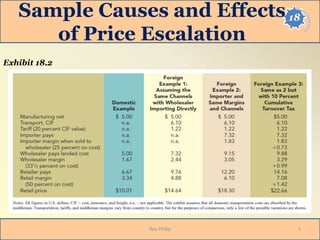

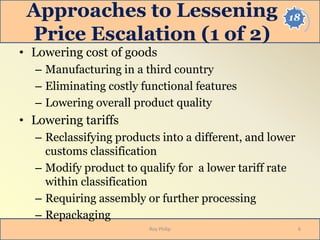

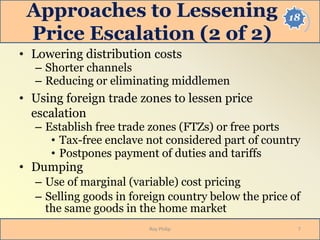

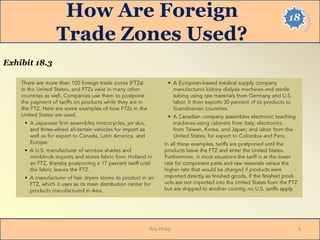

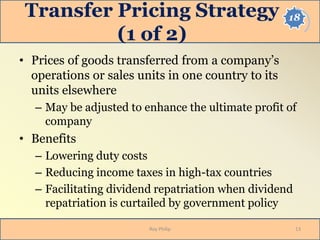

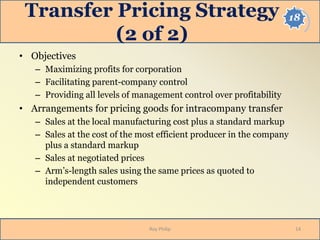

The document addresses various pricing strategies in international marketing, including parallel imports, variable-cost and full-cost pricing, and skimming versus penetration pricing. It discusses methods to lessen price escalation such as lowering distribution costs and utilizing foreign trade zones. Additionally, it covers countertrade as a pricing tool, transfer pricing strategies, and the implications of leasing in international markets.