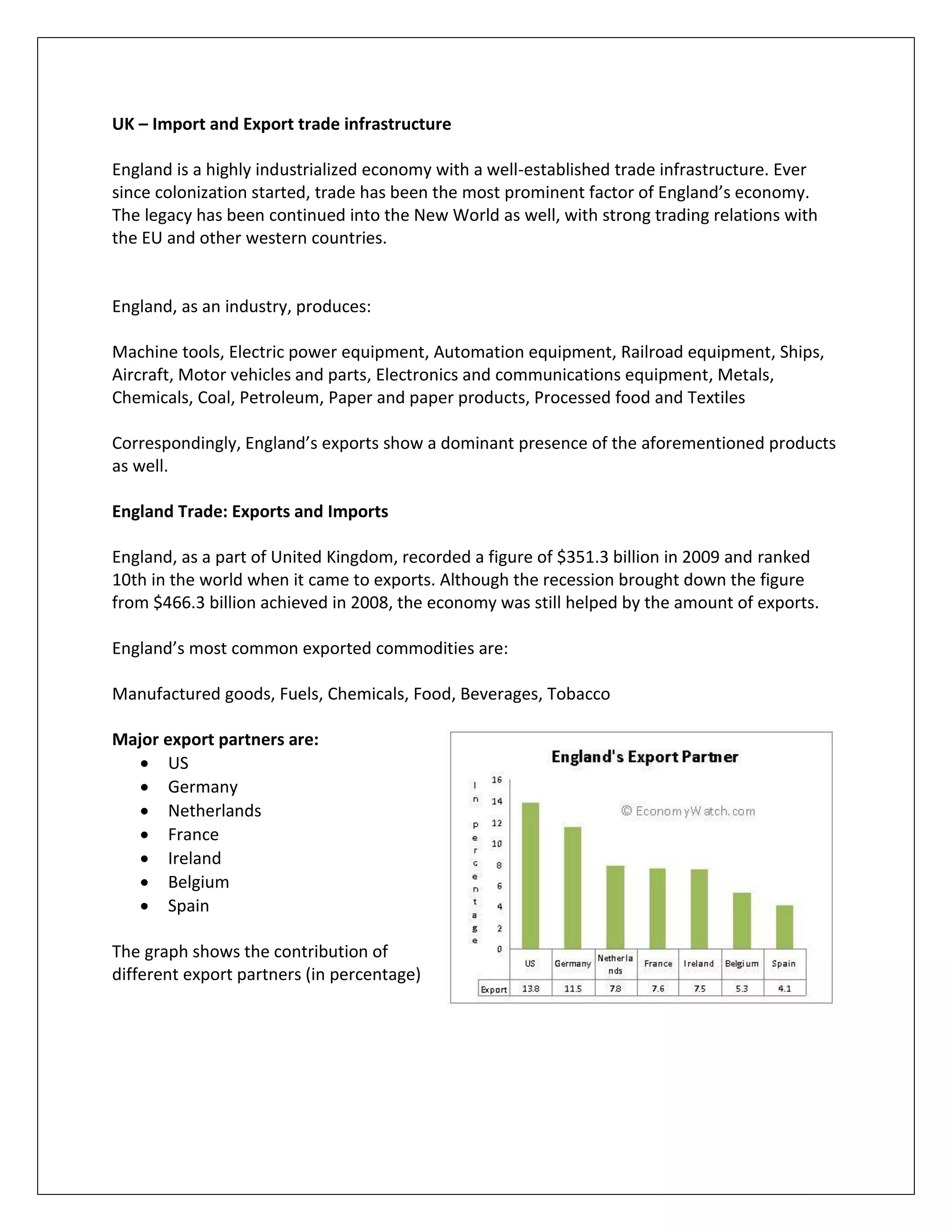

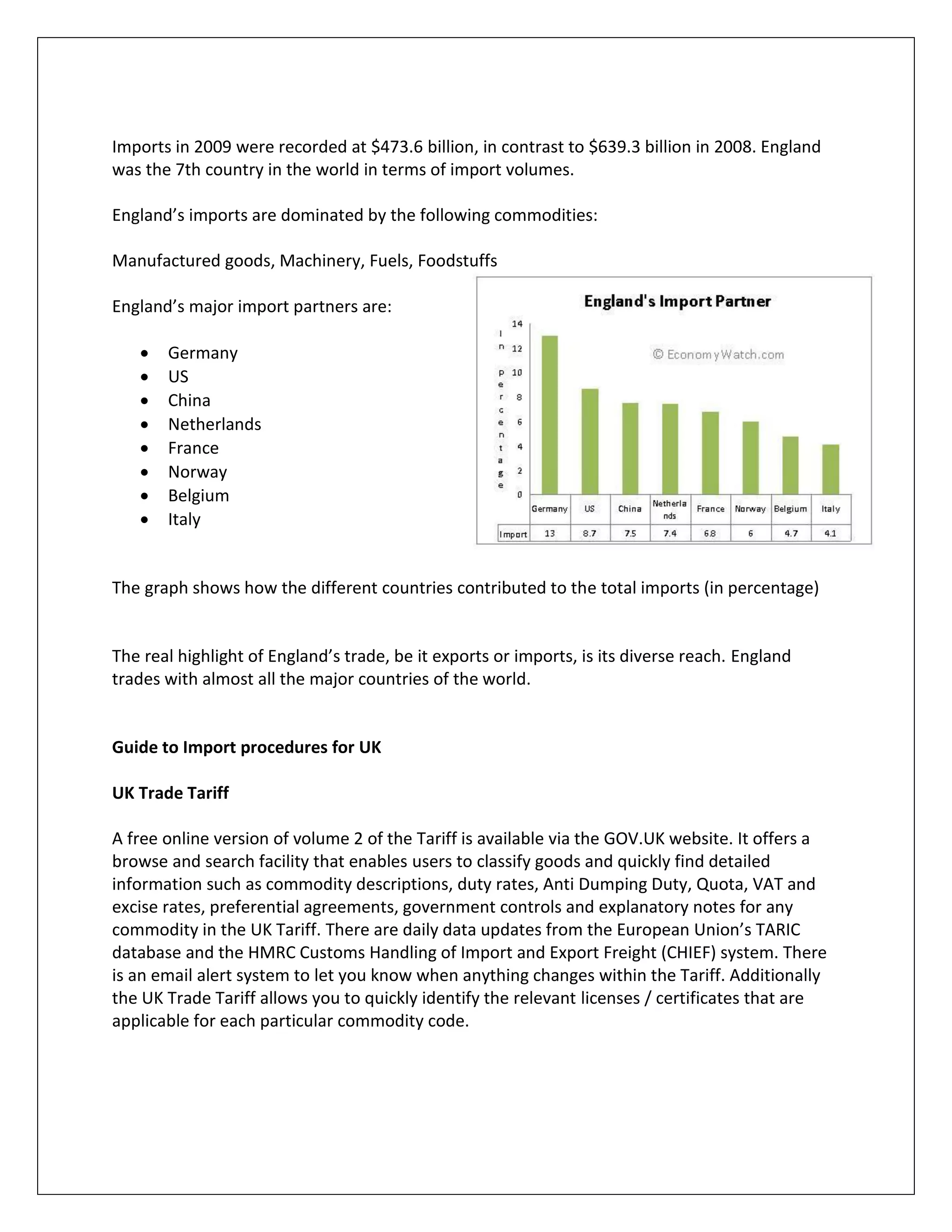

The document provides information on import and export procedures for the United Kingdom. It discusses UK trade infrastructure, import guidelines including tariffs, licenses, and documentation. Export guidelines covered include export declarations, taxes, and personally transporting goods. Key points of import include using the correct commodity code to determine duties and restrictions. Export declarations are required to collect trade statistics.