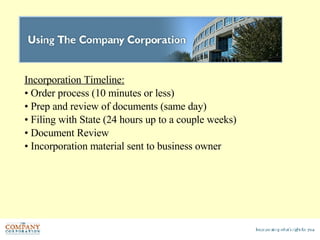

The document provides information about incorporating a business and forming an LLC, including the benefits, entity structures, and process. It discusses C corporations, S corporations, and LLCs. Forming a legal business entity provides liability protection and tax benefits. The Company Corporation is an experienced provider of online business formation services that can help incorporate a business quickly in as little as 10 minutes.