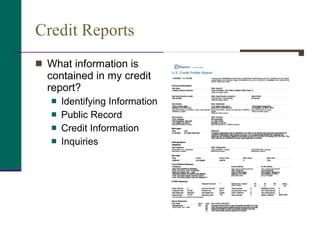

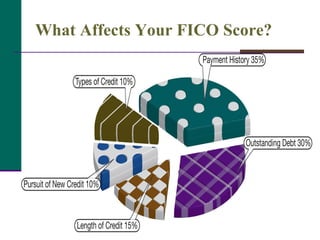

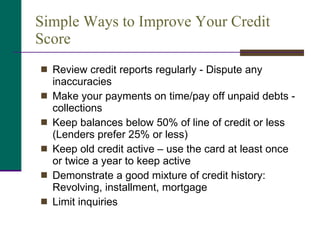

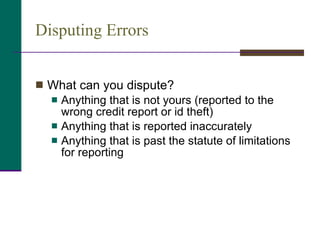

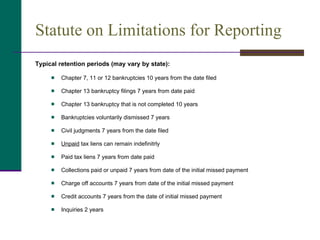

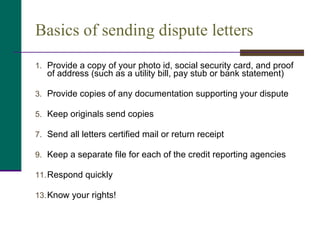

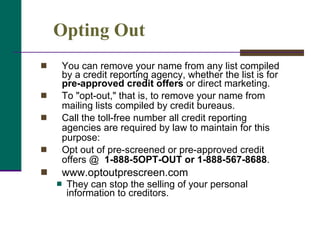

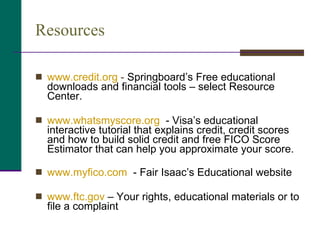

The document provides an overview of credit reports and scores, describing their significance in various aspects of life, such as obtaining loans and employment. It emphasizes the importance of ensuring accurate information in credit reports, discusses potential errors, and outlines consumer rights under relevant laws. Additionally, it offers resources for obtaining credit reports, understanding credit scores, and disputing inaccuracies.

![Thank You! Springboard Nonprofit Consumer Credit Management 800-WISE PLAN www.credit.org [email_address]](https://image.slidesharecdn.com/ucrs-100811165026-phpapp02/85/Understanding-Your-Credit-Report-and-Score-29-320.jpg)