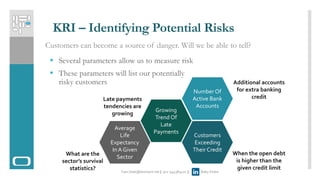

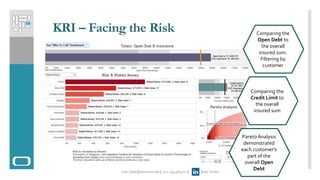

This document introduces key risk indicators (KRI) models for managing customer credit and risks. It discusses how KRIs can be used to measure and visualize risks through business intelligence dashboards. Specific KRIs are identified for credit risk, such as late payments, credit limits exceeded, number of bank accounts, and life expectancy in a given sector. The KRI dashboards would provide an interactive interface to examine individual high-risk customers and make informed decisions about credit management. Customized KRI models and business analytics solutions are offered to help clients optimize performance and decision-making.