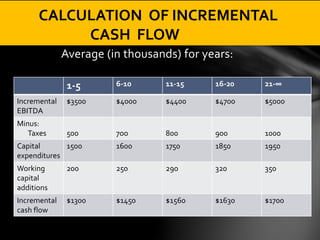

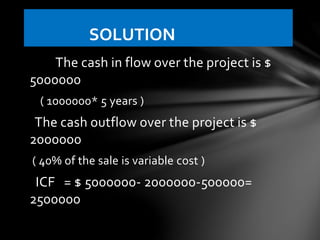

Incremental cash flow is the additional operating cash flow generated by a new project. It is calculated by taking the incremental revenues and subtracting the incremental costs, including taxes, capital expenditures, and working capital additions. The document provides an example calculation of incremental cash flow over multiple time periods for a new project. It also gives an example problem calculating the incremental cash flow of a new machinery investment that would increase annual sales by $1 million. Incremental cash flow is important for evaluating and comparing project profitability.