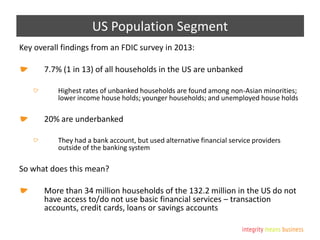

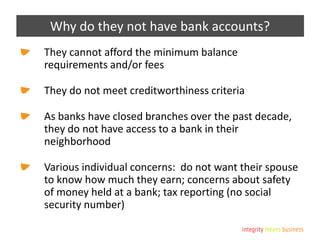

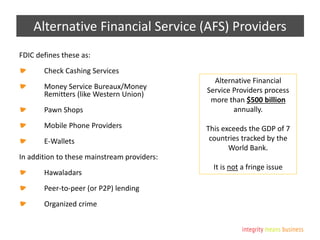

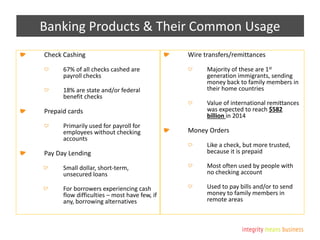

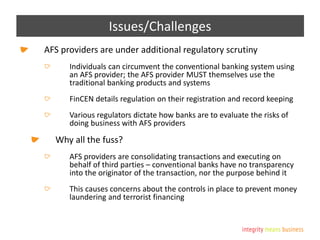

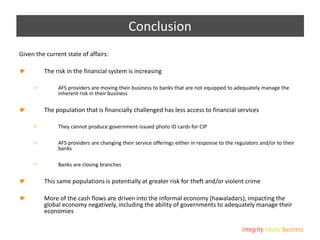

Post-crisis banking legislation aimed to enhance consumer protection and ensure bank stability, but it has negatively impacted access to financial services for many ordinary Americans. Stricter regulations have led banks to exit relationships with alternative financial service providers or increase oversight of them. As a result, over 34 million US households now have less access to basic banking services like loans and money transfers. This has increased risks of theft and crime for the underbanked while pushing more financial activity underground towards informal providers outside of regulatory oversight. The new rules ultimately seem to have reduced, rather than expanded, financial access for those most in need.