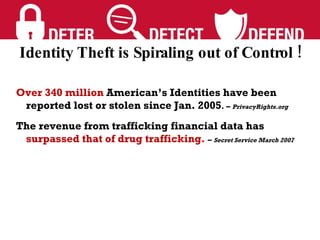

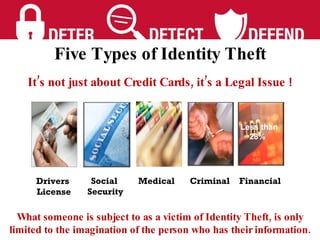

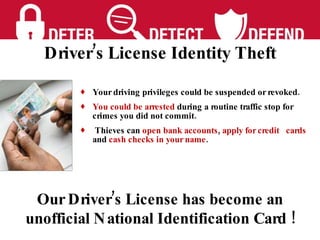

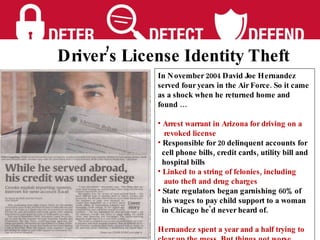

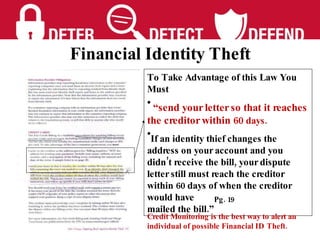

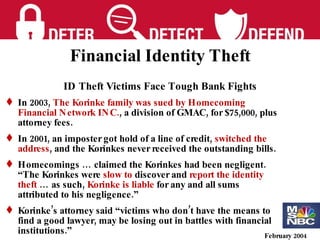

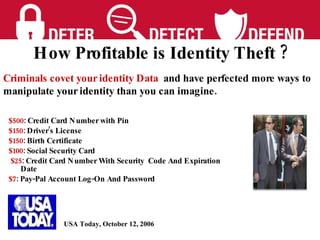

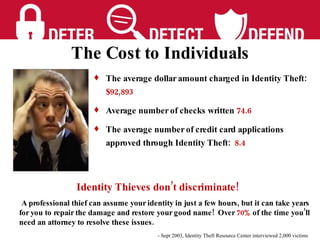

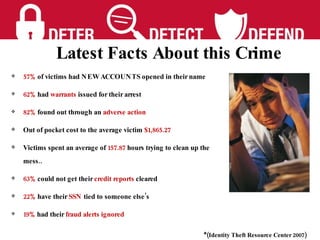

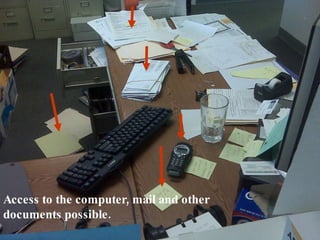

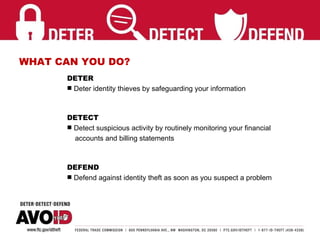

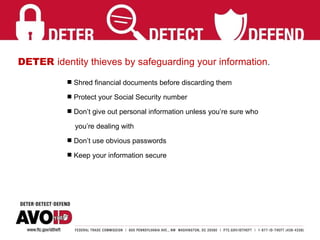

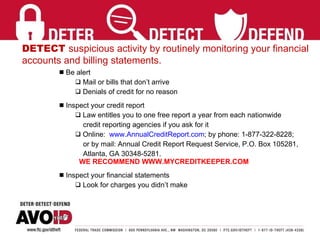

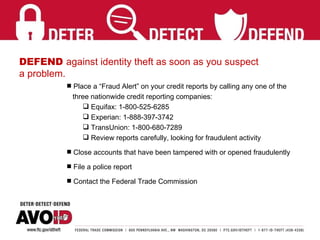

The document discusses the growing problem of identity theft in the United States. It defines identity theft and outlines some key statistics, such as over 340 million Americans having their identities stolen since 2005. It also discusses the different types of identity theft, including how thieves can steal identities to gain employment, file taxes, obtain loans and credit cards, or even be arrested for someone else's crimes. Lastly, it provides tips on how to deter, detect, and defend against identity theft by monitoring accounts and reports for fraudulent activity.