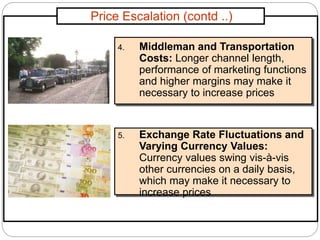

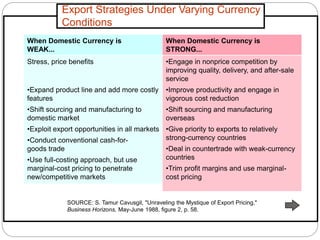

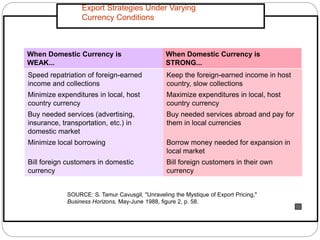

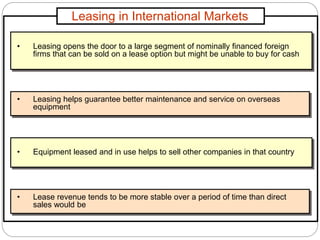

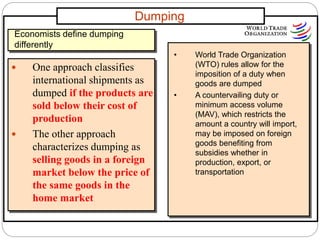

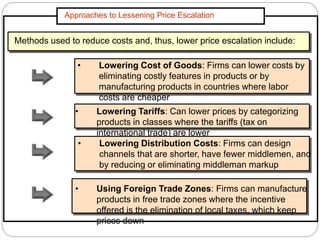

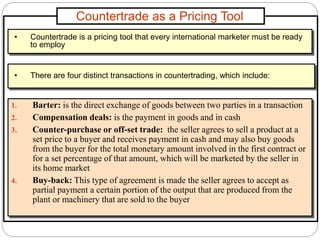

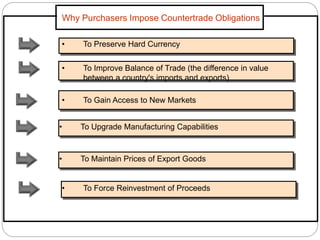

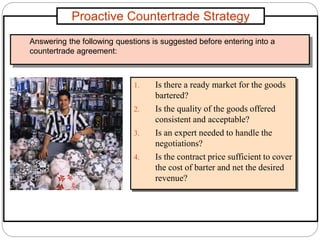

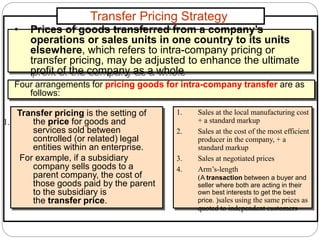

International pricing decisions involve complex issues due to economic, financial, and mathematical implications. Firms must consider objectives like controlling end prices across broad product lines and numerous countries. They also face challenges like parallel imports and price escalation due to exchange rate fluctuations and higher costs. Approaches to international pricing include cost-plus, skimming, and penetration pricing. Firms try to minimize price increases through measures such as lowering production costs, reducing tariffs and distribution costs, and using foreign trade zones or countertrade agreements.