1) The document is the 40th issue of Inscriptions magazine from Gopast Centre for Learning.

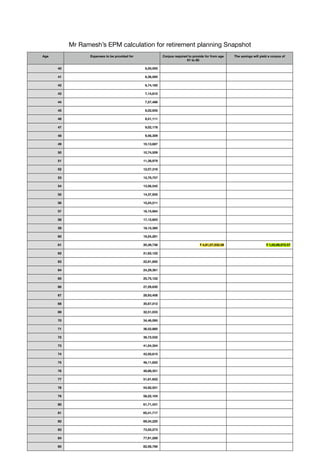

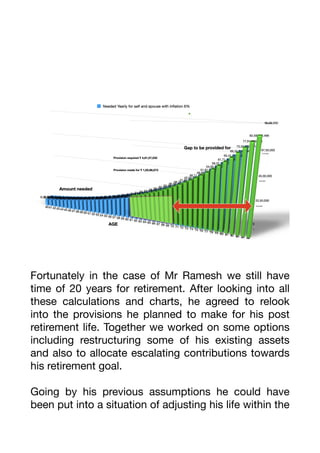

2) It includes articles on coping skills, retirement planning, insurance advising, and an inspirational story of a woman who found relief from her depression through helping her injured sister-in-law.

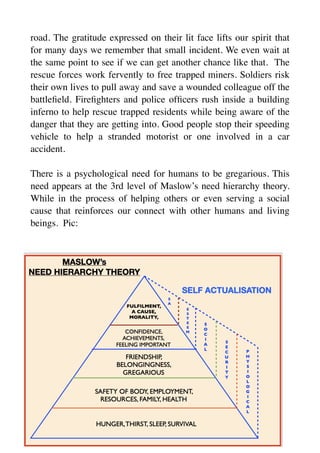

3) One of the articles discusses how serving and helping others can interrupt the downward emotional spiral some experience during difficult times, as it shifts one's focus outward and provides positive feelings of purpose and relief.