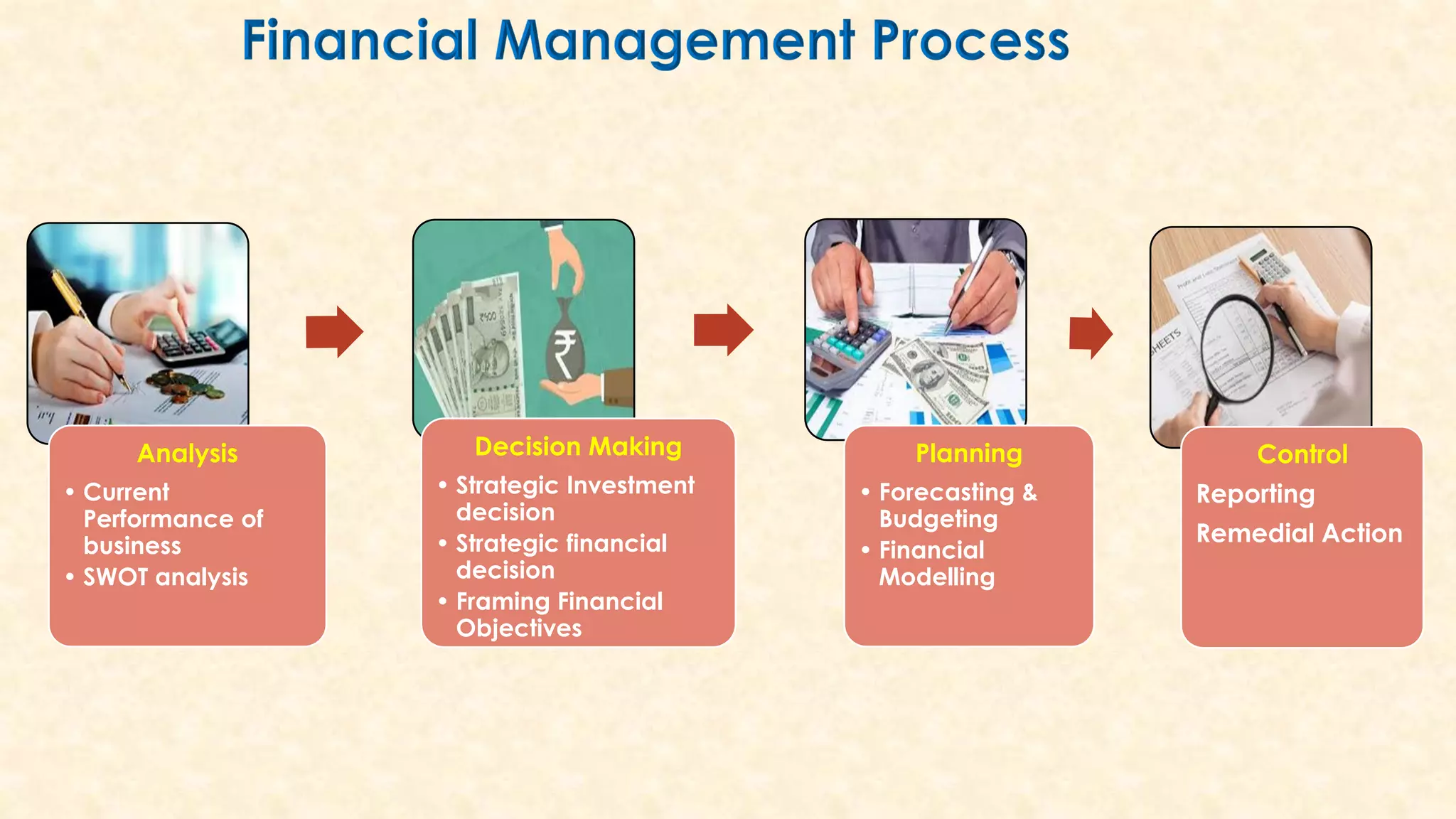

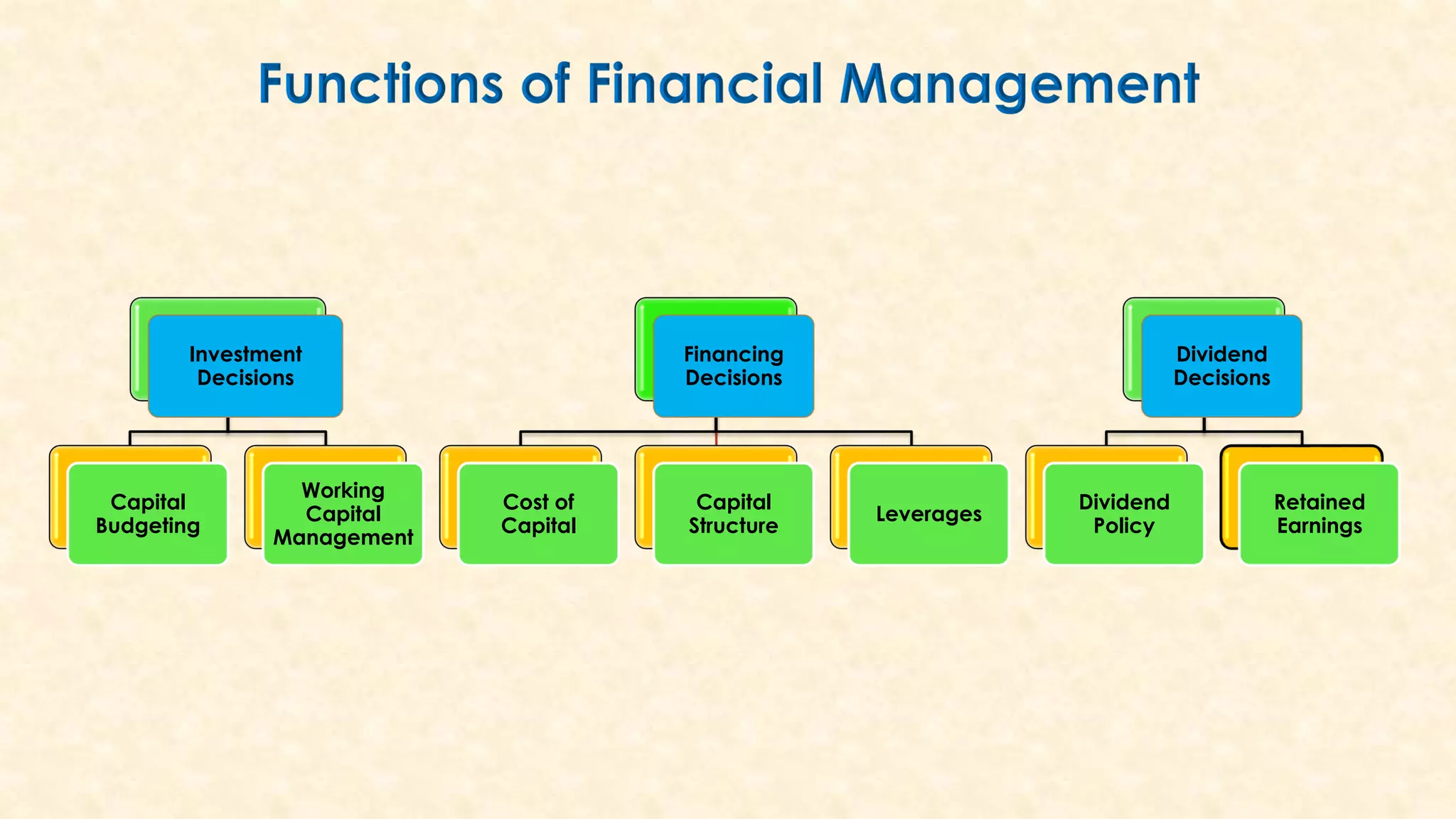

The document discusses the principles and importance of financial management, defining it as the planning and controlling of an organization's financial resources. It highlights the objectives of financial management, including profit maximization and wealth maximization, and outlines various functions such as fund allocation and investment decisions. Additionally, it emphasizes that financial management is crucial for the survival and growth of organizations, offering diverse career opportunities in the field.