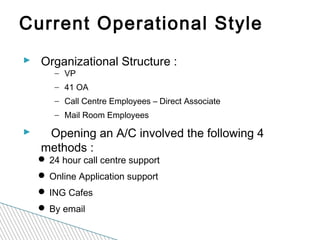

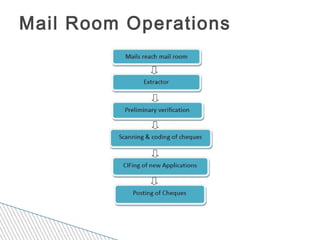

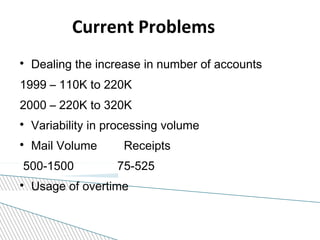

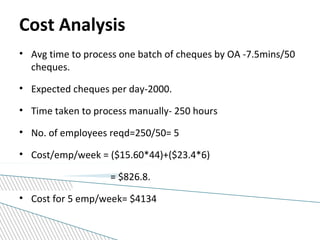

This document discusses ING Direct Canada, a bank that launched in 1997 as part of the ING Group. It offered savings accounts with high interest rates and low fees. While successful in attracting customers, ING Direct faced challenges from increasing mail volumes and variability in processing. Alternatives like outsourcing or increasing staff were evaluated but found lacking. The document recommends automating the scanning and encoding of cheques using optical character recognition software to improve efficiency long-term without increasing costs. It estimates the software would pay for itself within 5 years compared to continuing manual processing.