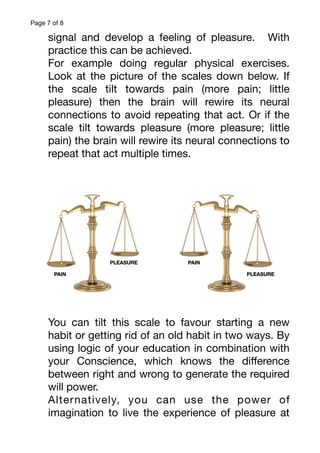

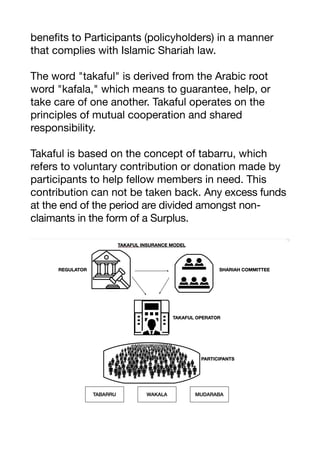

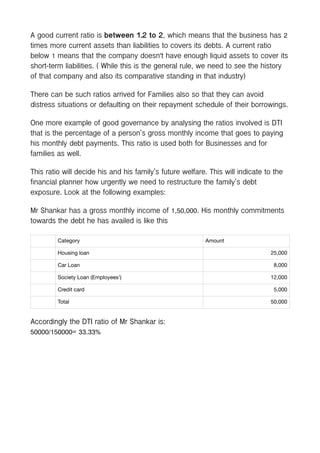

The document discusses the concepts of autonomy and accountability, emphasizing the power of individual choice and its consequences on life decisions. It explores the formation of habits, detailing techniques for changing harmful habits and developing positive ones through mindfulness, environmental adjustments, and cognitive reinterpretation. Additionally, it covers Islamic financing and takaful insurance principles, highlighting their compliance with shariah law and the roles of participants and actuaries within these frameworks.