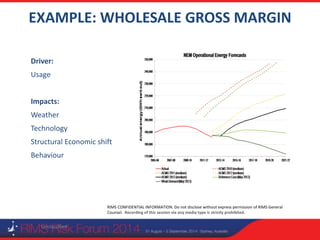

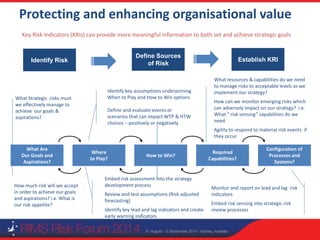

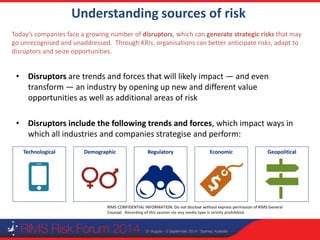

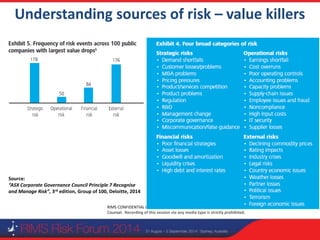

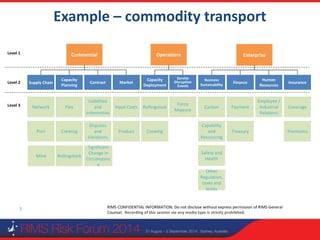

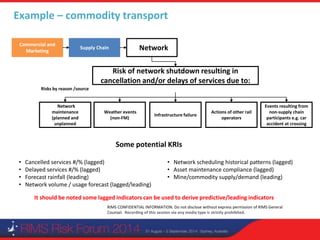

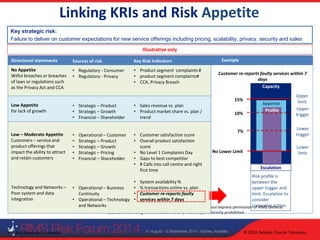

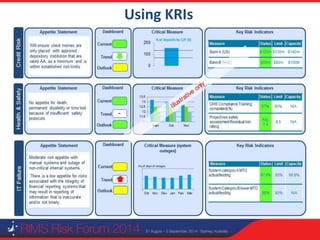

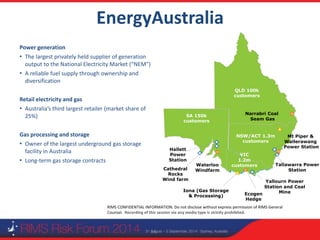

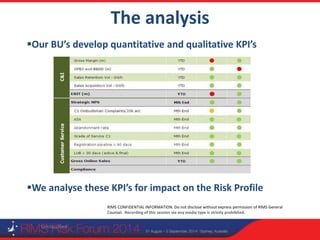

This document contains information about a presentation on key risk indicators (KRIs). It discusses how KRIs can help companies anticipate strategic risks from disruptors and better achieve their goals. Examples of KRIs are provided from the energy industry, including indicators for issues like plant maintenance, customer complaints, and wholesale gross margins. The document emphasizes that KRIs should be used to support decision making and drive actions to manage risks.

![RIMS CONFIDENTIAL INFORMATION. Do not disclose without express permission of RIMS General

Counsel. Recording of this session via any media type is strictly prohibited.

Are we observing a change to the Risk Appetite?

Unclassified

CONSEQUENCE [$]

PROBABILITY

[%]

· Green / Amber within Appetite.

Amber would indicate we are

approaching threshold and action is

required

· Assurance / Control activities

across the business operating

effectively

· Red is outside of Appetite and

immediate action is required

· Assurance / Control activities are

not operating effectively

RISK LOSS DISTRIBUTION APPETITE Line [$]](https://image.slidesharecdn.com/keyriskindicators-conceptsandexamplesdeloitte2014-230224210333-7def182c/85/Key-Risk-Indicators-Concepts-and-Examples-Deloitte-2014-pdf-21-320.jpg)