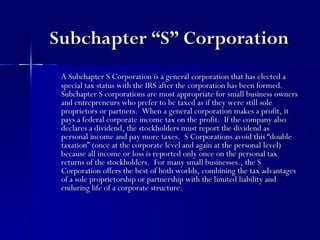

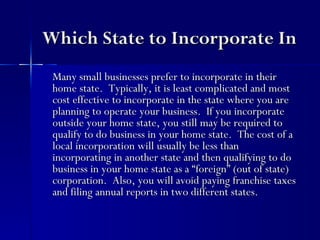

Incorporating a business provides several key legal and financial benefits. It reduces personal liability so owners' personal assets are protected from business debts. It adds credibility that can help attract customers and investors. Incorporation also provides tax advantages like deductible benefits and retirement plans. The most common structures are C corporations, S corporations, close corporations, and LLCs, with each having different requirements and tax implications. States like Delaware and Nevada are popular for out-of-state incorporations due to their business-friendly laws, but businesses must still qualify to operate in their home state.