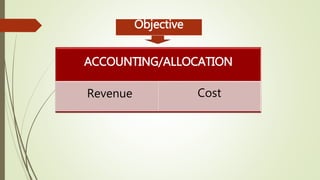

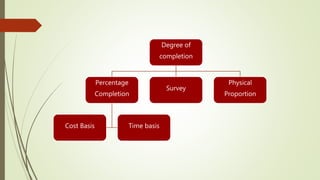

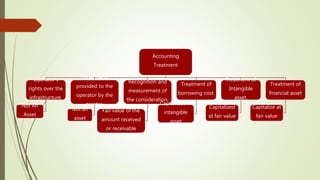

This document outlines the key principles of Ind AS 11 Construction Contracts. It discusses the history, applicability, types of contracts, revenue and cost recognition, degree of completion methods, disclosures required, and accounting for service concession arrangements. The standard is mandatory for construction contracts but not real estate transactions. Revenue is recognized based on the percentage of completion or cost incurred to date depending on whether the outcome can be reliably estimated. Costs include direct, allocated, and excluded costs. Extensive disclosures are required around revenue, methods, costs, and balances.