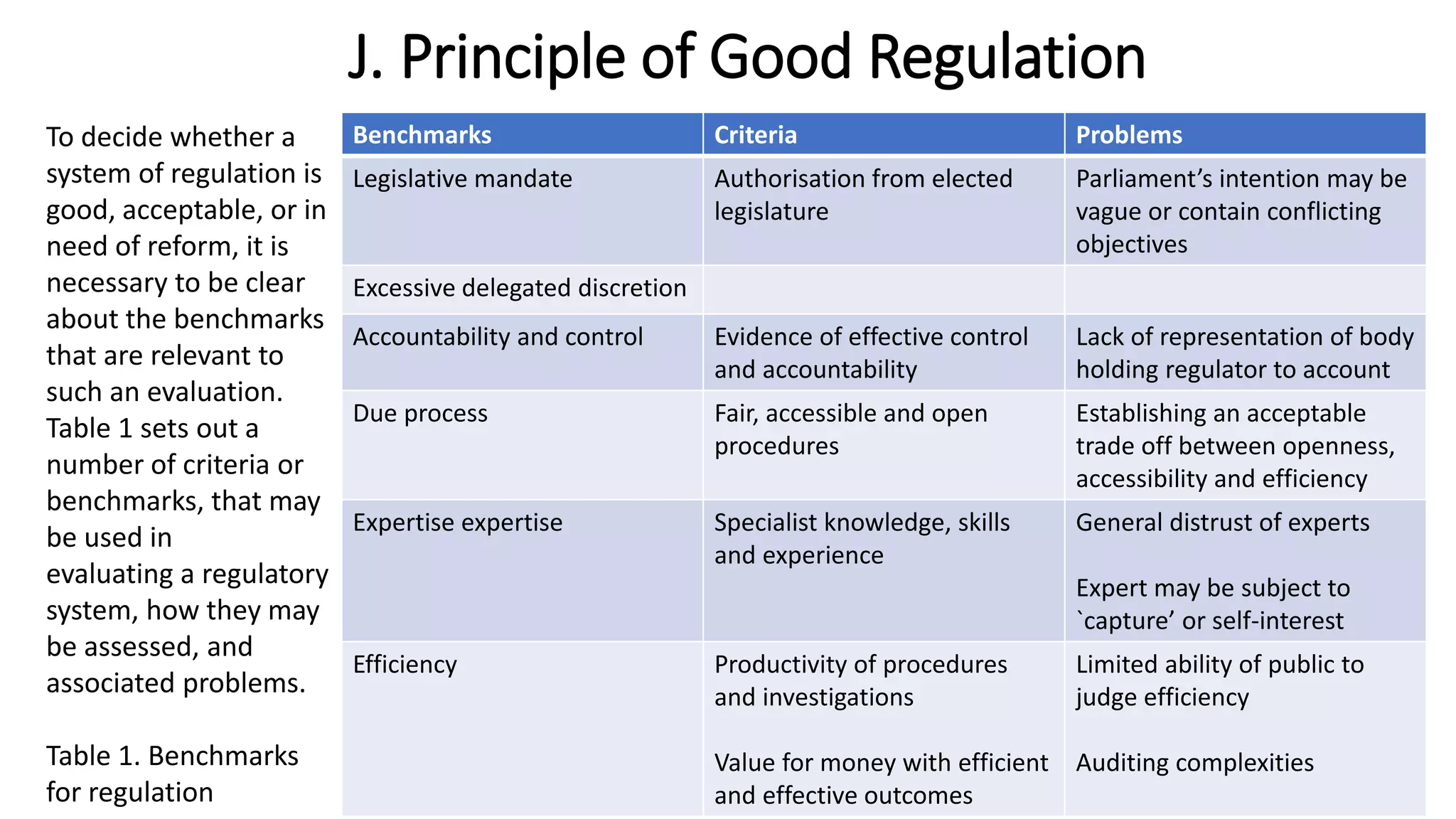

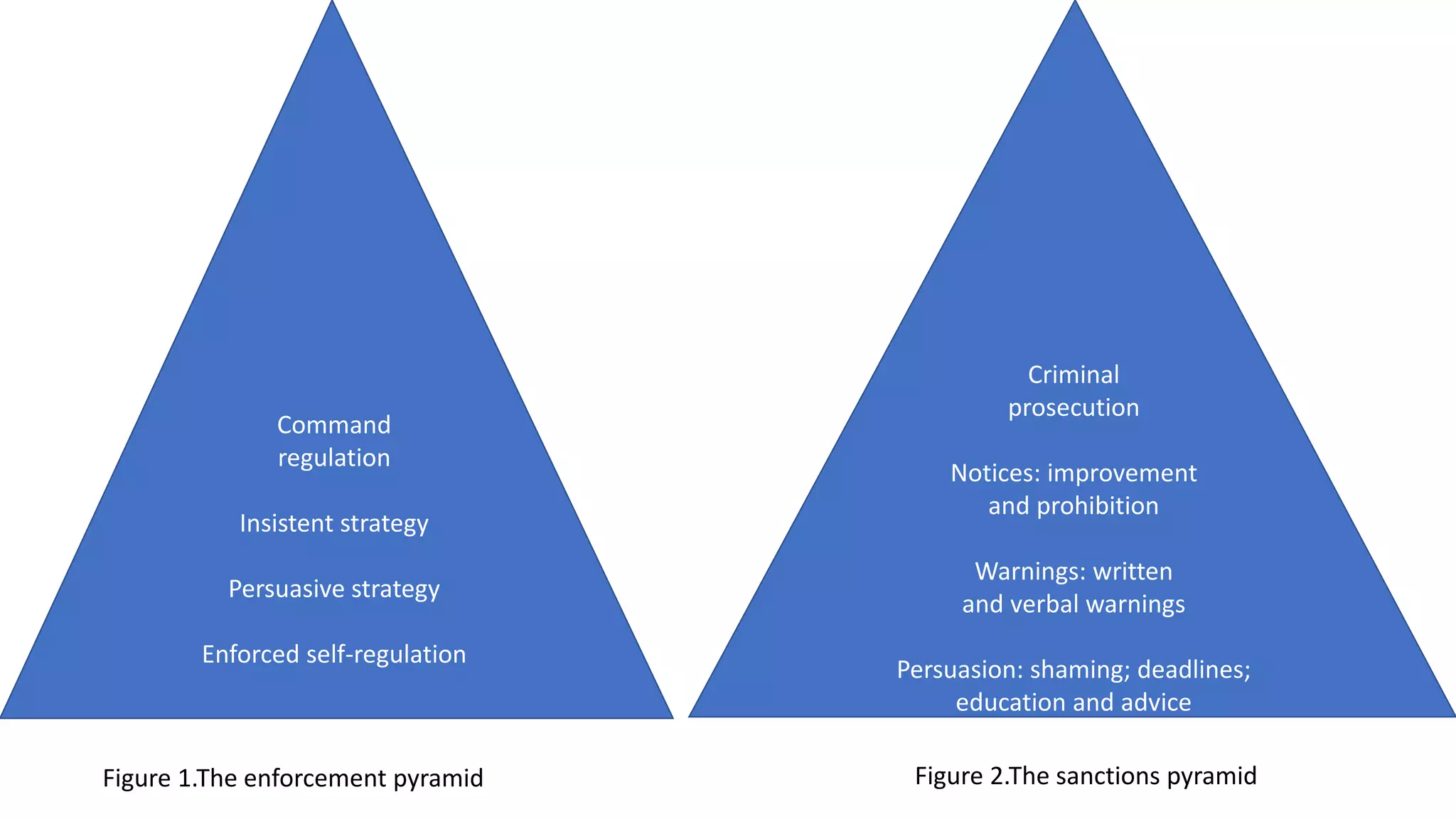

This document summarizes key aspects of infrastructure regulatory systems. It discusses the need for infrastructure regulation due to natural monopolies and market failures. It outlines various forms of economic, social, and environmental regulation. It also describes regulatory bodies, strategies, principles of good regulation, challenges in developing countries, and approaches to regulate for the poorest populations. The goal is to develop effective regulatory frameworks and improve regulatory performance.