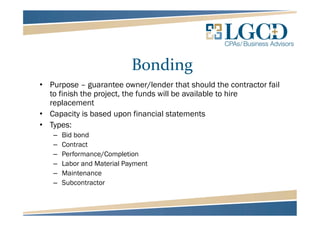

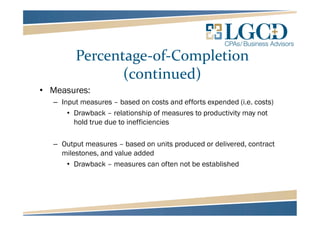

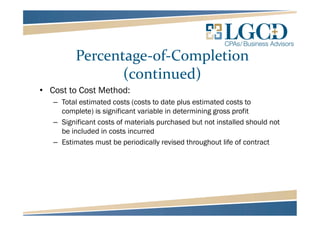

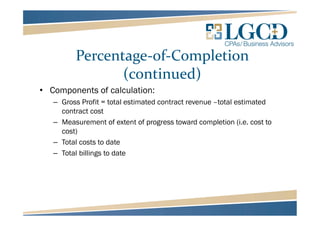

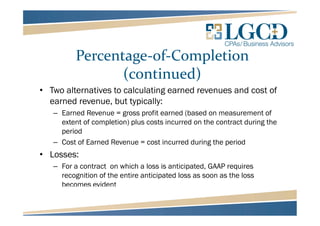

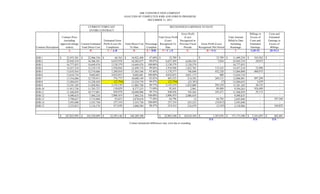

This document provides an agenda and overview for a presentation on risks in the construction industry and financial reporting for construction contracts. It discusses common risks like competitive bidding, estimating costs, unique accounting requirements, and bonding. It then explains the percentage-of-completion and completed-contract methods for recognizing revenue and includes an example showing a table with contract details, costs, billings, and profit recognized for 15 different jobs.