Embed presentation

Downloaded 1,258 times

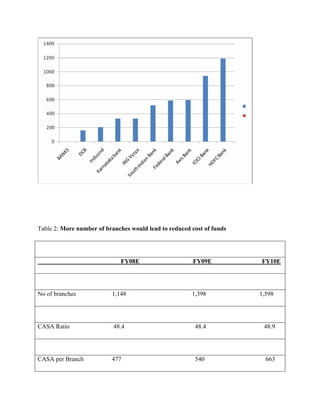

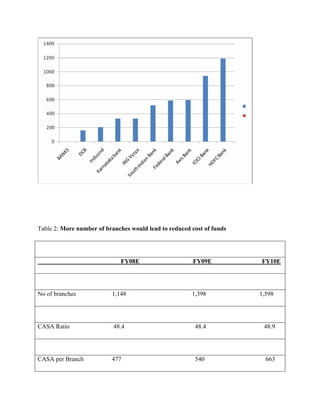

This document summarizes a case study on the corporate restructuring that occurred through the amalgamation of HDFC Bank and Centurion Bank of Punjab in India. The study aims to evaluate the share swap ratio of the merger and analyze the individual and combined benefits. It uses techniques like EPS, DCF, terminal value and WACC to calculate the share exchange ratio and net share exchange ratio. The introduction provides context on corporate restructuring and mergers & acquisitions in the Indian banking sector. The methodology section outlines a case study approach focusing on the SWOT analysis, profiles and synergies of the two banks before and after the amalgamation.