This document discusses trends in e-commerce growth and its impact on the industrial real estate market. Some key points:

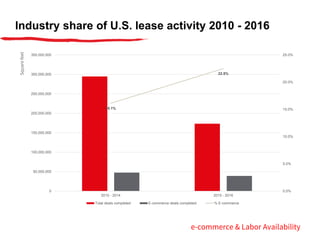

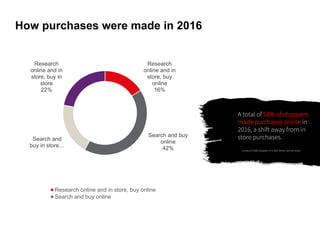

- E-commerce's share of total US retail sales has steadily increased since 2011 and reached 10.8% in 2015.

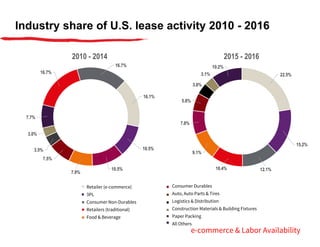

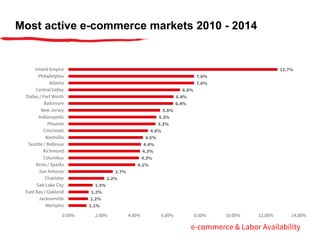

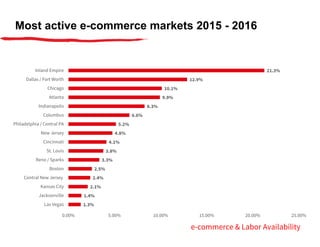

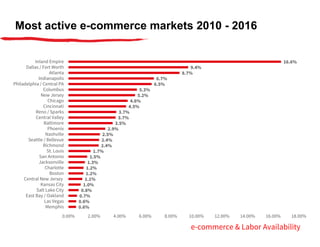

- The top e-commerce markets from 2010-2016 were the Inland Empire and Dallas/Fort Worth, reflecting increased demand for fulfillment centers.

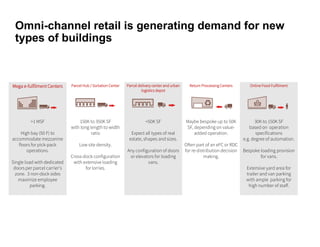

- E-commerce is generating demand for new types of industrial buildings like mega fulfillment centers, parcel hubs, and last-mile delivery centers.

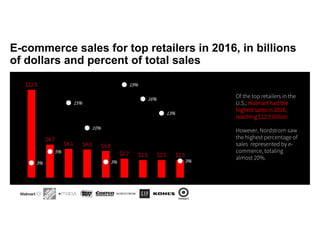

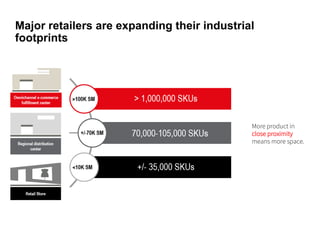

- Major retailers are expanding their industrial footprints to accommodate growing e-commerce operations and inventory needs.