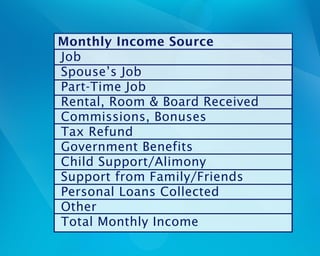

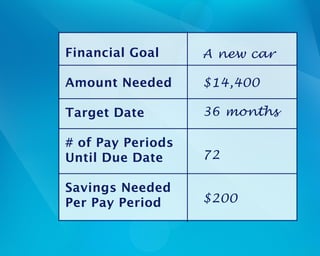

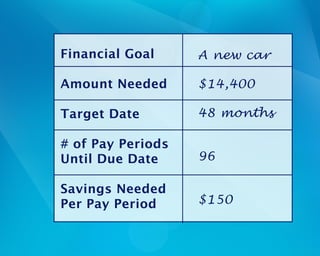

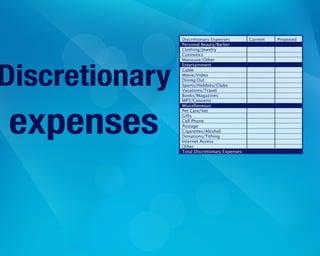

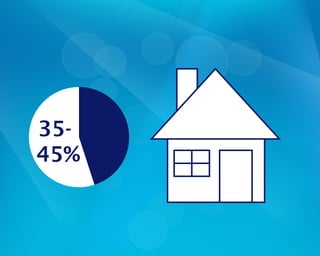

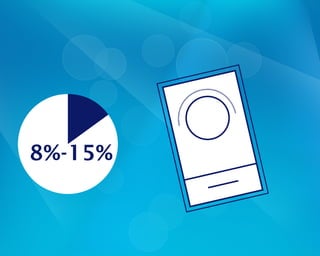

The document is a multi-part guide about budgeting from Credit.org. It discusses tracking spending, calculating income, setting financial goals, balancing monthly expenses with income, and categorizing expenses as necessary or discretionary. It recommends budgets allocate 35-45% to housing, 15-25% to transportation, 8-15% to food, 10-20% to utilities and other bills, 8-15% to insurance, 3-5% to savings, and the remaining amounts to discretionary spending and debt payments.