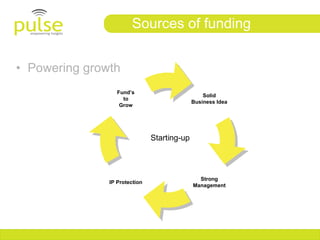

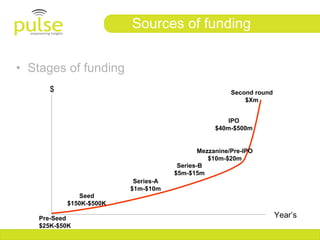

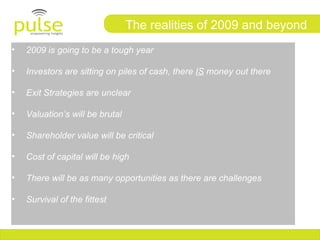

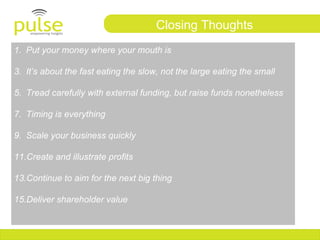

This document discusses sources of funding for startups. It outlines the different stages of funding from friends and family (pre-seed), to seed funding from grants and angels, to Series A/B/C funding from venture capitalists (VC). It also discusses mezzanine or pre-IPO funding from private investors/institutions, and IPO funding from financial institutions and the public. The document advises selecting investors based on what they can offer beyond money, like expertise, synergies, reputation and more. It stresses the responsibility of using funding wisely to invest for growth and deliver on promises to investors.