This survey collected data from 194 commercial real estate owners and managers regarding investments in secondary and tertiary markets. Key findings include:

- 44% of respondents expect to make additional investments in non-core markets in 2011, seeing them as offering the best development opportunities.

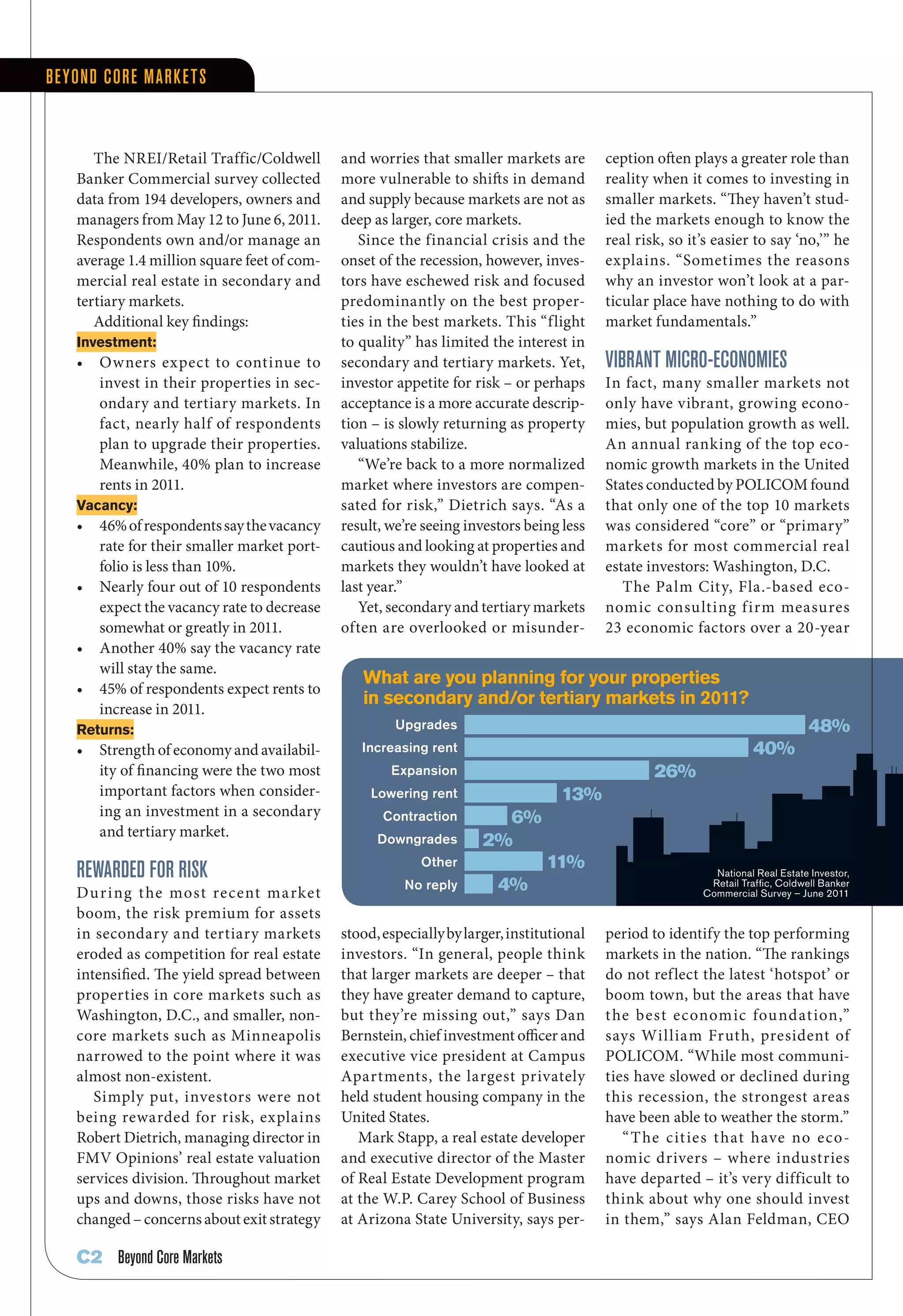

- Nearly half of respondents plan to upgrade existing properties in these markets, while 40% plan to increase rents in 2011.

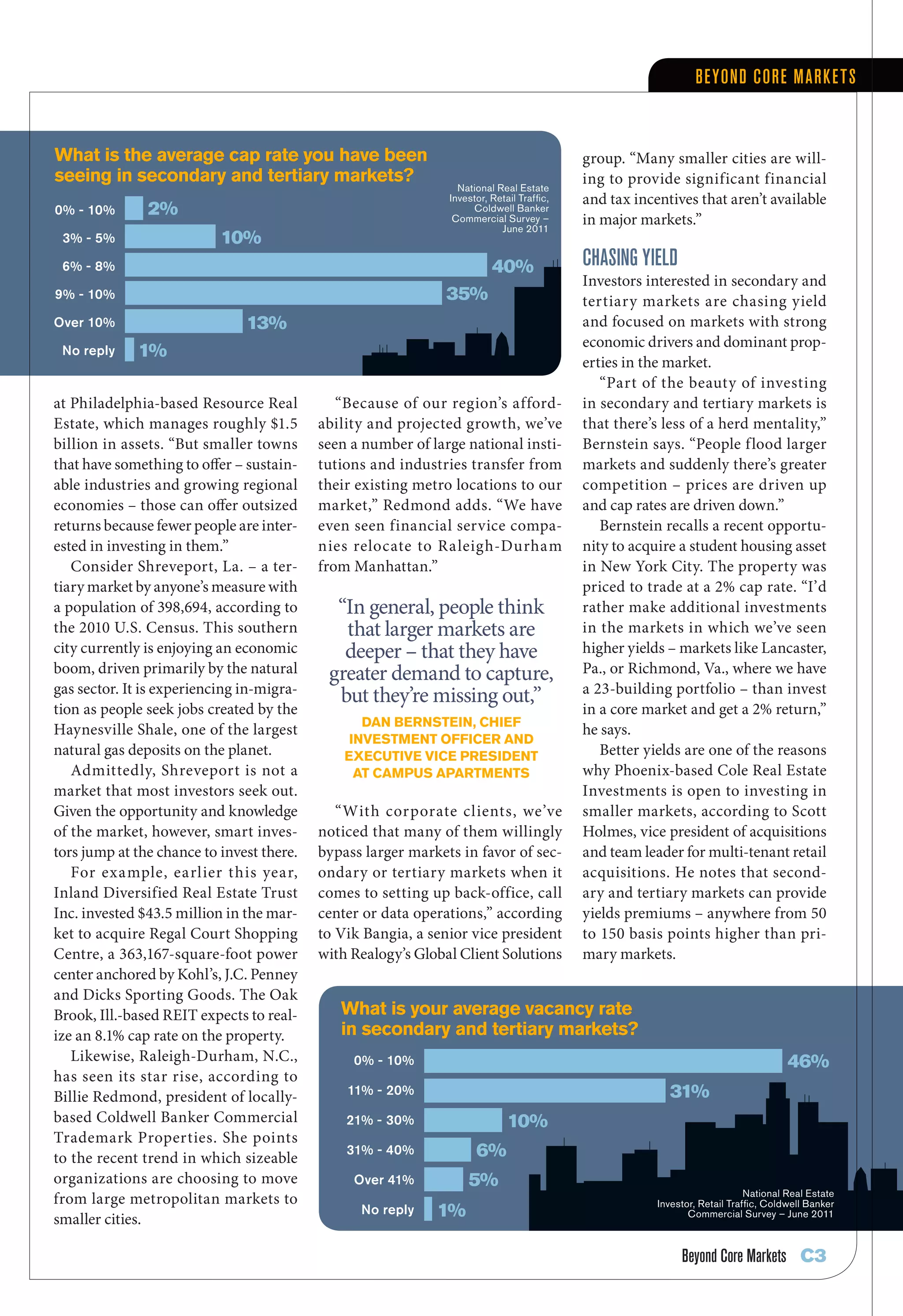

- Average cap rates seen in non-core markets range from 8-12.5%, offering higher yields than core markets.

- The strength of the local economy and availability of financing were the most important factors for considering investments in secondary/tertierary markets.