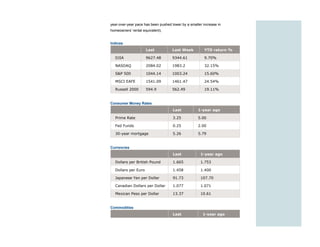

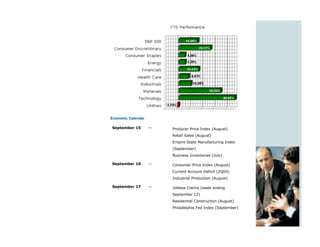

The economic data this week showed signs that the U.S. and global economies have stabilized and possibly bottomed out. Retail sales are expected to rise significantly due to the "Cash for Clunkers" program. Upcoming reports on retail sales, consumer prices, and other economic indicators next week could generate market reactions. Financial markets continued higher despite thin economic data, perhaps waiting for stronger confirmation of recovery.