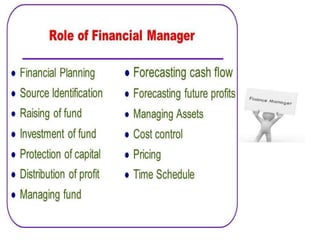

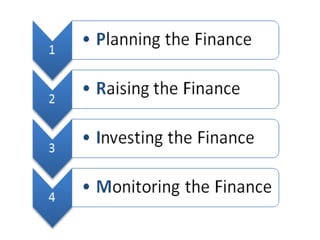

This document provides an overview of finance, including its meaning, features, scope, and the role of a finance manager. Finance is concerned with the management of money and other valuables to maintain and create economic value. The key features include channeling funds, acquiring/allocating/utilizing funds, and maximizing shareholder wealth. The scope of finance includes public, security/investment analysis, institutional, international, and financial management. The aim is to anticipate, acquire, allocate, and utilize funds to increase profitability and maximize firm value. A finance manager acts central to audit/control and strategic alliances like M&As. Their organizational structure typically includes a treasurer for financing/investments and controller for asset management/