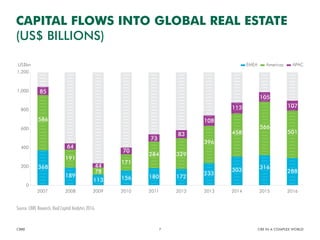

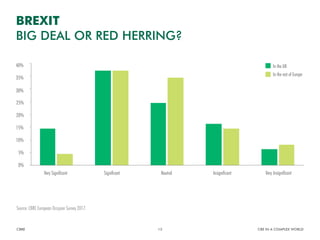

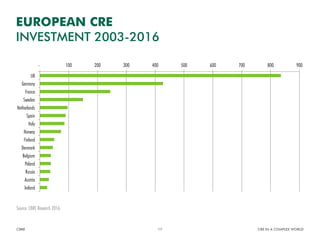

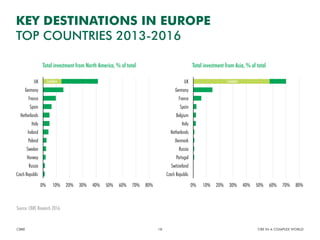

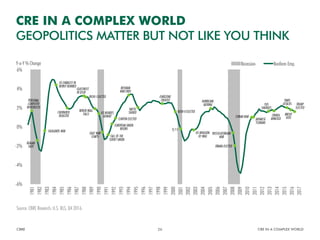

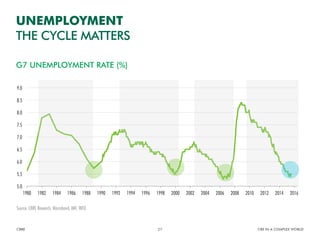

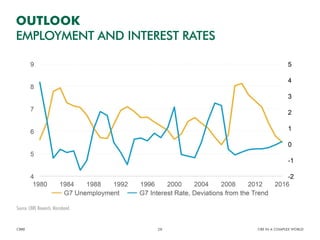

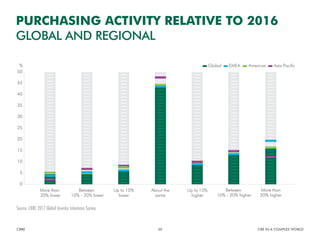

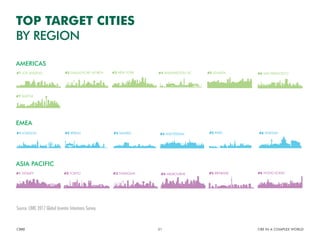

The document discusses the state of commercial real estate markets globally and in various regions. It notes that demand in London began tapering off in 2016 and availability is at a 10-year average. Investment volumes in London were down 19% in 2016. The outlook predicts more stable investment activity globally in 2017 compared to 2016, with London, Berlin, and Sydney among the top target cities. Geopolitical events have impacts but economic cycles are more important long-term drivers of real estate markets.