This document discusses establishing an effective compliance program at commercial lenders. It notes the intense pressure for cost reduction and revenue growth that requires a coordinated compliance risk management system. An effective program has elements like qualified compliance staff, risk testing, documentation, and addressing regulatory changes. Key elements include compliance resources, testing, responsibility, policies, communication, training, technology, issue reporting, and adapting to new laws. The document provides sources for further information on preparing for and passing regulatory exams and compliance program best practices.

![Compliance Program

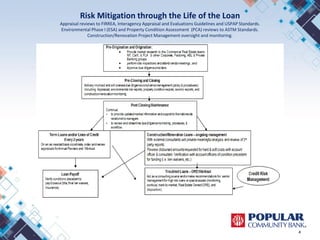

Authority / Responsibility / Structure

6

• Board

• Senior Management

• Director Risk Management

• Corporate Compliance Director

• Regulatory Compliance Manager

1. Oversees compliance CRA, HMDA, & other regulations

• Compliance Officer [The staff (Legal, Audit, other departments)]

is charged with managing compliance risk.

• BSA/AML/OFAC Manager

• Regulatory Risk Testing Manager (RRTM)](https://image.slidesharecdn.com/coveringyourbasesmcdonald-170510201528/85/Covering-Your-Bases-McDonald-6-320.jpg)