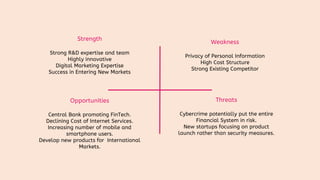

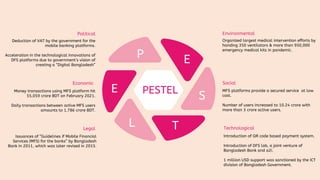

The document provides a situation analysis of the fintech sector in Bangladesh, highlighting its strengths, weaknesses, opportunities, and threats (SWOT). Key strengths include strong R&D expertise, while weaknesses revolve around privacy concerns and high costs. Opportunities arise from government support and increasing internet access, but threats from cybercrime and competition loom large.