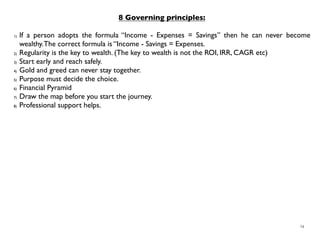

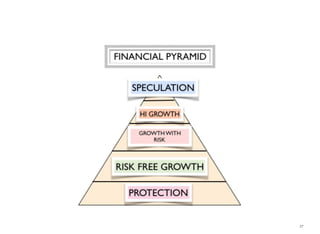

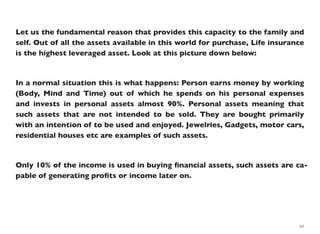

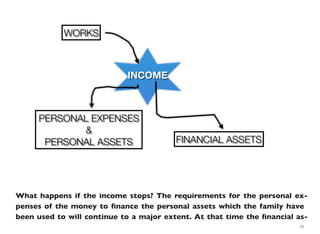

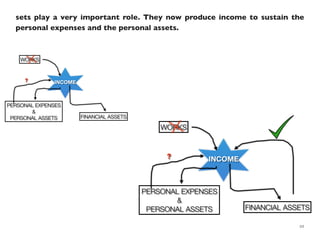

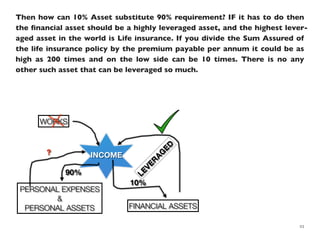

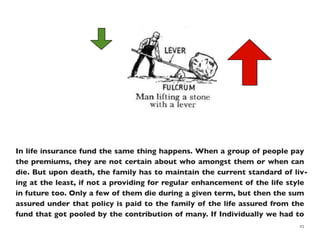

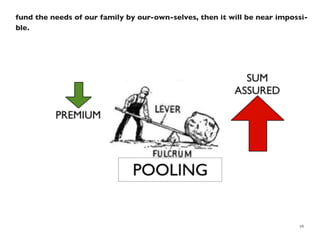

The document summarizes the importance of protection as the foundation of a financial pyramid. It discusses how people use their body, mind and time to earn money, but death, disability or critical illness can severely impact finances. Life insurance is highlighted as the highest leveraged asset that can help protect a family's income and allow them to continue ascending the financial pyramid even if the primary earner's income stops. The 10% of income spent on life insurance can substitute for the 90% used on personal expenses and assets. Protection of earnings through life insurance is positioned as the most important first step in building lasting wealth.