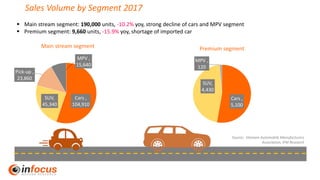

The automotive market in Vietnam has grown significantly in recent years and is forecast to continue expanding. Total vehicle sales volumes grew from around 76,000 in 2013 to over 242,000 in 2018, and are projected to reach 310,000 by 2020. Key drivers of growth include lower import taxes, expanding infrastructure, rising incomes, and increased urbanization. Cars remain the dominant segment, though SUV sales are increasing as well. IFM Research provides market analysis and strategic consulting services to help companies navigate Vietnam's automotive market, including market sizing, consumer behavior studies, pricing analysis and brand tracking.