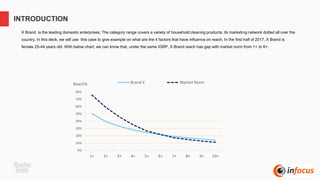

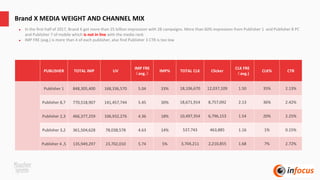

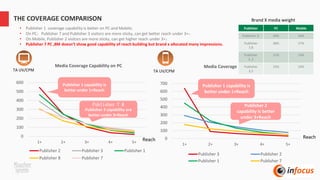

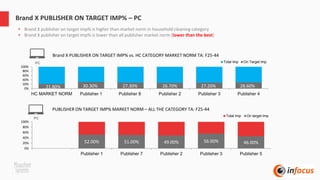

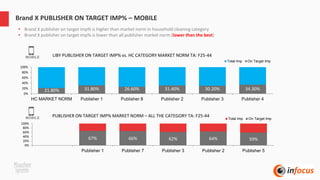

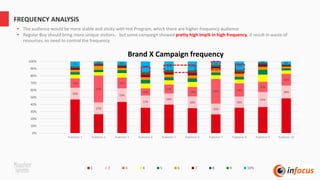

The document discusses factors that influence reach for Brand X, a leading household cleaning brand in China. It analyzes Brand X's media performance in the first half of 2017 and identifies opportunities for improving its reach. Specifically, it finds that Brand X's reach was lower than market norms. This was influenced by its media weight being concentrated among a few publishers, opportunities to improve its on-target impression percentage, and needing more stringent frequency capping. Reallocating budget to reach-building websites and reducing spending on some lower-performing publishers could help Brand X improve its reach.