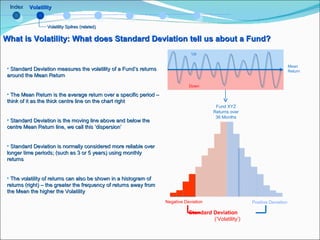

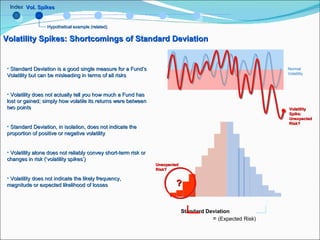

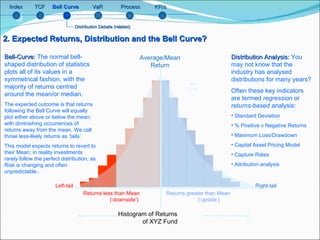

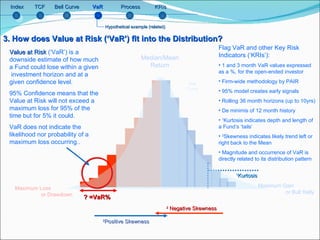

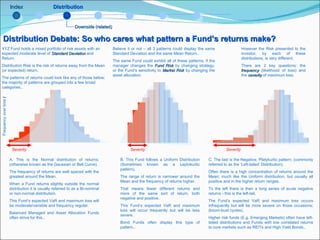

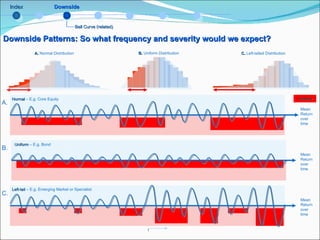

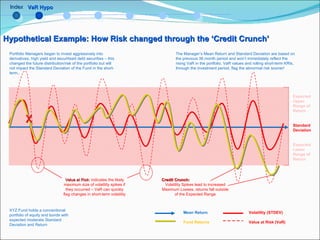

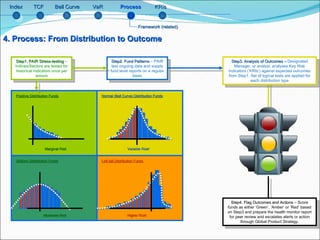

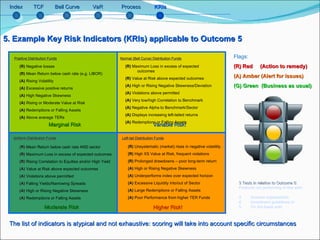

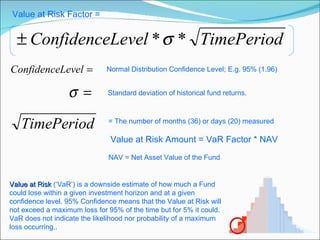

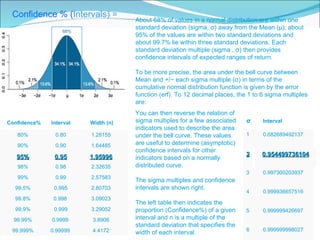

The document discusses using Value at Risk (VaR) as a risk measure to demonstrate Treating Customers Fairly (TCF) outcomes to regulators. It explains how VaR fits into a fund's distribution pattern and can flag unexpected risks like volatility spikes earlier than traditional measures. Key Risk Indicators are presented that can help analyze whether funds are performing as expected based on investor guidelines.