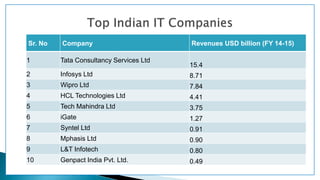

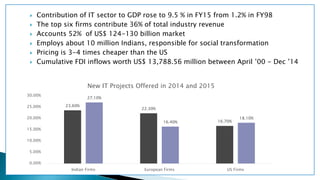

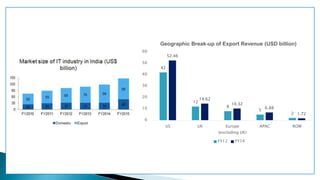

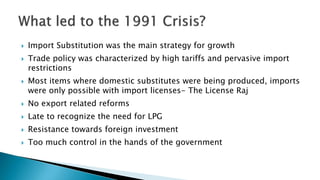

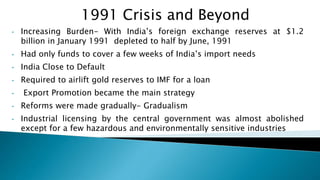

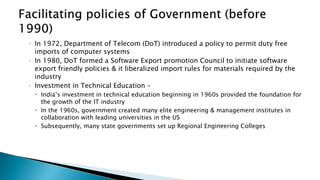

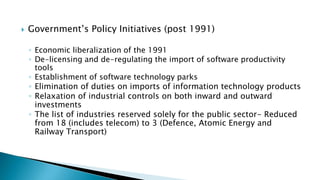

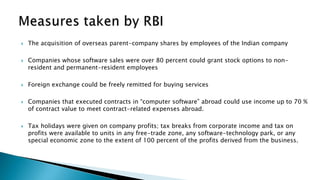

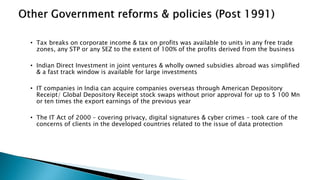

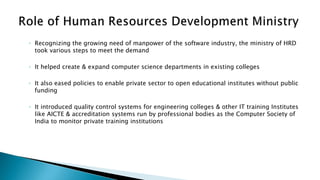

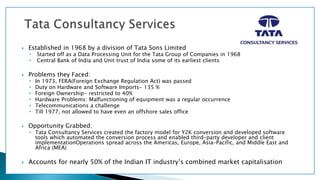

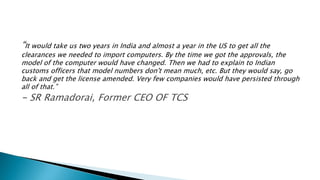

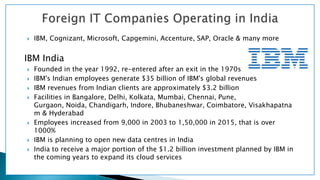

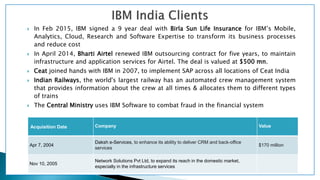

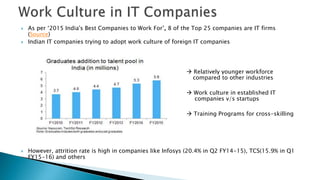

The document summarizes the growth and development of the Indian software industry from the 1990s to the present. It discusses factors that contributed to the industry's growth such as emphasis on engineering education, low wages, satellite communication, and time zone advantages. It also outlines government policies that promoted the industry, including liberalization in 1991, establishment of software technology parks, tax incentives, and liberal foreign investment policies. The document provides current statistics on the size and leaders of the Indian software industry.