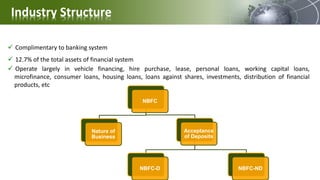

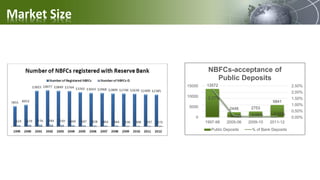

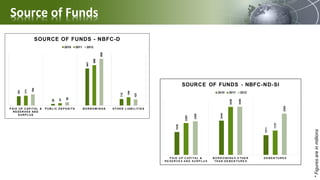

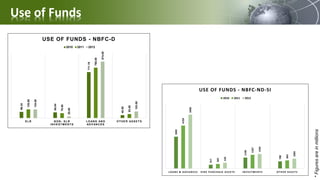

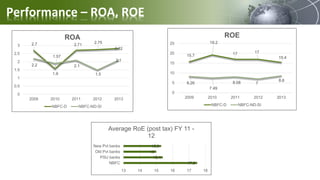

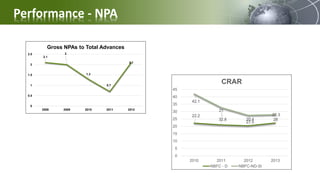

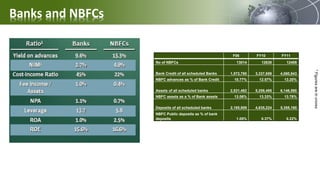

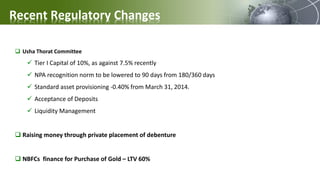

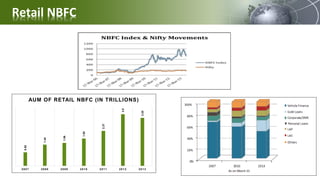

This document provides an analysis of India's non-banking financial company (NBFC) sector. It discusses the industry structure, nature of business, and differences between NBFCs and banks. NBFCs complement the banking system and account for 12.7% of the financial system's total assets. The document also analyzes NBFCs' sources and uses of funds, financial performance metrics like return on assets and non-performing assets, and recent regulatory changes affecting the sector. Overall, it presents an overview of the NBFC industry in India.