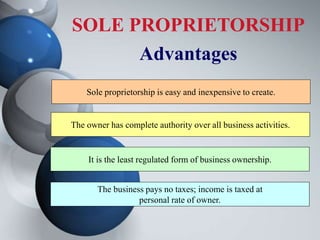

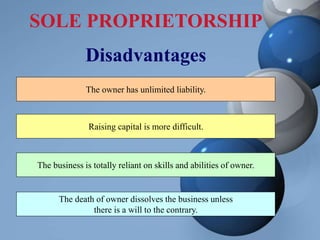

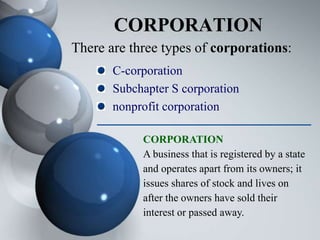

Sole proprietorships are the easiest form of business to create but the owner has unlimited liability. Partnerships can draw on multiple skills and resources but partners can be liable for each other's actions. Corporations provide limited liability, making it possible to raise more investment money. There are three types of corporations: C-corporations, S-corporations, and non-profits. C-corporations are taxed twice but have more flexibility. S-corporations avoid double taxation. Non-profits must operate exclusively for charitable purposes. Entrepreneurs should consider their skills, capital needs, and liability comfort when deciding on a business structure.