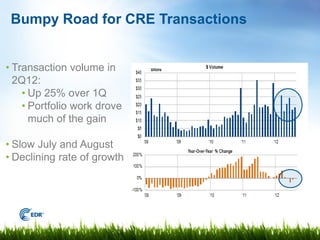

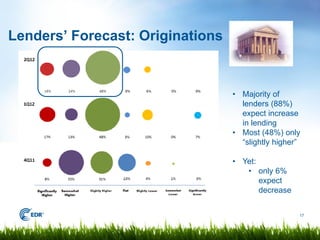

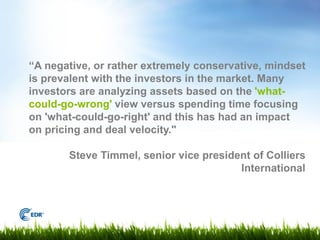

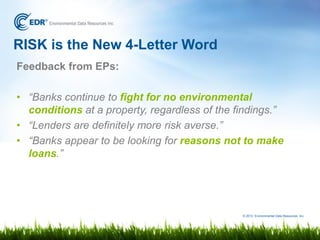

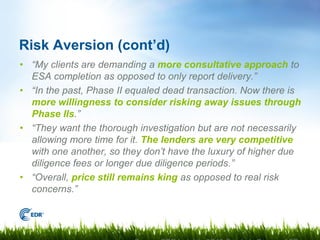

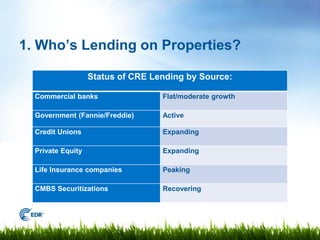

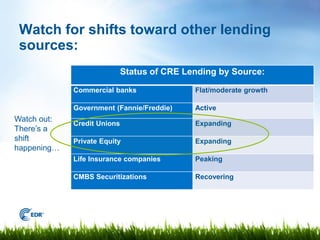

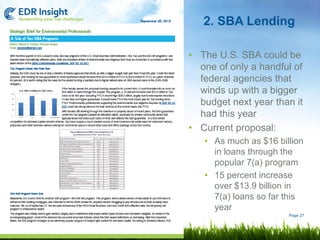

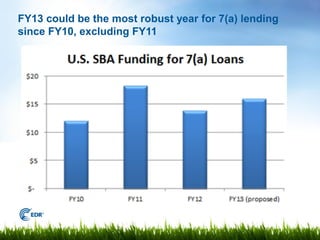

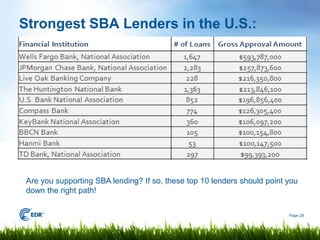

The commercial real estate market is recovering gradually with transaction volume up 25% in the second quarter of 2012 compared to the first quarter. However, lending remains cautious with banks focusing on top-quality assets in major markets. Investors are risk averse and concerned about potential issues that could negatively impact property values. Areas of opportunity include increased lending by government programs, REIT acquisitions, retail expansion, and energy benchmarking requirements. Consultants should focus on client education and differentiating themselves through technology to succeed in this uncertain market.