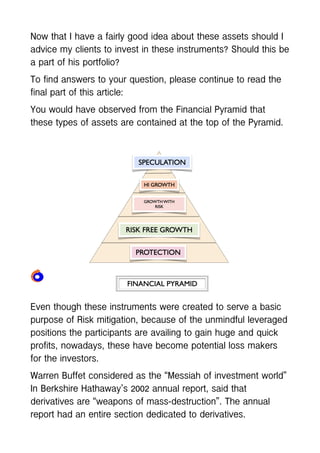

The document celebrates the 10th anniversary of the 'inscriptions' magazine from gopast, featuring articles on personal development, financial derivatives, and professional insights. It emphasizes the importance of human freedom to make choices, the influence of emotions on decision-making, and offers a four-step method (RICH) to improve one’s responses to life's challenges. Additionally, it discusses the evolution of financial derivatives and their role in managing risk in the modern economy.