The document provides an overview of the insurance sector in India including:

- A brief history tracing the sector from open competitive markets in the 1800s to nationalization in 1956 and re-liberalization in 1999.

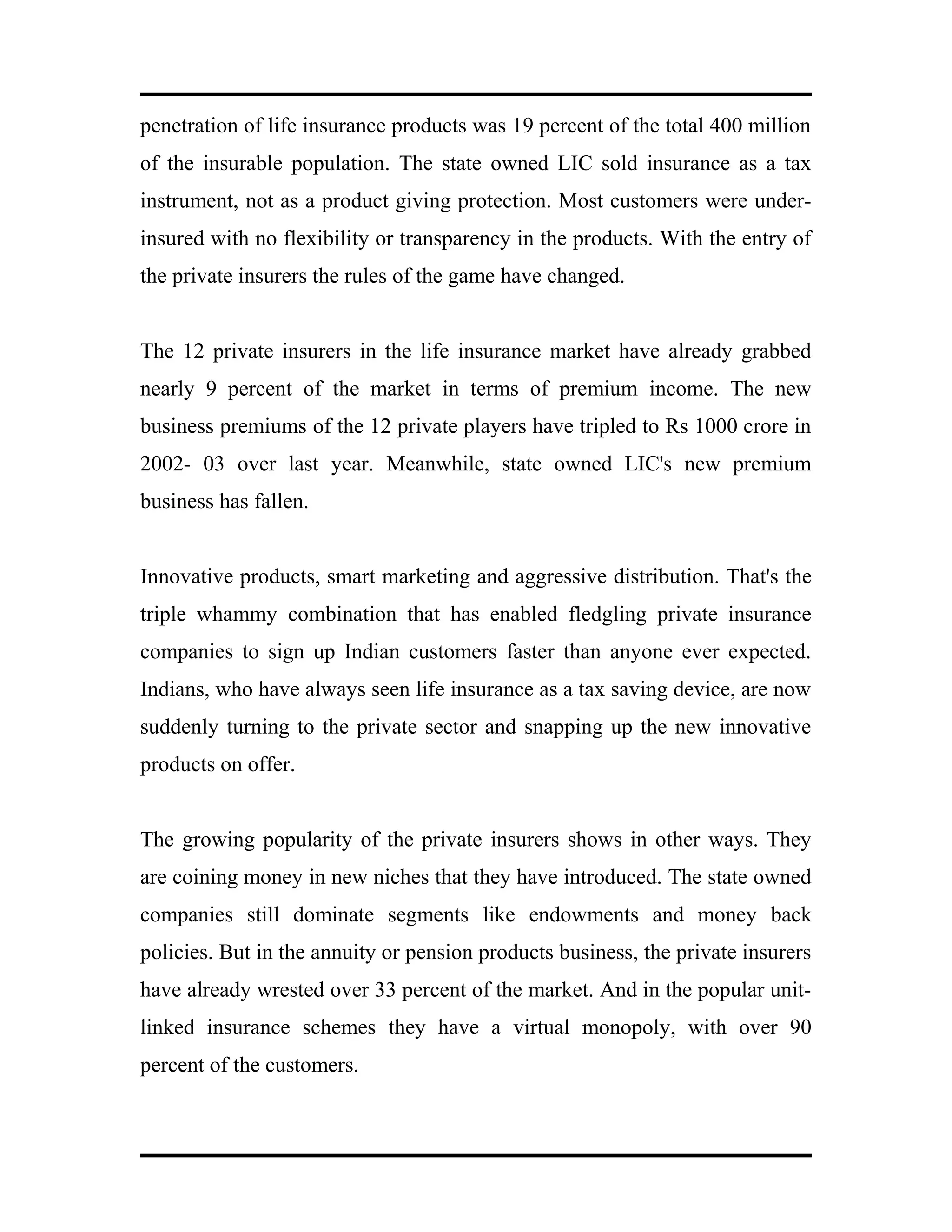

- Details on the current state of the life and non-life insurance markets, with the public sector still dominating but private players gaining market share.

- Private life insurers have increased their market share to 10% while private non-life insurers have reached 14% market share in recent years.

- The liberalization of the insurance sector has led to improved services and greater opportunities but public sector insurers still control over 80% of the market.

![plan has no foundation. Marketing strategies serve as the fundamental

underpinning of marketing plans designed to fill market needs and reach

marketing objectives [3]. It is important that these objectives have

measurable results.

A good marketing strategy should integrate an organization's marketing

goals, policies, and action sequences (tactics) into a cohesive whole. Many

companies cascade a strategy throughout an organization, by creating

strategy tactics that then become strategy goals for the next level or group.

Each group is expected to take that strategy goal and develop a set of tactics

to achieve that goal. This is why it is important to make each strategy goal

measurable.

Marketing strategies are dynamic and interactive. They are partially planned

and partially unplanned. See strategy dynamics.

Types of marketing strategies

Every marketing strategy is unique, but if we abstract from the

individualizing details, each can be reduced into a generic marketing

strategy. There are a number of ways of categorizing these generic

strategies. A brief description of the most common categorizing schemes is

presented below:

Strategies based on market dominance - In this scheme, firms are classified

based on their market share or dominance of an industry. Typically there are

three types of market dominance strategies:

• Leader](https://image.slidesharecdn.com/bajaj-allianz-report-rahulsaxena1-140505004434-phpapp02/75/Bajaj-allianz-report-7-2048.jpg)