addition, any function of

these variables have the same condition. Hence:

n−1

j=0

E[f2

j (Btj+1

− Btj

)2

] =

n−1

j=0

E[f2

j ]E[(Btj+1

− Btj

)2

] =

n−1

j=0

E[f2

j ](tj+1 − tj)

24](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-27-2048.jpg)

![since E[(Btj+1

− Btj

)2

] = (tj+1 − tj) (similar case and steps as the example 2.2.11).

Moreover, the random variables tk, Bt+1 −Btk

, tj, Bj+1 −Btj

are mutually indepen-

dent since j < k. Therefore:

E[fj(Btj+1

− Btj

)fk(Btk+1

− Btk

)] = 0

since E[Btj+1

− Btj

] = 0 by the conditions of the Brownian motion. By applying

the above steps it follows that:

E[I(f(t))]2

=

n−1

j=0

E[f2

j ](tj+1 − tj)

Afterwords, we proceed to the following step:

| f(t) |2

=

n−1

j=0

f2

j 1[tj,tj+1)(t) +

k<j

fkfj1[tj,tj+1)(t)1[tk,tk+1)(t) =

n−1

j=0

f2

j 1[tj,tj+1)(t)

since 1[tj,tj+1)(t)1[tk,tk+1)(t) = 0 for k < j. Then, following the previous steps we

have that:

E

b

a

| f(t) |2

dt

(2.3)

= E

b

a

|

n−1

j=0

fj1[tj,tj+1) |2

dt

=

n−1

j=0

E[f2

j ]

b

a

1[tj,tj+1)dt

=

n−1

j=0

E[f2

j ](tj+1 − tj).

Consequently the Itˆo Isometry is proved (Mao, 2007, p.19), (Øksendal, 2003, p.29).

Example 2.4.4. Let assume {Bt : t 0} to be a standard Brownian motion i.e.B0 = 0.

Calculate the expectation and the standard deviation of

∞

0

e−t

dBt.

Firstly, we are going to find the expectation.

E[

∞

0

e−t

dBt] = E[Itˆo] = 0.

25](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-28-2048.jpg)

![We know for the variance that:

V ar[X] = E[X2

] − E[X]2

.

Since E[Itˆo] = 0 then:

V ar[

∞

0

e−t

dBt] = E[(

∞

0

e−t

bBt)2

]

= E[(

∞

0

e−t

dBt)(

∞

0

e−t

dBt)]

(Itˆo’s isometry)

= E[

∞

0

e−2t

dt] =

1

−2e2t

∞

0

=

1

2

Finally the standard deviation is equals to 1√

2

.

Subsequently, it will be defined now a more general class of stochastic processes (not

necessarily only for step functions) for which we will be able to define the Itˆo’s stochastic

integral.

Definition 2.4.5. A stochastic process f(t) belongs to the set M2

([a, b]) if it is adapted

to the filtration Fs = σ(Bs, s t) and also it satisfies the condition:

E

b

a

| f(t) |2

dt < ∞

The stochastic processes that belongs to M2

([a, b]) can be approached by step functions

as this conclusion is demonstrated by the theorem below:

Theorem 2.4.6. For any f ∈ M2

([a, b]), there is a step function sequence fstep,n(t), such

that:

lim

n→∞

E

b

a

| f(t) − fstep,n(t) |2

dt = 0

i.e. the stochastic process f is the limit of fstep,n(t).

Proof. In this proof we follow the three steps according to Mao(2007, p.20) but with more

detailed assumptions. Before starting it is considered necessary to have a short reference

to the three steps of this proof and the main idea of using them. This reference will be

helpful for the reader to understand better the syllogism of this proof and to be adapted

26](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-29-2048.jpg)

![to its particularities.

The first step shows that any stochastic process which belongs to M2

([a, b]) can be

approached by a sequence of bounded processes in M2

([a, b]). The second step refers to

the fact that any bounded stochastic process in M2

([a, b]) can be approached by a sequence

which consists of bounded and continuous processes in M2

([a, b]). Consequently,

any stochastic process in M2

([a, b]) can be approached by a sequence of bounded and

continuous processes in M2

([a, b]). Finally, the third step demonstrates that any bounded

and continuous processes in M2

([a, b]) can be approached by a step function sequence.

The composition of these three steps concludes that any stochastic process which belongs

to M2

([a, b]) can be approached by a step function sequence. Then, we are ready to cite

the three steps analytically.

1st

step: Let the stochastic process f(t) ∈ M2

([a, b]). We define a sequence of stochastic

processes which is: φn(t) = [−n ∨ f(t)] ∧ n. The sequence φn(t) is bounded by f(t)

and so it belongs to M2

([a, b]) for every n. Furthermore,

f(t) = lim

n→∞

φn(t),

and by the dominated convergence theorem [see A.1] it follows:

E

b

a

lim

n→∞

| f(t) − φn(t) |2

dt = 0

2nd

step: Assume φ(t) ∈ M2

([a, b]) to be bounded and we are going to create a sequence ψn(t)

as follows: ∀n there is a continuous function ρn : R → R+

such that ρn(t) = 0 for

0 t 1

n

and

∞

−∞

ρn(t)dt = 1. Therefore, it feasible that:

ψn(t) =

b

a

ρn(s − t)φ(s)dt. (2.4)

It is remarkable the fact that ψn(t) is a sequence of stochastic processes because φ(s)

is a stochastic sequence too. The integral (2.4) is a Riemann-Stieltjes integral and by

its properties and the fact that ψ(t) is bounded we conclude that the sequence ψn(t) is

27](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-30-2048.jpg)

![consisted by continuous functions and ψ(t) is a bounded sequence. Since ψ(t) ∈ M2

([a, b])

and from the bounded convergence theorem [see A.2] it follows:

E

b

a

lim

n→∞

| f(t) − φn(t) |2

dt = 0

3rd

step: Finally, if ψ(t) ∈ M2

([a, b]) is bounded and continuous we can create the step

function sequence fstep,n as below:

fstep,n(t) = ψ(a)1[a,a+b−a

a

](t) +

n−1

i=1

ψ a + i

b − a

a

1(a+i b−a

a

,a+(i+1)b−a

a

](t)

The above sequence is bounded. By applying again the bounded convergence theorem

[see A.2] it concludes that:

lim

n→∞

E

b

a

| ψ(t) − fstep,n(t) |2

dt = 0

By the above three steps and the use of the triangle inequality we have the final result:

lim

n→∞

E

b

a

| f(t) − fstep,n(t) |2

dt = 0.

Example 2.4.7. Let’s wonder which will be the choice of the partition tj. One example

of such a choice is given below. Assume the initial interval [0, T]. One possible choice of a

partition that belongs to this interval would be: 0 = tn

0 < tn

1 < tn

2 < . . . < tn

j < . . . < tn

n =

T, where j = 0, . . . , n and tn

j = jT

n

. By using this partition it would be possible to choose

a sequence of step functions as the possible approach of the stochastic process f(t, ω) to

the interval [0, T]. This sequence would be:

fstep,n(t) =

n−1

j=0

f(tj, ω)1[tj,tj+1)(t).

If the stochastic process f(t, ω) is continuous with respect to the variable t, it follows that:

lim

n→∞

E

b

a

| f(t) − fstep,n(t) |2

dt = 0.

Namely, the sequence of step functions fstep,n approaches the stochastic process f. For

instance, let f(t, ω) = B2

t . An approximation of the stochastic process f is:

fstep,n(t) =

n−1

j=0

B2

jT

n

1[jT

n

,

(j+1)T

n

)

(t).

28](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-31-2048.jpg)

![2.4.2 C’s stochastic integral

As we have seen, any stochastic process f ∈ M2

([a, b]) can be approached by a sequence of

step functions fstep,n. Moreover, due to the fact that the stochastic integral is also defined

with respect to a stochastic step function, we are ready to define the Itˆo’s stochastic

integral as below:

Definition 2.4.8. Let f ∈ M2

([a, b]). The Itˆo’s integral of stochastic process f with

respect to Brownian motion is defined by the following limit:

I(f(t)) =

b

a

f(t)dBt := lim

n→∞

I(fstep,n(t)) = lim

n→∞

b

a

fstep,n(t)dBt

where

lim

n→∞

E |

b

a

f(t) − fstep,n(t)dBt |2

= 0.

As we can see, the I(f(t)) =

b

a

f(t)dBt is a random variable and it is the L2

limit of

the sequence of random variables I(fstep,n(t)) = limn→∞

b

a

fstep,n(t)dBt. i.e.

lim

n→∞

E | I(f(t)) − I(fstep,n(t)) |2

= 0.

The existence of the above definition is ensured by the convergence of I(fstep,n(t)) =

b

a

fstep,n(t)dBt in L2

(Ω, F, P). Hence, we conclude to the following theorem:

Theorem 2.4.9. Let f ∈ M2

([a, b]) and fstep,n(t) a step function sequence which ap-

proaches the process f(t). Therefore, the sequence of stochastic integrals I(fstep,n(t)) =

b

a

fstep,n(t)dBt goes to a square integrable random variable.i.e. tends to L2

(Ω, F, P).

Proof. Because of the completeness of L2

, it is enough to show that the sequence sn :=

I(fstep,n(t)) is a Cauchy sequence in L2

. i.e. sn − sm L2 → 0 for n, m → ∞. Indeed:

29](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-32-2048.jpg)

![sn − sm L2 := E | sn − sm |2

1

2

= E |

b

a

fstep,n(t)dBt −

b

a

fstep,m(t)dBt |2

1

2

(Theorm 2.4.3, (i))

= E |

b

a

fstep,n(t) − fstep,m(t)(t)dBt |2

1

2

(Itˆo’s isometry)

= E

b

a

| fstep,n(t) − fstep,m(t) |2

dt

1

2

= E

b

a

| fstep,n(t) − f(t) + f(t) − fstep,m(t) |2

dt

1

2

= fstep,n(t) − f(t) + f(t) − fstep,m(t) M2

fstep,n(t) − f(t) M2 + f(t) − fstep,m(t) M2 → 0 for n, m → ∞

because fstep,n(t) → f(t). For that reason, the limit of I(fstep,n(t)) exists in L2

(Ω, F, P)

and it is called I(f(t)). That is followed because of the completeness of L2

(Ω, F, P).

Hence, through the definition of the stochastic integral I(f(t)) we achieve to overcome

the main issue of the infinite variation of Brownian motion. We exploit the result that its

quadratic variation is bounded.

Corollary 2.4.10. ∀ f, g ∈ M2

([0, T]) applied that:

E[I(f(t))I(g(t))] = E

b

a

f(t)dBt ·

b

a

g(t)dBt = E

b

a

f(t)g(t)dt

Proof. We use the following formula:

ab =

1

4

(| a + b |)2

− | a − b |)2

(2.5)

where a = I(f) and b = I(g). By taking expectations and substituting a and b to (2.5) it

follows:

E[I(f)I(g)] =

1

4

(E[| I(f)+I(g) |2

]−E[| I(f)−I(g) |2

]) =

1

4

(E[| I(f+g) |2

]−E[| I(f−g) |2

])

(2.6)

30](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-33-2048.jpg)

![where it has been used the linearity of Itˆo’s stochastic integral. However from Itˆo’s

isometry,

E | I(f + g) |2

= E

T

0

| f + g |2

dt

E | I(f − g) |2

= E

T

0

| f − g |2

dt .

Thus,

E[I(f(t))I(g(t))] =

1

4

E

T

0

| f + g |2

dt − E

T

0

| f − g |2

dt

=

1

4

E

T

0

| f + g |2

− | f − g |2

dt

=

1

4

E

T

0

4fgdt = E

T

0

fgdt

The above proof is presented in different versions by Karatzas and Shreve(1991, p.180)

and Mao(2007, p.27).

An example to show the way which a stochastic integral is solved by its definition is now

given. This particular example is solved by Øksendal(2003, p.29) who uses the hypothesis

B0 = 0. However, in this thesis will be provided a more analytical proof without the

above assumption.

Example 2.4.11. According to the definition of Itˆo’s stochastic integral prove that:

I(Bt) =

T

0

BtdBt =

1

2

B2

T −

T

2

.

The integrable stochastic process is f(t, ω) = Bt. We choose the partition 0 = tn

0 < tn

1 <

tn

2 < . . . < tn

j < . . . < tn

n = T, where j = 0, . . . , n and tn

j = jT

n

and its approximation will

be:

fstep,n(t) =

n

j=0

Btn

j

1[tn

j ,tn

j+1)(t).

Therefore, we take the following sequence of random variables:

I(fstep,n) =

n−1

j=0

Btn

j

(Btn

j+1

− Btn

j

).

31](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-34-2048.jpg)

![Its limit will be the stochastic integral that we want to find. Subsequently, we use the

following formula:

a(b − a) =

1

2

(b2

− a2

) −

1

2

(b − a)2

substituting a = Btn

j

, b = Btn

j+1

. Then, it follows:

Btn

j

(Btn

j+1

− Btn

j

) =

1

2

(B2

tn

j+1

− B2

tn

j

) −

1

2

(Btn

j+1

− Btn

j

)2

.

By taking sums from j = 0 to j = n − 1 we have that:

I(fstep,n) =

1

2

n−1

j=0

(B2

tn

j+1

− B2

tn

j

) −

1

2

n−1

j=0

(Btn

j+1

− Btn

j

)2

=

1

2

n−1

j=0

(Btn

j+1

− Btn

j

)(Btn

j+1

+ Btn

j

) −

1

2

n−1

j=0

(Btn

j+1

− Btn

j

)2

=

1

2

(Btn

n

− Btn

0

)(Btn

n

+ Btn

0

) −

1

2

n−1

j=0

(Btn

j+1

− Btn

j

)2

=

1

2

B2

T −

1

2

n−1

j=0

(Btn

j+1

− Btn

j

)2

.

It is therefore sufficient to estimate the L2

limit of random variable n−1

j=0 (Btn

j+1

− Btn

j

)2

.

Suppose that this limit would be 1

2

T. Indeed,

E |

1

2

n−1

j=0

(Btn

j+1

− Btn

j

)2

−

1

2

T |2

=

= E

1

4

n−1

j=0

(Btn

j+1

− Btn

j

)4

+

1

2 k<j

(Btn

j+1

− Btn

j

)2

(Btn

k+1

− Btn

k

)2

−

T

2

n−1

j=0

(Btn

j+1

− Btn

j

)2

+

T2

4

=

1

4

n−1

j=0

E[(Btn

j+1

− Btn

j

)4

] +

1

2 k<j

E[(Btn

j+1

− Btn

j

)2

]E[(Btn

k+1

− Btn

k

)2

] −

T

2

n−1

j=0

E[(Btn

j+1

− Btn

j

)2

] +

T2

4

=

n3T2

4n2

+

T2

4

−

T2

4n

−

nT2

2n

+

T2

4

=

T2

2n

→ 0.

since n → ∞. Therefore,

T

0

BtdBt =

1

2

B2

T −

T

2

.

32](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-35-2048.jpg)

![The above example indicates that the Itˆo’s stochastic integral has different proper-

ties in comparison with the Riemann-Stieltjes integral which is studied in Real Calculus

Analysis. This conclusion seems by:

T

0

BtdBt =

1

2

B2

T −

T

2

unexpected term

The undersigned term is an unexpected term for Riemann-Stieltjes integration. The ap-

pearance of this term is a result of the properties and definition of Itˆo’s stochastic integral

and to the fact that the integration is carried out on the Brownian motion. Specifi-

cally, the non-bounded variation of the Brownian motion does not allow the definition of

the Riemann-Stieltjes integral to be applied on it. Consequently, the definition of Itˆo’s

stochastic integral is imposed by this particularity of Brownian motion as it was seen in

the above example. Obviously, the above method that was used to define a stochastic

integral is complicated. As a result, in the next subsection is going to show an other

method that makes the definition of the stochastic integral much more easier.

According to the properties of stochastic integral we are able to mention the following

theorem for a stochastic process It.

Theorem 2.4.12. Let assume M2

([0, T]) be a set where any stochastic process, which

belongs to it, must satisfy the condition:

E

T

0

| f(t) |2

dt < ∞

and it has to be adapted to the filtration Fs = σ(Bs, s t). Suppose to have the stochastic

process f ∈ M2

([0, T]), 0 t Tand:

It =

t

0

f(s)dBs.

The following properties hold:

(i) The stochastic process It is a square-integrable continuous martingale.

(ii) The quadratic variation of It is given by:

< I >t=

t

0

| f(s) |2

ds

33](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-36-2048.jpg)

![Proof. (i) In order to show that the stochastic process It is a square-integrable contin-

uous martingale we have to proof:

(1) E[| It |] < ∞

(2) E[It | Fs] = Is

(3) E[supt∈[0,T] | It |2

] < ∞

For the point (1) we have that:

E[| It |] = E[|

t

0

f(s)dBs |]

(Mean V alue Property)

[E[|

t

0

f(s)dBs |]2

]

1

2

(Itˆo’s Isometry)

= [E[

t

0

| f(s) |2

ds]]

1

2 < ∞.

since f ∈ M2

([0, T]) and 0 t T.

For the point (2) we can initially notice from the definition of stochastic integral

that It is adapted to Ft. Furthermore:

E[It | Fs] = E[Is +

t

s

f(u)dBu | Fs]

= E[Is | Fs] + E[

t

s

f(u)dBu | Fs]

= Is

since the variation It − Is =

t

s

f(u)dBu is independent of the filtration Fs.

For the point (3) we know that for all t ∈ [0, T] it follows:

E[| It |2

] = E[|

t

0

f(s)dBs |2

] = E[

t

0

| f(s) |2

ds] < ∞.

Moreover, because [0, T] is a close interval we have that E[supt∈[0,T] | It |2

] < ∞.

Therefore, the stochastic process It is a square-integrable martingale regarding the

filtration Ft.

(ii) In order to proof the second property it is sufficient to show that Mt = I2

t − < I >t

34](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-37-2048.jpg)

![is a continuous martingale which becomes zero on t = 0. Indeed:

E[Mt | Fs] = E[I2

t −

t

0

| f(u) |2

du | Fs]

= E[(Is +

t

s

f(u)dBu)2

−

s

0

| f(u) |2

du −

t

s

| f(u) |2

du | Fs]

= I2

s + 2IsE[

t

s

f(u)dBu | Fs] + E[|

t

s

f(u)dBu |2

| Fs]

−

s

0

| f(u) |2

du − E[

s

0

| f(u) |2

du | Fs]

(Itˆo’s Isometry)

= I2

s + 2IsE[

t

s

f(u)dBu | Fs] −

s

0

| f(u) |2

du

= I2

s + E[Itˆo]

=0

−

s

0

| f(u) |2

du = Ms

Therefore, Mt is a martingale and by the uniqueness of the quadratic variation we

conclude to the desired result.

2.5 The Itˆo’s Lemma

As we saw in the previous subsection, the calculation of Itˆo’s stochastic integral can be

fulfilled by its definition. However, this method is extremely complicated and is used

mainly in particular cases. Therefore, it was necessary to be found some other method

which can make easier the calculation of this specific type of integrals. This method is

known as the Itˆo’s Lemma.

Lemma 2.5.1. The Itˆo Lemma. Assume the function f(x, t) which is twice continu-

ously differentiable. Hence:

df(B(t), t) =

∂f(B(t), t)

∂B(t)

dB(t) +

∂f(B(t), t)

∂t

dt +

1

2

∂2

f(B(t), t)

∂2B(t)

dt. (2.7)

Proof. It is recall that (dB(t))2

= dt, dtdB(t) = dB(t)dt = 0, (dt)2

= 0 and:

dB(t) = B(t + h) − B(t). (2.8)

35](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-38-2048.jpg)

![Furthermore, let that t → t + h and B(t) → B(t + h). According to the formal Taylor

expansion we have that:

f [B(t + h), t + h]

(2.8)

= f [dB(t) + B(t), t + h]

= f(B(t), t) +

∂f(B(t), t)

∂B(t)

dB(t) +

∂f(B(t), t)

∂t

dt +

1

2

∂2

f(B(t), t)

∂2B(t)

(dB(t))2

+

1

2

∂2

f(B(t), t)

∂2t

(dt)2

0

= f(B(t), t) +

∂f(B(t), t)

∂B(t)

dB(t) +

∂f(B(t), t)

∂t

dt +

1

2

∂2

f(B(t), t)

∂2B(t)

dt.

Hence, it follows that:

df(B(t), t)

(2.8)

= f(B(t + h), t + h) − f(B(t), t)

= f(B(t), t) +

∂f(B(t), t)

∂B(t)

dB(t) +

∂f(B(t), t)

∂t

dt +

1

2

∂2

f(B(t), t)

∂2B(t)

dt − f(B(t), t)

=

∂f(B(t), t)

∂B(t)

dB(t) +

∂f(B(t), t)

∂t

dt +

1

2

∂2

f(B(t), t)

∂2B(t)

dt.

Thus, the Lemma it is proved.

An example is given below in order to illustrate the application of the Itˆo’s lemma.

Example 2.5.2. Let {B(t) : t 0} be a Brownian motion. Find E[B(t)2

].

Assume that f(x, t) = x2

. Then X(t) = f(B(t), t) and by Itˆo’s lemma we have that:

dX(t) = df(B(t), t)

=

∂f(B(t), t)

∂B(t)

dB(t) +

∂f(B(t), t)

∂t

+

1

2

∂2

f(B(t), t)

∂2B(t)

dt.

Therefore, we have to estimate the partial derivatives as below:

∂f(x, t)

∂x

= 2x,

∂f(x, t)

∂t

= 0,

∂2

f(x, t)

∂2x

= 2.

36](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-39-2048.jpg)

![Then, we substitute:

∂f(B(t), t)

∂B(t)

= 2B(t),

∂f(x, t)

∂t

= 0,

∂2

f(B(t), t)

∂2B(t)

= 2

and from (2.7) it follows that:

dB2

(t) = 2B(t)dB(t) + [0 +

1

2

2]dt

= 2B(t)dB(t) + dt

(integrate both sides) B2

(t) − B2

(0)

=0

=

t

0

2B(s)dB(s) +

t

0

1ds

B2

(t) =

t

0

2B(s)dB(s) +

t

0

1ds

B2

(t) =

t

0

2B(s)dB(s) + t.

It is noticeable that the integral is an Itˆo’s integral. Then, we take expectations on both

sides as follows:

E[B2

(t)] = E[

t

0

2B(s)dB(s)] + t

= E[Itˆo]

(theorem2.4.3,prop.(ii))

+t

= 0 + t = t.

3 Stochastic Differential Equations

This chapter includes an introduction to the theory of stochastic differential equations and

their solutions. The Stochastic differential equations arise in various scientific disciplines

of science and technology. They arise whenever the relationship between continuously

fluctuating quantities and the rate of change over time and space is known. Or other-

wise, when such a relationship can be assumed in order to model and describe natural

37](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-40-2048.jpg)

![Therefore:

dXt

dt

= (µ + σ

•

Bt)Xt ⇔

dXt = µXtdt + σXtdBt (3.2)

and it is obvious that:

dXt

Xt

= µdt + σdBt ⇒

t

0

dXt

Xt

=

t

0

µdt + σdBt = µt + σBt (3.3)

Then, we apply the Itˆo’s Lemma in the stochastic process Zt = ln(Xt) in order to find a

solution for the above stochastic differential equation. Firstly, it is assumed f(x, t) = lnx.

Thus:

∂f(x, t)

∂x

=

1

x

∂f(x, t)

∂t

= 0

∂2

f(x, t)

∂2x

= −

1

x2

by substituting:

∂f(Xt, t)

∂Xt

=

1

Xt

∂f(Xt, t)

∂t

= 0

∂2

f(Xt, t)

∂2Xt

= −

1

X2

t

and from the Itˆo’s formula (2.7) we have that:

d(lnXt) =

1

Xt

dXt +

1

2

[0 −

1

X2

t

]dt

=

1

Xt

dXt −

1

2

1

X2

t

dt

=

1

Xt

dXt −

1

2

1

X2

t

(dX(t))2

(from 3.2)

=

1

Xt

dXt −

1

2

1

X2

t

σ2

X2

t dt

=

dXt

Xt

−

1

2

σ2

dt

40](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-43-2048.jpg)

![by integrating:

Zt = lnXt =

t

0

dXt

Xt

−

t

0

1

2

σ2

dt ⇒

t

0

dXt

Xt

= lnXt +

1

2

σ2

t

Subsequently, we substitute the above result into (3.3) and concludes:

Xt = X0e(µ−1

2

σ2

)t+σBt

The terms of 1

2

σ2

and σBt are due to the stochasticity. The stochastic process Xt is called

geometric Brownian motion and is used as a model for stock prices in the field of finance.

For that reason, it is customary for the stochastic process Xt to be denoted as St.

Corollary 3.2.2. From the above result it is clear that log(Xt

X0

) follows normal distribution

with expectation:

E log(

Xt

X0

) = E µ −

1

2

σ2

t + σ E [Bt]

=0

= µ −

1

2

σ2

t

and variance:

V ar log(

Xt

X0

) = V ar µ −

1

2

σ2

t

=0

+σ2

V ar [Bt] = σ2

t

Specifically, the logarithm of the stock price ratio is modelled as a normal random

variable. Furthermore, that model is based on the observation that the return of a stock

(i.e. the quantity dXt

Xt

) is equal to a constant µ and a variance of the form V ar(σBt) =

σ2

dBt, where Bt is a Brownian motion and σ governs the width of those fluctuations.

41](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-44-2048.jpg)

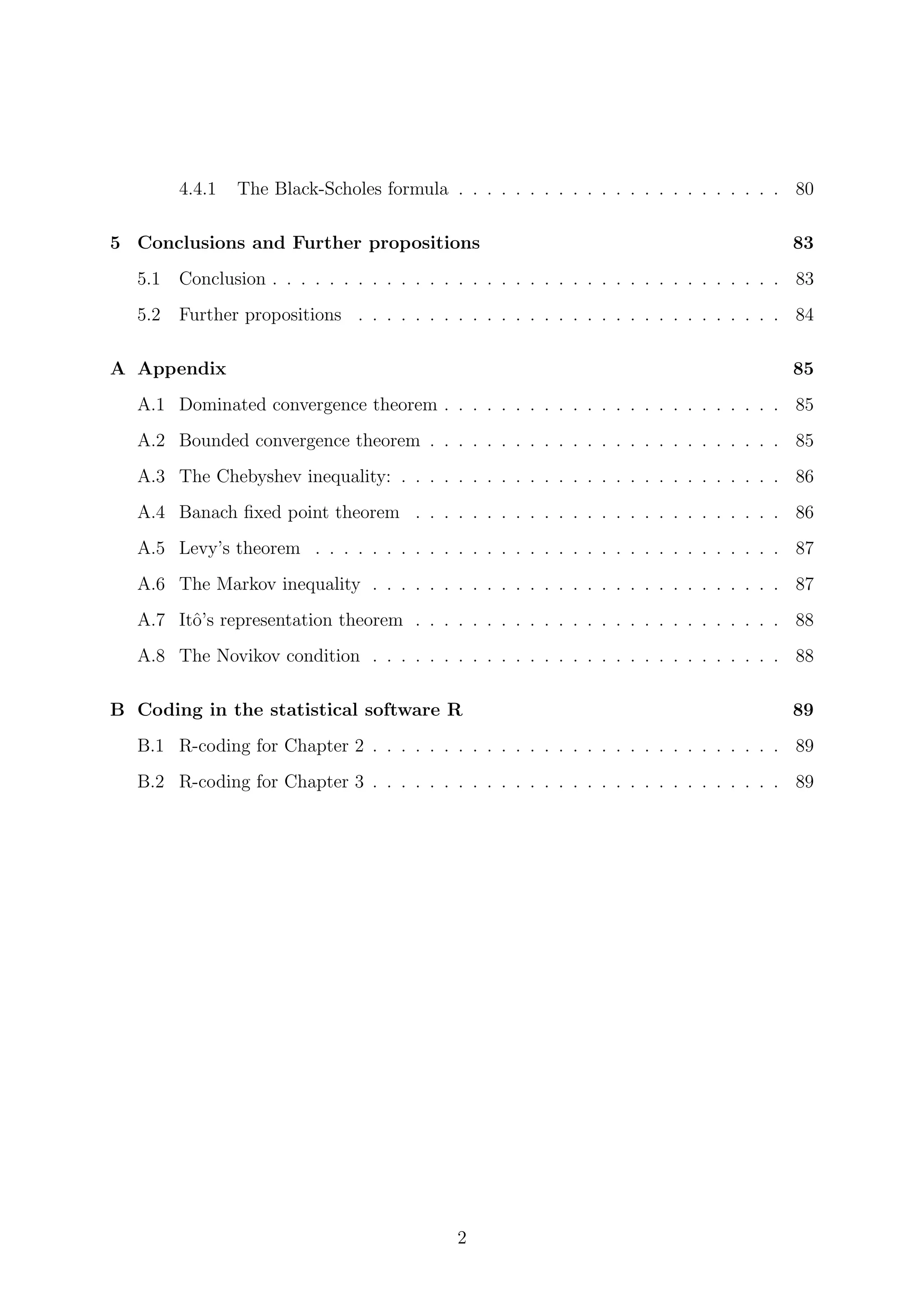

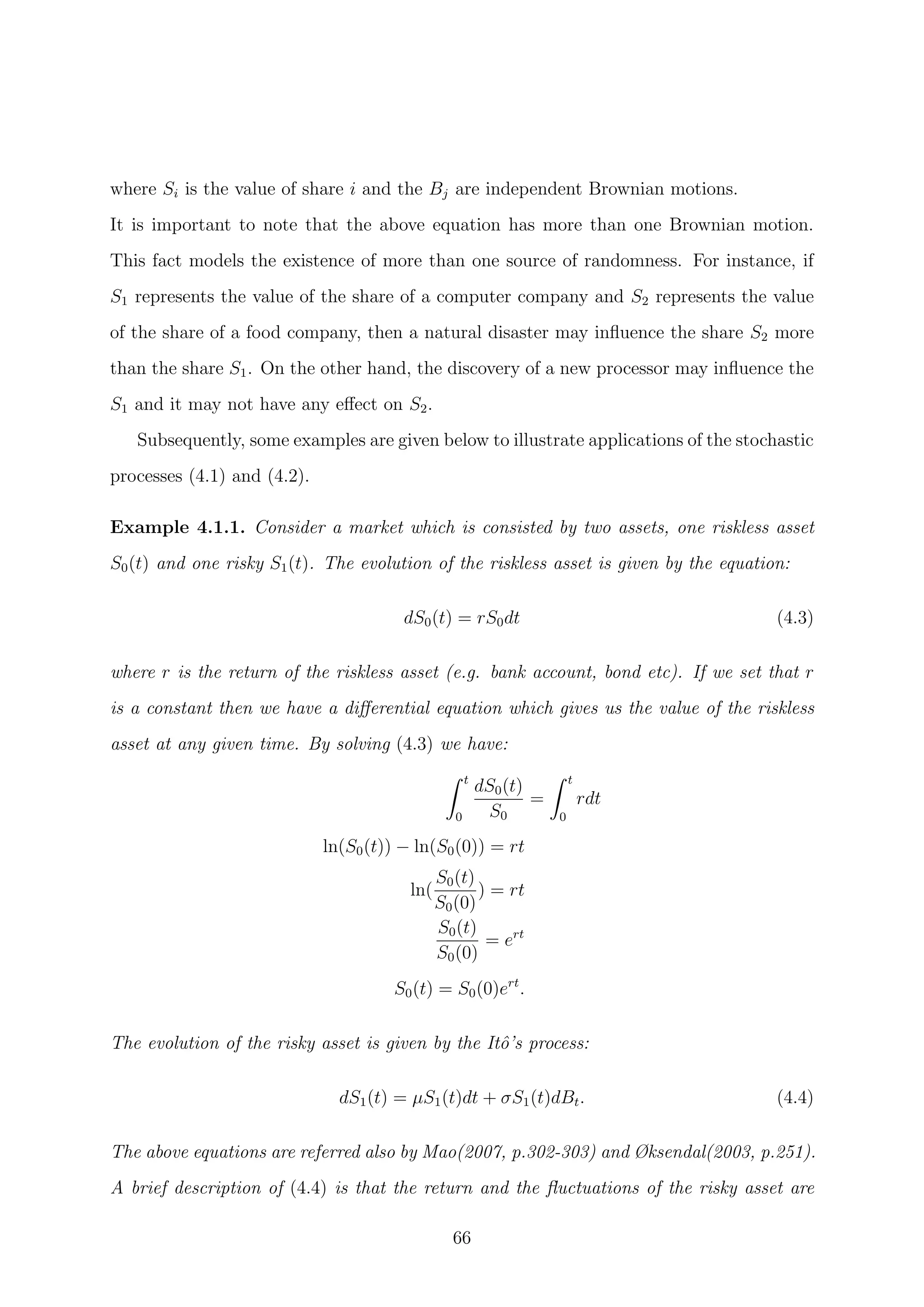

![Figure 3: Sample path of geometric Brownian motion [see code B.2.1].

Example 3.2.3. The Ornstein-Uhlenbeck process. Consider the stochastic differ-

ential equation:

dXt = −αXtdt + σdBt

with initial condition X0 = x. The solution of the above SDE (i.e a stochastic process)

is called the Ornstein-Uhlenbeck process and is used to many applications in Physics and

Finance. By applying Itˆo’s lemma to f(x, t) = xeαt

and with σ ∈ R we get:

df(x, t) = eαt

dXt + αxeαt

dt

because:

∂f(x, t)

∂x

= eαt

,

∂2

f(x, t)

∂2x

= 0,

∂f(x, t)

∂t

= xαeαt

.

Then,

df(Xt, t) = eαt

(−αXtdt + σdBt) + αXteαt

dt = eαt

σdBt.

By integrating on both sides:

f(Xt, t) − f(X0, 0) = σ

t

0

eαt

dBt ⇒

42](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-45-2048.jpg)

![eαt

Xt − x = σ

t

0

eαt

dBt,

where f(x0, 0) = X0 = x. Hence, we conclude:

Xt = xe−αt

+ e−αt

σ

t

0

eαt

dBt.

Corollary 3.2.4. By using the properties of the stochastic integral it is feasible to define

the mean value and the variance of Ornstein-Uhlenbeck process. herefore for the mean

value:

E[Xt] = E[xe−αt

+ e−αt

σ

t

0

eαt

dBt]

= E[xe−αt

] + E[e−αt

σ

t

0

eαt

dBt]

= E[xe−αt

] + e−αt

σE[

t

0

eαt

dBt]

= E[xe−αt

] + E[Itˆo]

=0

= xe−αt

and the variance:

V ar[Xt] = E[Xt − E[Xt]]2

.

But,

Xt − E[Xt] = xe−αt

+ e−αt

σ

t

0

eαt

dBt − xe−αt

= e−αt

σ

t

0

eαt

dBt.

Hence:

V ar[Xt] = E[e−αt

σ

t

0

eαt

dBt]2

= e−2αt

σ2

E[

t

0

eαt

dBt]2

= e−2αt

σ2

t

0

E[eαt

]2

dt

= e−2αt

σ2

t

0

e2αt

dt = e−2αt

σ2 1

2α

(e2αt

− 1) =

σ2

2α

(1 − e−2αt

)

This stochastic differential equation can be used as a model for interest rates. If we assume

the interest rate r as a function of time, then it is possible to have a stochastic process rt

43](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-46-2048.jpg)

![since the interest rates are not constant and simultaneously random over time. According

to Chan, Karolyi, Longstaff, Sanders(1992, p. 1211) the model of Vasicek which is a

stochastic differential equation of the form:

dXt = (α + βXt)dt + σdBt

is a generalization of the stochastic process of Ornstein - Uhlenbeck. Its solution can be

found by the same method that we used above for the equation of Ornstein - Uhlenbeck.

Figure 4: Sample path of Ornstein - Uhlenbeck process. Left: X0 = 5, α = 2, σ = 1.

Right: X0 = 5, α = −2, σ = −1 [see code B.2.2].

Example 3.2.5. Brownian Bridge. A Brownian Bridge is a continuous -time stochas-

tic process which is obtained by considering a standard Brownian motion process in a closed

time interval e.g. in [0, 1] as we can see on figure 5. Specifically, it has initial condition

X0 = 0 with terminal condition X1 = 0. Hence, it follows graphically a shaped bridge

which justifies the naming of the process.

Now, it is given below another differential equation which is often recommended in

probability theory:

dXt = −

Xt

1 − t

dt + dBt (3.4)

The solution of the above SDE is called Brownian Bridge. To solve it we apply the Itˆo’s

Lemma in the function f(x, t) = g(t)x where g(t) is a C1

function (i.e. its derivative

44](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-47-2048.jpg)

![Corollary 3.2.6. By using again the properties of stochastic integration we can define

the mean value and the variance of Brownian bridge. Indeed:

E[Xt] = E (1 − t)

t

0

dBt

1 − t

= (1 − t)E

t

0

dBt

1 − t

= (1 − t)E[Itˆo] = 0

and therefore V ar[Xt] = E[X2

t ]. So:

E[X2

t ] = (1 − t)2

E

t

0

dBt

1 − t

2

= (1 − t)2

E

t

0

dBt

1 − t

t

0

dBt

1 − t

(Itˆo’s Isometry)

= (1 − t)2

E

t

0

1

(1 − t)2

dt = (1 − t)2 1

1 − t

t

0

= t − t2

Corollary 3.2.7. From the above mean value and variance of Xt, it holds that Xt

Pr

→ 0

as t → 1.

Proof. Xt is said to converge in probability to 0 if ∀ > 0,

lim

t→1

P(| Xt − 0 |> ) = 0.

Indeed:

P[(Xt − 0) > ] = P[(Xt − E[Xt]) > ]

By Chebyshev’s inequality [see A.3]:

V ar[Xt]

2

=

t − t2

2

=

t(1 − t)

2

→ 0

since t → 1.

Therefore we have the desideratum.

The Brownian bridge has been used on Finance mathematics for the modelling of zero

- coupon bonds. Moreover, according to Horne, Garton, Krone and Lewis(2007, p.2354)

Brownian bridge can be used as a method to estimate movement paths (e.g. animal’s

movements) using discrete location data in short time intervals.

46](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-49-2048.jpg)

![Figure 5: Sample path of Brownian Bridge [see code B.2.3].

3.3 Strong and Weak Solutions

We will now define the concept of uniqueness for solutions of stochastic differential equa-

tions.

Definition 3.3.1. The solution of stochastic differential equation (3.1) is said to be

strongly unique if given two stochastic processes Xt and Xt which satisfy the equation

(3.1) and it holds that:

P(X0 = X0) = 1 ⇒ P(Xt = Xt, ∀t 0) = 1.

Under certain circumstances it is possible to show that the stochastic differential

equations have unique strong solutions. Such conditions are the Lipschitz conditions

on the coefficients of the equation.

Theorem 3.3.2. Consider the stochastic differential equation (3.1) with coefficients σ

and b. These two functions are bounded and satisfy the following conditions:

Lipschitz condition:

| b(t, x) − b(t, y) | + | σ(t, x) − σ(t, y) | K | x − y | , ∀t, x, y

Linear growth condition:

| b(t, x) |2

+ | σ(t, x) |2

(1+ | x |2

), ∀t, x.

47](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-50-2048.jpg)

![Therefore the stochastic differential equation has a strong solution. This solution is

also unique.

The proof of this theorem is based on using the Banach fixed point theorem [see A.4].

For the sake of simplicity, the proof is investigated for stochastic differential equations in

the case of m = n = 1. Finally, it is important to be said that there are several variations

of this proof such as in Øksendal(2003, p.66), Allen(2007, p.91) and Mao(2007, p.51).

Proof. As we mentioned before, we will utilize the Banach fixed point theorem in order to

show the existence of a strong unique solution of an SDE. Initially, we define the following

iterative formula:

X

(i+1)

t = X0 +

t

0

b(t, X

(i)

t )dt +

t

0

σ(t, X

(i)

t )dBt.

If there is a stochastic process for which the relation X

(i+1)

t = X

(i)

t is satisfied (∀i), then

this particular process is the solution of the stochastic differential equation.

Let assume a function space M2

who is consisted by the stochastic processes Xt such

that, E[

T

0

| Xt |2

dt] < ∞. In addition, we suppose that this space is equipped with the

norm · λ who is defined below:

Xt

2

λ = E

T

0

e−λt

| Xt |2

dt .

Hence, this space is a complete space with norm, i.e. is a Banach space. Therefore, we

can define the operator Y : M2

→ M2

according to the relation:

YXt = X0 +

t

0

b(t, Xt)dt +

t

0

σ(t, Xt)dBt.

A point χ = Xt of space M2

which satisfies the equality Yχ = χ (or equivalently

Xt = YXt) is called the fixed point of the operator Y. In our case, this point is a stochastic

process Xt and will be the solution of the stochastic differential equation. Thus, in order

to prove that the equation can be solved, it is sufficient to use the fixed point theorem

which determines the existence contraction operator (Jost, 2005, p.46). In our case, there

is a contraction operator Y if for any χ1, χ2 ∈ M2

it applies:

Yχ1 − Yχ2 θ χ1 − χ2

48](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-51-2048.jpg)

![Proposition 3.3.4. A strong solution of a stochastic differential equation is also a weak

solution but the inverse is not valid. The concept of uniqueness can be generalized also in

non-strong solutions.

An example is now given in order to illustrate a possible form of a weak solution of

stochastic differential equation. This example is referred without solution in Mao(2007,

p.78). In Karatzas and Shreve(1991, p.301) and Berestycki(2010, p.75) give solutions of

this problem but a more detailed version of them is given below.

Example 3.3.5. Let assume a weak solution of a stochastic differential equation. Suppose

to have the below stochastic differential equation (which is known as Tanaka’s equation):

dXt = sign(Xt)dBt (3.6)

. where:

sign(Xt) =

+1, if Xt 0

−1, if Xt < 0.

And let’s say that Xt is an any Brownian motion

∼

Bt and Ft is a filtration for which

∼

Bt

is a Brownian motion. Suppose Bt to be the Itˆo’s stochastic integral:

Bt:=

t

0

sign(

∼

Bt)d

∼

Bt . (3.7)

Since Xt :=

∼

Bt, we can write (3.3) in the following differential form:

d Bt= sign(Xt)dXt ⇒ dXt = sign(Xt)d Bt .

Consequently, Xt =

∼

Bt will be a weak solution of the stochastic differential equation (3.6)

if the stochastic process Bt is a Brownian motion (in response to the filtration Ft). This

can be shown by applying the Levy’s Theorem [see A.5] and the properties of the Itˆo’s

stochastic integral. Indeed, Bt is adapted to the filtration Ft in accordance to its definition.

Moreover, from theorem 2.3.12 it is obvious that Bt is also a martingale because it can be

expressed as an Itˆo’s stochastic integral. Regarding the application of Levy’s theorem it is

51](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-54-2048.jpg)

![sufficient to proof that the stochastic process Zt :=B2

t −t is also a martingale. We have

that:

E[Zt | Fs] = E[B2

t −t | Fs] = E

t

0

sign(

∼

Bt)

∼

dBt

2

− t | Fs

= E

s

0

sign(

∼

Bt)

∼

dBt +

t

s

sign(

∼

Bt)

∼

dBt

2

− t | Fs

=

s

0

sign(

∼

Bt)

∼

dBt

2

+ E

t

0

sign(

∼

Bt)

∼

dBt

2

| Fs

+ 2

s

0

sign(

∼

Bt)

∼

dBt

2

E

t

s

sign(

∼

Bt)

∼

dBt | Fs − t

=

s

0

sign(

∼

Bt)

∼

dBt

2

+ (t − s) − 0 − t

=B2

s −s = Zs

For that reason, Zt is also a martingale. Consequently, in accordance with Levy’s Theorem

Bt is a Brownian motion.

3.4 Numerical methods of SDEs

One might hope that analytical methods exist for all stochastic differential equations and

which give their solutions. However, this can not be the case as most stochastic differential

equations do not have an analytical solution. Therefore, the most appropriate methods

for the solution of stochastic differential equations are numerical methods. In the current

subsection will focus on two of these methods, Euler and Milstein approximations.

Consider the scalar stochastic differential equation of the form:

dXt = b(t, Xt)dt + σ(t, Xt)dBt (3.8)

in the time interval [τ0, T] with initial condition Xτ0 = X0. The term b(t, Xt) is called

the displacement coefficient which is the deterministic part of the stochastic differential

equation and characterizes the local trend. The term σ(t, Xt) is called the diffusion

coefficient which influences the average size of the fluctuations of X. In addition, those

fluctuations are originated by the Brownian motion Bt.

52](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-55-2048.jpg)

![3.4.1 The Euler-Maruyama method

The simplest stochastic numerical approximation (Schaffter, 2010, p.4) and the most

commonly used method is the approximation of Euler-Maruyama (or similarly method of

Euler) and it is named after Leonhard Euler and Gisiro Maruyama.

For a given partition:

τ0 = t0 < t1 < t2 < . . . < tj < . . . < tn = T

of the time interval [τ0, T], the Euler approximation is a stochastic process of continuous

time Y = {Yt, τ0 t T} which satisfies the iterative formula:

Yi+1 = Yi + b(ti, Yi)(ti+1 − ti) + σ(ti, Yi)(Bti+1

− Bti

) (3.9)

for i = 0, 1, 2, ..., n − 1, Yi = Yti

and initial value Y0 = X0.

It will be denoted:

∆ti = ti+1 − ti

to be the i-th increment and we will call:

δ = max

i

∆ti

to be the greatest of them. Usually, it will be considered a uniform partition (i.e. equidis-

tant points in time):

ti = τ0 + iδ,

where δ = ∆ti ≡ ∆t = (T−t0)

n

(for a large enough number n ∈ Z such that δ ∈ (0, 1)).

The key question is how can we define the random increments:

∆Bi = Bi+1 − Bi

for i = 0, 1, ..., n−1. According to the example (2.2.11) we have that Bt −Bs ∼ N(0, t−s)

where t > s. Consequently, it holds:

Bt − Bs =

√

t − sZs,t

53](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-56-2048.jpg)

![where Zs,t ∼ N(0, 1). By applying this solution in each subinterval [ti, ti+1] we have that:

Yi+1 = Yi + b(ti, Yi)(ti+1 − ti) + σ(ti, Yi) ∆tiZi

where Zi ∼ N(0, 1) are independent random variables, since the increments of the Brow-

nian motion in non-overlapping intervals are independent.

Definition 3.4.1. By the above notations, the Euler approximation can be written simpler

as below:

Yi+1 = Yi + b(ti, Yi)∆ti + σ(ti, Yi)∆Bi (3.10)

for i = 0, 1, ..., n − 1.

The successful implementation of the Euler method on a statistical software is based

on the recurring structure of the equation, which calculates approximate values of Itˆo

process only at discrete points in time. The term ”form” will be used to describe a recur-

ring algorithm which gives us the values of the discrete-time approximation to the given

moments. Recall that although the values at discrete time points are more interesting to

us, we will consider an approximation of a discrete time as a continuous time stochastic

process defined in the entire interval [τ0, T]. Moreover, each discrete-time approximation

corresponds to a specific ”form” which describes, as it is said above, a recurring algorithm.

Remark 3.4.2. Consider Xt be a geometric Brownian motion and b(t, X) = bX and

σ(t, X) = σX. Then the Euler’s form becomes:

Xt+∆t = Xt + bXt∆t + σXt(Bt+∆t − Bt)

whilst the exact solution is:

Xt+∆t = Xte((b−1

2

σ2

)∆t+σ(Bt+∆t−Bt)).

We know that if b ∈ R, which | b | is sufficiently small, then 1 + b ≈ eb

is a good

54](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-57-2048.jpg)

![approximation. Consequently, if ∆t is sufficiently small, then:

Xt + bXt∆t + σXt(Bt+∆t − Bt) = Xt[1 + b∆t + σ(Bt+∆t − Bt)]

≈ Xte(b∆t+σ(Bt+∆t−Bt)

= Xt+∆te( 1

2

σ2∆t)

and with small ∆t we have 1

2

σ2

∆t ≈ 0.

Afterwards, it is going to be defined the convergence of the method. Before doing this,

it is necessary to be defined the criterion of absolute error as below:

ε = E[| XT − YT |]. (3.11)

Specifically, it is the mean of the absolute value of the difference between the Itˆo’s stochas-

tic process and the approximation in a finite terminal moment T. Usually, we will use

the notation Y δ

, where δ is a given maximum step size in (0, δ0) (δ0 is a finite positive

number), to show the dependence of the approximation Y on this size.

Definition 3.4.3. A general discrete-time approximation Y δ

, with a maximum step δ,

converges strongly with order γ > 0 to a stochastic process X on the time moment T, if

there exists a positive constant C such that:

εstrong(δ) = E(| XT − Y δ

T |) Cδγ

for each δ ∈ (0, δ0 > 0). (3.12)

The above definition has been provided in many variations in the literature, but the

inequality (3.12) is a physical generalization of the deterministic case.

(Schaffter, 2010, p.6), (Higham, 2001, p.534), (Mikosch, 1998, p.161)

Definition 3.4.4. On the other hand, a method has a weak order of convergence with

oerder γ > 0 if there exists a positive constant C such that for all smooth functions f, in

some class, it follows:

εweak(δ) =| Ef(XT ) − Ef(Y δ

T ) | Cδγ

for each δ ∈ (0, δ0 > 0). (3.13)

55](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-58-2048.jpg)

![Remark 3.4.5. According to the literature if the conditions of theorem 3.3.2 are satisfied

(i.e. the coefficients b and σ satisfy the Lipschitz condition and the linear growth con-

dition), then the Euler’s form converges and it has strong order of convergence γ = 1

2

.

Specifically,

εstrong(δ) = E(| XT − Y δ

T |) Cδ

1

2 for each δ ∈ (0, δ0 > 0)

and strong order of convergence γ = 1. Specifically,

εweak(δ) =| Ef(XT ) − Ef(Y δ

T ) | Cδ1

for each δ ∈ (0, δ0 > 0).

(Onskog, 2007, p.76), (Higham, 2001, p.537), (Shores, 2006, p.77).

Corollary 3.4.6. As it is mentioned, the Euler’s method converges strongly with order

γ = 1

2

. Then, by the Markov’s inequality [see A.6] we have that:

P E(| Xtn − Y δ

n |) ∆t

1

4

1

∆t

1

4

E(| Xtn − Y δ

n |) C∆t

1

4

or equivalently

P E(| Xtn − Y δ

n |< ∆t

1

4 ) 1 − C∆t

1

4 ,

i.e. the error is small with great probability along any path.

Remark 3.4.7. A strong convergence is a pathwise approximation of X and provide

measurements of the rate at which mean of the error decomposes as C∆γ

is sufficiently

small (3.12). On the other hand, a weak convergence measures is the approximation of the

moments of X and the decomposition rate of the error of the means when C∆γ

becomes

very small (3.13).

Now an example is given below in order to illustrate the different aspects of simulation

of an approximation to a discrete-time of an Itˆo’s stochastic process. Moreover through

its detailed solution it can be ascertained if the Euler’s method can be attributed in a

practical way.

56](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-59-2048.jpg)

![Example 3.4.8. Initially, consider the Itˆo’s stochastic process X = {Xt, t 0} (geomet-

ric Brownian motion) which satisfies the linear stochastic differential equation:

dXt = µXtdt + σXtdBt, (3.14)

where t ∈ [0, T] and with initial value X0 ∈ R.

Obviously, µ(t, x) = µx is the displacement coefficient and σ(t, x) = σx is the diffusion

coefficient. By the example 3.2.1 we know that the analytical solution of (3.14) is:

Xt = X0e(µ−1

2

σ2

)t+σBt

(3.15)

for t ∈ [0, T] and the given Brownian motion B = {Bt, t 0}. Due to the fact that we

know the solution analytically, we have the chance to compare the Euler’s approximation

with the exact solution and to estimate the error. In order to simulate a path of an Euler’s

approximation, for a given time partition, we start from the initial condition Y0 = X0 and

we proceed recursively to produce the next term. The Euler’s form is:

Yi+1 = Yi + µYi∆t + σYi∆Bi (3.16)

with i = 0, 1, 2, ... and coefficients µ(t, x) = µx and σ(t, x) = σx as above. ∆Bi is the

increase of Brownian motion in the interval ti t ti+1. We can determine the values

of the exact solution by (3.15) for the same path of Brownian motion. It can be taken:

Xτn = X0e(µ−1

2

σ2

)τn+σBτn

where {τn : n = 1, 2, ...., n1} is a uniform partition of [0, T].

It is noticeable that the statistical softwares can estimate the paths of the Brownian

motion which are used to give the increments Bti+1

−Bti

that are necessary to (3.16). For

simplicity, we choose for the numerical method the step ∆t to be an integer multiple R 1

of the increment δt for Brownian path. Therefore, we are sure that the set of points {τj}

contains the points {tj} which can define the Euler’s approximation. Hence, we conclude

to the following graphs:

57](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-60-2048.jpg)

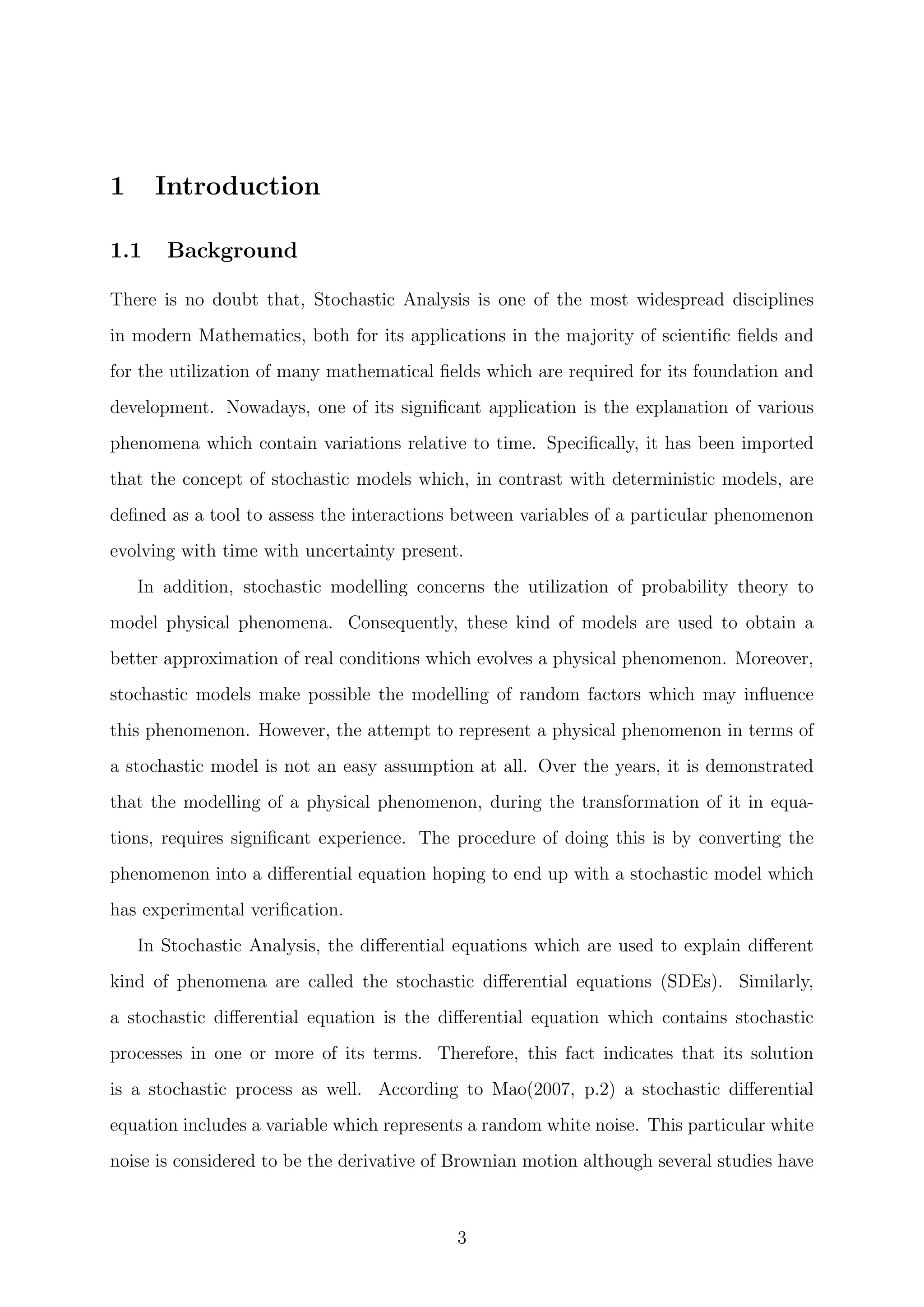

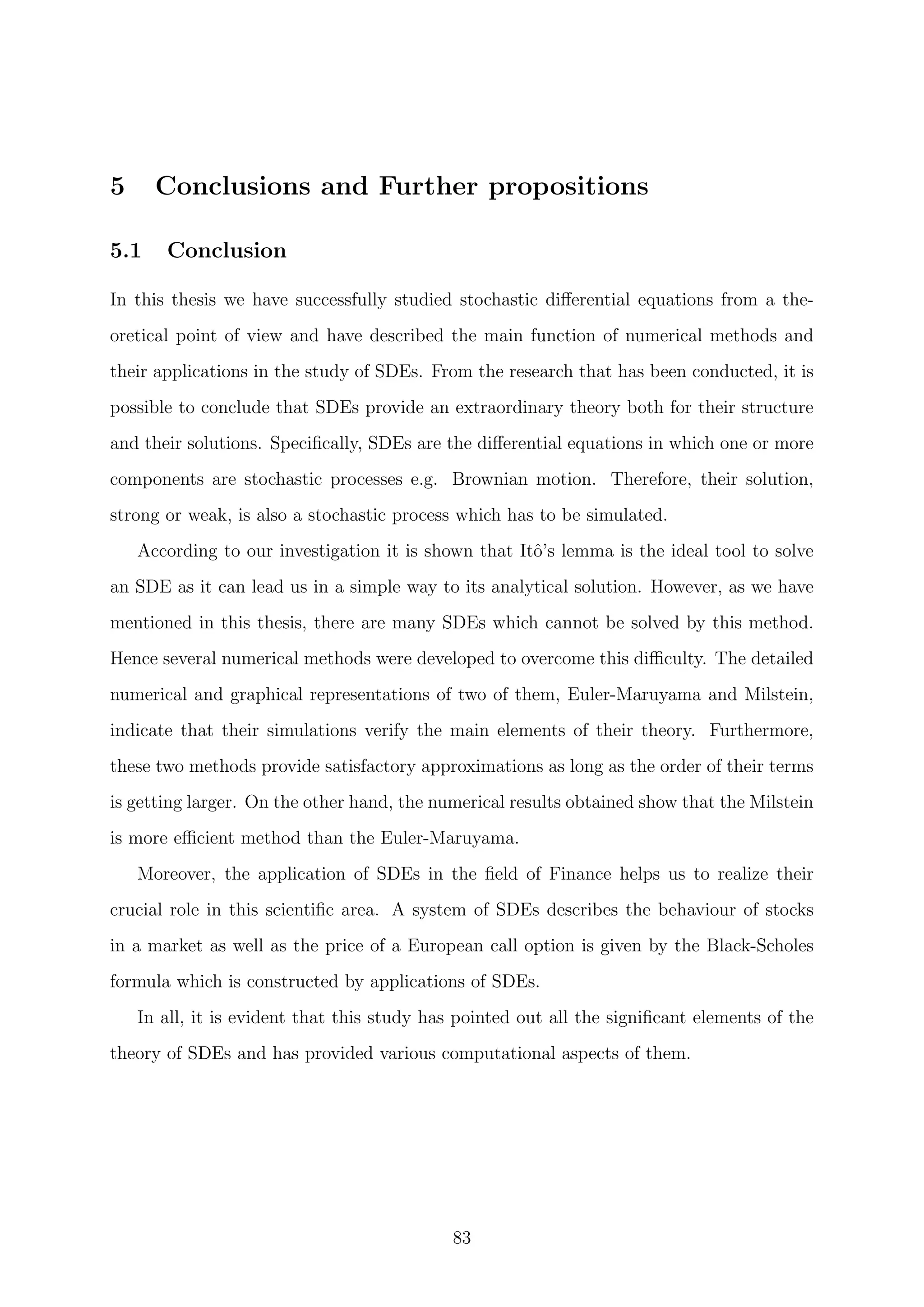

![Figure 6: Euler’s approximation (red) and the exact solution of geometric Brownian

Motion (light blue) with X0 = 1, µ = 0.05 and σ = 0.2 [see code B.2.4 and remark B.2.5].

The figure 6 illustrates the production of an Euler’s approximation with equidistant

points in the time interval [0, 1] for the Itˆo’s stochastic process which satisfies (3.14). The

left up image has δ = 2−2

, the right up has step: δ = 2−4

, the left down has: δ = 2−6

and

the right down: δ = 2−8

. Consequently, it is obvious that the smaller the step, the higher

the approximation to the Itˆo’s stochastic process.

Subsequently, we use the above example 3.4.8 to check the criterion of absolute error with

more accuracy and to proof numerically the conclusions from the figure 6. Recall that we

will deal with the geometric Brownian motion which satisfies (3.14) and has the analytical

solution (3.15).

Hence, we simulate N - paths of Brownian motion to use them to create N approximate

solutions for Y and N exact solutions for X. We denote YT,κ and XT,κ to be the final

value of the κ-th approximate solution and exact solution respectively. From (3.11) the

58](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-61-2048.jpg)

![absolute error can be estimated by the following quantity:

ˆε =

1

N

N

κ=1

| XT,κ − YT,κ | . (3.17)

Therefore, by simulating N = 25 paths of the Itˆo’s process (which satisfies 3.14) we can

estrimate the absolute error ˆε as it is defined by (3.17). The following results are occurred:

δ 2−2

2−4

2−6

2−8

ˆε 0.01267835 0.006312543 0.002848442 0.001257862

Table 1: Absolute errors ˆε for different steps [see code B.2.6 and remark B.2.7].

Finally, by comparing the results of the table 1, it can be observed that the estimation

of the absolute error ˆε decreases when δ becomes increasingly small. Hence it is proved

that our predictions from the above graphs are verified.

3.4.2 The Milstein method

Initially, we are going to describe the Taylor-Itˆo expansion which is the stochastic rep-

resentation of the Taylor expansion in the deterministic case. Generally, the Taylor-Itˆo

expansion is an iterative implementation of the Itˆo’s Lemma.

Consider the following scalar stochastic differential equation:

dXt = b(Xt)dt + σ(Xt)dBt (3.18)

For the sake of simplicity, the functions b and σ do not depend on the variable of time t.

By applying the Itˆo’s Lemma on f(Xt) follows that:

df(Xt) = σ(Xt)

∂f(Xt)

∂x

dBt + b(Xt)

∂f(Xt)

∂t

+

1

2

σ2

(Xt)

∂2

f(Xt)

∂x2

dt. (3.19)

If we define:

K0 ≡ b(Xt)

∂

∂t

+

1

2

σ2

(Xt)

∂2

∂x2

K1 ≡ σ(Xt)

∂

∂x

59](https://image.slidesharecdn.com/b0d13018-fa0c-465f-86c0-5017f068511e-161113225724/75/final_report_template-62-2048.jpg)

![By applying ∆ := t − t0 and ∆Bt := Bt − Bt0 to (3.27), it follows that:

t

t0

s

t0

dBrdBs =

1

2

(∆Bt)2

−

1

2

∆t.

Generally, for the random interval of the form [ti, ti+1] we substitute:

t0 = ti

t = ti+1

∆t := ti+1 − ti

and combining (3.26) and (3.27) we have:

Xti+1

= Xti

+ b(Xti

)∆t + σ(Xti

)∆Bi +

1

2

σ(Xti

)σ (Xti

)((∆Bt)2

− ∆t)+

∼

R

It is obvious that the first three terms of the above recurrent equation:

Yi+1 = Yi + b(Yi)∆t + σ(Yi)∆Bi

represent the Euler-Maruyama method. However, by keeping all the terms of the equation: